CONSUMER INFORMATION SOLUTIONS

Occupancy Advisor

Key Benefits

• Loan Origination: Help determine whether

the property is occupied by the owner to

discover potential misrepresentation on loan

modifications, refinances, home equity loans/

lines of credit and/or reverse mortgages

Safeguard against potential

loan default

• Servicing: Determine occupancy to

mitigate risk during MSR acquisitions

A borrower’s intent to occupy a subject property can

be materially misrepresented in the loan process. In

recent years, approximately 14% of loans sold to Fannie

Mae included occupancy misrepresentation.1 Processes

used by lenders today to determine whether a property

is occupied by the owner are often cumbersome,

complicated and inefficient. Many times, investors and

mortgage insurance companies do not have the tools or

visibility to assess whether a property is owner-occupied

and are faced with loans that may become delinquent.

• Claims: Minimize the need to rescind

coverage with access to critical

occupancy data

Detect potential misrepresentation

• Account Management: Validate

occupancy status on delinquent HELOCs

with high utilization to suspend or freeze

the line

• Portfolio Review: Determine risk when

acquiring new loans to ensure due diligence

was performed and minimize putback risk

and losses

Occupancy Advisor™ helps to verify whether a property

(single-family, multi-family, condo, co-op, or apartment) is

occupied by the owner of record after the loan has been

assumed by the investor or covered by the mortgage

insurer. Multiple addresses across multiple independent

sources are associated with a single individual to provide

you with a more efficient source of occupancy validation.

Our unique data sources include:

• Credit – where bills are sent (i.e., credit cards)

• Property – where real estate tax bills are sent, whether

homestead exemptions are present, etc.

• Utility – where utility or other bills are sent, the service

location address, and the cases where the billing and the

service address are the same

1 Fannie Mae Mortgage Fraud Statistics, September 2014

Occupancy Advisor

Efficiently evaluate which loans may need further

investigation to verify occupancy

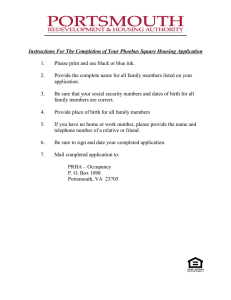

Occupancy Advisor provides a report showing a set of values indicating the likelihood

that a property is occupied by the owner. This includes the score, key model indicators,

reject codes, warning codes, and up to three additional modules. These modules include the

Consumer Services Database Module, Property Report Module, and FirstSearch Module.

Communications

& Utility Data

Input Property

225 3rd Ave, Apt 2B,

Anytown, NY 10021

456 8 Ave, Apt 512,

Anycity, GA 30309

Credit

Data

Property

Data

FirstSearch

Data

Communications &

Utility Module

Property Module

FirstSearch Module

Bundled telecomm

account addresses on

file match input address

Property tax bill match? Y

Homestead or Other

Exemption? Y

Most recent response

address matches

input address

Bundled telecomm

account addresses on

file DO NOT match

input address

Property tax bill match? N

Homestead or Other

Exemption? N

Most recent response

address DOES NOT

match input address

Scores near 100 = Non-Occupant

Scores near 800 = Occupant

Owner Occupancy Score

750

200

IF…I have a mortgage on 225 3rd Avenue,

AND my credit card bills come to the same address

AND my property tax bill is also sent to that address

AND I use power at that address

AND I watch TV there

AND I’m not currently associated with any other address,

THEN… I probably live at 225 3rd Avenue.

Contact Us Today

For more information, contact your Equifax sales representative or visit:

www.equifax.com/mortgage

Copyright © 2014, Equifax Inc., Atlanta, Georgia. All rights reserved. Equifax and EFX are registered trademarks of Equifax Inc.

All other registered marks, service marks and trademarks listed are the property of their respective owners. EFX-00207-6-14