The Rank, Stock, Order and Epidemic Effects of Technology Adoption:

advertisement

The Rank, Stock, Order and Epidemic

Effects of Technology Adoption:

An Empirical Study of Bounce Protection Programs

Marc Anthony Fusaro

East Carolina University

Department of Economics

A-427 Brewster Building

(252) 328-2872

(252) 328-6743 (fax)

FusaroM@ecu.edu

The author would like to thank Rob Porter, Shane Greenstein, Ron Braeutigam, Bill Rogerson,

and Nick Kreisle, for helpful comments and ideas.

The Rank, Stock, Order and Epidemic

Effects of Technology Adoption:

An Empirical Study of Bounce Protection Programs

January 2007

Abstract:

Karshenas and Stoneman (1993) gathered four theories of technology adoption: the

rank, stock, order and epidemic effect. Tests of these four effects reveal support for

rank and epidemic but not the stock or order effects. Since then numerous other

studies have tried to find evidence in support of the stock and order effects. But

evidence has been elusive, until now. Further, a survey by Frame and White (2004)

concludes that much more work is needed into financial innovation. In this paper

accomplishes three goals, (1) evidence is found to support certain technology

adoption theories (the order effects and possibly the stock effects). (2) Since the

technology under consideration is a financial innovation called bounce protection,

the paper answers Frame and White’s call for papers. And (3) refinements are made

to the Karshenas and Stoneman methodology and found to be superior to the original

empirical model.

Key Words: Banking, Bounce Protection, Checking Account, Diffusion, NSF fees, Overdraft

Protection, Technology Adoption

The author would like to thank Rob Porter, Shane Greenstein, Ron Braeutigam, Bill Rogerson,

and Nick Kreisle, for helpful comments and ideas.

2

Technology Adoption

1. INTRODUCTION

Students in introductory economics learn that the key to productivity growth and societal

wealth in the long run is technological advancement. On the firm level, superior technology can

drive a firm’s performance and competitiveness. Achieving these societal and firm results

necessitates not just the development of new technology but also its diffusion. For instance,

Krugman (1994) implicates delays in new technology adoption as a contributing factor to the

slowdown in productivity growth during the 1970s. Further, if early mover advantages are

persistent, then a firm’s delay in adopting is a persistent rather than a transitory disadvantage. The

literature contains several theories, but less empirical evidence, to explain how and why firms adopt

new technology. The contributions of this paper are threefold. First it provides some of the first

evidence for early mover advantages as a driver of adoption. Second, it makes methodological

contribution. Third, it answers Frame and White’s (2004) call for more research into financial

innovations.

Technology adoption models seek to explain why and when firms adopt new technology and

why some firms adopt earlier than others. Hoppe (2002) and Geroski (2000) survey the theoretical

adoption literature. The models could be divided into three types: heterogeneous firms, information

spreading, and competitive models. Deep empirical evidence supports the firm heterogeneity or

rank effects models. Indeed nearly every empirical adoption study confirms that firm size is a factor

in adoption. Less empirical work has been done on the information spreading or epidemic models

(Abdulai and Huffman, 2005, is one example). While little empirical evidence currently exists to

support the competitive models, this paper is one of the first to do so.

3

Technology Adoption

The competitive models can be further categorized but empirical evidence to distinguish or

support these is scant, until now. Karshenas and Stoneman (1993) and Abdulai and Huffman (2005)

consider four rather than three effects. They divide competitive models into two categories, the

stock and order effect. Both imply that adoption is negatively related to the share of the market

which has adopted. Stock effects can be summarized in single period models, whereas order effects

refer to persistent early mover advantages1. Karshenas and Stoneman (1993), Abdulai and Huffman

(2005) and Colombo and Mosconi (1995) fail to find any support for the stock or order effects.

Genesove (1999) and Mulligan and Llinares (2003) confirm competitive effects but do not attempt

to distinguish between the two effects or to control for other potential effects. Molyneux and

Shamroukh (1996) finds evidence that contradicts the predictions of the stock and order effects.

Specifically, they show that adoption is increased by competitor adoption. Gouray and Pentecost

(2002) find evidence to support the order effect but reject the stock effect. In the current study,

evidence is found to support the order effect and the rank effect (including a positive effect on firm

size); the epidemic effect is rejected; and the results are consistent with but not determinative of the

stock effect. This is the first study – with the possible exception of Gouray and Pentecost – to

confirm the validity of the competitive models (stock and order effects).

This paper also fills a void in studies of financial innovation, a literature which is surveyed

by Frame and White (2004). The common theme of their article is the paucity of research on the

rather broad area of financial innovation. This paper fills an area which is especially lacking,

diffusion studies. The financial innovation being considered is bounce protection, a product/process

offered to retail bank customers. It provides a good opportunity to test the adoption theories given

1

More complete descriptions of all four effects are provided in section (3).

4

Technology Adoption

above and simultaneously help fill the lack of research on financial innovation. Bounce protection

is process/product whereby a bank pays overdrawn checks rather than returning – bouncing – them2.

While it is fine to test the diffusion of bounce protection as a process, at the core of the process lies

a technology, the algorithms for determining which customers pose a risk if their checks were to be

paid. Algorithms and accompanying computer software, legal compliance, and other support are

sold by several consultants to the banking industry operating under brand names such as “NoBounce” and “Courtesy Pay”.

Bounce protection has appeared a few places in the literature. Fusaro (2006) finds that 20%

of overdraft checks are intentional, (i.e., customers are writing are themselves payday loans) with

the other 80% being checking account mistakes. Fusaro (2003) finds evidence that customers

appreciate bounce protection as they tend to migrate toward banks offering the service. Bar-Ilan

(1990) models what he called “overdrafts” and what is more precisely called an “overdraft

protection line of credit” (see section 2). He studies a situation where bounced checks do not occur.

