European gas vs coal plant switching

European gas vs coal plant switching

A Timera Energy briefing

May 2015

10

8

6

4

50

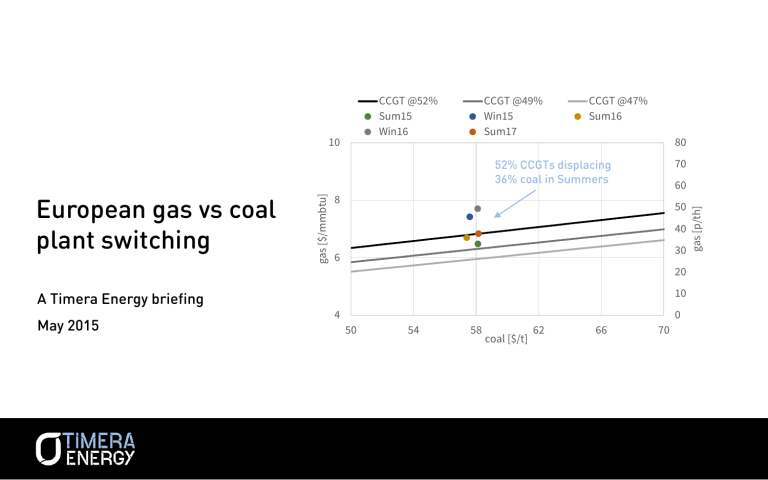

CCGT @52%

Sum15

Win16

54 58

CCGT @49%

Win15

Sum17

CCGT @47%

Sum16

52% CCGTs displacing

36% coal in Summers coal [$/t]

62 66 70

0

20

10

80

70

60

50

40

30

Headlines: Gas plant competitiveness increasing

Gas hub price weakness is supporting a recovery in gas plant competitiveness… & risk adjusted asset values

•

• Gas price slump: European hub prices are falling as a result of a growing global oversupply of LNG and weaker oil prices. Europe is absorbing higher volumes of LNG as a market of last resort. This may tip the gas market into pronounced oversupply.

Gas vs coal plant: Lower gas prices are reducing the gap in gas vs coal plant competitiveness. Gas-fired power plants play an important role in absorbing surplus hub gas, meaning higher load factors and plant margins.

10

5

0

30

25

20

UK coal vs gas generation costs (CDS – CSS) recent fall in coal plant competitive advantage

15

-5

-10

Source: Timera Energy

• UK first: Significant gas vs coal switching is already taking place in the UK given the carbon price floor and this looks set to continue. This is starting to increase realised CCGT margins and load factors.

• Continent next: At current hub prices, Continental gas plants remain ‘out of the money’. But competitiveness is improving, increasing peak margin capture opportunities in some markets (e.g. Belgium, France).

• Asset value: Falling gas prices increase the ‘in the moneyness’ of gas plant optionality. This means higher expected margins, more value in the right tail of asset margin distributions (asymmetric upside) and higher risk adjusted asset values.

1) 2

Gas vs coal switching: UK

The UK is Europe’s ‘canary in the coal mine’ for gas displacement of coal plant… and it is already a reality

30

25

UK CCGT (49%) and coal (36%) plant generation margins

CDS CSS

CDS falling

10

Current UK gas vs coal (36%) switching dynamics

CCGT @52%

Sum15

Win16

CCGT @49%

Win15

Sum17

CCGT @47%

Sum16

80

20

15 weak forward

CDS & CSS

52% CCGTs displacing

36% coal in Summers

70

60

10

8

50

40

5

6

30

0 20

-5 some CSS recovery

10

4 0

50 54 58 62 66 70 coal [$/t]

Source: Timera Energy

• Spreads: Realised UK spark spreads (CSS) have started to recover over the last year, although forward market pricing remains weak. Dark spreads (CDS) have fallen as power prices drop (with gas hub prices) and the UK carbon price floor rises.

• Switching: At current NBP forward summer hub prices, newer CCGT (52%) are displacing older coal plants (36%).

