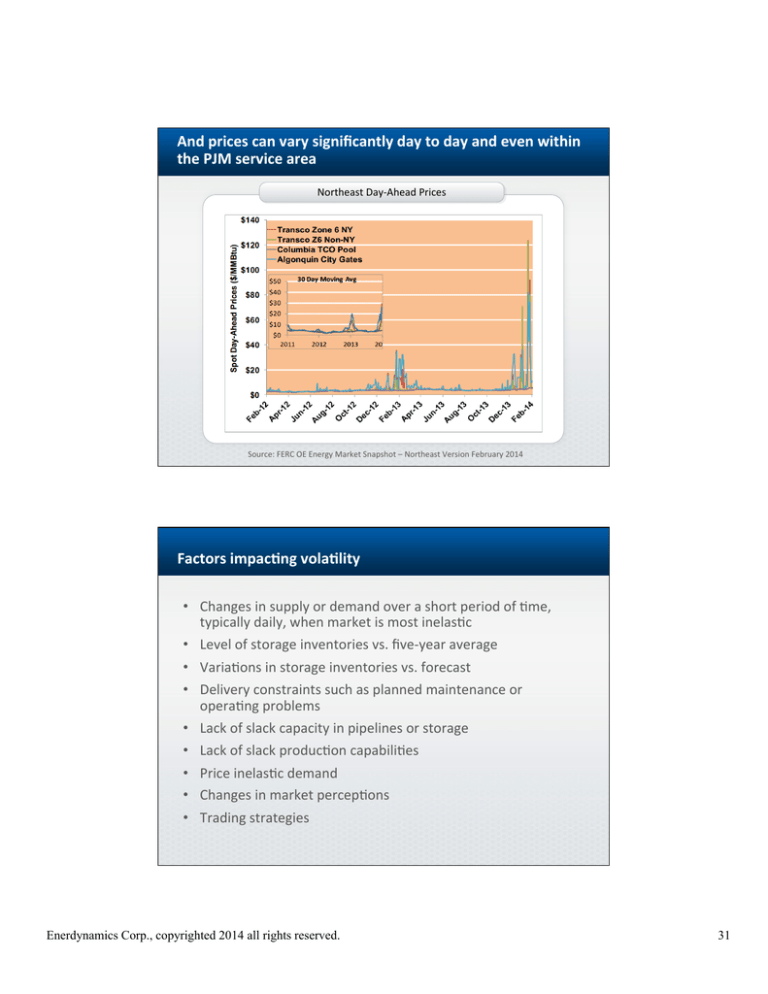

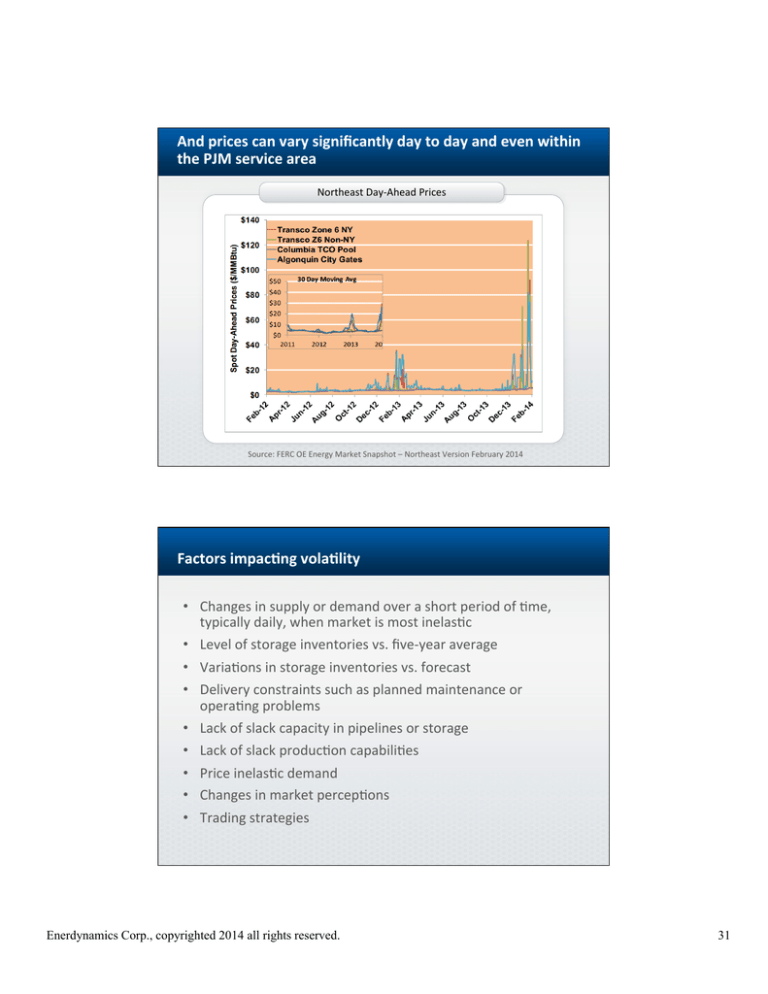

And prices can vary significantly day to day and even within the PJM service area Northeast Day-­‐Ahead Prices Source: FERC OE Energy Market Snapshot – Northeast Version February 2014 Factors impac6ng vola6lity • Changes in supply or demand over a short period of 9me, typically daily, when market is most inelas9c • Level of storage inventories vs. five-­‐year average • Varia9ons in storage inventories vs. forecast • Delivery constraints such as planned maintenance or opera9ng problems • Lack of slack capacity in pipelines or storage • Lack of slack produc9on capabili9es • Price inelas9c demand • Changes in market percep9ons • Trading strategies Enerdynamics Corp., copyrighted 2007, all

Enerdynamics Corp., copyrighted 2014 all rights reserved.

rights reserved.

31

31

Vola6lity can vary significantly by month Natural gas historical and implied vola9lity Source: EIA Interstate Pipeline Transporta6on Enerdynamics Corp., copyrighted 2007, all

Enerdynamics Corp., copyrighted 2014 all rights reserved.

rights reserved.

32

32

Interstate transport services (including pricing) are subject to federal jurisdic6on FERC • Just and reasonable rates • Terms and condi9ons of services • Licensing new pipelines • Market oversight Department of Transporta9on (PHMSA) • Safety and maintenance Pipeline service op6ons Firm Transport (FT): long-­‐term contract, high demand charge, rates set by tariff, capacity available on almost all days • Reserva9on