Asset Management: Luxembourg, your location of choice

Asset Management

Luxembourg, your location of choice

Seizing opportunities in Luxembourg

This publication is exclusively designed for the general information of readers only and does not constitute professional advice. This publication is (i) not intended to address the specific circumstances of any particular individual or entity, and (ii) not necessarily comprehensive, complete, accurate. PwC

Luxembourg does not guarantee that such information is accurate as of the date it is received or that it will continue to be accurate in the future. The reader must be aware that the information to which he/she has access is provided “as is” without any express or implied guarantee by PwC Luxembourg. PwC

Luxembourg cannot be held liable for mistakes, omissions, or for the possible effects, results or outcome obtained further to the use of this publication or for any loss which may arise from reliance on materials contained in it, which is issued for informative purposes only. No reader should act on or refrain from acting on the basis of any matter contained in this publication without considering and, if necessary, taking appropriate advice in respect of his/her own particular circumstances.

PwC Luxembourg (www.pwc.lu) is the largest professional services firm in Luxembourg with 2,450 people employed from 55 different countries. It provides audit, tax and advisory services including management consulting, transaction, financing and regulatory advice to a wide variety of clients from local and middle market entrepreneurs to large multinational companies operating from Luxembourg and the Greater Region. It helps its clients create the value they are looking for by giving comfort to the capital markets and providing advice through an industry focused approach.

The global PwC network is the largest provider of professional services in audit, tax and advisory. We’re a network of independent firms in 157 countries and employ more than 195,000 people. Tell us what matters to you and find out more by visiting us at www.pwc.com and www.pwc.lu.

Luxembourg Asset Management in 2020, a new vision

The Asset Management sector stands on the precipice of fundamental shifts that will make it significantly different tomorrow than it is today.

The good news is that we can look forward to a bright future: worldwide assets under management are continuing to rise, and we predict they will exceed USD 100 trillion by 2020*.

The increase in investable assets amid a wave of post-crisis regulations has created a uniquely favourable environment for asset managers to move centre stage.

Because asset growth will be mainly driven by the rising demand of the retirement market, the growing importance of sovereign wealth funds and increasing wealth in emerging markets, asset managers will favour territories that can demonstrate a framework of long-term stability, transparency and a commitment to serving an international fund industry.

With a proven focus on providing experience and infrastructure to service the industry, Luxembourg is set to benefit from this period of transformation. More particularly, Luxembourg is well positioned to leverage on the increase in cross-border activity, both in terms of investment and distribution, and to play a central role. The

Grand Duchy also has the key attributes necessary to become the leading global

AIF platform as it did with UCITS, and to thereby help alternative fund managers and institutional investors turn AIF

(Alternative Investment Fund) regulations into an advantage rather than a burden.

There is no doubt that 2020 will be a different world for asset managers. Those who intend to succeed have already started to shape their responses to the gamechangers that lie ahead. We are confident that many asset managers will rise to the new challenges and will capitalise on them. We, at PwC Luxembourg, are ready to help our clients with the myriad of changes looming on the horizon and see this as a great opportunity for Luxembourg to lead the way into a new era for asset management.

Steven Libby

Luxembourg Asset Management Leader

Steven Libby

Luxembourg Asset Management Leader

* PwC publication, Asset Management: 2020, A Brave New World.

Table of contents

1. Why Luxembourg?

............................................................................................................

4

2. Building your strategy

.......................................................................................

14

2.1. The right location is part of the right strategy

.........................

16

• Location

• Products

• Distribution channels

• Target investors

2.2. Legal structures of Luxembourg regulated investment vehicles

..............................................................................................................

24

• In a nutshell

• Comparative table

• Details per structure

1. Legal framework

2. Legal forms

3. Investors

4. Type of securities that may be issued to investors

5. Ongoing subscription and redemption of shares/units

6. Structuring of capital calls

7. Minimum capital requirement, compartments and classes

8. Management Company and compulsory service providers in Luxembourg

- Management Company and “self-managed SICAV” status

- AIFM and the “internally-managed AIF” status

- Central administration

- Depositary bank

- External auditor

9. Eligible investments and investment restrictions

10. Frequency of NAV calculation and valuation principles

11. Distribution channels

12. Fund taxation

13. Tax Treaties

14. VAT on services provided

15. Applicability of the EU Savings Directive

16. Possibility to use intermediary vehicles for co-investment, tax or other purposes

Table of contents

3. Practical guide

..................................................................................................................

42

3.1. Set-up

.....................................................................................................................................

44

• Drafting constitutional documentation

• Submission of the investment vehicle’s documentation to the CSSF

• Incorporation, CSSF visa and launch of the investment vehicle

• Tax considerations

- Funds

- Management Company

• One-off and ongoing costs at a glance

3.2. Distribution

...................................................................................................................

48

• UCITS

• AIFs

3.3. Maintenance

.................................................................................................................

54

• CSSF supervision

• Reporting requirements

• Amendments to an existing investment vehicle

• Tax considerations

- Funds

- Management Company

- Investors

- Value Added Tax (VAT)

- Challenges

3.4. Restructuring

...............................................................................................................

60

• Mergers

• Master-feeders

• Re-domiciliation

3.5. Liquidation

....................................................................................................................

67

• Liquidation of investment vehicles and compartments

- Liquidation of a SICAV

- Liquidation of a FCP

- Liquidation of a compartment of an investment vehicle

• Tax considerations

4. An influential player in Luxembourg

....................................

70

Contacts

...........................................................................................................................................

70

5. Glossary

........................................................................................................................................

71

Why Luxembourg?

• Welcome to the largest investment fund centre in Europe

• Luxembourg: 30 years of success in

Asset Management

• Your gateway to the world

• Located at the heart of Europe

• Unmatched political and budgetary stability

• Government access and support

• A stable and rewarding tax environment

• An international and highly productive workforce

• Luxembourg in a nutshell

6

PwC Luxembourg

1. Why Luxembourg?

Welcome to the largest investment fund centre in Europe

Cross-border distribution leader

With more than

EUR

3

trillion

Assets under Management

67%

of authorisations of

Luxembourg for crossborder distribution worldwide

Luxembourg is Europe’s largest investment fund centre and world’s second largest after the US

Luxembourg’s position as a key domicile for internationally distributed funds began in 1988 when the first UCITS Directive was implemented into local law. Since this date,

Luxembourg has enjoyed significant and consistent growth in both assets and fund numbers with a notable surge since the turn of the century reflecting the increasing attractiveness of Luxembourg as a hub for mainstream and alternative global fund products.

Historically, Luxembourg’s success has been fuelled by its ability to offer an attractive platform for retail funds distributed in

Europe and globally.

At PwC Luxembourg, we are confident that the expertise of the fund community in

Luxembourg, together with the business minded environment and the long standing tradition of being a safe fund centre will allow the Grand Duchy to weather the regulatory storm. We are pleased to provide this summary of the Luxembourg business and regulatory environment for your information and stand ready to provide support whatever your needs may be.

Asset Management: Luxembourg, your location of choice

7

Cross-border registrations

18,000 in 2001

83,505 in 2014

55,787 from luxembourgish funds

Cross-border funds

3,260 in 2001

10,430 in 2014

5,726 domiciliated in

Luxembourg

Number of

SIFs

227 in 2006

1,590 in 2014

Number of compartments

From

727 in 1990 to

13,849 in December 2014

Domicile share of authorisations for cross-border distribution of ETFs, in March 2014

Luxembourg

40%

8

PwC Luxembourg

Luxembourg: 30 years of success in Asset Management

EUR bn

2014

Luxembourg reaches record AuM of over 3 trillion Euros representing an increase of 18,34% since 1 January 2014.