• Margin capture: Once price shape & volatility are overlaid, the increase in CCGT competitiveness translates into a greater ability to capture margin, i.e. the ‘in the moneyness’ of CCGT optionality increases.

1) 3

Gas vs coal switching: Continent

CCGT values have been deeply discounted by owners… but falling gas prices support peak margin capture

• Spreads: Continental spark spreads (CSS) remain negative, with coal plants dominating marginal setting of power prices.

• Role of gas: CCGTs have been relegated to a peaking role, 10

Current German gas vs coal (36%) switching dynamics

CCGT @52%

Win15

Sum17

CCGT @49%

Sum16

Sum15

CCGT @47%

Win16 but this role is becoming increasingly important in some markets over winter e.g. Belgium & France.

• Switching: Gas hub prices need to fall from current levels

8

Significant gas plant competitiveness gap remains in Germany

6 around 7 $/mmbtu to below 5 $/mmbtu to induce structural

(baseload) displacement of coal plants by CCGTs. But as hub prices fall, CCGT load factors will increase in peak periods.

4

50 54 58 coal [$/t]

62 66 70

Source: Timera Energy

• Margin capture: As gas prices fall, CCGT competitiveness is improving, albeit from a very weak starting point. In other words the ‘out of the moneyness’ of CCGT optionality is falling and peak margin capture opportunities are increasing.

• Asset value: The challenge for Continental CCGTs is covering fixed costs, hence current low asset values. But capacity payments are being progressed across NW Europe. And CCGT’s have asymmetric value upside as gas prices fall & power volatility rises.

1) 4

European gas price dynamics

The global gas market is entering a new phase of oversupply... putting pressure on European hub prices

Gas price phases: Europe in a global context

2014-15 gas price dynamics

• Slump in Asian LNG spot prices

• Sharp drop in oil-index contract prices

• Flexible LNG flowing back into European hubs as a market of last resort

• Regional price convergence (Europe vs Asia) sharp decline and convergence in global gas prices

Implications

• European hubs (NBP/TTF) are currently acting as global gas price support/floor

• Hub prices may need to fall further, to a level where power sector gas demand provides support (via higher CCGT load factors)

Source: Timera Energy

1) 5

Hub prices under pressure from rising LNG imports

Europe will need to absorb surplus flexible LNG as a market of last resort... but at what price?

BCMA

600

EU demand recovery?

Hub price tipping point

• Surplus LNG volumes are flowing to Europe

& displacing Russian contract volumes

• The European gas market is close to the

‘tipping point’ where LNG surplus exceeds contractual flex to reduce Russian volumes

• Beyond this point, European hubs may fall sharply (& disconnect from oil-indexation)

Gas-fired plant impact

• Once the flexibility to reduce Russian contract volumes is exhausted, power sector gas demand will become a primary factor supporting European hub prices

500

400

300

200

100

0

Non RU pipeline

EU demand Non flex supply

European Gas

LNG to displace flex RU gas

EU

LNG

Req

LNG

Surplus

Can Europe soakup surplus LNG?

Incremental demand & supply will dictate global pricing

Uncertain

Chinese LNG demand

China

Emerging market

EU flex supply requirement

LNG available for Europe

Source: Timera Energy

Non EU LNG Global LNG demand supply

Global LNG

465

365

265

165

65

-35

-135

1) 6

Gas plant switching support for hub prices

In an oversupplied European gas market, higher CCGT load factors provide key gas demand support

European supply and demand balance (2016)

• Russian oil-indexed contract prices (~ 7 $/mmbtu) are currently driving marginal hub price dynamics

• But European LNG import volumes (green supply tranche), may be close to the ‘tipping point’ where oil-index contracts are pushed off the margin

• Gas vs coal plant switching then becomes a key source of incremental demand and price support

• The UK provides initial switching support: ~ 20 bcma in a 5.50-7.00 $/mmbtu gas price range