rate: $/Dth/monthly per daily space reserved • Commodity rate: $/Dth actually transported • Fuel: x% of Dth transported Interrup9ble Transport (IT): all variable charges, rates nego9able between tariff max/min, no guarantee on capacity availability • Commodity Rate: $/Dth actually transported • Fuel: x% of Dth transported Capacity Release: firm shippers can resell rights to capacity • Prices set by nego9a9on Enerdynamics Corp., copyrighted 2007, all

Enerdynamics Corp., copyrighted 2014 all rights reserved.

rights reserved.

33

33

Many pipelines offer varying levels of “firmness” Typical firm service op9ons: • Primary firm Must follow scheduling 9me frames with variances subject to balancing rules • Secondary firm Allows use of secondary receipt/delivery points, but with lower priority than primary firm customers • No-­‐no9ce •

Allows variance from scheduled amount within contract quan99es Authorized overrun Can exceed contract quan99es up to a limit, for an addi9onal price Capacity release is an alternate way to obtain firm capacity • Firm contract holders post offers on pipeline electronic bulle9n boards (EBB) • May be released through pre-­‐arranged deal or through bidding on EBB • Releasing party can specify amount, dura9on, and rights to recall • May be at tariff rate, a discount, or a premium • Most common dura9on is monthly, but can be less than monthly, seasonal, annual or long-­‐term Enerdynamics Corp., copyrighted 2007, all

Enerdynamics Corp., copyrighted 2014 all rights reserved.

rights reserved.