In January 2014, the first ever RQFII UCITS fund, allowing investors to access securities listed in Mainland China, has been launched in

Luxembourg (this fund got authorisation from CSSF in November 2013).

2013

The AIFMD 2011/61/EU of 8 June 2011 has been implemented in Luxembourg law with the Law of 12 July 2013.

2012

The Luxembourg draft law transposing the

AIFMD was submitted to parliament.

2010

As se ts un de r M an ag em en t

UCITS IV is transposed into national law.

2007

MiFID is transposed into national law.

Law of 13 February 2007 on Specialised Investment Funds

(SIF).

2002

The euro is introduced, replacing the Luxembourg franc.

The third UCITS Directive is transposed into national law.

1992

The Maastricht Treaty establishes the European Union.

1991

Law of 10 July 1991 on Institutional funds.

1988

Luxembourg becomes the first member state to transpose the European Directive for

Collective Investments (UCITS). The Association of the Luxembourg Fund Industry

( ALFI ) is established.

Asset Management: Luxembourg, your location of choice

9

Your gateway to the world

• The world’s biggest fund managers have chosen Luxembourg as the base for their global distribution.

• More than 50 fund promoters from over 19 countries have chosen Luxembourg as their international hub.

• The main countries of origin for fund promoters are US, United Kingdom, Switzerland and France. The others originate from countries in Europe, Asia, the Middle East and the

Americas.

• Luxembourg funds are distributed to over 70 countries in Europe, Asia, the Middle East and the Americas.

Luxembourg funds are exported to more than

MAIN FUND DOMICILES

AND NUMBER OF

COUNTRIES OF

DISTRIBUTION

The table herewith shows the top 25 cross-border groups in Europe classified by the number of countries into which they are selling.

70

countries

1 FRANKLIN TEMPLETON

2 HSBC

3 BLACKROCK

4 FIDELITY WORLDWIDE INVESTMENTS

5 BNP PARIBAS

6 ALLIANZ GROUP

7 GAM (INCLUDING SWISS AND GLOBAL)

8 JP MORGAN

8 PIONEER INVESTMENTS

10 SCHRODERS

10 UBS

12 INVESCO

12 AMUNDI GROUP

14 ABERDEEN ASSET MANAGEMNT

15 ROYAL BANK OF SCOTLAND

16 DEUTSCHE BANK

16 HENDERSON GROUP

16 BNY MELLON

16 LEGG MASON

16 PIMCO

16 CAPITAL GROUP

22 ALLIANCEBERNSTEIN MANAGEMENT

22 ING INVESTMENT MANAGEMENT

22 PINEBRIDGE

25 CREDIT SUISSE GROUP

25 INVESTEC

25 PICTET & CIE

26

25

25

25

26

26

26

26

24

24

24

29

28

27

26

31

30

30

29

35

33

32

31

49

45

44

39

First domicile and # of countries of distribution (cr Second domicile and # of countries of distribution (cr

LU 48 -

LU 40 IE

- -

18 GG

LU 36 IE 25 DE

LU 38 UK 11 IE

LU 34 FR 12 -

LU 32 IE 12 DE

LU 26 IE

LU 31 HK

23 UK

6 -

LU 30 AT 4 -

LU 29 UK 13 HK

LU 29 IE

LU 27 IE

15 FR

25 KY

LU 28 FR 13 IE

LU 27 UK 6 IE

LU 26 -

LU 22 IE

- -

16 DE

IE

IE

LU 25 UK 12 -

IE 24 LU 14 UK

22 LU 10 -

25 -

LU 25 -

- -

- -

LU 24 -

LU 24 -

IE 24 -

LU 22 IE

LU 22 GG

LU 23 CH

- -

- -

- -

10 LI

7 UK

2 -

12

-

5

3

4

2

4

-

4

-

7

-

13

11

5

-

3

-

-

-

11

-

-

-

-

4

-

Ranking according to the total number of country registrations for all cross-border funds of each group.

Domicile share of authorisations for cross-border distribution

67%

20%

2%

4%

2%

5%

Most popular markets for cross-border funds from:

Luxembourg

Authorisations in:

Germany

Switzerland

Austria

France

Netherlands

4,704

4,098

4,067

3,470

3,258

Ireland

Authorisations in:

United Kingdom

Germany

France

Netherlands

Switzerland

1,880

1,708

1,371

1,343

1,275

Funds Domicile:

Luxembourg

Ireland

France

Jersey

United Kingdom

Other

Sources: Lipper LIM and PwC analysis, 31 December 2014.

10

PwC Luxembourg

Located at the heart of Europe

Luxembourg is within driving distance of all major European business centres.

Around 40% of the European Union’s wealth is concentrated in a 500km area around Luxembourg. When extended to

700km, this figure rises to around 70%.

Luxembourg in the heart of a

500+ million customer base

40% of the EU wealth

70% of the EU wealth

700

km

500

km

40% of the EU wealth

70% of the EU wealth

700

km

500

km

Asset Management: Luxembourg, your location of choice

11

Unmatched political and budgetary stability

Luxembourg is famous for its long-standing political stability and one of the lowest debt to GDP ratio of the EU (23.6% vs

85.4% for the EU28). The country credit trustworthiness is rated at AAA by Standard and Poor’s.

Source:

Lux Debt to GDP ratio | 23.6 | Eurostat, as of 2013,

Government consolidated gross debt

EU Debt to GDP ratio | 85.4 | Eurostat, as of 2013,

Government consolidated gross debt EU 28

Lux rating | AAA

Government access and support

The Luxembourg government has always had an open and friendly ear for the various business players. The authorities are accessible, officials are easy to contact and open to dialogue. This close relationship between government and business community will allow Luxembourg to continue to strengthen its position as the most attractive fund centre.

A stable and rewarding tax environment

Total Tax Rate VAT

Luxembourg ranks 20 out of 189 economies analysed in the “Paying Taxes 2015” survey led by PwC and the World Bank.

Luxembourg’s low percentage is explained by the availability of important tax credits for investments in fixed assets which offset the corporate income tax liability of a company.

Luxembourg has always applied the lowest rates in the EU. The difference rates applicable are: 3%, 8%, 14% and

17% according to the goods or services purchased.

Although Luxembourg raised these rates as of January 2015, they remain the lowest throughout Europe.

Double tax treaties

Luxembourg has signed, and still continues to sign, a large number of treaties with

EU and non-EU countries to avoid double taxation of individuals and companies resident for tax in another country. So far,

Luxembourg has entered into 68 treaties.

Snapshot of business taxes

Luxembourg

Profit Tax Total Tax Rate

EU and EFTA

Labour Tax Total Tax Rate

Source: PwC Paying Taxes 2015 analysis

Stability

World

Other Tax Total Tax Rate

With public finance comfortably within EU stability and Growth Pact requirements,

Luxembourg will maintain one of the most attractive tax regimes in Europe.

Personal tax

Personal taxation and social-security regime are very competitive compared to other European countries; there are many allowances, deductions, and exemptions in the Luxembourg income tax regime.

Tax area

Corporate

Tax

Value Added

Tax (VAT)

Individual

Tax

Intellectual

Property (IP)

Rates

29.22%

0.5%

0%-15%

Income tax

Net wealth tax

Withholding tax

3%

8%

14%

17%

Applies to food, hotels, restaurants, medical, entertainment etc.

Applies to domestic services

Applies to the supply of certain items, i.e. solid mineral fuel and mineral oil, custody and management of securities

Standard rate

0% - 44.1% Individual income tax

80% Exemption for net income derived from certain IP rights

12

PwC Luxembourg

An international and highly productive workforce

45% of Luxembourg residents are not from Luxembourg

, and each day, around 166,000 people commute to

Luxembourg.

A defining characteristic of the Grand

Duchy of Luxembourg is the diversity of its people and the

ease of integration

into the community.