The empirical framework used here follows the design of Karshenas and Stoneman. The

model described in section (4) is the Karshenas and Stoneman model with some modifications. A

data set of banks is used to test for the presence of four technology adoption theories and to test the

effectiveness of the model changes. The changes are found to be improvements on the original

framework. And evidence is found to support the rank, stock and order effects. But the data fail to

support the epidemic effect. These results differ from the Karshenas and Stoneman and Abdulai and

Huffman papers which supported the epidemic effect but failed to show evidence for the stock or

order effects.

2

Bounce protection is defined in more detail in section (2).

5

Technology Adoption

This paper accomplishes three goals. First, it shows evidence for the competitive models,

in particular, the stock and order effects. Second, it fills a void in financial innovation diffusion

studies. Third, it provides methodological improvements to Karshenas and Stoneman’s empirical

model. The rest of the paper proceeds as follows. Section (2) contains some background on the

industry and the definition of bounce protection. Section (3) covers the rank, stock, order and

epidemic effects and the variables used to identify each. Section (4) describes the structural model

and the estimation strategy. Section (5) describes the data. Results and analysis are in section (6).

Section (7) offers some concluding remarks.

2. INDUSTRY BACKGROUND–WHAT IS BOUNCE PROTECTION?

When a check is presented for payment in excess of the account balance, several things can

happen. The bank can transfer money from a savings account to cover the check. It can loan money

to the customer to cover the check at a predetermined interest rate. It can pay the check, allowing

a negative balance in the account (with no interest charged). Or it can return, or bounce, the check.

The first two options are called overdraft protection. Usually the customer applies for

overdraft protection. When a savings account is used for overdraft protection, the bank transfers

money from a designated savings account to the checking account and charge a small fee, usually

between $2 and $5. With a line-of-credit based overdraft protection, the bank loans enough money

to cover the shortfall, usually with an interest rate comparable to credit cards and often without a fee.

In June 2004, 90% of US banks offered one or both kinds of overdraft protection.

6

Technology Adoption

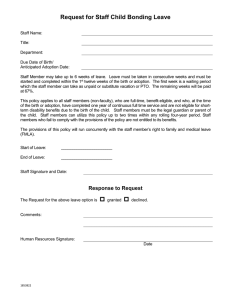

For customers not enrolled in overdraft

Figure 1: Definition of Bounce Protection

protection or for those whose savings account

An overdraft check is presented for

payment. What can happen?

or line of credit is exhausted, the check is an

overdraft. Then the bank faces a decision –

bounce the check or pay it. Historically, for

good customers – high net worth or first time

If customer has Overdraft Protection:

Î Bank transfers money from

another account at the bank

Ï Bank loans money to cover the

overdraft

overdrafters – a bank officer often decided to

If no overdraft protection, bank can:

Ð Bank pays overdraft checks

pay the check, allowing the account to have a

Ñ Bank bounces overdraft checks

* Bounce Protection *

negative balance. In recent years, several

banks started paying overdrafts for more than just their best customers. Many use systematic

methods for determining which overdrafts to pay and which to bounce. A policy of paying the

majority of overdrafts is called a bounce protection program. The definition of bounce protection

is summarized in figure (1).

Some consider the bounce protection a loan, as the money to pay the overdraft is coming

from the bank’s funds rather than from any of the customer’s deposit accounts. Other work (Fusaro,

2006) suggests that it is a closer substitute to a bounced check than to a payday loan. To the extent

that bounce protection constitutes a loan, it is rather similar to an overdraft protection line-of-credit.

With the line-of-credit the customer must apply for the overdraft protection line-of-credit in

advance; a credit check is performed; and the bank is subject to onerous lending regulations. The

bounce protect is a stopgap for people who do not have overdraft protection available. Bounce

protection targets different consumers than overdraft protection – those with less elastic demand

measured across time or individual. That said, the author has noticed – but not yet been able to

quantify – that some banks are intentionally replacing overdraft protection with bounce protection.

7

Technology Adoption

3. RANK, STOCK, ORDER AND EPIDEMIC EFFECTS

The goal of an adoption study is to explain why firms adopt with different lags from the

introduction of the technology. Several theories have been advanced to explain observed adoption

patterns. Hoppe (2002) and Geroski (2000) survey the theoretical literature on adoption. Karshenas

and Stoneman (1993) bring together four of the effects considered in the theoretical literature, the

epidemic, stock, order, and rank effects. This section contains a brief description of each with a

discussion of the variables used to measure each effect.

3.1 Epidemic Effect

The epidemic effect states that a new technology, like a disease, spreads by contact.

According to an epidemic model, each firm learns about the existence of a new technology only

from contact with a previous adopter. Firms may gain human capital relevant to operating the new

technology from contact with other adopters. An example of this literature is Mansfield (1968 and

1989). This effect is often taken to be correlated with time. Indeed, in Karshanas and Stoneman

(1993) [henceforth KS] and Hannan and McDowell (1987), the time factor in the model is taken to

represent the epidemic effect.

In the case of the banking firm and bounce protection, bank managers attend industry

association conferences at which they could learn about bounce protection. They also conduct

research on the products offered by their competitors. If the epidemic effect is present it likely

operates through one of these channels. KS find evidence for epidemic effects in their analysis; but

8

Technology Adoption

in the banking industry case considered here, there is no support for this effect. This particular

product seems to spread through consultants’ sales forces rather than company to company.

3.2 Stock Effect

Also known as game-theoretic models, the stock effect is based on the premise that the

returns to technology adoption decline with the number of firms utilizing the technology; when the

technology is rare it imparts a competitive advantage to its users, but as the technology becomes

ubiquitous no firm as an advantage. Given a cost of adoption, some number of firms adopt beyond

which adoption is unprofitable. As the cost of the technology declines, the market can support more

firms using the new technology. In stock effect models, firms are homogeneous.