34

34

Market value of transporta6on is determined by price differen6als Produc9on Area $3.74/Dth Market Hub $4.94/Dth The value of transporta9on is equal to the expected difference in market prices between regions over the term of the agreement Scheduling process • Pipeline determines opera9onal capacity using pipeline flow models and forecast condi9ons • Users request transporta9on or storage transac9on (nomina9ons) • Opera9ons Department processes nomina9ons • If all nomina9ons can be physically accommodated, they are scheduled • If not, nomina9ons are allocated based on priority Enerdynamics Corp., copyrighted 2007, all

Enerdynamics Corp., copyrighted 2014 all rights reserved.

rights reserved.

35

35

Scheduling process – Firm vs. IT Firm Transporta9on (FT) Scheduled first based on firm priority Interrup9ble Transporta9on (IT) Scheduled aser firm in order of price Scheduling example Capacity available = 1,020,000 Dth "

Shipper

Contract # Service

JF Marke9ng 01345

FT

Volume

Price

Scheduled 250,000

Tariff

250,000 My LDC

01431

FT

700,000

Tariff

700,000 GasSmart

02339

IT

50,000

0.20

50,000 MegaEnergy

02455

IT

50,000

0.18

20,000 Genco Intl.

02568

IT

100,000

0.16

0 Enerdynamics Corp., copyrighted 2007, all

Enerdynamics Corp., copyrighted 2014 all rights reserved.

rights reserved.

36

36

When can scheduled transporta6on be cut? • Bumping by higher priority customers • Curtailment due to opera9onal issues Gas nomina6ons 6me frames do not match electric scheduling Standard NAESB Gas Nomina9ons (Central Clock Time) Nomina6on Cycle Nomina6on Schedule No6fica6on Time Nomina6on Flow Begins Can Bump IT? Timely 11:30 a.m. 4:30 p.m. 9:00 a.m. next day N/A Evening 6:00 p.m. 10:00 p.m. 9:00 a.m. next day Yes Intraday 1 10:00 a.m. 2:00 p.m. 5:00 p.m. current day Yes Intraday 2 5:00 p.m. 9:00 p.m. 9:00 p.m. current day No Note some pipelines offer addi9onal nomina9ons cycles, or make best efforts to fulfill out-­‐of-­‐cycle nomina9ons Enerdynamics Corp., copyrighted 2007, all

Enerdynamics Corp., copyrighted 2014 all rights reserved.

rights reserved.

37

37

FERC NOPR on rules changes to address gas/electric differences •

•

•

•

Shis start of gas day to 4 a.m. CCT Move 9mely cycle nomina9on deadline to 1 p.m. CCT Create two addi9onal intra-­‐day cycles for four in total Allow mul9-­‐party transporta9on agreements FERC Proposed Gas Nomina9ons (Central Clock Time) Nomina6on Cycle Nomina6on Schedule No6fica6on Time Nomina6on Flow Begins Can Bump IT? Maximum Nomina6on Change Timely 1:00 p.m. 4 p.m. 4 a.m. next day N/A 100% Evening 6:00 p.m. 10 p.m. 4 a.m. next day Yes 100% Intraday 1 8:00 a.m. 11 a.m. 12 noon Yes ~66% Intraday 2 10:30 a.m. 2 p.m. 4 p.m. Yes 50% Intraday 3 4:00 p.m. 6 p.m. 7 p.m. Yes 37.5% Intraday 4 7:00 p.m. 9 p.m. 9 p.m. No ~29.2% Balancing may be daily, monthly or a combina6on of both Cumula9ve imbalance

8 -­‐1 MMBtu

7 6 5 4 Daily imbalance

3 2 1 +1 MMBtu Balanced -­‐1 MMBtu

Gas Out Gas In +2 MMBtu -­‐1 MMBtu 0 Day One Enerdynamics Corp., copyrighted 2007, all

Enerdynamics Corp., copyrighted 2014 all rights reserved.

rights reserved.