The labour market in Luxembourg offers a pool of highly skilled and multilingual resources from Luxembourg as well as

France, Germany and Belgium.

The integration of foreigners is very easy as

Luxembourgish, French and German are the official languages

, and as

75% of

Luxembourgers can speak

English

. Luxembourg’s quality of living, social security coverage, fine public infrastructure, rewarding packages and ideal gateway to European careers have attracted highly skilled profiles.

Luxembourg in a nutshell

Unmatched political and budgetary stability Located at the heart of Europe

Government access and support

A stable and rewarding tax environment

European largest fund domicile and world’s second largest fund centre after the US

Luxembourg’s national debt has been one of the lowest in Europe over the last three years (23.6% of GDP in 2013)

An international and highly productive workforce with a sound expertise in all aspects of the fund life cycle

One of the lowest unemployment rates in

Europe (7% in December 2014)

Source:

Lux unemployment rate | 7.0 | Eurostat, as of 2014/12

Lux debt to gdp | 23.6 | Eurostat, as of 2013, Government consolidated gross debt

Building your strategy

2.1. The right location is part of the right strategy

• Location

• Products

• Distribution channels

• Target investors

2.2. Legal structures of

Luxembourg regulated investment vehicles

• In a nutshell

• Comparative table

• Details per structure

1. Legal framework

2. Legal forms

3. Investors

4. Type of securities that may be issued to investors

5. Ongoing subscription and redemption of shares/ units

6. Structuring of capital calls

7. Minimum capital requirement, compartments and classes

8. Management Company and compulsory service providers in Luxembourg

- Management Company and “self-managed

SICAV” status

- AIFM and the “internally-managed AIF” status

- Central administration

- Depositary bank

- External auditor

9. Eligible investments and investment restrictions

10. Frequency of NAV calculation and valuation principles

11. Distribution channels

12. Fund taxation

13. Tax treaties

14. VAT on services provided

15. Applicability of the EU Savings Directive

16. Possibility to use intermediary vehicles for co-investment, tax or other purposes

16

PwC Luxembourg

2. Building your strategy

2.1. The right location is part of the right strategy

All good things start with a solid strategy.

To design the most efficient strategy to create, maintain and successfully distribute an investment fund that meets your long term business objectives, many different, and often competing factors, need to be identified and evaluated. For example, the type of fund structure that best suits both the investment strategy you wish to offer and local distributors and/or that local target investors feel comfortable with, what target markets provide the best chances of sales success; what, if any, specific local requirements exist in each of the targeted local markets, what key distribution channels are available, what is the appetite of local investors for your strategy, just to name a few.

A robust and well-designed strategy needs to be comprehensively developed and efficiently executed to maximise your opportunities for long-term success. Such a robust strategy often has the following key elements:

“Nothing good happens by accident”

Ken Blanchard,

“The 1 minute entrepreneur”

The Fund Strategy Mix

Location

(page 17)

• Where should my fund be domiciled?

• Which jurisdictions should be targeted?

Distribution channels

(page 20)

• What distribution models should be used (i.e. public distribution, private placement, listing)?

• What distribution channels are available and most appropriate?

The Fund

Strategy Mix

Products

(page 19)

What type of fund structure and product should I create and with what sort of features to satisfy local requirements:

• UCITS,

• AIFs,

• ETFs.

Target investors

(page 22)

Which type of investors should be targeted:

• Pension funds/private banks/Corporates/HNWI’s/ mass retail?

Asset Management: Luxembourg, your location of choice

17

Location

European fund asset domiciles (UCITS)

2,643

336 296

249 226 196

105 100 92 84

237

Luxembourg

Ireland France

UK

Others

Source: EFAMA (AuM - December 2014 in million euros)

UCITS % market share in Europe

UK

13%

France

14%

1,274

1,146

995

Others

16%

Switzerland

4%

Germany

4%

Luxembourg

33%

Ireland

16%

Selecting the most appropriate location in which to create and base your investment fund and then to target foreign markets is the starting point of a robust and efficient long-term distribution strategy. The initial market selection is critical as attempting to change the domicile of an investment fund at a later stage, whilst possible, is very time consuming, administratively difficult and costly.

As it has for more than 30 years,

Luxembourg remains the location of choice for fund domiciliation within Europe and as a centre for funds that are sold crossborder across Europe and the world. Not only is Luxembourg the second largest fund domicile in the world, after the US, and Europe’s leading centre for fund domiciliation, it also remains the world’s number one fund domicile for cross-border fund distribution 1 . This long-term leading position is due to a myriad interconnected factors, including but not limited to:

• Reputation for market oriented public policy

• Robust regulatory framework of

EU laws

• Economic and political stability

• Tax efficiency and neutrality

• Service provider specialisation

• Full focus on exporting fund solutions

Over the years, the Luxembourg based fund has become synonymous of the UCITS brand and of their crossborder distribution.

Source: EFAMA December 2014

Another key factor in Luxembourg’s continued success in cross-border funds is its small internal market. Whereas all other large countries shape their fund industry based on their internal market and constraints,

Luxembourg’s small domestic market has permitted the government and fund industry to focus its tax, regulatory and business policies almost exclusively on the exportation or cross-border sales of investment funds and thus developing an investment fund environment almost totally focussed on and supportive of cross-border fund distribution.

In 1988, Luxembourg was the first country to fully implement the original 1985 UCITS

Directive and it has developed a large multilingual labour force and ability to service and assist with the distribution of funds from and in different jurisdictions. In addition to this, the country’s fund tax treatment and EU based regulatory environment is malleable enough to allow fund promoters to quickly adapt their fund ranges, thus being able to respond to changing investor demands and market requirements.

Due to its internal market size and strong working commitment of all key stakeholders,

Luxembourg is able to react extremely quickly to market developments and asset managers’ requirements and modify policies relating to funds as the need may be. The confidence that the global asset management industry has in

Luxembourg is demonstrated by the fact that as of 2013, Luxembourg hosted 49 of the 50 top cross-border fund managers.

1 Cross-border fund distribution: funds distributed in at least 3 countries, including their domicile country.

18

PwC Luxembourg

Evolution of alternative funds domiciled and administered in Luxembourg

At the same time Luxembourg has developed a strong track record in alternative investment products and bespoke investment structures such as hedge funds, funds of hedge funds, private equity vehicles and real estate funds, managing more than

EUR 5oo billion in alternative assets.

% of hedge funds by main country of domicile

Caymans

0% 5% 10% 15% 20% 25% 30% 35% 40% 45%

40,1%

27,7%

27,7%

Delaware

21,7%

6,9%

BVI

3,6%

3,3%

Ireland

11,9%

1,3%

Luxembourg

14%

20,8%

Others

2008

Source: HFR

2009 2010

21,1%

2011 2012 2013 2014

Asset Management: Luxembourg, your location of choice

19

Products

The appetite for financial products often varies considerably from one local jurisdiction to another, due to cultural norms, historical developments over the years, local regulations and often the different tax treatments that favour one type of financial product over another. All of these issues should be analysed in arriving at the most appropriate fund product to create and support your distribution strategy. Another key issue to consider is whether your product will be distributed on a multi-jurisdictional basis, if so, how widely and what specific product features are different investor types in different target markets looking for. For example, products that accumulate income, distribute income, provide hedging, guarantee capital, etc. Getting the right balance of product features to maximise investor appeal in each of the foreign markets you wish to enter, but at the same time not creating overly complex and administrative inefficient products, can be a difficult balance to get right. However, this appropriate balance will have a significant influence on the longterm success of your fund.

