VAT Terminology and

Rates – a Recap

13

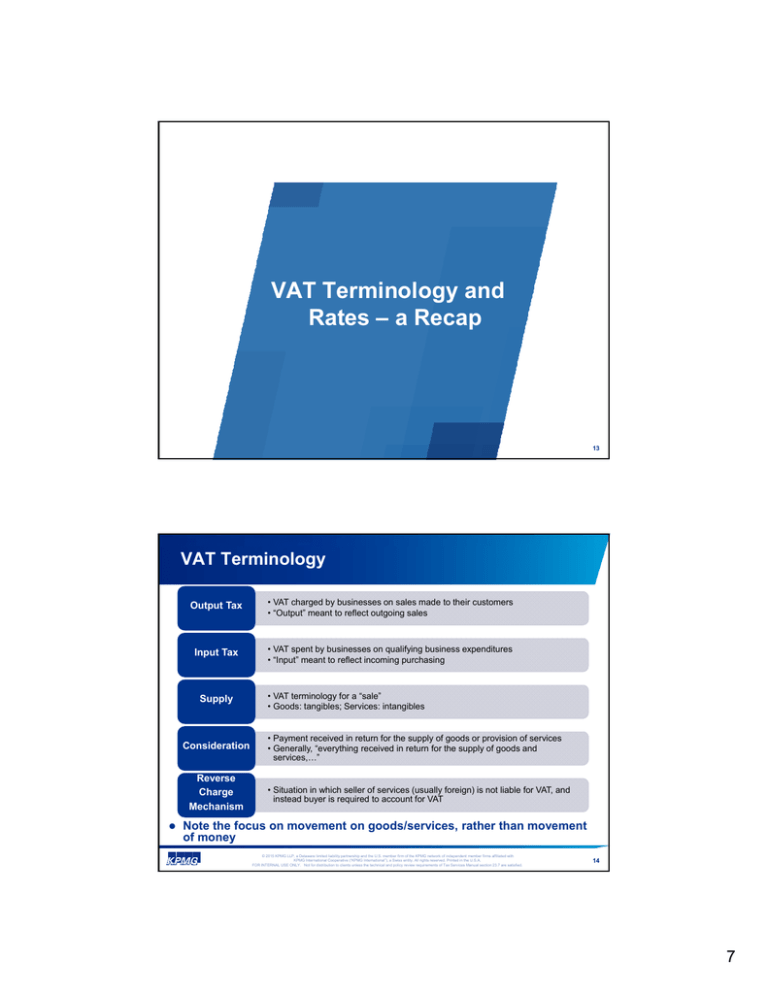

VAT Terminology

Output Tax

• VAT charged by businesses on sales made to their customers

• “Output” meant to reflect outgoing sales

Input Tax

• VAT spent by businesses on qualifying business expenditures

• “Input” meant to reflect incoming purchasing

Supply

Consideration

Reverse

Charge

Mechanism

• VAT terminology for a “sale”

• Goods: tangibles; Services: intangibles

• Payment received in return for the supply of goods or provision of services

• Generally, “everything received in return for the supply of goods and

services,…”

• Situation in which seller of services (usually foreign) is not liable for VAT, and

instead buyer is required to account for VAT

Note the focus on movement on goods/services, rather than movement

of money

© 2015 KPMG LLP, a Delaware limited liability partnership and the U.S. member firm of the KPMG network of independent member firms affiliated with

KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved. Printed in the U.S.A.

FOR INTERNAL USE ONLY. Not for distribution to clients unless the technical and policy review requirements of Tax Services Manual section 23.7 are satisfied.

14

7

VAT Rates

Standard

• EU VAT rates range from 15% to 27%. Average EU VAT rate is

approaching 21.5%—somewhat less in ASPAC and LATAM

Reduced

• Any rate lower than the standard rate

• E.g., basic food stuff, books—usually political decision

Zero-rated

• No VAT is charged, but seller HAS a right to credit input tax

• E.g., exported goods and services

Exempt

• No VAT is charged, but the seller HAS NO right to credit input

tax

• E.g., certain financial, medical and education services

Outside

Scope

• Not within the scope of VAT in the jurisdiction concerned

• E.g., charities and non-business

© 2015 KPMG LLP, a Delaware limited liability partnership and the U.S. member firm of the KPMG network of independent member firms affiliated with

KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved. Printed in the U.S.A.