Models such as that of Reinganum (1981) and Gotz (1999) specify stock effects. The former

specifies that technology reduces production costs, leading to higher output, which then leads to

lower prices, lowering the returns to adoption. The latter uses a variation of the Dixit-Stiglitz model.

In the case of bounce protection, the mechanism is different. Research shows that consumers

migrate toward banks offering bounce protection (Fusaro 2003). As more banks adopt bounce

protection, there are fewer customers to attract from the fewer banks not offering the service. KS

fails to find any evidence for the stock effect. The findings of this paper are consistent with the

stock effect, but the model is not capable of identifying stock effects in the presence of order effects.

3.3 Order Effect

Like the stock effect, the order effect depends on the number of adopters but it differs in that

the order effect depends on the number of adopters at the time of adoption. Early adopters accrue

9

Technology Adoption

benefits that are persistent even as followers adopt. For example, the first adopter establishes itself

as the market leader – the brand name; the market leader has the inside track to get limited resources

such as skilled labor or supply contracts or prime land. The later a firm adopts, the less benefit

accrues because limited resources are hard to acquire and customers view the early adopters as more

advanced. Thus, when adoption costs are sufficiently high, it is profitable to be the first adopter but

not the second or third. As costs decrease, adoption becomes profitable for a second bank, then a

third, etc.

The order effect is particularly appealing intellectually in the case of bounce protection.

Many banks do not advertise bounce protection for regulatory reasons. As a result, the only

customers who know of its existence are those who experienced it (i.e., those who have overdrafted

and had their checks paid). Thus, bounce protection helps banks retain customers rather than attract

customers.

Again, firms are ex ante homogeneous. However, the adoption decision causes a persistent

ex post heterogeneity. Theoretical models of this type can be found in Ireland and Stoneman (1985)

and Fudenberg and Tirole (1985). The only relevant variable is the market share of adopters at the

time firm i adopted. KS fail to find evidence for the order effect but this research finds such

evidence.

3.4 Rank Effect

The rank effect is based on a presence of exogenous firm heterogeneity. This heterogeneity

causes firms to have differing returns to adoption and thus differing reservation prices. As the price

declines, it falls below more firms’ reservation prices and more firms adopt. These simple models

10

Technology Adoption

assert that a firm’s adoption decision is a function of a vector of firm characteristics. Davies (1979)

and Ireland and Stoneman (1986) have rank effect models.

Typically, variables such as firm size, output growth, firm age, research and development

expenditure, corporate independence of the unit of observation, and market factors such as

concentration ratio are thought to influence the rank effect. In the case of bounce protection, some

additional variables are appropriate.

Firm Size: Most adoption studies find larger institutions adopting earlier. This is usually

thought to be due to scale factors, risk factors, and capital availability. Previous work has

recognized that smaller firms could be more flexible and able to respond faster but usually find the

scale, risk, and capital factors dominate. These results confirm a positive correlation between firm

size and adoption.

Output Growth: In the case of capital technology adoption, a growing firm is naturally

augmenting its existing stock of machines. In order to adopt, it must see a benefit of installing new

technology over old rather than the stronger condition of replacing old with new technology.

Bounce Protection is a change in policy which involves an infusion of intellectual capital, but the

issue of replacing existing capital does not exist. Since the technology here is scalable, no new

capital is required to accommodate growth. KS used market growth because they do not have data

on firm growth. This variable is included for comparison with previous studies; however, there is

no reason to expect it to be significant. The results confirm that market growth is not a factor in

adoption of bounce protection. Using firm growth rate rather than market growth does not change

the result.

Corporate Status: A unit in a larger organization could have access to investment capital or

it could suffer from a lack of flexibility. Because the typical pricing scheme for this product is a

11

Technology Adoption

share of the revenue generated by bounce protection (e.g., its cost is proportional to its size),

investment capital is unlikely to be relevant. The flexibility issue is supported by anecdotal evidence

so we would expect a unit of a larger corporate entity to be less likely to adopt bounce protection.

The results of the logit indicate that a corporate overlord slows adoption. But in the full model this

variable is statistically insignificant.

Concentration Ratio: Competitive factors could lead to slower or faster adoption rates.

Indeed, models have predicted both. This variable is included as a summary of those competitive

forces. Competitive factors in adoption have been specified in models by Hoppe (2000), Riordan

(1992), and David and Olsen (1992). The results indicate that more concentrated markets are more

likely to adopt.

Profit Pressure: One factor mentioned by industry insiders is the spread between interest

margins and non-interest expenses. This variable – profit pressure – is said to influence bounce

protection adoption thus: When interest margins decline to the point that they can not cover fixed

(non-interest) expenses, bank managers are pressured to find alternative, risky, sources of revenue.

Many have turned to bounce protection, a lucrative, but regulatorily risky, new method of increasing

fee revenue. This variable was found to be significant by Fusaro (2006). Though this variable could

easily be questioned based on economic theory, it is tested empirically and no evidence is found to

support it.

Prices: The levels of ATM and NSF fees are endogenous, but they are used as a proxy for

other underlying issues such as the presence of a business strategy to generate revenue from fees

rather than from interest margins. These prices are found to be insignificant.

Urban: Banks located in rural counties behave differently from those in metropolitan areas.

Since bounce protection is a way of augmenting customer service, it is more frequently used in rural

12

Technology Adoption

areas where customer service is more highly valued. Metropolitan areas are more likely to be

innovators. The results confirm the latter.

In section (4), a model of the rank, stock, and order effects is presented. Empirical results

are presented in section (6).

4. A MODEL OF TECHNOLOGY ADOPTION

The basic structure of a model to describe technology adoption derives from Hannan and

McDowell (1987). In this section, the KS (Karshenas and Stoneman, 1993) model is presented.

