Insider access to carefully selected, lucrative technology investments

advertisement

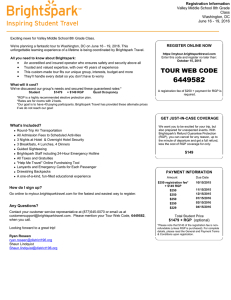

Insider access to carefully selected, lucrative technology investments Never before have you had the ability to tap into the tech sector’s hottest venture capital deals; however, now you can with Brightspark’s new investment model. Brightspark, a successful Canadian early stage VC founded in 1999, is now offering accredited investors the potential for significant returns through a highly vetted pipeline of innovative technology companies. With a low minimum financial commitment, constant proprietary deal flow, and the ability to choose your deals, you can customize your portfolio and invest alongside Brightspark’s partners and institutional investors. Sign up for free at brightspark.com/signup and welcome exclusive insider access to the most promising technology investment opportunities in Canada. Features Brightspark invests in late seed and early series A companies with solid validation, earlier than most VC’s, translating to favourable valuations How you will benefit Industry leading returns Brightspark selects repeat entrepreneurs with differentiating IP in the following sectors: mobile, social, cloud, enterprise, and data discovery, where it has deep expertise Invest in best companies in the hottest markets Choose your portfolio approach by investing in select deals or in all, depending on your diversification strategy and comfort on a per deal basis, with a low minimum investment of $10K per deal Flexibility that suits your portfolio diversification needs Brightspark applies traditional VC discipline by taking care of sourcing, diligence, deal structure, auditing, managing, administration, tax documents, and legals Invest with ease Brightspark provides quarterly and annual reporting You are well informed Canada-wide offices (Toronto, Montreal, Atlantic) with Western Canada coming soon Access to the best opportunities coast to coast Brightspark does not commit to a specific deal volume, focusing on quality investments with defined exit strategy Continuous pipeline of deals with large exit potential Jonathan Latsky 416-564-6535 jonathanl@brightspark.com Toronto office: 140-101 College St Toronto, ON M5G 1L7 Montreal office: 51 Sherbrooke St West Montreal, QC H2X 1X2 Credentials Partners Mark Skapinker, based in Toronto, and Sophie Forest, based in Montreal, have decades of experience investing in early stage companies (Delrina - $500M exit, Radian6 - $360M, Servicesoft $500M, ThinkDynamics - $55M) and they co-invest in every deal For more information contact: Tap into proven expertise and invest alongside the partners, and other institutions Brightspark is a lightning rod for innovative young companies given its solid track record, huge network in the early stage ecosystem, and sees hundreds of funding candidates per year, accepting less than 3% Exposure to practically all early stage opportunities Partners are proven business operators, which enables them to fill skills gaps of companies, unlike most investors who are less operationally engaged Lower your financial risk Financial Limited Partnership structure No liability over and above your investment Canadian transactions so no currency, tax, and legal foreign exposure Reduced risk and complexity Gains typically treated as capital gains You pay less taxes Management fees are 1.5% per year for only 3 years, about 70% less than comparable VC firms Your goals are aligned with Brightspark, i.e., to deliver large exits For each successful investment, once you are paid back your initial amount in full, you receive 85% of the gain, more than the industry average of 75-80% Your return is maximized www.brightspark.com