The latest available statistics show that towards the end of 2012, the weight of the

UCITS funds was considerably higher than the non-UCITS funds. The latter were not originally regulated or subject to the EU passport rules. Post the 2008 financial crisis, regulated funds and managers have become more important. The idea behind introducing the AIFMD is that regulated hedge funds could also have the benefit of an EU passport.

Over the past couple of years there have been an increasing number of alternative funds launched as SIF in Luxembourg. It is strongly anticipated that over the next few years the

AIFMD will create a brand of its own, as strong as that of UCITS.

The following fund products are mainly used in Luxembourg from a global distribution perspective:

Definition

Main characteristics

Undertakings for

Collective Investment in

Transferable Securities

(UCITS)

Undertaking the sole object of which is the collective investment in transferable securities and/or in other liquid financial assets of capital raised from the public and which operates on the principle of risk-spreading and the units of which are, at the request of holders, re-purchased or redeemed, directly or indirectly, out of those undertakings’ assets 3 .

• It targets to reach the widest range of investors possible.

Alternative Investment

Funds (AIFs)

Vehicle (other than UCITS funds) which raises capital from a number of investors with a view of investing it in accordance with a defined investment policy 4 .

• An AIF can be a non-UCITS collective investment fund, but also certain non-regulated entities.

Why?

Who are the target investors?

• A wider choice of funds is possible;

• Can be offered to a very extensive range of investors;

• Greater transparency than other products;

• UCITS regulations are unique and strong;

• Enhanced risk controls 5 ;

• Defined level of investor protection through strict investment limits;

• Easy and to a large extent harmonised distribution.

• Creation of a single market through harmonised rules;

• Increased monitoring of systemic risks and increased transparency;

• Ensures enhanced investor protection for alternative products;

• Can be easily sold to professional investors within the EU Member

States due to the marketing passport that has come into force on

22 July 2013.

Retail and institutional investors.

Sophisticated investors

(professional investors, High

Net Worth Individuals).

Exchange traded funds

(“ETFs”) 2

Investment vehicle that is structured to enable investors to track a particular index through a single instrument that can be purchased or sold on a stock exchange.

• Easy set-up, as a UCITS fund, in most cases;

• ETFs have both the characteristics of an investment fund, such as low costs and broad diversification but also characteristics more commonly associated with equities, such as access to real time pricing and trading.

• High product transparency, flexibility as a portfolio management instrument, and low total expense ratio;

• Quick and easy investor access to the capital market as ETFs can be purchased on the stock market just like shares, and they can be traded daily during trading hours and more control as investors can place limit or stop-loss orders;

• Tax efficient instruments that require only the market price of one share as capital investment.

Retail and institutional investors, depending whether the ETF is set up as UCITS fund or AIF.

2 “Being distinctive Exchange Traded Funds”, PwC Luxembourg, 2010.

3 European Directive 85/611/EC on the coordination of laws, regulations and administrative provisions relating to undertakings for collective investment in transferable securities (UCITS).

4 “The AIFMD outside the EU Why non-EU managers should gear up for the AIFMD”, PwC Luxembourg.

5 “UCITS Handbook - How to Set up, Monitor, Manage and Distribute a UCITS Fund”, ISTE Ltd and John Wiley and Sons, Inc, p.236-237.

20

PwC Luxembourg

Distribution channels

After having selected the location of choice for your fund as well as the type of products and features you would like to offer, the next step is to contemplate on how to enter a specific target distribution market taking into local and international regulations, such as MiFID II.

Selling your fund can be undertaken through different types of distribution methods, strategies and specific channels of marketing.

Generally speaking there are three methods to enter target markets:

Public distribution Private placement Listing

Main characteristics

Degree of harmonisation at

European level

Products

Target investors

How?

Fund distribution through a specific notification process to the Home and Host

Regulators.

• Under UCITS Directive, the notification procedures are broadly harmonised for

EU wide distribution but there are still many differences in the local marketing arrangements in each EU Member State that must be complied with (apart from the various tax reporting requirements in some jurisdictions). For example, there are still many EU Member States which require the appointment of a local paying agent. The same can apply to AIFs marketed within the EU.

• Outside the EU, UCITS must of course comply with the local regulations regarding public distribution of foreign funds. These local regulations will vary from country to country but it is fair to say that the registration process to be authorised in order to publicly sell a UCITS outside the

EU is usually significantly more complex, time consuming and ultimately costly, than the “notification” process governed by the

UCITS Directive for EU Member States.

However, in some non-EU jurisdictions, such is the acceptance of the UCITS brand that in many jurisdictions UCITS funds have a “lighter” authorisation process than the non-UCITS equivalent investment funds.

UCITS and AIFs.

All of the local investors normally and without any restriction.

A private, non-public sale between an investment fund and individual investor, usually outside the regulatory framework governing public distribution or marketing.

Private placement rules are not harmonised within the EU, each jurisdiction being able to operate national rules to permit such distribution. Some jurisdictions do not permit any form of private placement at all or at least to retail clients (for example, France and Italy, also post- AIFMD implementation, Germany).

Thus, in three of the largest markets, you will no longer be able to sell investment funds to investors on an unregulated, private basis.

Post 22 July 2013 to 2015, when the AIFM

Directive comes into force at the national level, the regime governing marketing to EU investors will depend on where the manager and the AIF are based.

Most countries in the EU are going to change their national regulation to incorporate AIFMD and will most likely close down private placement after a transitional period. There is going to be a maze of regulation which managers in the EU or outside will need help in interpreting.

Either directly or through financial intermediaries.

The third party fund distribution may be open, closed and guided. The open architecture, how it is called in practice, implies that the intermediaries offer a large pallet of third party funds that pertain to competing asset management groups. On the opposite side we have the closed architecture, which offers to investors only its own products

(for instance, a bank that only promotes its own fund ranges). The “meeting” point of these two types of channels is the guided architecture in which the intermediary offers third party funds from a carefully selected platform of management groups.

UCITS and AIFs.

Professional investors rather than mass retail or high net worth individuals, for UCITS usually a small number of institutional investors because local regulations in many jurisdictions permit such investors to subscribe to shares or units in a foreign

UCITS without registration.

Direct client interfacing, no local agents, no financial intermediaries.

Admission and trading of securities on a regulated market.

The listing procedure has as pre-requisite the authorisation for public distribution in the selected jurisdictions.

ETFs (mainly set-up as UCITS or AIFs).

All of the local investors normally and without any restriction.

Once approval for public distribution has been obtained, the issuer must prepare an authorisation and/or listing application file

(the complexity of which depends on the targeted country) and submit it to the local stock exchange for validation.

Both UCITS and AIF funds can be listed on the Luxembourg Stock Exchange, as well as on other European exchanges like the

London Stock Exchange, Frankfurt Börse,

Paris Stock Exchange, Amsterdam Stock

Exchange and Zürich Stock Exchange.