Refinements are presented and tested in section (6.2). Define gijtτ as the increment in period τ profit

for firm i, in market j if the firm adopted a bounce protection program in period t.

Define Ri to be the vector of factors, inherent to firm i, that may make it more or less likely

to benefit from adoption. This vector represents the rank effect. Let Fjt be the number of adopters

at time t in market j. The stock and order effects both depend on the number of firms to adopt (stock

depends on the number at the current period; order depends on the number at time of adoption).

Then the increment in time τ profit derived from adopting the technology at time t is a function of

Ri, Fjτ and Fjt:

(

gijtτ = g Ri , F jt , F jτ

)

which says that gijtτ is a function of firm characteristics, the number of firms in market j that had the

technology at time t (i.e., at the time of firm i’s adoption), and the number of firms that have the

technology at time τ (i.e., contemporaneous to the profit being measured). Naturally t#τ and we

13

expect

Technology Adoption

dg

dF t

and

dg

dF τ

to be negative if order and stock effects respectively are present.

Summing this profit increment over time from adoption forward, gives the total discounted

increment in profit from adopting bounce protection at time t:

∞

G =

t

ij

∫e

τ

=t

− r (τ − t )

(

)

g Ri , F jt , F jτ ∂τ

Notice that Gijt is indexed by i, j, and t but not by τ. The first two are the bank and market

respectively since profit, G, depends on bank specific factors and market specific factors. The

superscript t indicates that summed future discounted profit depends on the adoption time since

adoption price varies over time and since a bank’s position in the order of adoption will change with

adoption date (i.e. order effects are relevant). The profit, G, is not indexed by τ since we summed

(i.e., integrated) over the profit in each post-adoption period, gijtτ.

Adoption occurs in the period when discounted future profit from adopting net of price of

adoption (Pt) is greatest. See KS for more on this arbitrage condition for adoption3. This allows

for situations where a firm waits for prices to decline. The arbitrage condition can be expressed as

the maximization problem:

[

max e − rt Gijt − P t

t

]

The solution to this problem gives the following first order condition:

3

Intuition behind the arbitrage condition is that banks time their adoption for maximum

benefits. They balance a falling price of the technology against the cost of waiting to adopt. KS

also consider a profit condition where by banks adopt once the net present value of adoption is

positive. KS test these two conditions and find the arbitrage condition to be a better predictor of

adoption. Thus the arbitrage condition is used here.

14

Technology Adoption

dP

dg dF

⎧

e − rt ⎨rP t −

− g Ri , F jt , F jt +

dt

dF dt

⎩

(

)

1

r

⎫

⎬=0

⎭

See KS for details. Multiply the exponent term to the right hand side and call the resulting

expression yit:

yit = rP t −

(

)

dP

dg dF

− g Ri , F jt , F jt +

dt

dF dt

1

r

This equation is the benefit from waiting to adopt. The first term is due to interest earned on the

price of adoption, the second is due to paying more (less) when the price increases (decreases). The

third term is due to foregone current benefits of adoption. The last term is due to lost benefits from

moving down the order of adoption. Notice that the third argument of g (the stock effect) is now

evaluated at date t (adoption date). Since the second and third arguments are both evaluated at the

same time period in this equation, collapse the arguments of g [e.g., g(Ri, Fjt, Fjt) = g(Ri, Fjt)]. For

convenience of estimation, specify a linear functional form for g and g' . Then we get

yit = rP t −

dP

dF

− ρRi + ςF jt + φ0 + φρ Ri + φσ F jt

dt

dt

(

) (

)

1

(2)

r

In the presence of positive (negative) rank effects, the coefficients in the vector, ρ , will be

negative (positive). The opposite sign is because g enters the equation above with a negative sign.

In the presence of order effects, the φ coefficients will be negative and ς will be positive. If there

are stock effects, ς will be positive. The results support the rank and order effects and are consistent

with the stock effect.

The expression yt is the slope of future discounted profit to be earned from adopting bounce

protection at t net of adoption cost. Or yt is net marginal benefit of adopting at t. Figure (2) shows

future discounted profits, G , plotted against adoption date, t; y is the slope of this curve. This is the

15

Technology Adoption

path of profits from adopting bounce protection for a typical bank. Naturally a bank should adopt

at the peak of the curve (point B). A bank on the upward sloping portion of the curve (near point

A) can benefit from waiting to adopt, whereas one on the downward sloping portion of the curve

(near point C) has missed its prime opportunity to adopt and should do so immediately.

The epidemic effect is added to the empirical model in section (6), which describes the

empirical strategy and reports results. The following section describes the data.

5. THE BANK DATA

Data are combined from three sources. The primary data set is a national sample of bank

prices and fees4 (Fees Database). These data are augmented by the Consolidated Reports of

Condition and Income (Call Reports) and Summary of Deposits (SOD). The fees database is a

sample of 2487 bank-years, collected each June from 2000 to 2004. However, only the 711

observations collected in 2004 can be used for the primary estimation. The data contain an indicator

for a bounce protection program and the level of various bank fees. The Call Reports contain balance

sheet and income statement information such as deposits, assets, and fee income. They are publicly

available from the Federal Reserve and the FDIC. The SOD data are available from the FDIC and

contains deposit information at the branch level, which is used to calculate market shares.

In the 2004 data, a distinction is made between a formal and an informal bounce protection

program. A formal program is one which has well established criteria determining which overdrafts

4

These data are collected by Moebs Services, Lake Bluff, IL.

16

Technology Adoption

are paid and which are bounced. An informal program is one in which a bank official has the

discretion to bounce or pay an overdraft. The full sample can not be used for two reasons. First,

adoption dates are observed for only the banks in the 2004 sample. Second, the adoption date is not

clear for banks the offer an informal program since often this type of program is adopted graudally.

