Workplace and safety tips brought to you by:

Ollis & Company

DID YOU KNOW

Building on its unprecedented participation

from last year's event, OSHA has

announced this year's Fall Safety StandDown to prevent falls in construction,

scheduled for May 4-15, 2015. Last year,

tens of thousands of employers and more

than 1 million workers across the country

joined OSHA in a week-long construction

Fall Safety Stand-Down, the largest

occupational safety event ever hosted in

the United States.

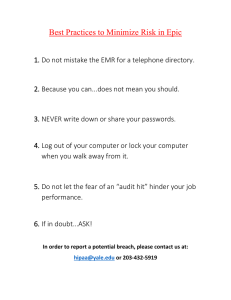

Boost Your Cyber Security with

One Simple Solution

There are plenty of intensive ways to

increase your company’s cyber

security such as using VPNs or

implementing firewalls. But the

easiest way to quickly boost your

cyber security is to encourage your

employees to use complex, secure

passwords.

Software Advice, a trusted firm for

software buyers, conducted a survey

of 192 employees and found that 44

percent of employees are not

confident about the strength of their

passwords. The firm also found that

one third of employees surveyed

reuse passwords or use the same

password for multiple log ins. This is

especially dangerous because it

allows hackers to access multiple

accounts via a single stolen

password.

Encourage, or even require, your

employees to use strong passwords.

Strong passwords should be at least

eight characters long and mix upper

and lowercase letters and numbers.

Using common names or words is a

bad idea, since a common hacker

technique is to use dictionary hacking

that attempts common word and

number combinations.

Anthem’s Costly Data

Breach

In February, Anthem, the secondlargest U.S. health insurance

provider, confirmed that it had

suffered a data breach that resulted

in the exposure and theft of the

personal information of up to 80

million current and former customers

and employees. Hackers accessed

the database that held this

information by using a stolen

password.

Fortunately, Anthem does have a

cyber security insurance policy in

place that covers up to $100 million

in losses. But the large amount of

individuals affected by this attack is

expected to exhaust the policy, since

Anthem intends to notify each

(Continued on next page.)

Combining Wellness & Risk Management

Anthem’s Data Breach

Combine your workplace wellness program with your risk management and

safety program and you could see big savings on your workers’ compensation

costs.

(Continued from previous page.)

Workers’ compensation is one of a business’ largest operational expenses—

and costs are on the rise. According to the Insurance Information Institute,

medical costs will account for up to 67 percent of total costs of workers’

compensation claims by 2019.

Integrating workplace wellness with your risk management program can help

you control workers’ compensation claim costs by reducing both return-to-work

days and the frequency and severity of claims. Not only will you see savings in

your employee health care benefits, but you’ll also see a drop in the medical

costs associated with workers’ compensation claims.

Workplace wellness programs often focus on risk factors such as smoking and

obesity, which lead to higher health insurance premiums. But weight

management and fitness also affect on-the-job safety and are risk factors for

accidents as well. By integrating your risk management program with your

workplace wellness program, you can focus on the total wellbeing of your

workers—improving their personal health and fitness while also preventing

work-related injuries and illnesses.

So where do you start with integrating these two programs to create one

healthy workplace culture? Or what if you don’t even have a wellness program

in place yet? Every company is different, and there is not a one-size-fits-all

approach that will work for every employer. Consider making a series of small

changes first. Start a walking program, which is usually little or no cost. Put

healthy food options in the vending machine. Or offer on-site weight

management and smoking cessation counseling. Work toward creating a

program that tracks participants' progress.

person. Therefore, if Anthem

exceeds the limits of its policy, it will

be responsible for the additional

costs.

The fact that Anthem is a large

company does not mean it was more

prone to a data breach. Companies

of any size need to be prepared for

the threat of a breach with proper

cyber liability coverage because data

breaches are costly. According to the

Ponemon Institute’s 2014 Cost of a

Data Breach Survey, the average per

record cost of a data breach was

$201 in 2013; the average

organizational cost of a data breach

was $5.9 million.

Contact Ollis & Company to discuss

your cyber insurance options.

If you need assistance getting started, Ollis & Company has a variety of

workplace wellness resources and tools, in addition to resources to reduce

workers’ compensation costs.

Workplace and safety tips brought to you by the

insurance professionals at:

Ollis & Company

© 2015 Zywave, Inc. All rights reserved.