Asset Management: Luxembourg, your location of choice

21

UCITS: a worldwide recognised brand

Worldwide presence of Luxembourg funds

Focus on Europe

80% (+19%)

58% (+6%)

63% (+4%)

Focus on Americas

0% (~0%)

91% (+4000%)

46% (+1%)

63% (-6%)

Focus on Asia

67% (+7%)

100% (+24%)

65% (+208%)

100% (+5750%)

64% (+11%)

66% (-4%)

69% (+12%)

19% (+300%)

60% (+4%)

95% (+10%)

58% (+2%)

77% (+3%)

70% (-5%)

72% (+5%)

Proportion

75%

94%

72%

83%

91%

91%

33%

63%

64%

76%

95%

89%

96%

96%

80%

43%

77%

57%

67%

67%

65%

58%

100%

69%

63%

60%

86%

93%

100%

61%

96%

78%

66%

91%

100%

69%

79%

92%

Country

Hungary

Iceland

Ireland

Isle of Man

Italy

Jersey

Latvia

Liechtenstein

Lithuania

Malta

Monaco

Netherlands

Norway

Poland

Portugal

Romania

Andorra

Austria

Belgium

Bulgaria

Cyprus

Czech Republic

Denmark

Estonia

Faroe Islands

Finland

France

Germany

Gibraltar

Greece

Greenland

Guernsey

Slovakia

Slovenia

Spain

Sweden

Switzerland

United Kingdom

Growth

17%

4%

0%

0%

3%

2%

0%

5%

11%

52%

-1%

18%

8%

8%

19%

3%

-8%

0%

7%

16%

8%

6%

200%

9%

4%

4%

5%

1%

0%

73%

9%

-1%

8%

-6%

9%

8%

5%

-6%

Country

Australia

Brunei Darussalam

Hong Kong

Japan

Korea

Macao

New Zealand

Singapore

Taiwan

Bahrain

Jordan

Kuwait

Lebanon

Oman

Qatar

Saudi Arabia

Turkey

United Arab Emirates

Proportion

77%

81%

100%

100%

100%

100%

100%

100%

92%

65%

95%

70%

50%

69%

19%

100%

72%

58%

Country

Bahamas

Canada

Cayman Islands

Chile

Colombia

Dominican Republic

El Salvador

Mexico

Panama

Peru

Saint Martin

Trinidad & Tobago

United States

Botswana

Mauritius

South Africa

Proportion

91%

46%

100%

98%

40%

100%

100%

54%

50%

0%

100%

0%

0%

66%

29%

63%

Growth

3%

34%

950%

33%

24%

5750%

1983% inf

0%

208%

300% inf

5%

2%

10%

-5% inf

12%

Growth

4000%

1%

0%

-2%

0%

33%

67%

-10% inf

0% inf

0%

0%

-4%

0%

-6%

Sources: Lipper LIM and PwC Luxembourg analysis, 31 December 2014.

Cooperation Agreement Inter-state arrangement for facilitating the cross-border offering of collective investment schemes.

Cross border registrations of Luxembourg funds

% Registrations of Luxembourg cross border funds as a percentage of total cross border fund registrations in each market

(%) Percentage change in the number of Luxembourg cross border fund registrations between 2013 and 2014

22

PwC Luxembourg

Target investors

Total AuM by investor type

Institutional investors breakdown

Pension funds

32%

Retail

24%

Institutional

76%

42%

Insurance companies

Other institutionals*

23%

3%

Banks

From EFAMA “Asset Management in Europe” report published in June 2014

* The other institutional investors are usually defined as foundations, charities, governments, central banks, sovereign wealth funds, etc.

Generally speaking, investment funds that qualify as UCITS can be offered to all types of investors, main categories being institutional and retail clients.

Institutional clients consist of a broad range of investors as depicted above. Despite the large number of investors fitting into this category, institutional investors are dominated by insurance companies and pension funds.

Overall, these two investor types account for

69% of total AuM in Europe in 2013.

The retail investor segment tends to be dominated by households, often referred to as “mass retail”, mass affluent and high net worth individuals.

The most appropriate distribution channel to target such investors depends on the type of investor. For example, retail UCITS products are most commonly distributed via large networks of retails banks and private bank offices. The use of fund platforms to facilitate the sale of UCITS has grown considerably over the past 10 years. These “platforms” are, in reality, an intermediate entity connecting the fund to the end investor. Retail clients are more than often accessed indirectly, via the socalled “unit linked funds” which are offered by the insurance industry.

This distribution channel is sustained by the different national tax incentives/tax relief at the UCITS level. Also, one type of channel that has developed over the past five years is that of boutique intermediaries

(targeting professional and institutional investors). This third party distribution channel is formed by experienced industry professionals who, among others, also advise their clients on specific fund structures, sales strategies and targeted fund distribution. They also offer tailored solutions to asset managers.

Asset Management: Luxembourg, your location of choice

23

The figures below show the main distribution channels used in practice for offering UCITS and non-UCITS funds depending on the target markets:

Germany

Insurance companies

4%

IFAs**

9%

Online banks

10%

Independent

Management

Companies

11%

Source: BVI

Others

4%

Retail banks

62%

Switzerland

Insurance companies

5%

Source: SFA

Hong Kong

Private banks

95%

Insurance companies

10%

Direct Agents

11%

Mandatory provident funds*

21%

Source: Cerulli Edge

United Kingdom

Retail banks

2%

Private banks

6%

Fund of funds

9%

Insurance wrapper

12%

Institutions

13%

Source: European Fund Market data digest

Supermarket

2%

IFAs**

56%

France

Direct sales

1%

IFAs**

8%

Private banks

11%

Italy

Institutions

34%

Insurance companies

10%

IFAs**

10%

Fund of funds

11%

Insurance wrapper

14%

Source: European Fund Market data digest

Retail banks

21%

Source: Assogestioni

* Compulsory pension schemes for Hong Kong residents

** Independent Financial Advisers

IFAs**

4%

Retail banks

27%

Private Banks

27%

Banks

80%

24

PwC Luxembourg

2.2. Legal structures of Luxembourg regulated investment vehicles

In a nutshell

Investment vehicles characteristics

An “onshore” investment vehicle subject to the supervision of a recognised financial authority (the “CSSF” –

Commission de Surveillance du Secteur Financier).

Allowing investment in any type of asset.

Opened to all types of investors in Luxembourg

(i.e. no competency or minimum investment requirement).

Benefiting from less stringent regulatory requirements

(as it is dedicated to institutional, professional and other well-informed investors).

Allowing investment in any type of private equity asset and not subject to investment risk diversification requirements.

Distributable to the public in any EU country (via the UCITS passport).

Dedicated to professional investors which can be managed by any EU AIFM and which can be marketed in any EU country (provided that the investment vehicle qualifies as an AIF and that all the requirements of the AIFM Law shall be complied with).

Not subject to corporate income tax.

With features close to a fund although it is subject to corporate income tax.

Part I UCITS x x x x

Part II UCI x x x x x

SIF x x x x x

SICAR x x x x x

Asset Management: Luxembourg, your location of choice

25

What about the alternative investment funds and the AIFMD?

The Alternative Investment Fund Managers

Directive 2011/61/EU of 8 June 2011

(the “AIFMD”) has been implemented in

Luxembourg law with the Law of

12 July 2013 on Alternative Fund Managers

(the “AIFM Law”) and aims at regulating

Alternative Investment Fund Managers

(“AIFMs”). According to the AIFM Law, an Alternative Investment Fund (“AIF”) is an undertaking for collective investment, including investment compartments thereof, which: a. raises capital from a number of investors, with a view to investing it in accordance with a defined investment policy for the benefit of those investors; and b. does not require authorisation pursuant to the Directive 2009/65/EC (i.e. the

UCITS IV Directive);

Therefore a SIF and a SICAR only qualify as AIFs provided that they raise capital from a number of investors, with a view to investing in accordance with a defined investment policy for the benefit of their investors, unless exemptions apply (please refer to page 37).

In case of Part II UCIs, there is no need to demonstrate that the investment vehicle fulfils the definition criteria of an AIF.

All Part II UCI qualify as AIFs within the meaning of the AIFM Law and there is no exception to this rule.

The AIFM Law and the European

Commission Delegated Regulation n° 231/2013 of 19 December 2012 does not really provide additional requirements for AIFs, but provides a set of stringent requirements for the AIFMs as set out in page 36 (AIFM and the “internally-managed

AIF” status) and the flyer “Licensing and reporting of a Luxembourg AIFM” attached to this brochure.

For the purpose of clarity, the case of SIF and SICAR which do not qualify as AIFs will not be set out in this brochure, as well as the case of investment vehicles which are not regulated and which qualify as

AIFs.