A quarter, 182, of the banks offer a formal bounce protection program at the time of data collection.

These banks were called to determine the date they adopted the program. Based on their answers,

the data was coded in six month intervals going back five years. The average adoption date was two

years before the data collection (censoring date) with a standard deviation of 17 months. Fifteen

banks adopted prior to five years pre-collection; these are considered initial adopters.

The time series of prices, Pt, shows a steady rate of decline of prices. This is estimated from

conversations with industry insiders. KS discuss a potential of bias from using a potentially

endogenous variable (prices) as an explanatory variable. However, the smooth downward trend used

for the price series suggests that endogenous prices may not be a problem here. While this smooth

downward trend does not match the ex-post market price, the crucial feature to a potential adopting

bank is that future prices to adopters are falling. It is unlikely that banks have any more insight into

future prices. Thus, we believe that our price series is an accurate representation of banks

expectations of future prices.

Table (1) shows summary statistics for the data. The average bank is in a market where 32%

of banks offer bounce protection and 68% of the market is held by the top 5 banks. Markets are

Consolidated Metropolitan Statistical Areas (CMSAs), Metropolitan Statistical Areas (MSAs) or

rural counties. Market concentration ratio is calculated using the SOD branch deposit data for each

market. All banks in the market are used in this calculation not just sample banks. Thus, for each

sample bank we have an accurate measure of market concentration rather than an estimate from the

17

Technology Adoption

Table 1: Summary Statistics of Depository Data Set

Variable

Obs

Mean

Std. Dev.

Min

Max

Units

Bounce Protect Program

Formal Program

Informally Overdraft

Market Bounce Protection

NSF Charge

Surcharge

711

711

711

711

454a

.256

.595

32.25

24.10

1.49

–

–

19.12

5.14

0.40

0

0

3.45

5.00

0.50

1

1

88.46

36.76

3.00

Indicator

Indicator

%

$

$

Adoption Date (formal prgm)

Before sample period

During sample

Never (Censored)

Interest Rateb

15

167

529

711

–

Fall 02

–

192

–

17 months

–

124

–

–

–

94

–

Fall 04

–

602

Basis Points

Deposits

Large Bank

Medium Bank

Deposit Growth

Market Concentration

Urban Bank

711

711

711

711

711

711

2954

.086

.444

12.5

68.5

.714

24300

–

–

18.1

16.0

–

0.5

0

0

–7.89

43.9

0

427000

1

1

115

100

1

$ Million

Indicator

Indicator

% rate

%

Indicator

Date

Evolution of Adoption: Percentage, hazard ratec of sample offering bounce protection:

Jun 99 Dec 99 Jun 00 Dec 00 Jun 01 Dec 01 Jun 02 Dec 02 Jun 03 Dec 03 Jun 04 Dec 04

2.1% 2.4% 2.5% 3.5%

4.6% 7.3%

8.7% 13.9% 15.9% 22.4% 25.5% 25.6%

–

0.4%

2.2%

4.3%

7.9%

11.4%

a

Some small banks have no ATMs; others offer free use of theirs; 454 banks charge a surcharge.

b

At date of adoption or date of censor for those not adopting.

c

Hazard Rate is the ratio of those adopting in period t to those who had not adopted as of period t-1.

sample data.

Obviously, market rate of adoption (Ftj) is measured not for all banks but based on a random

sample of banks. Many rural counties and some small MSAs have fewer than 10 observations. For

such markets, adoption rate would be measured too imprecisely. These observations are pooled

within a state, essentially making the assumption that rural counties and small MSAs within a state

share adoption rates.

The bottom segment of the graph shows the evolution of the program. Only 2.1% of the

18

Technology Adoption

banks in the sample adopted prior to the sample period. The pace of adoption was slow in the first

few periods but accelerated subsequently with many more banks adopting later. Abstracting from

apparent seasonality, the lower growth occurs in the earlier periods, with the exception of the final

period. This pattern seems to indicate that epidemic effects are present. The logit estimation in

section (6.1) also points to the possibility of epidemic effects but the full model results argue against

epidemic effects. The next section presents the data estimation and results.

6. ESTIMATION RESULTS

This section reports the results of a logit estimation before reporting the results of the full

model.

6.1 Cross Sectional Logit Estimation

Cross sectional estimation does not utilize the time at which a firm adopted. In the literature,

this type of adoption study is common because data on the time of adoption are rare. Rather, most

adoption studies, having only a cross section of data, see previous adopters and non adopters.

Studies using such data can evaluate the rank and sometimes epidemic effects but not the stock or

order effects.

Table (2) shows that most estimation results are as expected. The first set of estimations on

the top portion of the table contains all of the variables listed in section (3) which correspond to KS.

The lower portion of the table (Model 2) shows the results of estimation using a shorter list of

19

Technology Adoption

covariates. The shorter covariate vector is used in estimating the full model reported in section

(6.2). In column (a), the dependant variable is an indicator for whether the bank has a formal bounce

protection program. A formal program is one that has well defined terms as to whether a check with

insufficient funds will be paid or returned. The dependent variable in columns (b) and (c) is an

indicator for any type of bounce protection program, one that is formalized or one where check

return decisions depend on the judgement of a bank officer. Column (b) reports results from 2004

data only, the same sample as column (a). Column (c) uses data from 2000 to 2004. All variables

for an observation from year x, both dependent and independent, were collected in year x. Column

(c) uses the most data; column (b) is offered for comparison with column (a). Column (a) is offered

for comparison with the full model below, especially the version with restricted variables – model

(2) – as the same covariates are used in the full model.