• But more significant oversupply may also require

Continental switching to induce demand support:

~80bcma in a 4.00 to $6.00 $/mmbtu price range.

higher gas demand at lower prices as CCGT load factors increase

Source: Timera Energy

1) 7

UK case study: switching already a reality

UK gas vs coal switching is already acting to alleviate downward pressure on European hub prices

UK ‘canary in the coal mine’

• UK is 1 st European market to switch given: o Carbon price floor (penalises coal) o Gas dominance of marginal pricing

25

UK Coal vs CCGT output 2014-15 (GW)

20

• So as NBP/TTF prices fall, it is UK CCGT gas demand that first supports NBP/TTF prices

15

10

Switching already a reality

• NBP/TTF price slump from surplus LNG flow in Summer 2014 caused 5-10GW of coal to be displaced by more efficient CCGTs (Jun-Sep)

-

5

• 2015 Summer gas vs coal prices are now again at a level where switching will occur

5-10GW of CCGT displacement of coal in summer 2014

Coal CCGT Source: Timera Energy

1) 8

UK case study: current pricing

Forward UK CSS remains relatively weak… but gas vs coal switching is set to boost realised CCGT margins

• Switching: CCGTs displacing coal over summers. Further gas price falls will push more CCGTs into merit for longer periods.

• Realised margin: As plants move into merit, load factors and margin capture increase and running costs (e.g. starts) decrease.

• Non-linearity: margin recovery has a non-linear relationship to price, i.e. realised margin can increase quickly (ATM optionality).

70

Current vs historic (2010+) UK gas vs coal (36%) switching

55

50

45

40

65

60

35

30

50 55 60 65 coal [$/t]

70 75

CCGT @52%

CCGT @49%

CCGT @47%

Historic

Sum15

Win15

Sum16

Win16

Sum17

80

Source: Timera Energy

60

50

40

30

20

10

0

UK CCGT (52%) vs coal plant (36%) SRMC

CCGT @52% Coal @36%

Transport cost

Variable O&M

UK Carbon cost

EU Carbon cost

Fuel cost

1) 9

Quantifying gas asset margin & load factors

Robust valuation of European gas-fired plants requires quantification of asset risk/return distributions

• Gas plant role: European gas plants are currently operating as peaking and mid-merit capacity. This means a large portion of asset value is being realised over the day-ahead and within-day horizon.

• Shape & volatility: In this environment, the ability of assets to capture hourly price shape and respond to periods of price volatility is a key driver of asset values.

• Valuing gas assets: Asset optionality (flexibility) in capturing margin

45

40

35

30

25

20

15

10

5

0

Example modelled CCGT margin envelope (5%, 50%, 95%) asymmetric value upside non-linear margin increase as gas prices fall from price shape and volatility needs to be valued properly. A Base,

2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 2025

Example 2022 CCGT margin distribution

High & Low margin scenario approach does not do this justice.

• Capturing risk/return: A probabilistic (e.g. simulation) based modelling approach is required to value this optionality. This generates asset risk/return distributions (see charts) which are as important as ‘expected’ (50%) margin in quantifying asset value. asset value distribution has ‘fat’ right tail which increases expected value

1) 10

Commercial implications

An increase in gas plant competitiveness should translate into higher risk adjusted asset values

• New reality: A structural oversupply of LNG and weaker oil prices are driving a downward trend in European gas hub prices.

This is increasing European gas plant competiveness i.e. the ‘out of the moneyness’ of gas plant optionality is decreasing.

• Margin impact: Realised CCGT margin capture in the UK has started to increase. Peak margin capture opportunities are improving in some Continental markets. But forward CSS remain weak, although less negative now on the Continent.

• Market interest: Buyer interest in UK CCGTs has significantly increased over the last 12-18 months. But deep value discounts remain for Continental gas plants given more challenging risk/return dynamics and bearish CSS sentiment.

• Value increase: There are two ways gas plant value can increase as a result of falling gas hub prices:

1.