26

PwC Luxembourg

The comparative table enclosed gives an overview of the legal structures of Luxembourg regulated investment vehicles.

To learn more about a specific topic in the table insert, please

Comparative table insert

Comparative table

1 - Legal framework

(details page 27)

Part I UCITS

Part I of the law of 17

December 2010 on UCIs

(the “2010 Law”).

Part II UCI

Part II of the 2010 Law.

SIF

Law of 13 February 2007 on SIFs (the “SIF Law”).

Yes, principle of “variable capital”.

Yes, principle of “variable capital”.

SICAR

Law of 15 June 2004 on investment company in risk capital (the “SICAR

Law”).

Corporate form only.

2- Legal forms

(details page 28)

3 – Investors

(details page 30)

4 - Type of securities that may be issued to investors

(details page 30)

5 - Ongoing subscription and redemption of shares/ units

6 - Structuring of capital calls

(details page 31)

Corporate form or contractual form.

All types of investors.

• Shares/Units.

Yes, principle of “variable capital”.

7 – Minimum capital compartments and classes

(details page 32)

Corporate form or contractual form.

All types of investors.

• Shares/Units.

Corporate form or contractual form.

Well-informed investors.

• Shares/Units.

• Beneficiary units.

• Debt.

Well-informed investors.

• Shares/Units.

• Beneficiary units.

• Debt.

Yes, principle of “variable capital”.

Not relevant.

• Minimum capital of

EUR 1.25 Mio to be reached within

6 months following approval.

• Multiple compartments authorised.

• Classes of shares authorised.

Capital calls may be organised by way of capital commitments or through the issue of partly paid shares or units (for

FCPs and SICAFs only).

• Minimum capital of

EUR 1.25 Mio to be reached within

6 months following approval.

• Multiple compartments authorised.

• Classes of shares authorised.

Capital calls may be organised either by way of capital commitments or through the issue of partly paid shares or units.

• Minimum capital of

EUR 1.25 Mio to be reached within 12 months following approval.

• Multiple compartments authorised.

• Classes of shares authorised.

Capital calls may be organised either by way of capital commitments or through the issue of partly paid shares.

• Minimum capital of

EUR 1 Mio to be reached within 12 months following approval.

• Multiple compartments authorised.

• Classes of shares authorised.

8 – Management

Company and service providers in

Luxembourg

(details page 33)

9- Eligible investments restrictions

(details page 39)

• Depositary bank.

• Central administration.

• Chapter 15

Management company

(if not self-managed).

• External auditor.

Transferable securities and/or any other liquid financial assets authorised by the UCITS IV Directive.

Maximum 10% of the fund/sub-fund’s gross assets in one issuer as defined by the UCITS

Directive.

• Depositary bank.

• Central administration.

• Chapter 15 or Chapter

16 Management company (if not selfmanaged).

• External auditor.

Any type of assets.

Maximum 10% of the fund/sub-fund’s gross assets in one issuer.

It is however possible to set up and entirely hold a special purpose vehicle.

• Depositary bank.

• Central administration.

• Chapter 15 or Chapter

16 Management company (if not selfmanaged).

• External auditor.

Any type of assets.

Maximum 30% of the fund/sub-fund’s gross assets in one issuer.

It is however possible to set up and entirely hold a special purpose vehicle.

• Depositary bank.

• Central administration.

• Chapter 15 or Chapter

16 Management company (if not selfmanaged).

• External auditor.

Assets representing risk capital. Investment in risk capital means the direct or indirect contribution of assets to entities in view of their launch, development or listing on a stock exchange.

No risk spreading requirements.

This document is also available online:

http://www.pwc.lu/en/asset-management/docs/comparative-table

Asset Management: Luxembourg, your location of choice

27

Details per structure

1. Legal framework

The main laws governing Asset Management in Luxembourg are:

UCITS SIF

The Law of 17 December 2010 on undertakings for collective investment (the “2010 Law”), which regulates Part I and Part

II funds, the first category of them being more known under the UCITS brand benefiting from a distribution passport across Europe.

The Law of 13 February 2007 on specialised investment funds (the “SIF Law”).

SICAR

The Law of 15 June 2004 on the investment company in risk capital (the “SICAR

Law”).

AIFM

The Law of 12 July 2013 on alternative investment fund managers (the “AIFM Law”).

In addition to Luxembourg laws and regulations, asset management service providers and investment vehicles are subject to regulations and circulars issued by the Luxembourg Commission for the Supervision of the Financial Sector (i.e. the “Commission de Surveillance du Secteur

Financier” in French, generally called the “CSSF”).

The main CSSF regulations and circulars to be considered per investment vehicle are the following:

For Part I funds (i.e. UCITS funds):

• CSSF Regulation 10-05 on fund mergers, master-feeder structures and notification procedures;

• CSSF Regulation 10-04 on organisational requirements, conflicts of interests, conduct of business, risk management and content of agreement between a depositary and a

Management Company;

• CSSF Circular 13/559 on

ESMA guidelines on ETFs and other UCITS issues;

• CSSF Circular 12/546 on the authorisation and organisation of Luxembourg UCITS

Management Companies or self-managed UCITS;

• CSSF Circular 11/512 on the presentation of the main regulatory changes in risk management following the publication of CSSF Regulation

10-4 and ESMA clarifications;

• CSSF Circular 08/380 regarding CESR guidelines concerning eligible assets for investments by UCITS;

• CSSF Circular 08/356 on the use of securities lending, “réméré” and repo transactions;

For Part II funds:

• CSSF Circular 08/356 on the use of securities lending, “réméré” and repo transactions;

• CSSF Circular 02/77 on the protection of investors in case of NAV calculation error or breach of investment;

• IML Circular 91/75 clarifying certain aspects of the UCI legislative framework, as amended by CSSF Circular 05/177.

• CSSF Circular 07/308 on the use of derivatives and management of financial risks;

• CSSF Circular 02/77 on the protection of investors in case of NAV calculation error or breach of investment;

• IML Circular 91/75 clarifying certain aspects of the UCI legislative framework, as amended by CSSF Circular

05/177.

For SIFs:

• CSSF Regulation

12-01 clarifying risk management and conflicts of interest rules;

• CSSF Circular 08/372 on guidelines for depositaries of SIFs adopting alternative investment strategies, where those funds use the services of a prime broker;

• CSSF Circular 07/309 on risk diversification requirements applicable to SIFs.

For SICARs:

• CSSF Circular 06/241 on the concept of risk capital under the SICAR Law.

28

PwC Luxembourg

2. Legal forms

Luxembourg regulated investment vehicles can either be created under a contractual or a corporate form depending on the law to which they are subject. This is the case for all types of investment funds (or undertakings for collective investments), category including UCITS and Part II funds as well as the SIF, but not the SICAR, which is not subject to a risk spreading principle and which is always organised under a corporate form. Aside from that, each of these investment vehicles may be structured as a stand-alone vehicle or as an umbrella vehicle with multiple compartments (or sub-funds in the case of investment funds) having segregated assets and liabilities.

The contractual form is represented by the common fund (“Fonds Commun de Placement” in French, or “FCP”) and is only available for UCITS, Part

II, and SIF funds, but not for SICARs which are by laws organised under a corporate form. The FCP is an undivided collection of assets, managed by a

Management Company on behalf of joint owners called “unitholders”. Legally speaking, it is established by a contract between the Management Company and the depositary bank, which create

“management regulations”. Investors, in the form of unitholders, buy units issued by the Management Company which represent a portion of the FCP managed and, by doing so, become a party to the contract. The units so acquired represent their right in the undivided collection of assets. Their liability is limited to the amount contributed by them.