The percent of the market offering bounce protection is highly significant and positive in all

six formulations. This variable could be interpreted as evidence for the epidemic effect as Bartoloni

and Baussola (2001) do. This interpretation is consistent with the accelerating adoption pattern

shown on the bottom portion of table (1). This result could also be interpreted as evidence against

the competitive theories, as the stock and order effects both imply that this coefficient be negative.

As mentioned earlier, other competitive models have predicted the positive relationship found here.

The model results, shown in the next section, better distinguish these effects.

The inclusion of market concentration is another attempt to capture competitive factors. This

variable is significant, for the informal bounce protection regressions [columns (b) and (c)] but not

significant for the formalized programs [column (a)]. The sign is

20

Technology Adoption

Table 2: Logit Estimates

Dependant variable:

Formal Bounce

Protection Programb

Column (a)

Model (1)

Constant

Epidemic Effect:

Pct. of Market offering BP

Competitive Factors

Market Concentration

Rank Effect:

Bank Size

Large Bank Indicator

Medium Bank Indicator

Not Part of Corp Struct.

Market Growth

Pressure

NSF Fee

ATM Surcharge

Urban

Year Indicators

Likelihood Ratio

Model (2)

Constant

Epidemic Effect:

Pct. of Market offering BP

Competitive Factors

Market Concentration

Rank Effect:

Bank Size

Medium Bank Indicator

Not Part of Corp Struct.

Urban

Year Indicators

Likelihood Ratio

Formal or Informal Bounce

Protection Programb

Column (b)

Column (c)

Coef

Std Error

Coef

Std Error

Coef

Std Error

–8.942*

1.496

–11.59*

2.52

–7.520*

1.130

6.161*

0.661

9.640*

1.301

7.522*

0.578

0.916

0.857

3.763*

1.462

1.435^

0.581

0.303*

–0.620

0.594^

0.767*

–0.711

–0.962a

0.031

–0.741a

0.355

0.101

0.534

0.246

0.228

0.890

1.380a

0.023

0.563a

0.318

0.194

0.246

0.560

0.479

2.093

0.083a

–.0013

–1.20a*

0.427

0.141

0.753

0.383

0.324

1.938

1.00a

.0320

0.448a

0.488

0.173^

–0.152

0.194

0.677^

–0.185

1.31a

–0.083

–0.272a

–0.083

Yes‡

323.9*

0.074

0.359

0.176

0.300

0.651

1.05a

0.014

0.219a

0.216

104.6*

193.6*

–8.036*

1.131

–11.98*

2.377

–7.407*

0.952

6.356*

0.653

9.501*

1.232

7.571*

0.574

0.708

0.843

3.083^

1.387

1.416†

0.573

0.276*

0.777*

0.796*

0.359

0.065

0.204

0.227

0.316

0.277^

0.571‡

0.519

0.356

0.126

0.341

0.320

0.480

0.142*

0.265‡

0.684†

–0.069

Yes‡

320.4*

0.053

0.148

0.300

0.215

186.5*

96.95*

Sample Size (Years)

711 (2004)

713 (2004)

2487 (2000–4)

‡

In Millionths

significant at: 90%, ^95%, *99%

b

A formal bounce protection program is one in which the bank has well established criteria to

determine when to pay a bad check; this data was collected in 2004 only. An informal program is any

in which bank managers sometimes pay bad checks if they feel that it is good for business. Any

bounce protection program is a formal or informal program.

a

21

Technology Adoption

positive signaling that less competitive markets are more likely to adopt the new technology. In

most theoretical and empirical adoption work the opposite is true, competition drives markets to

adopt new technology. Since this result holds only for informal programs, which are more prevalent

at small banks, most likely it indicates that smaller banks use bounce protection to compete with

larger banks in markets where large banks dominate (concentrated markets).

The other explanatory variables are intended to capture the rank effect. As most adoption

studies find, larger firms are more likely to adopt. Bank size is measured by the log of deposits and

two indicators for medium and large banks. The continuous variable is positive and significant as

is common in adoption studies. For a formal program, medium sized banks – those between 100

million and a billion in assets – are more likely to have a formal program. The results for informal

programs are surprising as common wisdom holds that community banks pioneered this practice.

22

Technology Adoption

For a formalized program, the significance of medium sized banks may indicate that large banks are

reluctant to adopt while the regulatory issues are still in question.

Banks that are not part of a greater bank holding company are more likely to adopt the formal

program. This result favors the theory that a corporate structure inhibits flexibility over the theory

that a corporate parent could provide funds for capital adoption. Urban banks are no more likely to

adopt, at least after the effects of market concentration and bank size are taken into account.

The variables dealing with market growth, the level of banks fees and pressure do not prove

to be significant and so are not retained in model (2), though in the case of NSF fees, it is hard to

draw any conclusions since it is surely endogenous to the adoption decision.

6.2 The Full Model

Two of the contributions of this research are to improve on the KS empirical methodology

and to find one of the first examples of the stock and order effects. In accordance with those two

goals this section is divided into two parts. In the first, the empirical model is presented and its

ability to fit the data is compared to the KS methodology. The second section presents empirical

results for the rank, stock, order and epidemic effects.

6.2.1 An Empirical Model

Maximum likelihood estimation is used here. In particular the survival time likelihood

function is:

L(α , ρ, φ , ς ) = ∏ h(a , ρ, φ , ς ) S (a , ρ , φ , ς )

B

Before describing the hazzard (h) and survivor (S) functions a word of intuition should be made.

23

Technology Adoption

Figure (2) shows future discounted profits, G , plotted against adoption date, t; y (marginal benefit

net of marginal cost of adopting at t) is the slope of this curve. Optimally, a bank should adopt at

the peak of the curve (point B) where adoption is highest. A bank on the upward sloping portion

of the curve (near point A) can benefit from waiting to adopt, whereas one on the downward sloping

portion of the curve (near point C) has missed its prime opportunity to adopt and should do so

immediately.