FOR INTERNAL USE ONLY. Not for distribution to clients unless the technical and policy review requirements of Tax Services Manual section 23.7 are satisfied.

15

Global Trends and

Developments

8

Global Challenges

Import

valuation

issues

Sourcing

changes for

e-services

Importer of

record must be

owner to

recover VAT

Proposed

Sourcing

changes for

e-services

Current

reform

Cashflow

VAT

system

Proposed

reform

Introduction

in April 2015

Multiple

indirect taxes

and

jurisdictions

VAT credits

vs. refunds

Import

restrictions

Difficulties

with VAT

refunds

Various rate changes

© 2015 KPMG LLP, a Delaware limited liability partnership and the U.S. member firm of the KPMG network of independent member firms affiliated with

KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved. Printed in the U.S.A.

FOR INTERNAL USE ONLY. Not for distribution to clients unless the technical and policy review requirements of Tax Services Manual section 23.7 are satisfied.

17

VAT Rate Changes – Past 12 Months,

Country

Effective Date

Original Rate

New Rate

Serbia

1/1/2014

8%*

10%*

France

1/1/2014

19.6%, 7%*

20%, 10%*

Cyprus

1/1/2014

18%, 8%*

19%, 9%*

Ghana

1/1/2014

12.5%

15%

Mexico

1/1/2014

11% border region

16%, Standard

Honduras

1/1/2014

12%

15%

Japan

4/1/2014

5%

8%

Dominican Republic

1/1/2015

18%

16%

Ukraine

1/1/2015

20%

17%

Luxembourg

1/1/2015

15%,12%*, 6%*

17%, 14%*, 8%*

Czech Republic

1/1/2015

21%, 15%*

21%, 15%*, 10%*

Source: WNT Research

* Reduced VAT rate

© 2015 KPMG LLP, a Delaware limited liability partnership and the U.S. member firm of the KPMG network of independent member firms affiliated with

KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved. Printed in the U.S.A.

FOR INTERNAL USE ONLY. Not for distribution to clients unless the technical and policy review requirements of Tax Services Manual section 23.7 are satisfied.

16

9

Global VAT/GST Expansion

China started in 2011 a reform to replace its business tax with a

VAT

Jurisdictions that have recently introduced a VAT/GST

− Full VAT is expected to be in place by the end of 2015 for all of China

− Bahamas (Jan. 1, 2015)

− Malaysia (Apr. 1, 2015) to replace sales and services tax

Potential introduction

− Egypt: plan to replace current sales tax with a VAT by January 2016?

− India: plan to replace current complex indirect tax system with a GST

by April 2016?

Others

− Gulf Cooperation States: undergoing discussions of a VAT framework

agreement

− United States: included in certain discussions for a comprehensive

tax reform (based on the Canadian GST model?)

© 2015 KPMG LLP, a Delaware limited liability partnership and the U.S. member firm of the KPMG network of independent member firms affiliated with

KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved. Printed in the U.S.A.

FOR INTERNAL USE ONLY. Not for distribution to clients unless the technical and policy review requirements of Tax Services Manual section 23.7 are satisfied.

19

Global Shift in VAT/GST Taxation of Services

The Organisation for Economic Co-operation and Development (OECD) is working on

International VAT/GST Guidelines

− Business-to-business (B2B) transactions

Guidelines on B2B international services that were finalized in 2014 and have

already been endorsed by over 100 countries

B2B services should generally be taxed where the service recipient is located

Renewed focus on ensuring that VAT exempt businesses are also subject to

these rules and the potential to exploit mismatches in taxation are phased out

− Business-to-consumer (B2C) transactions

Draft guidelines have been released for comments on December 18, 2014

Remote sellers of electronic services to final customers may be required to

register and remit VAT/GST in the country where the final customer is resident

In addition to the European Union, Iceland, Switzerland, Norway, Ghana,

Kenya, South Africa, and Albania more jurisdictions are looking into new

VAT/GST rules on e-services

• Korea (Jul.1 , 2015); Japan (Oct. 1, 2015)

• Australia, New Zealand, Canada?

© 2015 KPMG LLP, a Delaware limited liability partnership and the U.S. member firm of the KPMG network of independent member firms affiliated with

KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved. Printed in the U.S.A.

FOR INTERNAL USE ONLY. Not for distribution to clients unless the technical and policy review requirements of Tax Services Manual section 23.7 are satisfied.

20

10