Higher peak margins, increasing the right tail of asset value distributions & peak insurance values

2.

Structural recovery in gas plant competitiveness (e.g. hub prices reach the tipping point as LNG imports rise)

• Value quantification: In order to quantify the impact of 1. and 2. on risk adjusted asset value and asset risk/return dynamics, it is important to use a probabilistic plant valuation model that generates asset margin distributions.

1) 11

Timera Energy & what we do

We offer expertise on value & risk in energy markets... and have a client base of leading companies

Our clients include Service

Valuation

Investment

Contracting

Value Monetisation

Risk Management

Description market analysis, value quantification and risk/return analysis for power plants, gas storage assets and gas/LNG supply contracts.

investment case development, entry/exit strategy, market value driver analysis, portfolio structuring and transaction support.

contract sales strategy, negotiation, structuring and reopener support for gas/LNG supply, gas storage & power offtake contracts.

asset value maximisation, hedging strategy and commercial analytics for flexible power, gas & LNG assets & portfolios.

exposure definition, risk measurement, capital allocation, risk limits, risk governance & controls.

1) 12

Timera Energy team

Our team members have extensive senior industry experience and practical commercial knowledge

Olly Spinks

• 20 years energy industry experience

• Expert in commercial and risk analysis

• Ran BP’s gas & power commercial analytics function

David Stokes

• 20 years energy/commodity market experience

• Expert in value/risk management of flexible assets

• Industry roles with Origin, Williams, JP Morgan

Nick Perry

• 30 years industry experience (Amoco, Exxon, Enron)

• Expert in commercial & risk management strategy

• Board level experience (Director Enron Europe)

Diederick Tesselaar

• Former Head of Trading at Petronas (UK)

• 15 years structured gas and power trading experience

• Head of Structured Trading EGL, Power Trader at Nuon

Howard Rogers

• 30 years gas industry experience (BP, OIES)

• Expert in fundamental analysis of energy markets

• Director of Gas Research Programme at OIES

Emilio Viudez-Ruido

• 15 years experience in European gas and power markets

• Strong expertise in valuation, hedging and risk analysis

• Expert in deconstruction & analysis of asset exposures

1) 13

Examples of recent client work

We deliver practical solutions adding tangible value to our clients… based on first hand experience

Project

Gas plant investment

UK Capacity

Market

CCGT monetisation

CCGT investment

Centrica CCGT asset sales

Client

Infrastructure

Fund

UK Generator

Infrastructure

Fund

Infrastructure

Fund

Infra fund

Summary

• Advisory on CCGT and peaking plant investment opportunities across NW Europe

• Analysis of market evolution, asset margins and project risk/return dynamics

• Analysis of capacity price evolution & margin impact for different asset classes

• Impact of capacity/energy margin evolution on asset margin/investment strategy

• Analysis of practical constraints in monetising CCGT portfolio in prompt/fwd market

• Delivery of commercial/risk analytics capability to support asset monetisation

• Identification and analysis of specific CCGT investment opportunities

• Market analysis, asset risk/return analysis, offtake contract structuring

• UK power market projections & asset margin analysis to feed DCF model

• Advised on structuring & negotiation of tolling & energy management contracts

1) 14

Areas we could work with you

The following list covers some areas of potential collaboration

We have worked for with a number of large private equity and infrastructure funds in the following areas:

Asset valuation - applying our in-house stochastic asset valuation modelling capability

Market analysis - using our market models for European power & gas markets to analyse asset margins

Investment case development – e.g. analysis of risk/return dynamics, monetisation strategy, business model

Entry/exit strategy – defining target assets and investment lifecycle strategy

Asset contracting – defining contracting, hedging and optimisation strategies (& asset value impact)

Energy services contracting – structuring of pricing, exposure transfer, incentivisation & performance metrics

Transaction support – e.g. bid advisory, due diligence

Asset integration – post acquisition integration and business capability development

1) 15