OPR-5453I-A EXP 31 MAY 2018 © 2016 EDWARD D. JONES & CO., L.P. ALL RIGHTS RESERVED.

Understanding My Statement

Every financial services provider is required to send you an account statement. But at

Edward Jones, we want to do much more than simply what’s required. We view your

statement as an essential source of information for your decision making. The easier it is

for you to understand your statement, including the customization we offer, the more

empowered you’ll be to make decisions for your future.

Let’s Get Started!

The following pages answer many of the

r John &

o fo

Portfoli

questions you may have about your

890

3-456-7

sor, 12

Q. Advi

45

3

e

2

Jo

1

O

or

M

al Advis

t Louis,

Financi

t Ave, S

vestmen

, 2014

1234 In

- Jun 27

1

3

ay

iod M

ent Per

Statem

account statement. After you

read this guide, you will:

• Know the options available

lp

need he

Do you

l branch

ement?

your loca

ient stat

ll

cl

ca

ur

ud

st

yo

cl

g

If so, ju

tasks, in

regardin

N

g

riety of

perwork?

estions

with a va ificates; updatin

have qu

Jones pa

u

u

d

yo

ar

yo

w

o

lp

D

rt

he

e Ed

count;

stock ce

she can

ing som

your ac

nds and

complet

or. He or

t divide

ated with ests; and

ministrat

ns abou

r associ

qu

tio

be

re

office ad

e

m

es

k

nu

qu

e

d chec

ering

and phon

telephon

posits an s or her name

ing answ

ess or

hi

ndling de

e, addr

ha

ep

m

;

ke

na

es

o

e

th

t quot

tions. S

g marke

ent ques

providin

investm

ing nonanswer

handy.

number

for You

elping

eed a H

for customizing your

statement

• Know where to locate specific

information on your statement

MITH

JOHN S ITH

M

MARY S EET

TR

S

1234

56789

T

S

Y,

IT

C

statement

• Know where to find additional

information

ar y

o Summ

Por tfoli alue

P

rtfolio V

o

Total P

64.81

$223,8

Ago

1 Month

Ago

1 Year

Ago

3 Years

Ago

5 Years

counts

w of Ac

Overvie

Hand?

to Work

idends u may be missing an

iv

D

f

o

r

yo

past

owe

? If not,

though

king,

g stocks

folio. Al

ut the P

• Have a better understanding of

terms used throughout your

mith

Mary S

64.81

$215,4

22.74

$219,3

12.59

$237,3

57.00

,3

0

0

$2

in

spea

port

dend-pay

orically

to your

than

own divi

oney in

lts, hist

er time

Do you

re resu

invest m

ov

tu

re

fu

rn

e

to

tu

ity

pace

arante

tter re

opportun

u keep

ed a be

esn't gu

yo

id

do

ov

lp

ce

pr

he

an

n

tails.

have

they ca

r for de

perform

stocks

e.

l adviso

meaning

-paying

out notic

financia

stocks,

ith

ur

dividend

g

w

yo

in

ed

ay

ct

onta

dend-p

eliminat

goals. C

non-divi

sed or

rm

ea

-te

cr

ng

de

lo

sed,

with your

be increa

ds may

Dividen

Account

r

Numbe

Holder

Account

Doe &

A

hn

Jo

Doe

Jane B

Doe

John A

Doe

Jane B

678-9-0

123-45

678-9-0

123-45

678-9-1

123-45

Value

Ago

1 Year

5.31

$58,84

.60

$2,137

39.83

$158,3

22.74

$219,3

Curre

Va

9

$41,56

$96

2

$181,3

,8

3

2

2

$

s

of

Account

ith Right

nants W

e

Joint Te

ent for th

p

rshi

count

unt statem

Sur vivo

ment Ac

your acco

. Refer to

al Retire

t

ed

du

un

vi

uc

co

di

od

In

pr

ment Ac

ent was

al Retire

tual statem

Individu

tee an ac

s

not guaran

nt

es

ou

do

it

cc

,

Total A

this page

unt.

ovided on

each acco

ation is pr

regarding

unt inform

ils

co

ta

ac

de

c

gh

ecifi

sp

Althou

e

or

m

n and

registratio

ww

www.edwardjones.com

Member SIPC

A

3042

Parkway

ogress ts, MO 63043201 Pr

d Heigh

an

yl

ar

M

I want to know the following:

What Are My Accounts’ Values?. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1

What Products and Services Am I Using?. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2

How Am I Doing? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3–7

Personal Rate of Return

Account Summary Line Graph and Table

Summary of Income

Estimated Interest and Dividends

Summary of Assets

What Assets Do I Own, and How Much Are They Worth?. . . . . . . . . . . . . . . . . . . . . . . . . . . . . .8–11

Am I On Track to Achieve My Goals?. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12

When Is My Retirement Fee Due?. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13

Which Beneficiaries Do I Have On File?. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13

How Much Am I Required to Take Out of My Retirement Account?. . . . . . . . . . . . . . . . . . . . . . . 14

What Activity Has Occurred in My Account?. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14–16

Does My Statement Display Details of My Realized Gains and Losses?. . . . . . . . . . . . . . . . . . . . 17

Frequently Asked Questions. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 18

Glossary. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 19–20

Appendix: Information Provided on

Additional Sections of the Statement. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 21–22

Resources . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 23

OPR-5453I-A EXP 31 MAY 2018 © 2016 EDWARD D. JONES & CO., L.P. ALL RIGHTS RESERVED.

Table of Contents

OPR-5453I-A EXP 31 MAY 2018 © 2016 EDWARD D. JONES & CO., L.P. ALL RIGHTS RESERVED.

What Are My Accounts’ Values?

Portfolio Summary

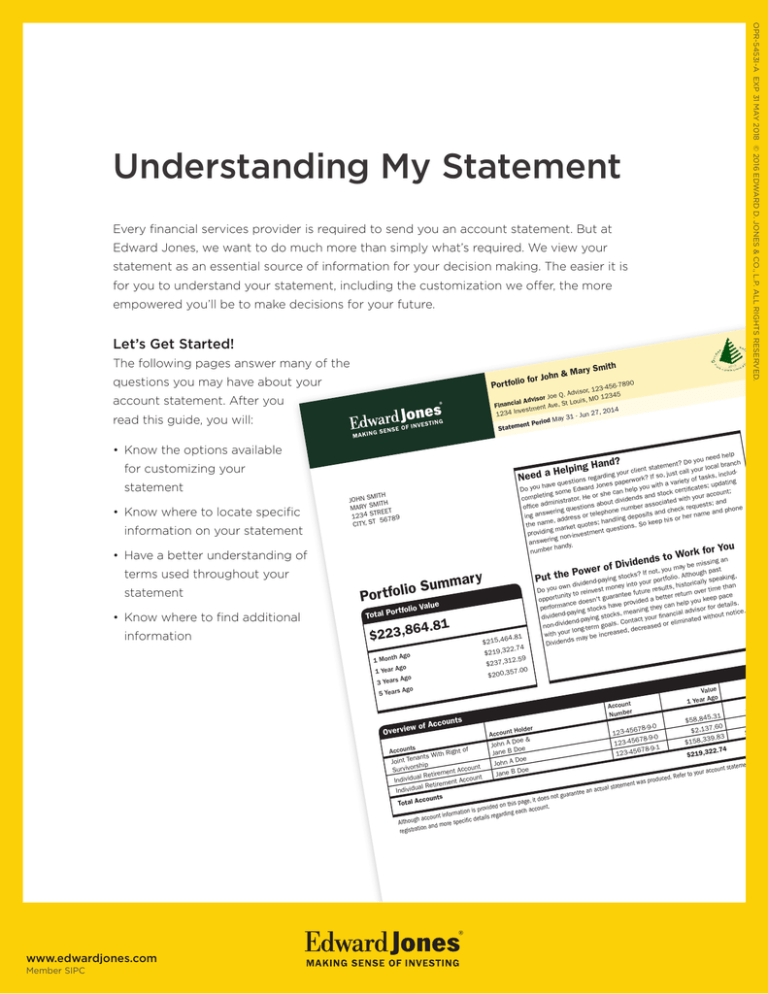

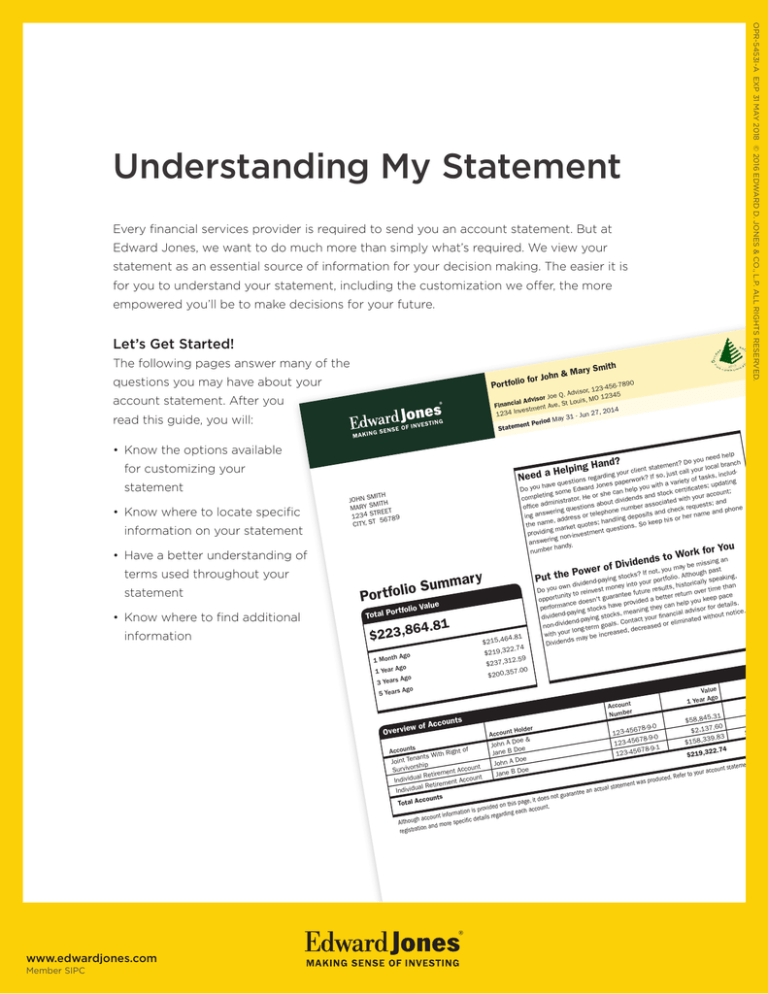

The Portfolio Summary at the beginning of your statement package includes a total value

for all of the accounts in your statement mailing group.

Other features of the summary include:

• A list of your investment accounts and their values compared with their values one month

Portfolio for John & Mary S

ago, one year ago, three years ago and five years ago

Financial Advisor Joe Q. Advisor, 12

1234 Investment Ave, St Louis, MO

• A section for other products and services, including loans and credit cards

Statement Period May 31 - Jun 27,

• The contact information for your financial advisor displayed in the header, which is also

provided on each page of your statement

You will receive the Portfolio Summary if you have more

JOHN than

SMITH one account in your statement

Need a Helping Hand

MARY SMITH

1234 STREET

CITY, ST 56789

mailing group.

Do you have questions regarding

completing some Edward Jones

office administrator. He or she c

ing answering questions about d

the name, address or telephone

providing market quotes; handlin

answering non-investment quest

number handy.

Portfolio Summary

Total Portfolio Value

Portfolio for John & Mary Smith

$223,864.81

Financial Advisor Joe Q. Advisor, 123-456-7890

1234 Investment Ave, St Louis, MO 12345

Statement Period May 31 - Jun 27, 2014

JOHN SMITH

MARY SMITH

1234 STREET

CITY, ST 56789

Do you have questions regarding your client statement? Do you need help

completing some Edward Jones paperwork? If so, just call your local branch

office administrator. He or she can help you with a variety of tasks, including answering questions about dividends and stock certificates; updating

the name, address or telephone number associated with your account;

providing market quotes; handling deposits and check requests; and

answering non-investment questions. So keep his or her name and phone

number handy.

Portfolio Summary

Total Portfolio Value

$223,864.81

1 Month Ago

1 Month Ago

Need a Helping Hand?

$215,464.81

1 Year Ago

$219,322.74

3 Years Ago

$237,312.59

5 Years Ago

$200,357.00

$219,322.74

3 Years Ago

$237,312.59

5 Years Ago

$200,357.00

Do you own dividend-paying stoc

opportunity to reinvest money in

performance doesn't guarantee

dividend-paying stocks have prov

non-dividend-paying stocks, mea

with your long-term goals. Conta

Dividends may be increased, dec

Put the Power of Dividends to Work for You

Do you own dividend-paying stocks? If not, you may be missing an

opportunity to reinvest money into your portfolio. Although past

performance doesn't guarantee future results, historically speaking,

dividend-paying stocks have provided a better return over time than

non-dividend-paying stocks, meaning they can help you keep pace

with your long-term goals. Contact your financial advisor for details.

Dividends may be increased, decreased or eliminated without notice.

Overview of Accounts

Accounts

Account Holder

Account

Number

Joint Tenants With Right of

Survivorship

John A Doe &

Jane B Doe

123-45678-9-0

$58,845.31

$41,569.54

Individual Retirement Account

John A Doe

123-45678-9-0

$2,137.60

$965.78

Individual Retirement Account

Jane B Doe

123-45678-9-1

$158,339.83

$181,329.49

$219,322.74

$223,864.81

Total Accounts

$215,464.81

1 Year Ago

Put the Power of Div

Value

1 Year Ago

Current

Value

Although account information is provided on this page, it does not guarantee an actual statement was produced. Refer to your account statement for the exact

registration and more specific details regarding each account.

Overview of Accounts

Accounts

Account Holder

Account

Number

Joint Tenants With Right of

Survivorship

John A Doe &

Jane B Doe

123-45678-9-0

Individual Retirement Account

John A Doe

123-45678-9-0

Individual Retirement Account

Jane B Doe

123-45678-9-1

Total Accounts

Although account information is provided on this page, it does not guarantee an actual statement was produc

registration and more specific details regarding each account.

201 Progress Parkway

Maryland Heights, MO 63043-3042

PAGE 1 OF 23

www.edwardjones.com

Member SIPC

At Edward Jones, we offer many types of investments and services. This section provides

information on those you have chosen, such as:

• Loans

• Credit cards

• Trust services

• Insurance protection

You can find your account numbers, balances, available credit and interest rates

(if applicable) on these investments and services.

Overview of Other Products and Services

Loans and Credit

Amount of money you can borrow

for John A Doe &

Jane B Doe

Account Number

Balance

Approved

Credit

Available

Credit

Interest

Rate

123-45678-9-0

-$74,534.68

$79,704*

$5,170

5.25%

* Your approved credit is not a commitment to loan funds. It is based on the value of your investment account which could change daily. The amount you may

be eligible to borrow may differ from your approved credit. Borrowing against securities has its risks and is not appropriate for everyone. If the value of your

collateral declines, you may be required to deposit cash or additional securities, or the securities in your account may be sold to meet the margin call. The

interest rate will vary depending on the amount you borrowed and will begin to accrue from the date of the loan and be charged to the account. A minimum

account value is required if you have loan features on your account. Call your financial advisor today.

If you receive a Portfolio Summary for a given statement period, this information will display

in the Overview of Other Products and Services section within your Portfolio Summary.

If you do not receive a Portfolio Summary, the Summary of Other Products and Services

section will display within the body of your statement and provide this information for

the given account.

Please note: An available line of credit will display even if you have not chosen to use this

service. This amount can fluctuate daily based on the value of your account.

PAGE 2 OF 23

OPR-5453I-A EXP 31 MAY 2018 © 2016 EDWARD D. JONES & CO., L.P. ALL RIGHTS RESERVED.

What Products and Services Am I Using?

When it comes to tracking your progress, you have a few options. You may select what’s

best for you via the Documents tab or Settings page of Online Access, or by contacting

your financial advisor.

You may opt to receive:

• Your personal rate of return with or without benchmarks

• The account summary option of your choice

• An income summary

• An estimate of your interest and dividends

• An asset summary

Personal Rate of Return

Your personal rate of return measures the performance of your account. It helps you track

your progress as you work toward your long-term goals.

The Rate of Return section displays your personal rate of return for the current quarter,

the year to date, the last 12 months, three years annualized and five years annualized.

Once you opt in to receive this section, you can choose to display it monthly or quarterly

(March, June, September and December).

Rate of Return

Your Personal Rate of Return for

Assets Held at Edward Jones

This Quarter

Year to Date

Last 12

Months

3 Years

Annualized

5 Years

Annualized

1.22%

1.22%

9.80%

8.74%

11.15%

Your Personal Rate of Return is as of March 21, 2014.

Your Personal Rate of Return: Your Personal Rate of Return measures the investment performance of your account. It incorporates

the timing of your additions and withdrawals and reflects commissions and fees paid. Reviewing Your Personal Rate of Return is

important to help ensure you’re on track to achieving your financial goals.

For additional information, contact your financial advisor or please visit www.edwardjones.com/rateofreturn.

PAGE 3 OF 23

OPR-5453I-A EXP 31 MAY 2018 © 2016 EDWARD D. JONES & CO., L.P. ALL RIGHTS RESERVED.

How Am I Doing?

This example of the Rate of Return section includes the optional Performance Benchmarks,

which are a general measure of the market’s performance in these asset classes.

Rate of Return

Your Personal Rate of Return for Assets

Held at Edward Jones

This Quarter

Year to Date

Last 12

Months

3 Years

Annualized

5 Years

Annualized

1.32%

1.32%

10.01%

5.91%

12.78%

Your Personal Rate of Return is as of March 21, 2014. Performance Benchmarks are as of March 21, 2014.

Performance Benchmarks

Security A

1.45%

1.45%

21.43%

15.09%

20.62%

Security B

-2.00%

-2.00%

12.64%

5.65%

15.37%

Security C

1.60%

1.60%

-0.33%

3.71%

4.82%

Your Personal Rate of Return: Your Personal Rate of Return measures the investment performance of your account. It incorporates

the timing of your additions and withdrawals and reflects commissions and fees paid. Reviewing Your Personal Rate of Return is

important to help ensure you’re on track to achieving your financial goals.

Performance Benchmarks: Your Personal Rate of Return should be compared to the return necessary to achieve your financial goals.

However, we understand many investors would like to compare their Personal Rate of Return to market indexes. Keep in mind this may

not be an accurate comparison, as your Personal Rate of Return incorporates the timing of your specific additions and withdrawals and

your specific investment mix, while published returns of market indexes do not.

These market indexes are used as a general measure of market performance for several major asset classes. Market indexes assume

reinvestment of all distributions and do not take into account brokerage fees, taxes or investment management fees.

For additional information, contact your financial advisor or please visit www.edwardjones.com/rateofreturn.

You may choose to receive the Rate of Return section without the Performance

Benchmarks feature.

Account Summary Line Graph and Table

Option 1 – Value Summary

The Value Summary section provides details on how we determine your total account value

for this period and the calendar year. This table categorizes your activity to help you track

these values over time. It even includes your total account-based fees and charges for the

statement period. For more information about the specific line items, see “Change in Value”

in the Glossary on page 19. For more information about the fees and charges line item, see

the Appendix.

Value Summary

This Period

This Year

Beginning Value

$40,248.81

$45,118.61

$0.00

$0.00

Assets Added to Account

Income

Assets Withdrawn from Account

-$5,000.00

-$5,000.00

-$356.93

-$3,651.16

Change In Value

$6,516.93

$3,770.81

Ending Value

$41,569.54

Fees and charges

PAGE 4 OF 23

$160.73$1,331.28

OPR-5453I-A EXP 31 MAY 2018 © 2016 EDWARD D. JONES & CO., L.P. ALL RIGHTS RESERVED.

Personal Rate of Return with Performance Benchmarks Option

The Value of Your Account line graph illustrates your account’s value over time.

Value of Your Account

$240,000

$200,000

$180,000

$120,000

$80,000

Dec

Mar

2011

2012

Jun

Sep

Dec

Mar

Jun

Sep

2013

Option 3 – Line Graph and Value Summary

The automatic setting for your statement is to display the Value Summary table and Value

of Your Account line graph. You do have the option to alternatively display either section.

Summary of Income

Summary of Income is an optional section that shows your total distributions for the

current period and year broken down by the type of income.

We also provide “Income reported in a prior year” separately from other current-year

distributions when applicable.

If you’d like to estimate what income may be taxable versus tax-free before you receive your

Consolidated 1099 for the tax year, this section may be helpful when working with your tax

professional for tax reporting purposes. This section can also provide other distributions or

charges, such as loan interest for the current period and year.

Summary of Income

Income distributions from securities

Interest

Taxable

This Period

Tax-free

Total

Taxable

This Year

Tax-free

Total

$0.38

$287.50

$287.88

$0.97

$856.25

$857.22

90.40

745.73

$287.50

$378.28

$746.70

$856.25

$1,602.95

Dividends

Qualified (Q)*

Total

90.40

$90.78

745.73

*Reduced Tax Eligible

Note: Your year-end tax documents (eg., Form 1099) will provide specific classifications of your income distributions. Qualified (Q)

dividends may be taxed at reduced rates. Nonqualified (N) dividends may be taxed at ordinary rates. A portion of your Partially Qualified

(P) dividends may also be taxed at reduced rates. Edward Jones, its employees and financial advisors cannot provide tax or legal advice.

You should review your specific situation with your tax or legal professionals.

PAGE 5 OF 23

OPR-5453I-A EXP 31 MAY 2018 © 2016 EDWARD D. JONES & CO., L.P. ALL RIGHTS RESERVED.

Option 2 – Line Graph

To track your estimated income, the option to display any combination of three estimated

interest and dividends sections is available:

Table by security: Provides estimated totals by security for the next three months and the

next three quarters

Estimated Interest and Dividends by Security

3 Months

Ending

March

2015

3 Months

Ending

June 2015

Quantity

July

2014

August

2014

40

$0

$0

$23 $23

$23

$23

$92

Security B

583

16

16

16 50

52

51

201

Security C

481

32

32

Security D

685

36

43

$143

$149

Stocks

Security A

September

2014

3 Months

Ending

December

2014

12 Month

Total

Mutual Funds

Total

17

14

15 40

$33

$30

$54 $113

165

$458

The above is an estimate of the interest and dividends you can expect to earn on your investments in the next 12 months but it is only

an estimate and cannot be guaranteed by Edward Jones or the issuers of the securities. The estimate is known as the Estimated

Annual Income or EAI. It is based on past interest and dividend payments made by the securities held in your account. It is also based

on statements made by the issuers of those securities. The estimates project possible future interest and dividend payments based on

the number of bonds or shares held in your account at the time the estimate was done. Your actual investment income may be higher

or lower than the estimated amounts. Estimates for certain types of securities that have a return of principal or capital gain may be

overstated. Income being reinvested is indicated with “*” Income cannot be estimated for the securities indicated by “**”. It cannot be

estimated because the annual payment amount or frequency is not available at this time.

Table by month: Provides estimated totals by month as well as the amounts reinvested and

not reinvested

Estimated Interest and Dividends by Month

Month

Not Reinvested

Reinvested

Total

0

480

480

July

125

201

326

August

350

94

444

0

334

334

90

203

293

November

0

97

97

December

0

530

530

January

125

167

292

February

350

94

444

0

319

319

April

90

202

292

May

0

94

94

1,130

2,815

3,945

June

September

October

March

TOTAL

PAGE 6 OF 23

OPR-5453I-A EXP 31 MAY 2018 © 2016 EDWARD D. JONES & CO., L.P. ALL RIGHTS RESERVED.

Estimated Interest and Dividends

and not reinvested

Estimated Interest and Dividends Bar Chart

$20,000

$16,000

$12,000

Reinvested

Not Reinvested

$8,000

$4,000

$0

Jul

Jan

Oct

Apr

You may choose to select the tables that provide estimated interest and dividends by

security and by month if you’d like to see detailed information for each security as well as

your expected monthly totals.

If you prefer to see an illustration of your estimated interest and dividends, you may find

the bar chart to be more beneficial.

Summary of Assets

You have the option to display a categorized asset summary that provides:

• Current and previous months’ totals

• The amount your values have changed between the current and previous month

• Percentage held in each category

Summary of Assets (as of September 26, 2014)

Held at Edward Jones

Cash, Insured Bank Deposit &

Money Market funds

Value as of

08/30

Dollar Change

% of Total Value

2,364.36

2,364.36

0.00

0.74%

Bonds

163,944.75

163,868.60

76.15

51.41

Stocks

7,087.07

7,210.17

-123.10

2.22

145,539.35

147,571.77

-2,032.42

45.63

Total at Edward Jones

$318,935.53

$321,014.90

-$2,079.37

100%

Account Value

$318,935.53

$321,014.90

-$2,079.37

Mutual funds

PAGE 7 OF 23

Value as of

09/26

OPR-5453I-A EXP 31 MAY 2018 © 2016 EDWARD D. JONES & CO., L.P. ALL RIGHTS RESERVED.

Bar chart by month: Illustrates estimated totals by month as well as the amounts reinvested

The Asset Details section shows the value of every item you hold at Edward Jones.

For your convenience, we include outside assets linked to your Edward Jones account

if that information is available to us.

You may select the options below via the Documents tab or Settings page of

Online Access, or by contacting your financial advisor.

Option 1 – Performance/Cost Basis

Cost Basis and Unrealized Gain/Loss Summary

Providing the Cost Basis and Unrealized Gain/Loss columns, as shown in this illustration, is

the automatic setting. You do, however, have the option to select one of the other options in

the Performance/Cost Basis category. The Asset Details section displays dashes in the Cost

Basis and Unrealized Gain/Loss columns when the cost basis is unavailable or unknown.

Asset Details (as of Sept. 27, 2013) additional details at www.edwardjones.com/access

Mutual Funds

Price

Quantity

Cost Basis

Unrealized

Gain/Loss

Value

Security A

53.83

36.175

1,272.34

674.96

$1,947.30

Security B

48.61

1,289.196

——

——

62,667.82

Security C

6.67

7,719.505

——

——

51,489.10

We categorize your assets to make them easier to find on your statement. The asset categories

represented in your account determine the columns shown throughout this section.

PAGE 8 OF 23

OPR-5453I-A EXP 31 MAY 2018 © 2016 EDWARD D. JONES & CO., L.P. ALL RIGHTS RESERVED.

What Assets Do I Own, and

How Much Are They Worth?

This optional setting provides you with cost basis and unrealized gain/loss for each of your

lots, including a lot for your dividend reinvestments. You will see one lot (versus multiple

lots) for securities that use the average accounting method, such as open-end mutual funds.

Asset Details (as of September 25, 2015)

Assets held at Edward Jones

Balance

$9.55

Cash

Total Cash, Money Market

and Insured Bank Deposit

$9.55

Price

Quantity

Cost Basis

Unrealized

Gain/Loss

114.71

35.76167

3,303.93

798.29

Breakdown by Lot

Cost Per Share

Current Share

Cost Basis

Unrealized

Gain/Loss

Value

Purchase Date 5/28/2014

$91.92

35.00

3,217.40

797.45

4,014.85

Dividend Reinvest

$113.60*

—

86.53

0.84

39.62

98.68529

4,111.21

-201.30

Breakdown by Lot

Cost Per Share

Current Share

Cost Basis

Unrealized

Gain/Loss

Value

Purchase Date 5/28/2014

$41.67

95.00

3,959.30

-195.40

3,763.90

Dividend Reinvest

$41.22*

—

151.91

-5.90

146.01

70.08

66.71969

4,289.58

386.14

4,675.72

Breakdown by Lot

Cost Per Share

Current Share

Cost Basis

Unrealized

Gain/Loss

Value

Purchase Date 5/28/2014

$64.16

65.00

4,170.95

384.25

4,555.20

Dividend Reinvest

$68.98*

—

118.63

1.89

Stocks

ABC

CDE

EFG

Total Account Value

Value

4,102.22

87.37

3,909.91

120.52

$12,697.40

* - Average cost per share

Cost basis is the amount of your investment for tax purposes and is used to calculate gain or loss incurred on the sale or other

disposition of a security. Cost basis is not a measure of performance. The cost basis amounts in your statement should not be relied

upon for tax preparation purposes. Please refer to your official tax documents for more information about reporting cost basis to the

IRS. You should consult your attorney or qualified tax advisor regarding your situation. If you believe any of this cost basis information

is inaccurate, please call our Client Relations department.

PAGE 9 OF 23

OPR-5453I-A EXP 31 MAY 2018 © 2016 EDWARD D. JONES & CO., L.P. ALL RIGHTS RESERVED.

Cost Basis and Unrealized Gain/Loss Detail

This optional setting provides a rate of return percentage for each of your securities.

You automatically receive the Rate of Return section (provides account-level performance)

on a monthly basis when you select this option.

Asset Details (as of September 25, 2015)

Mutual Funds

Price

Quantity

ABC Fund

96.00

1,040.84772

99,921.38

Value

XYZ Fund

23.18.0

4,339.3491

100,586.11

Total Account Value

Rate of Return*

2.89%

1.89%

$200,507.49

*Your Rate of Return for each individual asset above is as of July 22, 2016. Returns greater than 12 months are annualized.

Your Rate of Return in the Asset Details section above measures the investment performance of each of your individual assets.

It incorporates the timing of your additions and withdrawals and reflects commissions and fees paid. Reviewing your Rate of Return

is important to help ensure you’re on track to achieving your financial goals. For additional information, contact your financial advisor

or please visit www.edwardjones.com/performance.

Basic Holdings without Cost Basis or Performance

This optional setting provides you with key details about each security: the price, quantity

and value for equities and maturity date, maturity value and current value for fixed income.

Asset Details (as of September 25, 2015)

Assets held at Edward Jones

Mutual Funds

Price

Quantity

Value

ABC Fund CIA

Symbol: ABC

Asset Category: Growth

$45.62

20.54

$937.03

XYZ Fund CIA

Symbol: XYZ

Asset Category: Growth & Income

$48.94

223.032

10,915.19

Total Account Value

$11,852.22

Ratings – Ratings from Standard & Poor’s (S&P), Moody’s and Fitch may be shown for certain securities. S&P requires we inform

you: (1) Ratings are NOT recommendations to buy, hold, sell or make any investment decisions and DO NOT address suitability or

future performance; (2) S&P DOES NOT guarantee the accuracy, completeness, or availability of any ratings and is NOT responsible

for results obtained from the use of any ratings. Certain disclaimers related to its ratings as are more specifically stated at

http://www.standardandpoors.com/disclaimers.

PAGE 10 OF 23

OPR-5453I-A EXP 31 MAY 2018 © 2016 EDWARD D. JONES & CO., L.P. ALL RIGHTS RESERVED.

Security Rate of Return

You may choose to display additional asset details beneath the name of your security.

Additional details may include:

• Symbol

• Asset Category

• Estimated Yield

• CUSIP

• Research Opinion

• Subaccount Information

Because each of your securities may have different characteristics, the details provided

by selecting this option may vary by asset type.

Asset Details

Taxable Municipal Bonds

Security A

GO DTD 03/10/2010

Callable 12/01/2019@ 100.00

Interest Rate: 6.45%

CUSIP: 123456789

Bond Rating: AA

Asset Category: Income

Estimated Yield: 5.91%

Federally Tax Exempt Municipal Bonds

Security B

DTD 08/06/2008

Callable 05/15/2018 @100.00

Interest Rate: 5.62%

CUSIP: 123456789

Bond Rating: Aa3/AAAsset Category: Income

Estimated Yield: 5.01%

Stocks

Security C

Symbol: ABC

Asset Category: Aggressive Research

Opinion: None

Estimated Yield: 0.92%

Mutual Funds

Security D

Symbol: ABC

Asset Category: Growth & Income

Loans

Loan Balance

Total Account Value

Unrealized

Gain/Loss

Value

5,200.00

250.10

5,450.10

Unrealized

Gain/Loss

Value

Maturity Date

Maturity Value

Cost Basis

12/1/2037

5,000.00

Maturity Date

Maturity Value

Cost Basis

5/15/2028

30,000.00

29,172.00

4,473.90

33,645.90

Value

Maturity Date

Maturity Value

Cost Basis

Unrealized

Gain/Loss

57.16

305

1,774.82

15,658.98

17,433.80

Unrealized

Gain/Loss

Value

Maturity Date

Maturity Value

Cost Basis

61.50

278.164

14,500.00

2,607.09

17,107.09

Ending Balance

Interest Rate

Beginning

Balance

Increases to

Loan Balance

Reductions

from Loan

Balance

4.75%

-3,174.11

-12.98

—

-3187.09

$70,449.80

Ratings – Ratings from Standard & Poor’s (S&P), Moody’s and Fitch may be shown for certain securities. S&P requires we inform you: (1) Ratings are NOT

recommendations to buy, hold, sell or make any investment decisions and DO NOT address suitability or future performance; (2) S&P DOES NOT guarantee the

accuracy, completeness, or availability of any ratings and is NOT responsible for results obtained from the use of any ratings. Certain disclaimers related to its ratings

as are more specifically stated at http://www.standardandpoors.com/disclaimers.

PAGE 11 OF 23

OPR-5453I-A EXP 31 MAY 2018 © 2016 EDWARD D. JONES & CO., L.P. ALL RIGHTS RESERVED.

Option 2 – Additional Asset Details

Financial Advisor Linda Kime, 925-373-0652

After you've discussed how your goals, tolerance

for risk, and portfolio impact and influence

2300 First Street Suite 232, Livermore, CA 94550

one another, you can view a summary of Statement

these conversations

on2015

your statement. InPage

addition,

ii of ii

Period Feb 28 - Mar 27,

the

3 Your Financial Foundation section prompts you to contact your financial advisor to

2

schedule an appointment as your reviews of these conversations come due.

Your Financial Foundation

Reaching your personal financial goals starts with a strong foundation that is created by defining your goals, determining your risk tolerance,

and building and reviewing your portfolio. At Edward Jones, reviewing the components of your financial foundation on a regular basis is

important to help you successfully navigate life changes and achieve your financial goals. The following is a summary of your financial

foundation, based on previous discussions with your financial advisor.

Retirement Goals for JOHN & JANE DOE

Description

Details

Goal Last Reviewed

Preparing for Retirement

Planned retirement age: 65 - John; 65 - Jane

Desired annual spending: $100,000

09/18/2014

Risk Tolerance

We believe it is important to understand your investment time horizon and your ability to withstand fluctuations in the value of your

investments, which can be caused by factors such as market movements, interest rate changes and inflation. One way to measure your

tolerance for these fluctuations is through the completion of a risk tolerance questionnaire. This questionnaire is designed to measure

your overall tolerance for risk, rather than your risk tolerance for a specific account. The answers you provided to the risk tolerance

questionnaire on 0 9 / 1 8 / 2 0 1 4 identified your overall risk tolerance level as medium to high .

Portfolio Review

It is important to review your portfolio to help keep your investments aligned with your overall risk tolerance and positioned toward

achieving your goals. Your last portfolio review discussion was on 0 9 / 1 7 / 2 0 1 4 .

Putting All the Pieces Together

Your financial relationship with Edward Jones may be composed of many accounts, each with a different mix of investments, working in

combination to achieve your goals. Consequently, the information above regarding your goals, risk tolerance and portfolio review refers to

your overall financial relationship with Edward Jones and not to a specific account. If this information is incorrect or if you have additional

questions, please contact your financial advisor.

Contact your financial advisor if you would like to include this information

on your statement.

Important disclosures; such as Statement of Financial Condition, Conditions that Govern Your Account, Account Safety, Errors, Complaints, Withholding,

Free Credit Balance, Fair Market Value or Terminology; relating to your account(s) are available on the last page of this package or at

www.edwardjones.com/statementdisclosures.

PAGE 12 OF 23

OPR-5453I-A EXP 31 MAY 2018 © 2016 EDWARD D. JONES & CO., L.P. ALL RIGHTS RESERVED.

Am I On Track to Achieve

Goals?

PortfolioMy

for John

Modica

Account Holder(s) John L Hailey

A Retirement Fee Notice displays on the quarter-end

statement preceding your fee’s due

Account Number 100-94965-1-2

Account

Type Traditional

Retirement Account

date. This due date falls in the month of the

anniversary

ofIndividual

your account

opening.

Financial Advisor Jayne D. Wakeman, 352-674-0063

3608 Wedgewood Lane, Buffalo Ridge Plaza II (466W), the Villages, FL

You will continue to see the notice until you

pay the

or- Sep

until

the month in whichPage

it is2 due,

Statement

Date fee

Aug 31

27, 2013

of 3

whichever

comes first. For example, your notice will display on December, January and

4

February statements if your fee is due in March and remains unpaid.

Retirement

RetirementFee

FeeNotice

Notice

Amount

Amountdue

duefor

foraccount

account123-45678-9-0

100-94965-1-2

$40.00

$40.00

Due

Duedate

date

March 20,

December

20,2013

2013

7

To

to you,

you, contact

contact your

your Financial

financial advisor.

Tolearn

learnmore

moreabout

aboutthe

the various

various payment

payment methods

methods available

available to

Advisor.

Summary of Assets (as of Sep 27, 2013)

additional details at www.edwardjones.com/access

If you’ve selected an AutoPay option, this information will display at the bottom of this

Cash, Money Market funds &

section.

designate

an AutoPay method for your retirement account fee, contact your

InsuredTo

Bank

Deposit

Balance

Cash

financial

advisor.

$600.96

Amoun

Mutual Funds

Amoun

t Withdrawn

Since Inception

t

Quantity

Invested

Value

Account Holder(s) John L Hailey

35.96

9.245

6,216.41

-6,930.00

332.45

Account Number 100-94965-1-2

Account Type Traditional Individual Retirement Account

$933.41

Financial Advisor Jayne D. Wakeman, 352-674-0063

information

for

up

to

five

primary

beneficiaries

for

your

3608 Wedgewood Lane, Buffalo Ridge Plaza II (466W), the Villages, FL

Price

Which Beneficiaries Do I Have On File?

Investment Co of America Fd A

Total Account Value

You have the option to display

31 - SepAgreement

27, 2013

Page 3 of 3

retirement accounts and accounts with a Statement

TransferDate

onAug

Death

in place. The

Retirement Summary

4

Designated

Beneficiaries section, which displays quarterly, helps you verify that your

beneficiary

information is up-to-date.

2013 Contributions

This Period

Cumulative

$0.00

$0.00

2012 Contributions

0.00

0.00

2013 Net Distributions

0.00

1,040.00

2013 Federal Tax Withholding

Primary

2013 Gross Distributions

Primary

Joann L Hailey

0.00

260.00

Designated

ciaries

DesignatedBenefi

Beneficiaries

0.00

John A Doe

1,300.00

100.00%

100.00%

Additional beneficiary designation information on file

Additional beneficiary designation information on file

Required

Distribution

(RMD)

Summary

Our

records Minimum

currently

reflect

the beneficiary(ies)

above

as the person(s) you intend to receive the assets in your account in the event of your

Required

Minimum

Distribution

(RMD)

Summary

Our records

refltoect

the benefi

ciary(ies)

as the

intend to receive

the assets

yourmost

account

in the

event of

death.

Takecurrently

a moment

ensure

our records

areabove

accurate

andperson(s)

completeyou

by comparing

this information

to in

your

recently

signed

This information is based solely on this account.

Thisdeath.

information

based solely

on the

value

of assets

held

inand

this

account

as

ofthis

theinformation

priorinformation

year. to your

your

Take

aismoment

to ensure

our

records

are

accurate

complete

by of

comparing

most

recently signed

"Beneficiary

Designation"form.

Please

contact

your

Edward

Jones

financial

advisor

if12/31

your beneficiary

needs

updating.

“Benefi

ciary

Designation”

form.

Please

contact

Amount

you

withdraw

this

year

$80.49

Amount

youare

arerequired

requiredtoto

withdraw

this

year your Edward Jones financial advisor if your beneficiary information needs updating.

$80.49

––£…™™™™

Amountpaid

paidtotoyou

youtotodate

date

Amount

$1,300.00

$1,300.00

Amount remaining to be withdrawn this year

$0.00

Amount remaining to be withdrawn this year

$0.00

If you have more than five primary beneficiaries or any contingent, non-individual (e.g., an

entity,

estate or

trust)

specialized beneficiaries, you will see a note at the bottom of this

Investment

and

Other or

Activity

Date indicating

Description that we have additional information on file for your account.

Quantity

section

@@

9/ 16

Dividend on Investment Co of America Fd A on 9.209 Shares @ 0.14

9/ 16

Reinvestment into Investment Co of America Fd A @ 35.82

0.036

Amount

$1.29

It is important to review and update the beneficiary designations on all your accounts

-1.29

regularly. It is particularly important when you have a major change in your life or when

there are changes that may impact your estate. Contact your financial advisor to update

Progress Parkwaydesignations. You may select this section for your statement www.edwardjones.com

your201

beneficiary

via the

Maryland Heights, MO 63043-3042

Member SIPC

Documents tab or Settings page of Online Access, or by contacting your financial advisor.

PAGE 13 OF 23

OPR-5453I-A EXP 31 MAY 2018 © 2016 EDWARD D. JONES & CO., L.P. ALL RIGHTS RESERVED.

When Is My Retirement Fee Due?

To

to you,

you, contact

contact your

your Financial

financial advisor.

Tolearn

learnmore

moreabout

aboutthe

the various

various payment

payment methods

methods available

available to

Advisor.

additional details at www.edwardjones.com/access

Cash, Money Market funds &

Insured Bank Deposit

Balance

How Much Am I Required to Take

Out of My Retirement Account?

$600.96

Cash

Mutual Funds

Price

Investment Co of America Fd A

35.96

Quantity

9.245

Amoun

t

Invested

Amoun

t Withdrawn

Since Inception

Value

6,216.41

-6,930.00

332.45

Totalyou

Account

Value age 70½, you generally are required to begin taking distributions from

$933.41

When

reach

your

traditional, SEP or SIMPLE IRA, or employer-sponsored retirement plan. We know that

Retirement

Summary

managing

your

required minimum distributions (RMDs) can be challenging. This section

can help you keep track.

This Period

Cumulative

$0.00

$0.00

2013 Contributions

2012 remember,

Contributions

Please

the amounts you see here are only for the assets in your

0.00

retirement

0.00

2013 Net Distributions

0.00

1,040.00

2013 Federal Tax Withholding

0.00

260.00

2013 Gross Distributions

0.00

1,300.00

account at Edward Jones. If you hold other retirement accounts, you may need to take

distributions from them as well.

Required

Minimum

Distribution

(RMD)

Summary

Required

Minimum

Distribution

(RMD)

Summary

This information is based solely on this account.

This information is based solely on the value of assets held in this account as of 12/31 of the prior year.

Amount

Amountyou

youare

arerequired

requiredtotowithdraw

withdrawthis

thisyear

year

$80.49

$80.49

Amountpaid

paidtotoyou

youtotodate

date

Amount

$1,300.00

$1,300.00

Amount remaining to be withdrawn this year

$0.00

Amount remaining to be withdrawn this year

$0.00

Investment and Other Activity

Date

Description

9/ 16

Dividend on Investment Co of America Fd A on 9.209 Shares @ 0.14

9/ 16

Reinvestment into Investment Co of America Fd A @ 35.82

@@

Quantity

What Activity Has Occurred in My Account?

0.036

Amount

$1.29

-1.29

You have three options for displaying your account activity: chronologically, by category or

both ways. You may select the options below via the Documents tab or Settings page of

201 Progress Parkway

Maryland Heights, MO 63043-3042

Online

Access, or by contacting your financial advisor.

www.edwardjones.com

Member SIPC

Option 1 - Order Activity Chronologically

The Investment and Other Activity by Date section shows activity chronologically for the

statement period and is the automatic setting. This option may be useful for you if you

prefer to use dates to track the activity that took place in your account. You’ll see the date

the transaction took place, a brief description of the transaction, a quantity and a dollar

amount (if applicable). It’s important to note that the date shown for trade transactions is

the settlement date (up to three business days after the trade date).

PAGE 14 OF 23

OPR-5453I-A EXP 31 MAY 2018 © 2016 EDWARD D. JONES & CO., L.P. ALL RIGHTS RESERVED.

Summary of Assets (as of Sep 27, 2013)

Income distributions from securities

Taxable

This Period

Tax-free

Total

Taxable

This Year

Tax-free

Total

$0.38

$287.50

$287.88

$0.97

$856.25

$857.22

90.40

745.73

$287.50

$378.28

$746.70

$856.25

$1,602.95

Interest

Dividends

Option

2(Q)*

- Order Activity by Category

Qualified

90.40

Total

$90.78

745.73

If you

choose

to display your account activity by category, you receive two sections: Sum*Reduced

Tax Eligible

Note:

year-end tax

documents

(eg.,

1099) willby

provide

specific classifi

cations

of yourprovided

income distributions.

Qualifi

ed (Q)

mary

ofYour

Activity

and

Detail

ofForm

Activity

Category.

The

totals

for the

categories

in

dividends may be taxed at reduced rates. Nonqualified (N) dividends may be taxed at ordinary rates. A portion of your Partially Qualified

the (P)

summary

section

directly

relate

to the

activity

reported

in advisors

the detail

option

dividends may

also be taxed

at reduced

rates. Edward

Jones,

its employees

and financial

cannot section.

provide tax orThis

legal advice.

You should review your specific situation with your tax or legal professionals.

may be ideal for you if you have a lot of activity within multiple categories.

Summary of Activity

Beginning Balance of Cash, Money Market funds and Insured Bank Deposit

$23,807.00

Additions

Income

Subtractions

$138.75

Total Additions

$138.75

Withdrawals to Purchase Securities

-$69.35

Total Subtractions

-$69.35

Ending Balance of Cash, Money Market funds and Insured Bank Deposit

$ 23,876.40

Detail of Activity by Category

Additions - Income

Date Where Invested

Quantity

Amount per

share/rate

Amount

Interest

Security A

5/27

Money Mkt

5

4.57

22.85

Security B

5/27

Money Mkt

10

4.63

46.30

5/20

Money Mkt

0.01

0.25

5/01

Reinvested

714.559

5/01

Reinvested

442.255

5/02

Reinvested

3,451.426

0.01

34.51

Date

Source of

Funds

Quantity

Amount per

share/rate

Amount

Money Market Dividends

Money Market for 29 Days

Dividends

Security E at Daily Accrual Rate

Tax Info N

12.44

Security C at Daily Accrual Rate

Tax Info N

Security D

Tax Info P

Subtractions - Withdrawals to Purchase Securities

Reinvestments

PAGE 15 OF 23

Reinvestment into Security E

5/01

Income

1.238

10.05

-12.44

Reinvestment into Security C

5/01

Income

1.95

11.49

-22.40

Reinvestment into Security D

5/02

Income

13.694

2.52

-34.51

OPR-5453I-A EXP 31 MAY 2018 © 2016 EDWARD D. JONES & CO., L.P. ALL RIGHTS RESERVED.

Summary of Income

Loan Balance

-77,897.75

——

-74,534.68

——

$41,569.54

Detail

Gain/Loss

DetailofofUnrealized

Unrealized

Gain/Loss

Mutual

Funds

Mutual

Funds

Value

Value

Security A

$1,947.30

First Eagle

Fund Cl

A

$1,947.30

Option

3 -Global

Order

Activity

Chronologically and by Category

Security B Investors Fund A

Fundamental

62,667.82

62,667.82

Unrealized

Unrealized

Gain/Loss

Gain/Loss

Cost

Cost Basis

Basis

$1,272.34

$1,272.34

$674.96

$674.96

——

——

——

——

Securitychoose

C

——

——

YouWilliston

may

to Amer

display your activity both ways: by 51,489.10

category

and chronologically.

You

Basin Mid North

51,489.10

——

——

Æ

would then receive the Summary of Activity, Detail of Activity by Category, and Investment

ofof

Realized

Gain/Loss

andSummary

Other

Activity

by

Date

sections simultaneously.

Summary

Realized

Gain/Loss

This Year

Year

This

$158.56

ShortTerm

Term(assets

(assetsheld

held1 1year

yearororless)

less)

Short

Loans

Detail

LongTerm

Term(held

(assets

over 1 year)

Long

overheld

1 year)

49,875.46

49,875.46

Some

activity in the Loans Detail section relates to activity in the Investment and $50,034.02

Other

Total

Total

$50,034.02

Activity by Date section. Funds from Example 1A are applied to the loan balance in Example

totals may

Summary totals

may not

not include

include proceeds

proceeds from

from uncosted

uncostedsecurities

securitiesororcertain

certaincorporate

corporateactions.

actions.

1B. Funds from Example 2A are applied to the loan balance in Example 2B.

Detail of Realized Gain/Loss from Sale of Securities

Detail of Realized Gain/Loss from Sale of Securities

The other activity shown takes place only within the Loans Detail section. As you see, this

Purchase

Purchase

Sale

Sale

Realized

Realized

Quantity Cost

Cost

Basis loan

Proceeds

Date Date

Date and reductions

Gain/Loss

section enables you to track the Date

increases

toBasis

your

balance Gain/Loss

easily.

Please

Quantity

Proceeds

WillistonABasin Mid North Amer

08/ 24/2010 09/16

09/ 16

1,012.232

$4,124.19

$6,620.00

Security

08/24/2010

1,012.232

$6,620.00

contact

your financial advisor

if you have

questions

about$4,124.19

your situation.

Fundamental

Investors Fund A

Security

B

WillistonCBasin Mid North Amer

Security

—— 09/26

09/ 26

——

123.203

123.203

2,910.46

2,910.46

6,000.00

6,000.00

08/ 24/2010 09/26

09/ 26

08/24/2010

900.746

900.746

3,669.95

3,669.95

6,035.00

6,035.00

$2,495.81

$2,495.81

LT

LT

3,089.54

3,089.54

2,365.05

2,365.05

LT

LT

LT

LT

––£…™™™™

Investment and Other Activity by Date

Investment and Other Activity

Date Description

Description

Date

@@

Example 1A

9/05

9/

05

Sell

Security B @

46.28 Fund A @ 46.28

Sell

Fundamental

Investors

9/13

9/

13

Dividend

Security B on

1,285.842

@ 0.125Shares @ 0.125

Dividend

onon

Fundamental

Investors

FundShares

A on 1,285.842

Statement Date Aug 31 - Sep 27, 2013

Reinvestment

Security B Investors

@ 47.92 Fund A @ 47.92

Reinvestment

intointo

Fundamental

9/13

9/

13

Example 2A

Account Holder(s) Gary L Lindemoen & Jill A Lindemoen

Account Number 894-11254-1-4

Account Type Joint Tenants With Right of Survivorship,

TOD

Quantity

Financial Advisor Brady L. Helmer, 218-233-0068Quantity

-45.376

-45.376

1104 2nd Ave S, Moorhead, MN 56560

6 9/19

9/ 19

Sell

Security

C @ Mid

6.54North

as ofAmer

09/16/13

Sell

Williston

Basin

@ 6.54 as of 09/16/13

-1,012.232

-1,012.232

Loans

Detail

Loans

Detail

201

Progress

Parkway

Example 2B

Date

Date

9/

05

9/05

Description

6,620.00

6,620.00

Description

9/

19

9/19

Direct

Payment

to to

Alerus

Financial

Direct

Payment

Security

D

9/

19

9/19

Reduction

to to

Loan

Balance

Reduction

Loan

Balance

9/

23

9/23

Loan

Interest

Charge

from

08/21

Thru

09/20

@ 5@

1/4%

Average

Balance

$ 78,951

Loan

Interest

Charge

from

08/21

Thru

09/20

5 1/4%

Average

Balance

$78,951

Member SIPC

Increases

Increasesto

to Reductions

Reductions to

to

Loan

Balance

Loan

Loan Balance

LoanBalance

Balance

Reduction

to to

Loan

Balance

Reduction

Loan

Balance

Total

Total

160.73

160.73

Page 4 of 4

-160.73

-160.73

www.edwardjones.com

Maryland Heights, MO 63043-3042

@@

Example 1B

3.354

3.354

Amount

Amount

$2,100.00

$2,100.00

$2,100.00

$2,100.00

-5,000.00

-5,000.00

6,620.00

6,620.00

-356.93

-356.93

-$5,356.93

-$5,356.93

$8,720.00

$8,720.00

Pending Trades

Date

Description

Settlement

Date

Total

Amount

9/ 26

Pending sell of Fundamental Investors Fund A 123.203 @ 48.70

10/ 1/ 2013

$6,000.00

9/ 26

Pending sell of Williston Basin Mid North Amer 900.746 @ 6.70

10/ 1/ 2013

6,035.00

Designated Beneficiaries

Primary

Marissa Lindemoen

Equal %

Alexa Lindemoen

Equal %

Brenna Lindemoen

Equal %

Our records currently reflect the beneficiary(ies) above as the person(s) you intend to receive the assets in your account in the event of your

death. Take a moment to ensure our records are accurate and complete by comparing this information to your most recently signed

"Beneficiary Designation"form. Please contact your Edward Jones financial advisor if your beneficiary information needs updating.

––£…™™™™

PAGE 16 OF 23

OPR-5453I-A EXP 31 MAY 2018 © 2016 EDWARD D. JONES & CO., L.P. ALL RIGHTS RESERVED.

Total Account Value

Beginning

Balance

Loan Balance

-77,897.75

Cost Basis

Unrealized

Gain/Loss

——

Ending

Balance

-74,534.68

——

Total Account Value

$41,569.54

Detail

Unrealized

Gain/Loss

Detailofof

Unrealized

Gain/Loss

Does

My

Statement

Display Details of

MyMutual

Realized

Gains and Losses? Value

Funds

Cost Basis

Mutual Funds

Security

First

Eagle AGlobal Fund Cl A

Value

Cost

Basis

Unrealized

Unrealized

Gain/Loss

Gain/Loss

$1,947.30

$1,947.30

$1,272.34

$1,272.34

$674.96

$674.96

Though

a summary

ofA realized gains and losses displays62,667.82

automatically upon

a sale, you——

can

Security

B Investors Fund

——

Fundamental

62,667.82

——

——

Security

Cadditionally see more detailed information. You

51,489.10

——

choose

toBasin

may select this——

option

if it’s what’s

Williston

Mid North Amer

51,489.10

——

——

Æ

best for you via the Documents tab or Settings page of Online Access, or by contacting

ofof

Realized

Gain/Loss

yourSummary

financial

advisor.

Summary

Realized Gain/Loss

This Year

Year

This

TheShort

Detail

Realized

Gain/Loss

from Sale of Securities section displays when a sale$158.56

of a

Short

Termof

(assets

held1 1year

year

less)

Term

(assets

held

oror

less)

LongTerm

Term

(assets

held

over 1the

year)statement period and if you have realized gains or losses

49,875.46

Long

(held

over

1 year)

49,875.46

security

occurs

during

for the

Total

Total statement period and/or the current year.

current

$50,034.02

$50,034.02

totals may

Summary totals

may not

not include

include proceeds

proceeds from

from uncosted

uncostedsecurities

securitiesororcertain

certaincorporate

corporateactions.

actions.

Detail of Realized Gain/Loss from Sale of Securities

Detail of Realized Gain/Loss from Sale of Securities

Purchase Sale

Sale

Purchase

Date Date

Date

Date

WillistonABasin Mid North Amer

Security

Cost

Basis

Cost

Basis

Proceeds

Proceeds

Realized

Realized

Gain/Loss

Gain/Loss

08/ 24/2010 09/16

09/ 16

08/24/2010

1,012.232

1,012.232

$4,124.19

$4,124.19

$6,620.00

$6,620.00

$2,495.81

$2,495.81

LT

LT

—— 09/26

09/ 26

——

123.203

123.203

2,910.46

2,910.46

6,000.00

6,000.00

08/ 24/2010 09/26

09/ 26

08/24/2010

900.746

900.746

3,669.95

3,669.95

6,035.00

6,035.00

3,089.54

3,089.54

2,365.05

2,365.05

LT

LT

LT

LT

Fundamental

Investors Fund A

Security

B

WillistonCBasin Mid North Amer

Security

Quantity

Quantity

––£…™™™™

Investment and Other Activity by Date

Investment and Other Activity

Description

Description

Date

Date

@@

Summary

ofSecurity

Realized

9/05

Sell

B@

46.28 Gain/Loss

9/

05

Sell

Fundamental

Investors

Fund A @ 46.28

Quantity

Quantity

Amount

Amount

-45.376

-45.376

$2,100.00

$2,100.00

Dividend

Security B on

1,285.842

@ 0.125Shares

160.73

13

Dividend

onon

Fundamental

Investors

FundShares

A on

1,285.842

@ 0.125

160.73

The9/9/13

Summary

of

Realized

Gain/Loss

section

displays

automatically upon a sale and/or

9/13

9/

13

Reinvestment

Security B Investors

@ 47.92 Fund A @ 47.92

Reinvestment

intointo

Fundamental

3.354

3.354

-160.73

-160.73

9/ 19

Sell Williston Basin Mid North Amer @ 6.54 as of 09/16/13

-1,012.232

6,620.00

if there

realized

for the current period. The cumulative gains/losses

for

9/19 is aSell

Security C gain

@ 6.54 or

as ofloss

09/16/13

-1,012.232

6,620.00

securities in the account are displayed within the short-term (held one year or less)

and/or long-term (held for more than one year) holding period category.

201 Progress Parkway

Maryland Heights, MO 63043-3042

PAGE 17 OF 23

www.edwardjones.com

Member SIPC

OPR-5453I-A EXP 31 MAY 2018 © 2016 EDWARD D. JONES & CO., L.P. ALL RIGHTS RESERVED.

Loans

Q: Why do I receive an account statement

in some months and not others?

A: We are required to send you a statement

at least every quarter if you hold any

Q: How do I customize my statement so

it displays the information that is most

important to me?

A: After discussing with your financial

balances or positions with us. You’ll also

advisor the options that might be best

get a statement for any month in which

for your account(s), you can work with

you have activity other than reinvested

him or her to make updates or select

money market dividends, pending trades

your preferences at your convenience

or interest on your cash balance. You’ll

on the Documents tab or Settings page

see those activities the next time you get

of Online Access. After your preferences

a statement. Contact your financial

have been selected, your new statement

advisor if you would like to receive a

options display on your next statement.

statement every month.

If you’re not signed up for Online Access,

visit www.edwardjones.com/access

Q: Why is my statement period not always

the first and last day of the month?

to enroll or contact your branch team

for assistance.

A: At Edward Jones, our statement period

ends on the last business Friday of the

month, with the month of December

being the only exception. In December,

Q: How can I get my statements delivered

electronically?

A: Sign up for e-delivery to receive an email

the statement period always ends on

notification that tells you when your

Dec. 31. The next statement period starts

account statements are available to

the following day.

view online. View the easy-to-follow

enrollment instructions by visiting

Q: Where do I find on my statement the

www.edwardjones.com/edelivery.

commissions paid for the purchase or

sale of a security?

A: This information may appear on your

trade confirmation. The ways in which

this information displays on trade confir-

Q: Are there any optional sections or

columns that are fixed based upon

the account type?

A: Statements for Advisory and Guided

mations vary by security type. Contact

Solutions taxable accounts must receive

your financial advisor if you have any

cost basis information. You may choose

additional questions.

to receive the Cost Basis Summary

option, which includes cost basis and

unrealized gain/loss values for each

security, or the Cost Basis Detail option,

which breaks down your securities

by lot.

PAGE 18 OF 23

OPR-5453I-A EXP 31 MAY 2018 © 2016 EDWARD D. JONES & CO., L.P. ALL RIGHTS RESERVED.

Frequently Asked Questions

Beneficiary – An individual, an institution, a

mergers, stock splits, spin-offs and other

trust or an estate that receives, or may

events that occur after purchase. Depending

become eligible to receive, benefits under a

upon your circumstances, your cost basis

will, an insurance policy, a retirement plan, an

may not reflect all applicable adjustments.

annuity, a trust or other contract.

It should not be used for tax preparation

Change in Value – An estimate of the

change in your account’s value due to

purposes without first consulting with your

tax professional.

market price fluctuation from one month to

Distribution –

the next and year-to-date. It may include

• A payment of cash or assets “in kind”

miscellaneous items such as commissions

and accrued interest. Because of these

variables, the following equation is used to

arrive at the change in value reported:

to an IRA owner

• A reportable event

Excess Accumulations – An amount of

a required minimum distribution (RMD)

Change in Value:

that is not withdrawn by the set deadline.

Ending Value

This amount may be subject to the 50%

- Beginning Value

IRS penalty.

- Assets Added

- Income

+ Assets Withdrawn

+ Fees and Charges

= Change in Value

In-kind Distribution – The distribution of an

asset in a form other than cash. Shares of

stock and mutual funds are two examples.

Realized Gain/Loss – The difference

between the cost basis and the amount

Contribution – Payment to an annuity or

received upon a sale, redemption or ex-

retirement plan. This is the amount that was

change of a security. This number should

deposited into a retirement account.

be verified by your tax professional before

Conversion – The movement of cash or

other assets from a traditional IRA, SEP IRA

Recharacterization – When a client makes

or SIMPLE IRA (that has met the two-year

a contribution to a Roth IRA, then later

waiting period) to a Roth IRA. A conversion

transfers all or a portion of that contribution

is a reportable event.

to a traditional IRA.

Cost Basis – This figure may help you

OR

understand a security’s taxable gain or loss.

When a client converts all or a portion of a

It is the original amount paid for a security,

traditional, SEP or SIMPLE IRA’s assets to a

including commissions and fees, and is

Roth IRA, then later transfers all or a portion

adjusted for reinvestments of income and

of the original conversion amount back to a

sales. It may also be adjusted for capital

traditional, SEP or SIMPLE IRA.

distributions, original issue discount (OID),

PAGE 19 OF 23

you use it for tax preparation purposes.

OPR-5453I-A EXP 31 MAY 2018 © 2016 EDWARD D. JONES & CO., L.P. ALL RIGHTS RESERVED.

Glossary

Transfer on Death Agreement – A contract

event that occurs when cash or other

between you and Edward Jones allowing the

assets are withdrawn from one eligible

distribution of assets from your account

retirement plan and all or part is put into

upon your death.

another eligible retirement plan within

60 calendar days.

between the current cost basis and the

Settlement Date – The date when an execut-

current value of an investment. The unreal-

ed “buy” or “sell” trade must be completed.

ized gain or loss shown on statements can

This is the date by which the buyer must pay

generally be used by you, when working

for a security and the seller must complete

with your financial advisor and tax profes-

the transfer of a security.

sional, to estimate the taxable gain or loss

Tax Free – Refers to the taxation of dividends. Tax-free dividends may be exempt

that could have resulted if you sold an

investment on that statement’s cutoff day.

from federal, state and local taxes. Please

Note: Edward Jones, its employees and

speak with your tax professional for more

financial advisors cannot provide tax or

information on reduced tax rates.

legal advice. You should consult your

Trade Date – The date a trade is placed and

filled in an account.

PAGE 20 OF 23

Unrealized Gain/Loss – The difference

attorney or qualified tax advisor regarding

your situation.

OPR-5453I-A EXP 31 MAY 2018 © 2016 EDWARD D. JONES & CO., L.P. ALL RIGHTS RESERVED.

Rollover – Generally a tax-free, reportable

Section

Contents

Disclosure

Displays important disclosures about investing with Edward Jones.

See www.edwardjones.com/statementdisclosures for more information.

Interested

Provides a confirmation of an interested party (for example, your

Parties

attorney or tax professional) who received a copy of your statement.

Speak with your financial advisor to set up this service and if you

have additional questions.

Maturity

Displays the laddering for your certificates of deposit and bonds.

Schedule

It includes the maturing values, current market values and percentage

of total maturing values if you hold these assets at Edward Jones. This

section assists with long-term planning, as laddering can balance the

risks associated with price and income fluctuation. This section is

optional, so contact your financial advisor if you wish for it to display

on your statement.

Money Market

Illustrates how money moves into and out of (deposits and withdrawals)

and Insured

your money market fund or Insured Bank Deposit. The running balance

Bank Deposit

helps you with reconciling these kinds of transactions. The applicable

Detail by Date

section displays automatically if you have a money market fund or

Sections

Insured Bank Deposit in your account.

Note: The available money market fund types are Money Market

Investment Shares and Money Market Retirement Shares.

Retirement

Displays reportable activity that took place within the statement period,

Summary

which may include contributions, conversions, distributions, excesses,

recharacterizations, rollovers and transfers.

PAGE 21 OF 23

OPR-5453I-A EXP 31 MAY 2018 © 2016 EDWARD D. JONES & CO., L.P. ALL RIGHTS RESERVED.

Appendix

Information Provided on

Additional Sections of the Statement

Section

Contents

Summary of

Displays the amounts for checks written from your Edward Jones

Check Writing

account if a category was assigned to the transaction. To assign a

Expenses

category, you must enter an expense code in the box marked “EC” on

your check; the section will display for the calendar year the expense

code was used. Because the section shows how your funds have

been allocated by category, it can assist you with budgeting.

See your financial advisor for the list of expense code categories.

Value

Displays the current and year-to-date account-based fees and charges,

Summary:

except reinvested fees. Examples of fees and charges include:

Fees and