The corporate form is represented by the investment company with variable (the

“SICAV”) or fixed capital (the “SICAF”) and is available for all types of vehicles

(UCITS, Part II and SIF funds as well as for SICARs). SICAVs are corporate vehicles whose articles of incorporation provide that the amount of capital is at all times equal to the net asset value of the vehicle. The capital increases or decreases automatically as a result of subscriptions or redemptions, without any of the formalities generally imposed under the Law of 10 August 1915 on commercial companies regarding issuance or reduction of capital. Investors in a SICAV are “shareholders” and as such have a right to vote in shareholders’ meetings in addition to their economic rights. In addition to the

SICAV, an investment vehicle may also be structured as a SICAF, being a corporate vehicle with fixed capital. However the

SICAF is rarely used as it is has limited flexibility in terms of investors’ in and out.

Variable capital

Fixed capital

Corporate forms

S.A.

S.C.A.

S.C.S. (simple)

Sté Coop. S.A.

Sté Coop.

S.à r.l.

S.C.S. (spéciale)

S.A.

S.C.A.

S.C.S. (simple)

Sté Coop. S.A.

Sté Coop.

S.à r.l.

S.C.S. (spéciale)

Part I

UCITS

No

No

No

No

No

No

No

No

No

Yes

Yes

No

No

No

Part II

UCI

Yes

Yes

No

No

Yes

Yes

No

No

No

Yes

Yes

No

No

No

SIF

Yes

Yes

Yes

No

Yes

Yes

No

Yes

Yes

Yes

Yes

Yes

Yes

Yes

SICAR

Yes

Yes

No

No

Yes

Yes

No

Yes

Yes

Yes

Yes

Yes

Yes

Yes

S.A.: “société anonyme” in French or public limited company.

S.C.A.: “société en commandite par action” in French or common limited partnership.

S.C.S. (simple): “société en commandite simple” in French or limited corporate partnership.

Sté Coop. S.A.: “société coopérative sous forme de société anonyme” in French or cooperative company organised as a public limited company.

S.à r.l.: “société à responsabilité limitée” in French or private limited company.

S.C.S. (spéciale): “société en commandite spéciale” in French or special limited partnership.

The choice of the corporate form of an investment vehicle relies on the combination of several factors such as the tax transparency of the company, the liability of shareholders, the limited or unlimited number of shareholders, the conditions to transfer shares, the faculty to separate among shareholders those who hold the power in the company (the managers) from those who only hold capital but do not intervene in the management, or the corporate governance rules.

The S.A. is thus particularly convenient to organise clearly the roles, powers and liabilities of managers, directors and shareholders.

This is of importance in the context of jointventures where all stakeholders may have

Asset Management: Luxembourg, your location of choice

29 different interests. As for the S.C.A., this corporate form is particularly interesting for founding shareholders who want to keep total control of the management. Their liability is unlimited, but they cannot be dismissed from the management without their own consent, except if it is provided otherwise by the articles of incorporation. As regards the

S.à r.l., the objective is to preserve a significant personal link between shareholders by limiting the transfer of shares to people who were not already shareholders of the company. A last example is the one of the S.C.S. (simple).

The S.C.S. (simple) is a form of partnership created between one or more general partner(s) and one or more limited partner(s), which is largely governed by contractual freedom with respect to its organisation and functioning. It is particularly suitable for founding shareholders who look for tax transparency at the level of the company itself and who want to keep total control of the management. The S.C.S. (spéciale), on its side, which is a new corporate legal form for a company, has been introduced in Luxembourg law by the AIFM Law. The main difference with the S.C.S. (simple) is that the S.C.S. (spéciale) has no legal personality distinct from its partners as the usual common law partnership regime.

Despite this lack of personality, assets that have been contributed to it are registered in its name and may only satisfy the rights of creditors that have been created in relation to the creation, running or liquidation of the

S.C.S. (spéciale).

Main features of the S.C.S. (spéciale) or special limited partnership:

• Legal personality: no;

• Members: one or several general partner(s) + one or several limited partner(s);

• Management: one or several manager(s), which can be general partner(s) or third parties and can delegate their powers;

• Profit allocation: to be determined by the partnership agreement;

• Default rule: in proportion to their interest share (“part d’intérêt”);

• Voting rights: possible to issue interest shares without voting rights;

• Decisions of partners: to be freely determined by the partnership agreement;

Default rules :

General meeting or written resolutions;

Decisions are taken at the majority of votes, except for an amendment of the purposes of the partnership (“objet social”), change of nationality, transformation or liquidation, which requires the approval of members representing 3/4 of interest shares + the approval of all general partners;

• Transfer of interest share:

- Interest share of limited partners: to be freely determined by the partnership agreement;

Default rule: requires the approval of all general partners;

- Interest share of general partners: to be freely determined by the partnership agreement;

Default rule: subject to the same rules as the amendment of the partnership agreement;

- Enforceable against the partnership/third parties only after notification or approval by the partnership;

• Assets: are registered in the name of the partnership (despite the lack of legal personality) and may only satisfy the rights of creditors that have been created in relation to the creation, running or liquidation of the S.C.S. (spéciale);

• Formalities: the partnership agreement can take the form of a private or public deed. It must be published by extract. The partnership exists as from the signature of the partnership agreement;

• Annual accounts: shall be prepared.

30

PwC Luxembourg

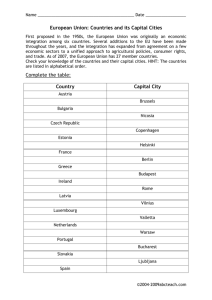

3. Investors

Depending on the vehicle concerned, different investors are entitled to invest in the vehicle. The distinction is generally made between UCITS and Part II funds, on one side, which are open to all types of investors and the SIF and the SICAR, on the other side.

Categories of investors

Part I

UCITS

Part II

UCI

SIF SICAR

Retail investors Yes Yes No* No*

High Net Worth

Individuals

Institutional investors

Professional investors

Yes Yes No* No*

Yes Yes Yes

Yes Yes Yes

Yes

Yes

* Unless:

• he adheres in writing to the status of

“well-informed” investor; and

• (1) he invests a minimum of

EUR 125,000 in the SIF/SICAR; or

(2) - for SIFs: he has been the subject of an assessment made by a credit institution within the meaning of Directive 2006/48/EC, by an investment firm within the meaning of Directive 2004/39/EC or by a

Management Company within the meaning of Directive 2001/107/EC certifying his expertise, his experience and his knowledge in adequately appraising an investment in the SIF;

- for SICARs: he has been subject to an assessment made by a credit institution within the meaning of Directive 2006/48/EC, by an investment firm within the meaning of Directive 2004/39/EC or by a

Management Company within the meaning of Directive 2001/107/EC certifying his expertise, his experience and his knowledge in adequately appraising an investment in risk capital.

The above conditions do not apply to directors and other persons intervening/ taking part in the management of a SIF/

SICAR.

When looking at the investor angle another important regulatory requirement is compliance with anti-money laundering and counter terrorist financing requirements

(AML/CTF) being mainly governed by the law of 12 November 2004 (as amended) and CSSF Regulation 12-02 With the upcoming 4th European Directive on AML/

CTF and the global importance of AML/

CTF in general, regulatory requirements will increase. Luxembourg however is well positioned to meet this trend, since the

AML/CTF regime is already very strong and will not require major changes to the regulatory framework unlike other jurisdictions. AML/CTF regulations have been in focus for years, are well developed and also consider investment fund specifics like distribution networks.

4. Type of securities that may be issued to investors

UCITS and Part II funds can only issue shares and units to investors whereas SIFs and SICARs may also issue beneficiary units and debt securities.

Furthermore, the issue and redemption of securities of the above mentioned vehicles has a real meaning when their capital is variable. When the capital of an investment company is fixed (SICAF), any issue and redemption of shares are subject to the rules of the Law of 10 August 1915 on commercial companies and impacts the share capital of the company, the articles of which must be amended accordingly.