Pre-sample adopters, should adopt at point B and be observed on the downward sloping

portion of the curve (where y is negative) at the inception of data collection.5 For these banks, the

probability of adopting pre-sample (or in the period of first availability) is hi(t) = Pr{yit + g < 0} if

t=1. Here, g is an error term. Firms at point A when the technology becomes available will arrive

at the peak and adopt and thus have the hazard hi(t) = Pr{yit + g = 0}. KS combine the equality and

inequality to get one weak inequality, hi(t) = Pr{yit + g # 0}, which they estimate. However, since

the pre-sample and during-sample adopters are distinguishable to the researcher, a better estimation

procedure is to use the above strong inequality for those banks who adopted prior to the beginning

of data collection and use the equality following it for all other observations. That is, banks that

adopted before data collection should be on the declining portion of the profit curve around point

C when data collections begin; all other adopters should be observed arriving at point B at the top

5

If data collection corresponds with the initial availability of the technology then we can

think of these banks as being near point C when the technology is first available and should be

observed adopting immediately. This will not change the hazard function math which follows.

24

Technology Adoption

Figure 2 Future Discounted Profit of

Adopting Bounce Protection at time t

of the curve and adopting. Non adopters should be

near point A at the censoring date. The optimization

technique should reflect this.

In the first case (pre-sample adopters), the

equation can be estimated as KS do. The adoption

condition is yit + g # 0. Assuming g is distributed

with some distribution function V(g), the hazzard rate

(instantaneous probability of adoption) is hi(t , –yit) =

Pr{yit + g # 0} = V(–yit). In the second case, rather than choosing coefficients to minimize yit, we

choose coefficients to get yit as close to zero as possible, or to minimize (yit)2 . So in the hazzard

function the yit is replaced with (yit)2 . The exponential functional form is imposed thus eliminating

any need for parameter restrictions to guarantee a positive hazard. The parametric hazards for the

inequality and equality cases respectively are

hi (t , R, F ) = e

− yit

and

( )

hi (t , R, F ) = e

− yit

2

where the expression y accounts for the rank, stock and order effects. In order to incorporate

epidemic effects, consider the Weibull distribution of adoption time. See KS for a derivation and

explanation of the epidemic effect modeling. Consider the following intuition for the use of the

Weibull. If the explanatory variables fully explain adoption then there will be no duration

dependence and α will be unity. If, as the epidemic effect posits, adoption will accumulate

momentum over time then α will be greater than unity. In other words, α>1 implies that banks are

more likely to adopt later rather than earlier which suggests the epidemic effect. Incorporating

epidemic effects with the respective hazards above yields.

25

Technology Adoption

(

hi t , Ri , F

t

j

) = αt (e )

− yit

α −1

α

(

and

hi t , Ri , F

t

j

) = αt

α −1

⎛ − ( yit ) ⎞

⎜e

⎟

⎝

⎠

2

α

(3) and (4)

These hazard functions imply the respective survivor functions:

(

S t , Ri , F

t

j

)

( )

t

= exp ⎡− t α e − yi

⎢⎣

α

⎤

⎥⎦

(

and

S t , Ri , F

t

j

)

⎡ α ⎛ − ( yit )2 ⎞ α ⎤ (5) and (6)

= exp ⎢− t ⎜ e

⎟ ⎥

⎝

⎠ ⎥⎦

⎢⎣

Pulling together the likelihood function from above, equations (4), (6) and (2) yields the

following estimation function. In order to get the estimation function for the KS methodology we

would simply use equation (3) and (5) rather than equations (4) and (6) – the second and third lines

respectively – below.

L(α , ρ, φ , ς ) =

∏ h(α , ρ,φ ,ς ) S (α , ρ,φ ,ς )

B

(

2

− yt

h(α , ρ, φ , ς ) = αt α −1 e ( i )

(

)

α

)

⎡ α − ( yit )2 α ⎤

S (α , ρ, φ , ς ) = exp ⎢ − t e

⎥⎦

⎣

dF

dP

yit = rP t −

− ( ρRi + ςFi ) + φ0 + φρ Ri + φς Fjt

dt

dt

(

)

1

r

where Ri is the vector of variables representing the rank effect; ρ is the vector of coefficients on Ri;

Pt is the price of adoption; Fjt is the fraction of market j banks who have adopted before time t; ΔP

and ΔF are the one period (half year) changes in prices and adoption rates respectively; r is the

interest rate; φ0 is the coefficient on

vector Ri and the scalar

Δ F ; φ is the vector of coefficients on the interaction of the

r ρ

Δ F ; and φ is the coefficient on the interaction of F t and Δ F .

ς

j

r

r

In order to test the efficacy of the proposed methodology adjustment both techniques are

estimated. Results are reported in the second column of Table (4) , labeled “y”, for estimation when

26

Technology Adoption

equation (3) is used as the hazard function, as KS do. In the first column, labeled “y2”, reported is

the method that uses the equation (4) hazard for those that adopt during the sample period but retains

the equation (3) hazard for those banks that adopt prior to the sample period. They give qualitatively

similar results – signs and significance of coefficients do not differ greatly. However, the

improvement recommended here has a significantly better fit than the method used by KS; the value

of the log likelihood is higher (–649 compared to –702 for the KS method which implies a

likelihood ration test statistic of 105.05).

6.2.2 Results for Rank, Stock, Order and Epidemic Effects

The rank effect is measured by the vector of coefficients ρ, the order effect is in the

coefficients φ , the stock effect is in the coefficient ς , and the epidemic effect is in α. If the

epidemic effect is present then α>1. Thus if we find α to be statistically below one (1) then there

is negative time dependence which is at odds with the epidemic effect. A positive value for the

coefficient ς is indicative of both stock effects and order effects.

