AEX ®

The AEX-Index® reflects

the performance of the

25 most actively traded

shares listed on Euronext

Amsterdam, and is the most

widely used indicator of the

Dutch stock market

NYSE Euronext – the world’s largest and most diverse

global exchange group – offers a wide range of indices

covering companies that account for substantial portions

of the world’s markets.

These indices provide the investing public with benchmarks that measure various

sectors and economies around the globe.

The AEX-Index® reflects the performance of the 25 most actively traded shares

listed on Euronext Amsterdam, and is the most widely used indicator of the Dutch

stock market. The Index was first calculated in 1983. A wide variety of structured

products and ETF’s are based on the Index and are listed on the exchange.

The Index also serves as the underlying for futures and options traded on Liffe,

NYSE Euronext’s leading international derivatives business.

To learn more about the AEX-Index, as well as our other index offerings,

visit: indices.nyx.com

AEX

FULL MARKET CAP OF CONSTITUENTS (IN MILLIONS)

Contacts

U.S. Index Representative

Nicholas L. Aninos Jr.

212-656-2723

naninos@nyx.com

European Index Representative

Harrold Prins

+31 20 550 4695

hprins@nyx.com

indexlicence@nyx.com

NYSE Euronext - USA

11 Wall Street

New York, NY 10005

+1 212 656 3000

NYSE Euronext - France

39 rue Cambon

F 75039 Paris Cedex 01

+33 1 49 27 10 00

Largest

Average

Median

Smallest

Total Index Value

€92,290.60

€14,500.09

€8,098.81

€890.55

€362,502.24

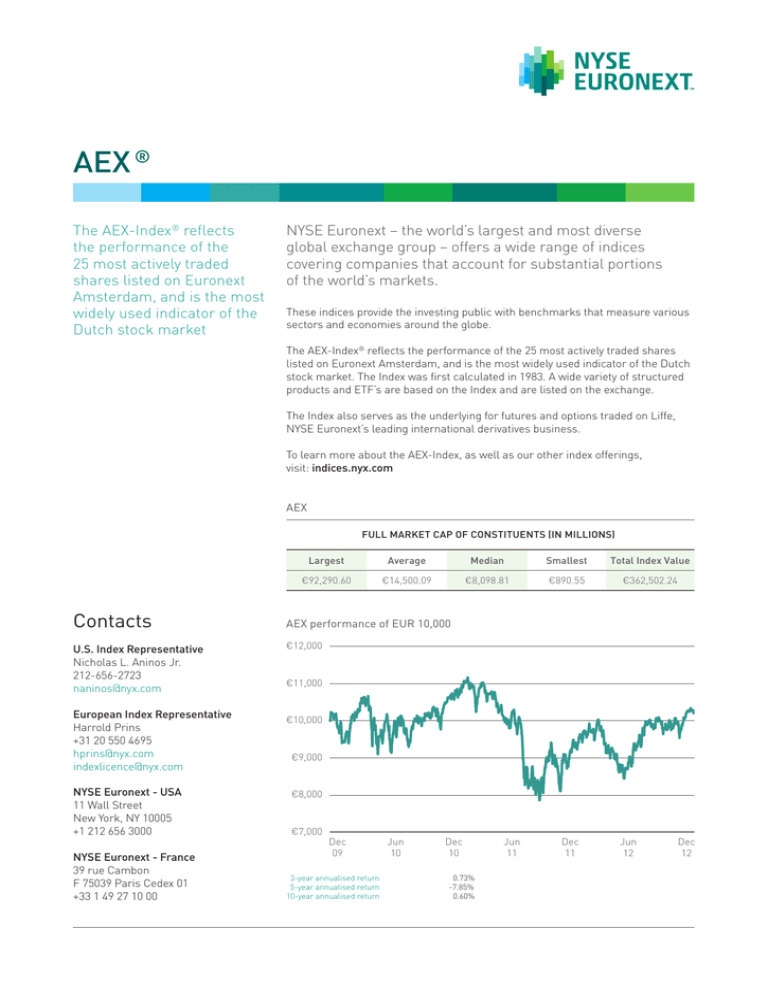

AEX performance of EUR 10,000

€12,000

€11,000

€10,000

€9,000

€8,000

€7,000

Dec

09

Jun

10

Dec

10

3-year annualised return 0.73%

5-year annualised return-7.85%

10-year annualised return 0.60%

Jun

11

Dec

11

Jun

12

Dec

12

BEST PERFORMANCE SINCE 2000

SPECIFICATIONS

Eligible Securities

PERFORMANCE

DATE

Day

10.55%

Monday, 13 October 08

Week

14.55%

24-09-01 - 28-09-01

Month

15.68%

Oct-02

Quarter

22.24%

Q3 2009

Companies listed on Euronext Amsterdam equity market. This

includes companies with Euronext Amsterdam as market of

reference and, subject to specific criteria, companies with

a market of reference that is not Euronext Amsterdam

Selection

The AEX-Index consists of the 25 most actively traded shares on

Euronext Amsterdam

Weighting

Based on free-float adjusted market capitalisation, the free-float

is rounded up to the next multiple of 5%

TOP 10 LARGEST COMPANIES

COMPANY

WEIGHT

UNILEVER

COMPANY

WEIGHT

16.15% ASML HOLDING

5.91%

ROYAL DUTCH SHELLA 13.70% ARCELORMITTAL

4.62%

ING GROEP

10.31% AKZO NOBEL

4.45%

PHILIPS KON

7.27% HEINEKEN

4.43%

UNIBAIL-RODAMCO

6.37% AHOLD KON

4.25%

Weighting Cap Applied

Yes (15%)

Review

Annual review to be effective after the close of the third Friday of