For a regulated investment vehicle which qualifies as an AIF, the type of securities that may be issued depends on the law to which the investment vehicle is subject (e.g. Part II of the 2010 Law, SIF Law, SICAR Law).

5. Ongoing subscription and redemption of shares/units

For UCITS and Part II funds, units and shares shall be issued at a price defined by dividing the net asset value of the investment vehicle by the number of units/ shares outstanding; such price may be increased by expenses and commissions.

The units/shares shall be redeemed at a price defined by dividing the net asset value of the investment vehicle by the number of units/shares outstanding; such price may be decreased by expenses and commissions. For SIFs, units and shares shall be issued and, as the case may be, redeemed in accordance with the conditions and procedures set forth in the constitutive documents of the vehicle.

The constitutive documents of the vehicle shall specify the conditions in which issues and redemptions may be suspended, without prejudice to legal causes. In the event of suspension of issues or redemptions, the investment vehicle must without delay inform the CSSF and, if it markets its units/shares in other

Member States of the European Union, the competent authorities of such States.

Where the interest of the investors so requires, redemptions may be suspended by the CSSF if the provisions of laws, regulations or the constitutive documents concerning the activity and operation of the vehicle are not observed. The issue and redemption of the units/shares shall be prohibited:

• during any period where there is no

Management Company (in case the investment vehicle is not self-managed) or depositary;

• where the Management Company

(in case the investment vehicle is not self-managed) or the depositary is put into liquidation or declared bankrupt or seeks a composition with creditors, a suspension of payment or a court controlled management or is the subject of similar proceedings.

The constitutive documents of the investment vehicle shall determine the frequency of the calculation of the issue and redemption price. Repayments to investors following a reduction of capital shall not be subject to any restriction other than the respect of the required minimum capital.

Distributions (interim or final) of dividends can be made irrespective of the realised results within the period to the extent the minimum share capital is maintained.

Asset Management: Luxembourg, your location of choice

31

As regards the SICAR, it can issue new shares in accordance with the conditions and procedures set forth in the articles of incorporation. Repayments and distribution of dividends to shareholders are not subject to any restrictions other than those set forth in the articles of incorporation.

For a regulated investment vehicle which qualifies as an AIF, subscriptions and redemptions of shares are organised depending on the law to which the investment vehicle is subject (e.g. Part II of the 2010 Law, SIF Law, SICAR Law).

6. Structuring of capital calls

Capital calls are not relevant for UCITS funds, but may be of interest in the framework of Part II funds, SIFs, SICARs and Luxembourg AIFs which may be used for private equity or real estate purposes.

In Part II funds under the form of a SICAV, capital calls shall be organised by way of capital commitments (i.e. contractual undertaking of an investor to subscribe shares of the company upon request and to fully pay them up). In Part II funds under the form a SICAF, capital calls in an SA/SCA may be organised either by way of capital commitments or through the issue of partly paid shares (to be paid up to 25% at least).

An S.à r.l. cannot issue partly paid shares.

In case the Part II fund is a FCP, capital calls may be organised either by way of capital commitments or through the issue of partly paid units.

For SIFs, capital calls may be organised either by way of capital commitments or through the issue of partly paid shares (to be paid up to 5% at least) or units.

For SICARs, capital calls may be organised either by way of capital commitments or through the issue of partly paid shares (to be paid up to 5% at least).

For a regulated investment vehicle which qualifies as an AIF, capital calls are organised depending on the law to which the investment vehicle is subject (e.g. Part II of the 2010 Law, SIF Law, SICAR Law).

32

PwC Luxembourg

7. Minimum capital requirement, compartments and classes

Part I UCITS

• Minimum capital of

EUR 1.25 Mio to be reached within 6 months following approval;

• Multiple compartments authorised;

• Classes of shares authorised.

Part II UCI

• Minimum capital of EUR 1.25

Mio to be reached within 6 months following approval;

• Multiple compartments authorised;

• Classes of shares authorised.

SIF

• Minimum capital of EUR 1.25

Mio to be reached within 12 months following approval;

• Multiple compartments authorised;

• Classes of shares authorised.

SICAR

• Minimum capital of EUR 1 Mio to be reached within 12 months following approval;

• Multiple compartments authorised;

• Classes of shares authorised.

For a regulated investment vehicle which qualifies as an AIF, the minimum capital requirement depends on the law to which the investment vehicle is subject (e.g. Part II of the 2010 Law, SIF Law, SICAR Law).

Each of the above investment vehicles may be structured as a stand-alone vehicle or as an umbrella vehicle with multiple compartments (or sub-funds in the case of investment funds) having segregated assets and liabilities. The constitutional documents of the investment vehicle must expressly provide for that possibility and the applicable operational rules. The prospectus must describe the specific investment policy of each compartment.

The rights and obligations of investors and of creditors concerning a compartment or which have arisen in connection with the creation, operation or liquidation of a compartment are limited to the assets of that compartment, unless a clause included in the constitutive documents provides otherwise. Each compartment is deemed to be a separate entity, unless a clause included in the constitutional documents provides differently. Each compartment of a UCITS or Part II fund, a SIF or a SICAR may be separately liquidated without such separate liquidation resulting in the liquidation of another compartment.

Only the liquidation of the last remaining compartment of the investment vehicle will result in the liquidation of the vehicle.

Umbrella ABC

Compartment 1

EU Equity

Compartment 2

US Bonds

Compartment 3

Mixed Equity,

Bonds

...

One or more classes of units or shares that match various characteristics may be created in a stand-alone vehicle or in each compartment of an umbrella vehicle. The classes of units or shares may for example have the following distinguishing features:

• distribution policy (distribution or capitalisation shares/units);

• currency (different currencies for the shares/units may be accommodated, e.g.

USD, EUR, JPY, etc.);

• investors targeted (either retail, professional or institutional investors, investors of a different nationality, etc.);

• structure of fees (different fee structures may be accommodated, e.g. in relation to the subscription fee, redemption fee, conversion fee, distribution fee, management fee, etc.);

• currency hedging (hedged classes or not);

• minimum subscription and holding requirements.

Umbrella ABC

Compartment 1

EU Equity

Compartment 2

US Bonds

Share Class

A

Distribution

Share Class

A

Distribution

Compartment 3

Mixed Equity,

Bonds

Share Class

A

EUR

Share Class

B

Capitalisation

Share Class

B

USD Hedge

Share Class

B

JPY

For UCITS, Part II and SIF funds, distributions

(interim or final) of dividends can be made irrespective of the realised results within the financial period, to the extent the minimum share capital is maintained. For SICARs, the payment of interim dividends is not subject to any rules other than those set forth in their articles of incorporation. For Luxembourg

AIFs, the distribution of dividends depends on whether it is a Part II fund, a SIF or a

SICAR.

...

Asset Management: Luxembourg, your location of choice

33

8. Management Company and compulsory service providers in Luxembourg

Part I UCITS

• Depositary bank;

• Central administration;

• Chapter 15 Management

Company (unless it is a selfmanaged SICAV/SICAF);

• External auditor.

Part II UCI

• Depositary bank;

• Central administration;

• Chapter 15 or Chapter 16

Management Company (unless it is a “self-managed” SICAV/

SICAF);

• External auditor.

SIF

• Depositary bank;

• Central administration;

• Chapter 15 or Chapter 16

Management Company (unless it is a “self-managed” SICAV/

SICAF);

• External auditor.

SICAR

• Depositary bank;

• Central administration;

• Chapter 15 or Chapter 16

Management Company (unless it is a “self-managed” SICAV/

SICAF);

• External auditor.

For a regulated investment vehicle which qualifies as an AIF, there shall be in addition: