Integrated Growth - AirBoss of America

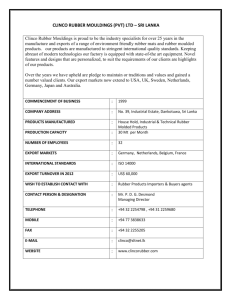

advertisement