Day Two Day Three 38

38

OFOs and EFOs result in 6ghter balancing rules and impact markets Pipeline forecast inventory is approaching upper or lower limits Users must balance more 9ghtly on a daily basis • Opera9onal Flow Order (OFO): stages from +/-­‐ 25% to +/-­‐ 5% • Emergency Flow Order (EFO): +/-­‐ 0% Failure to meet tolerance results in non-­‐compliance penal9es Balancing opportuni6es/risks • U9lizing packing and drasing to balance sales and supply • Economic value of “in kind” and “in cash” balancing op9ons • Failure to meet tolerance results in non-­‐compliance penal9es • Use of Opera9onal Balancing Agreements (OBAs) Enerdynamics Corp., copyrighted 2007, all

Enerdynamics Corp., copyrighted 2014 all rights reserved.

rights reserved.

39

39

Thought Ques6on Ex. 4 What type of transporta9on arrangement do you think is best suited to a gas generator? Why? LDC Transport Enerdynamics Corp., copyrighted 2007, all

Enerdynamics Corp., copyrighted 2014 all rights reserved.

rights reserved.

40

40

LDC and other intrastate services are subject to state jurisdic6on State Public U9li9es Commission • Grant exclusive service territories • Just and reasonable rates • Terms and condi9ons of services • Approval of major new projects • Safety and reliability Unlike interstate pipelines which generally have consistent rules, there is significant varia9on in rules between LDCs Most LDCs offer two separate services – bundled or transport only Bundled u9lity supply and transport or Transport only with supply provided by third party Almost all power plants elect for transport only and arrange for their own supply from a marketer Enerdynamics Corp., copyrighted 2007, all

Enerdynamics Corp., copyrighted 2014 all rights reserved.

rights reserved.

41

41

LDC transport service comes in at least two varie6es Firm Transport (FT): demand charge plus variable charge, rates set by tariff, capacity available on almost all days • Demand charge: $/Dth/monthly per contract quan9ty • Transport rate: $/Dth actually transported • Shrinkage: x% Dth Interrup9ble Transport (IT): all variable charges, rates may be nego9able, no guarantee on capacity availability • Transport Rate: $/Dth • Shrinkage: x% Dth Nego9able services are osen offered to power plants Almost all power plants elect interrup9ble transport services, although non-­‐standard terms may be nego9ated Scheduling priority • LDC systems are designed to include possible curtailment of large customers on peak demand days • Scheduling is typically done based on end-­‐user priori9es — Residen9al — Small commercial — Large firm customers — Large interrup9ble • LDC can osen curtail on short no9ce (30 min. – 8 hrs.) • Very high penal9es apply to customers who take gas when curtailed Enerdynamics Corp., copyrighted 2007, all

Enerdynamics Corp., copyrighted 2014 all rights reserved.

rights reserved.

42

42

Balancing and ratable takes • Balancing is based on difference between volume delivered by marketer into LDC and actual volume used by their customers • Balancing may be daily, monthly, or a combina9on • LDCs may call OFOs or EFOs • LDC system design is based on assump9on customers take daily quan99es in equal amounts over 24-­‐hour gas day, LDC may limit customers’ ability to vary usage hour by hour Thought Ques6on Ex. 5 What aspects of LDC service may cause issues for gas generators? Enerdynamics Corp., copyrighted 2007, all

Enerdynamics Corp., copyrighted 2014 all rights reserved.

rights reserved.

43

43

Storage and Hub Services Storage facili6es are subject to either federal or state jurisdic6on FERC or State PUC • Just and reasonable rates (osen nego9able) • Terms and condi9ons of services • Approval of major new projects • Safety Enerdynamics Corp., copyrighted 2007, all

Enerdynamics Corp., copyrighted 2014 all rights reserved.

rights reserved.

44

44

Storage service op6ons • Injec9on: Capability to get gas into storage -­‐ $/Dth variable charge + fuel charge – Firm – IT • Inventory: Capacity to hold gas in storage -­‐ $/Dth/monthly reserva9on charge • Withdrawal: Capability to get gas out of storage -­‐ $/Dth variable charge – Firm – IT • Quick turn versus seasonal • U9liza9on of storage requires transport in/out on connec9ng pipeline or LDC Examples of storage types Seasonal Quick Turn Enerdynamics Corp., copyrighted 2007, all

Enerdynamics Corp., copyrighted 2014 all rights reserved.

rights reserved.

45

45

Market value of storage September December $4.79/Dth $5.38/Dth The value of storage is the difference between the gas price at the 9me of injec9on and the gas price at the 9me of withdrawal (less carrying costs including the 9me value of money) Example: Time price arbitrage September December Current gas price: $4.79 MMBtu December futures price: $5.38 MMBtu Storage rates: Reserva9on charge $0.10/Dth/month Injec9on charge $0.02/Dth Withdrawal charge $0.03/Dth Fuel reimbursement 0.2% in-­‐kind If you have 100,000 MMBtu, should you sell now, or put it into storage for withdrawal in December? Enerdynamics Corp., copyrighted 2007, all

Enerdynamics Corp., copyrighted 2014 all rights reserved.

rights reserved.

46

46

Benefits: Use of storage Reserva9on charge:

100,000 Dth x 0.10/Dth/mo. x 4 mo. Injec9on charge: 100,000 Dth x 0.02/Dth Withdrawal charge:

100,000 Dth x 0.03/Dth Fuel reimbursement:

100,000 Dth x 0.2% x 5.38/Dth

Time value of money:

479,000 x 0.006667

Total cost of using storage:

Total cost per MMBtu: = 40,000 = 2,000 = 3,000 = 1,076 = 3,193 $ 49,269 $0.49 So value of using storage = future value – current value – cost of storage = 5.38 – 4.79 – 0.49 = $0.10/MMBtu In this case: 100,000 Dth x $0.10 = $10,000 Hub services • Wheeling • Parking • Loaning • Storage • Peaking gas sales • Balancing sales • Title transfer • Electronic trading • Hub-­‐to-­‐hub transfers Enerdynamics Corp., copyrighted 2007, all

Enerdynamics Corp., copyrighted 2014 all rights reserved.

rights reserved.

47

47

Example: Hub services lending Today (Day 0) Day 3 Current spot price: $5.25/MMBtu Forecast spot price: $5.00 /MMBtu You are 10,000 MMBtu short on a commi,ed firm sale for today. Balancing fee:

Lending fee:

Market price + $0.50/Dth $0.11/Dth What should you do to make up your volumes? Benefits: Use of hub lending What should you do to make up your volumes? Op9on 1: Pay balancing fee 10,000 x (5.25 + 0.50) = $57,500 Op9on 2: Buy spot gas 10,000 x 5.25 = $52,500 Op9on 3: Borrow gas from lending service, replace it on Day 3 with spot gas 10,000 x (5.00 + 0.11) = $51,100 Op9on 3 saves you $1,400 over the next best op9on, (Op9on 2) and the hub operator gets $1,100 in revenue! Enerdynamics Corp., copyrighted 2007, all

Enerdynamics Corp., copyrighted 2014 all rights reserved.

rights reserved.

48

48

Thought Ques6on Ex. 6 Why might a gas generator use storage or hub services? Why might a generator choose not to? Risk Management Enerdynamics Corp., copyrighted 2007, all

Enerdynamics Corp., copyrighted 2014 all rights reserved.

rights reserved.

49

49

Almost everyone in the market is either long or short Long More supply than needed Short Less supply than needed For a gas generator, is it be,er to be long or short? Short Long Seller Buyer Seller Buyer Seller Risk exposures in the energy business can be huge • Price risk • Basis risk • Volume risk • Counterparty risk • Execu9on risk • Opera9onal risk • Regulatory risk Enerdynamics Corp., copyrighted 2007, all

Enerdynamics Corp., copyrighted 2014 all rights reserved.

rights reserved.

