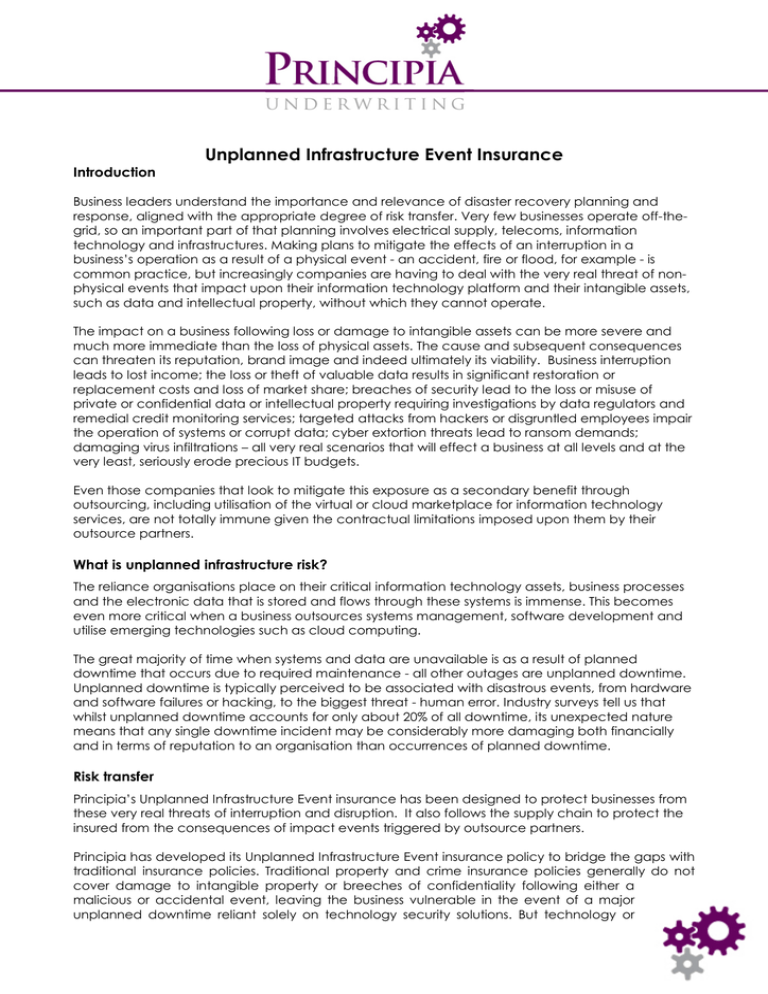

Unplanned Infrastructure Event Insurance

advertisement

FOR INTERNAL USE ONLY Unplanned Infrastructure Event Insurance Introduction Business leaders understand the importance and relevance of disaster recovery planning and response, aligned with the appropriate degree of risk transfer. Very few businesses operate off-thegrid, so an important part of that planning involves electrical supply, telecoms, information technology and infrastructures. Making plans to mitigate the effects of an interruption in a business’s operation as a result of a physical event - an accident, fire or flood, for example - is common practice, but increasingly companies are having to deal with the very real threat of nonphysical events that impact upon their information technology platform and their intangible assets, such as data and intellectual property, without which they cannot operate. The impact on a business following loss or damage to intangible assets can be more severe and much more immediate than the loss of physical assets. The cause and subsequent consequences can threaten its reputation, brand image and indeed ultimately its viability. Business interruption leads to lost income; the loss or theft of valuable data results in significant restoration or replacement costs and loss of market share; breaches of security lead to the loss or misuse of private or confidential data or intellectual property requiring investigations by data regulators and remedial credit monitoring services; targeted attacks from hackers or disgruntled employees impair the operation of systems or corrupt data; cyber extortion threats lead to ransom demands; damaging virus infiltrations – all very real scenarios that will effect a business at all levels and at the very least, seriously erode precious IT budgets. Even those companies that look to mitigate this exposure as a secondary benefit through outsourcing, including utilisation of the virtual or cloud marketplace for information technology services, are not totally immune given the contractual limitations imposed upon them by their outsource partners. What is unplanned infrastructure risk? The reliance organisations place on their critical information technology assets, business processes and the electronic data that is stored and flows through these systems is immense. This becomes even more critical when a business outsources systems management, software development and utilise emerging technologies such as cloud computing. The great majority of time when systems and data are unavailable is as a result of planned downtime that occurs due to required maintenance - all other outages are unplanned downtime. Unplanned downtime is typically perceived to be associated with disastrous events, from hardware and software failures or hacking, to the biggest threat - human error. Industry surveys tell us that whilst unplanned downtime accounts for only about 20% of all downtime, its unexpected nature means that any single downtime incident may be considerably more damaging both financially and in terms of reputation to an organisation than occurrences of planned downtime. Risk transfer Principia’s Unplanned Infrastructure Event insurance has been designed to protect businesses from these very real threats of interruption and disruption. It also follows the supply chain to protect the insured from the consequences of impact events triggered by outsource partners. Principia has developed its Unplanned Infrastructure Event insurance policy to bridge the gaps with traditional insurance policies. Traditional property and crime insurance policies generally do not cover damage to intangible property or breeches of confidentiality following either a malicious or accidental event, leaving the business vulnerable in the event of a major unplanned downtime reliant solely on technology security solutions. But technology or disaster recovery alone cannot guarantee network security or continuity. In order to protect critical technology assets, reduce liability exposures and minimise income loss, specialist insurance solutions are required. Unplanned Infrastructure Event insurance from Principia meets the costs and income loss associated with unplanned infrastructure events triggered by malicious or accidental events, such as: Malicious Accidental Introduction of self replicating virus and worms Operational/Human Error Security breaches caused by spyware, logic bombs or trojans Unauthorised access to or use of systems and data by employees or contractors Malfunction Pandemics and resultant inability to access premises Software error Hacking by unknown parties Seizure of IT assets by Governmental authorities Extortion threats and denial of service attacks, including spam and encryption of key databases Accidental loss or damage to data media Cyber terrorism Electromagnetic erasure of electronic data Loss of internal power generation Inadvertent destruction or inability to recreate lost or damaged electronic data or records What are the key benefits? • Protects residual loss from technology risks that are business critical • Allows cyber risk planning to form part of the wider business and risk management planning process • Helps to gain consensus between the business and IT managers on critical cyber risk issues and their management – protects the IT budget. • Enables the transfer of identified risks through insurance. Why Principia Underwriting? Our underwriting approach, policy offerings and service ethos are structured to recognise that risk is not static. Our insureds need protection for events that stem not just from their own actions but also problems caused by contractors and service providers that their business depends upon. This is supply-chain underwriting. For further information, please contact: Chris Newton Principia Underwriting Gallery 4 Lloyd’s building London EC3V 1LP Tel: +44 (0)20 3037 8036 M: +44(0)7545 205902 chris.newton@principia-underwriting.com