March. Quarterly updates for clear new entrants or replacements

for removed constituents after the close of the third Friday of

June, September and December

Free-Float Review

Annual review to be effective after the close of the third Friday

of March

% weight top 10 hldngs 77.45%

Capping Review

Annual review to be effective after the close of the third Friday

of March

RISK MEASURES

3 YEAR

5 YEAR

Calculated

10 YEAR

Standard Deviation

4.79

6.76

5.69

Mean

0.02

-0.44

0.22

Sharpe Ratio

0.37

0.16

0.12

Continuously (every 15 seconds)

Base Value

45.38 as of January 3, 1983

Historical Data Available

Yes, from the start

* Risk Measures based on monthly returns

Return Indices Available

TRAILING TOTAL RETURNS

Other linked Indices

Net and Gross return Indices (AEX NR and AEX GR)

%

PERFORMANCE €10K

11.52

€11,151.93

1-Year return

9.68

€10,967.77

3-Year return annualised

0.73

€10,220.08

5-Year return annualised

-7.85

€6,644.63

10-Year return annualised

0.60

€10,619.09

Annualised since inception

6.97

€75,520.05

6-Months return

AEX Volatility, AEX Equal Weight, AEX High Dividend NR,

AEX Dividend Index, AEX Leverage, AEX Triple Leverage,

AEX XBear, AEX Short, AEX Double Short, AEX Covered Call,

AEX Protective Put

Derivatives

Futures, options, ETF’s and structured products

ISIN

Price index: NL0000000107

Net return Index: QS0011211156

Gross return Index: QS0011131990

Bloomberg Code

AEX:IND, AEXNR:IND, AEXGR:IND

Reuters Code

.AEX, .AEXNR, .RAEX

YEARLY AVERAGE VOLATILITY

2012

2011

2010

2009

2008

2007

2006

2005

2004

2003

2002

19.26

24.04

23.31

34.85

34.09

18.56

15.80

13.75

19.90

34.52

36.59

All data as of December 31, 2012 unless otherwise indicated.

“AEX®” and “AEX-Index®” are registered trademarks of Euronext N.V. or its subsidiaries.

Disclaimer

This publication is solely intended as information. Although this publication is issued in good faith, no representation or warranty, express or implied, is or will be made and no

responsibility or liability is or will be accepted by NYSE Euronext or by any of its officers, employees or agents in relation to the accuracy or completeness of this publication and

any such liability is expressly disclaimed. No information set out or referred to in this publication shall form the basis of any contract. The creation of rights and obligations in

respect of financial products that are traded on the exchanges operated by NYSE Euronext’s subsidiaries shall depend solely on the applicable rules of the market operator. All

proprietary rights and interest in or connected with this publication are vested in NYSE Euronext.

www.nyx.com

©2013 NYSE Euronext All rights reserved

EU-14210/1302

![Question 2 [15 points]](http://s3.studylib.net/store/data/008612667_1-3c6e0662f7bbfa111ea1fe6b58f8cdef-300x300.png)