50

50

Measuring risk Mark-­‐to-­‐Market Where does the market say we are today? Market risk techniques Where might we be tomorrow? • Value-­‐at-­‐Risk A measure of how adverse moves in the market could impact por•olio value under “normal” market condi9ons • Stress tes9ng A method of assessing how extreme adverse market moves (“outside normal”) could impact por•olio value Value at Risk (VAR) “The expected loss for an adverse market movement with a specified probability over a par9cular period of 9me.” or “Maximum expected loss given assump9ons on future price vola9lity.” Enerdynamics Corp., copyrighted 2007, all

Enerdynamics Corp., copyrighted 2014 all rights reserved.

rights reserved.

51

51

VAR example “Given our company’s exposure to various commodi9es, revenue losses over a 12-­‐month period are expected to be less than $100 million with a 95% confidence level, given assump9ons on future price vola9lity.” $100 million Why use value at risk? • Quickly quan9fy risk associated with a specific transac9on • Compare risk associated with expected return for compe9ng transac9ons • Quan9fy risk across a por•olio of transac9ons • Evaluate impact of correlated risks between transac9ons on overall corporate risk profiles • Implement trading limits Enerdynamics Corp., copyrighted 2007, all

Enerdynamics Corp., copyrighted 2014 all rights reserved.

rights reserved.

52

52

Issues with value at risk • One number cannot adequately reflect complex risks • Calcula9on is dependent on es9mate of vola9lity going forward and on level of sta9s9cal certainty – actual losses may exceed VaR es9mate! Stress tes6ng In addi9on to calcula9ng VAR it is important to test results for what happens outside of the selected confidence level – “what happens to our P/L if events occur outside the 95% confidence level?” Enerdynamics Corp., copyrighted 2007, all

Enerdynamics Corp., copyrighted 2014 all rights reserved.

rights reserved.

What happens out here? 53

53

Why stress tes6ng maLers – Southwest Cold Weather Event February 1-­‐5, 2011 • Extreme cold (by Southwest standards) and wind chill • Rolling blackouts in ERCOT and El Paso Electric • Significantly reduced gas supply due to well freeze ups and loss of electric supply to compressors • Numerous units failed to start or were derated due to issues associated with cold resul9ng in rolling blackouts • But, even with these issues studies showed that gas supply was sufficient to run all gas genera9on had the units been able to operate Issue was genera9on equipment failure, not lack of gas supply Why stress tes6ng maLers – Mid-­‐Atlan6c and Northeast January 2014 • Extreme cold Jan. 6-­‐8 and again Jan. 17-­‐29 caused large increase in electric and gas demand • Gas prices in PJM area rose to $68/MMBtu during first period and to $120/MMBtu during second • Pipelines scheduled FT nomina9ons only • LDCs recalled released FT on pipelines • Well freeze ups in Appalachian Basin reduced supply • Marketers offered supply during second period, but generators were required to accept take-­‐or-­‐pay over mul9ple day period to obtain spot supplies • Gas interrup9ons affected only about 5% of PJM capacity Biggest issues were generator equipment failures, high gas prices, and mul9-­‐day purchase requirements Enerdynamics Corp., copyrighted 2007, all

Enerdynamics Corp., copyrighted 2014 all rights reserved.

rights reserved.

54

54

Generator risks associated with gas transac6ons • Gas price level changes with high vola9lity can make genera9on uneconomic in the electric market • Extreme price levels can result in cost of genera9on that exceeds electric maximum price • Volumetric risk causes balancing penal9es on pipeline/LDC or long/short problems • Credit issues result in non-­‐performance by supplier • Opera9onal problems in storage and pipelines result in lack of supplies • Market structure makes it difficult or expensive to acquire supply • Regulatory outcomes results in inability to pass through costs There are two very different ways to approach risk Hedging: Specula6on: Taking a posi9on to protect against poten9al adverse occurrences A,emp9ng to enhance profits by taking posi9ons based on assumed superior market knowledge Enerdynamics Corp., copyrighted 2007, all

Enerdynamics Corp., copyrighted 2014 all rights reserved.

rights reserved.

55

55

Physical tools for risk management • Pricing of physical deals • Alternate sources of supply • Gas in storage • Por•olio hedging • U9liza9on of pipeline/LDC balancing • U9liza9on of hub services • Ability to convert gas into electricity • Asset ownership Financial tools for risk management • Futures – NYMEX contracts • Op9ons – Puts – Calls • Over-­‐the-­‐counter deriva9ves – ICE / NYMEX ClearPortSM – Swaps – Ceilings/floors – Collars Enerdynamics Corp., copyrighted 2007, all

Enerdynamics Corp., copyrighted 2014 all rights reserved.

rights reserved.

56

56

There is no perfect hedge! There are no certain9es in trading or risk management!!! Thought Ques6on Ex. 7 What types of risk management tools would you expect a gas generator to use? Are there risks associated with using risk management tools? Enerdynamics Corp., copyrighted 2007, all

Enerdynamics Corp., copyrighted 2014 all rights reserved.

rights reserved.

57

57

Pujng it All Together Gas generators must make many decisions in acquiring gas! •

•

•

•

Supply Transporta9on Storage and hub Services Pricing and risk management The result of those decisions may impact the price a generator pays and even whether gas supply is available on any given day Enerdynamics Corp., copyrighted 2007, all

Enerdynamics Corp., copyrighted 2014 all rights reserved.

rights reserved.

58

58

Different generators have different types of needs Baseload Intermediate Peaking A key decision point is whether to manage your own supply needs or to outsource gas management Do it yourself •

Hold own transport and/or storage •

Ac9vely par9cipate in capacity release market and risk management •

Manage day-­‐to-­‐day scheduling and imbalances Outsource •

Short-­‐term gas supply purchases at citygate or plant tailgate •

Asset Management Agreement (AMA) = bundled supply •

Tolling agreement Most generators choose to outsource some or all of their supply needs Enerdynamics Corp., copyrighted 2007, all

Enerdynamics Corp., copyrighted 2014 all rights reserved.

rights reserved.

59

59

If managing your own supply needs, a generator must decide how much to commit in forward markets Transport • Released FT • IT • No transporta9on, buy at citygate or plant tailgate Supply • Long-­‐term • Monthly • Daily spot Storage • Yes or no? Six gas trends for 2014/2015 1.

Rising price expecta9ons ($4 -­‐ $6 range?) 2.

Total demand expected to remain strong due to con9nuing power plant demand and storage drawdown 3.

Will storage fill use up firm pipeline capacity? 4.

Supply will con9nue to be robust 5.

LNG exports will con9nue to raise profile globally, but won’t have much direct impact on U.S. un9l later 6.

FERC likely to approve changes to gas scheduling Enerdynamics Corp., copyrighted 2007, all

Enerdynamics Corp., copyrighted 2014 all rights reserved.

rights reserved.

60

60

Longer-­‐term issues for gas markets 1.

Will demand growth skyrocket? 2.

Will we see a sustained period of moderate prices, or yet another boom-­‐bust price run-­‐up? 3.

Will the con9nental market become a global market? 4.

Will the necessary infrastructure get built? 5.

Will supply keep growing or will environmental issues or low prices slow down drilling? 6.

What will be the impact of renewables, energy efficiency, and distributed genera9on? Follow us on Twi,er: @Enerdynamics “Like” us at: facebook.com/enerdynamics Visit our blog, Energy Currents: hLp://blog.enerdynamics.com Subscribe to Energy Insider, our quarterly eNewsle,er – just include your email address in the course evalua9on or subscribe on our website at: www.enerdynamics.com Stay connected . . . Enerdynamics Corp., copyrighted 2007, all

Enerdynamics Corp., copyrighted 2014 all rights reserved.

rights reserved.

61

61

So what does this all mean for gas generators? Even with coming rule changes and other a,empts to help generators, obtaining reliable gas supply at a reasonable price will con9nue to be a challenge. Enerdynamics Corp., copyrighted 2007, all

Enerdynamics Corp., copyrighted 2014 all rights reserved.

rights reserved.

62

62