Negative values for the

coefficients φ signal the order effect. Specifically, if φ is positive then there are no order effects;

if ς is also positive then this must be due to the

presence of stock effects. If φ is positive and ς is

negative then there are neither order effects nor

Table 3: What the Results Indicate

About The Stock and Order

Effects

ς<0

ς>0

φ<0

contradiction

Order

maybe Stock

φ>0

no Order

no Stock

no Order

Stock

stock effects. If φ is negative there are order

effects; if ς is also negative then there is a

contradiction since the negative φ implies order

effects and the negative ς implies no order effects.

If φ is negative and ς is positive then order effects are present but the presence of stock effects are

27

Technology Adoption

inconclusive; this is because the order effects can cause both (i.e. there is no need for order effects

to explain this result). The rank effect is present if the coefficients in the vector ρ are non-zero.

However, a negative coefficient implies direct association with adoption; a positive coefficient

implies an inverse association with adoption. Recall, as noted in section (4), that these variables

enter equation (2) – note the “-g” – with a negative sign, and thus enter the hazzard, survivor and

likelihood functions, with a negative sign. Therefore, the coefficients here should have opposite

signs from their interpretation.

First, consider the epidemic effect. A finding of α>1 would indicate positive duration

dependence. KS found duration dependence, which they interpret as evidence for the epidemic

effect. Table (4) shows the estimated value of α for bounce protection. The result, α<1, implies

negative duration dependence, which indicates fewer adoptions as time progresses. This is in

contrast to the findings of the cross sectional logit estimation in section (6.1) where firms in high

adoption markets are more likely to adopt. This result indicates that the logit result is more likely

to result from competitive effects than from epidemic effects.

28

Technology Adoption

Consider, now, the stock and order effects. These effects are tested by the coefficient ς and

by the vector of coefficients φ. Table (4) shows that ς is positive and φ is negative which indicates

that order effects are present and stock effects are possible but not certain. The term ς is positive

and statistically significant. Since φ is a vector, consider first statistical significance then the sign.

Table (4) reports the results of a likelihood ratio test on the vector of terms φ = [φ0,φρ,φς], which

Table 4: The Stock, Order, Rank, and Epidemic Effects

Hazard Functiona

y2

Coef

Epidemic Effect (α)

r*P

dP/dt

Rank Effect (ρ)

Bank Size

Medium Sized Bank

Not Part of Corporate Structure

Market Concentration

Urban

Stock/Order Effect (ς)

F

Order Effect (φ)

(F’/r)

(F’/r) Bank Size

(F’/r) Medium Sized Bank

(F’/r) Not Part of Corp Str.

(F’/r) Market Concentration

(F’/r) Urban

(F’/r) F

Likelihood Ratio test of Order

Effects: (φ0 = φρ = φς = 0)

y

Std Error

Coef

Std Error

0.029

0.721*

0.030

–0.00128*

–0.00123^

0.00044

0.00059

–0.00264*

–0.00326^

0.00100

0.00146

–0.127*

–0.149‡

–0.147

–0.667‡

–0.172

0.037

0.087

0.098

0.378

0.134

–0.404*

–0.262

–0.384

–2.765^

–0.995^

0.114

0.266

0.316

1.158

0.454

1.989^

0.899

5.348‡

2.775

–1.816*

0.013

–0.210*

0.207*

0.657^

0.237^

2.270*

0.484

0.029

0.056

0.055

0.280

0.101

0.601

–5.145*

0.108

0.123

0.135

1.946*

0.911*

6.297*

1.861

0.077

0.137

0.154

0.758

0.282

1.663

0.710*

225.8*

158.1*

Log Likelihood

-649.67

-702.19

Wald Statistic

282.7*

180.0*

‡

^

Number of Observations: 711

Significant at: 90%, 95%, *99%

a

Hazard function 1 uses the hazard in equation (3) which is also used by K&S

Hazard function 2 uses the method recommended herein which uses the equation (3) hazard for

individuals who adopted before the sample beginning but uses the equation (4) hazard for any

observation that is observed adopting.

29

Technology Adoption

shows them to be statistically significant in both regressions. To determine the sign of φ, consider

the sum φ[1,R,F]’, which is the function dg/dF . The fitted values of this sum have mean values of

–0.19 and – 0.34 respectively in the two estimations. Further, in the first estimation, there are no

positive observations; in the second, 2 of the 711 observations are positive. Thus, with a

consistently negative estimate for dg/dF , we may conclude that collectively φ is negative. The

positive and significant result on ς indicates that stock effects and/or order effects are present. The

negative sign on φ indicates that the order effect is present. Thus, in the presence of order effects,

the model cannot confirm the existence of stock effects. The results are, however, consistent with

stock effects.

The various elements of the rank effect are consistent with expectation and the logit

estimation. As is noted in section (4) and in this section on page (27), these coefficients should have

the opposite sign from what they did in Table (2) and from their interpretation. The estimation is

comparable (i.e., has the same sample and dependent variable) to the column (a) model (2) logit

estimation.

Bank size, having no corporate structure, market concentration and urban are all negative.

Thus the results show that more concentrated markets are more likely to adopt the technology, the

same result as in the logit estimation. See section (6.1) for discussion of this result. Larger banks

are more likely to adopt the technology. Bank size could have a bit of a concave shape as being a

medium sized bank is significant at the 10% level only in one of the equations. Size being positively

correlated with adoption is the most consistent result across the literature. Units of a bank holding

company, though significant in the logit estimation are not significant here. Urban banks are not

significant in the logit regressions nor in the first regression here.

The full model shows no evidence to support the epidemic effect. It shows a rank effect of

30

Technology Adoption

bank size and market concentration. But this paper is one of the first to find evidence of the order

effect. And the results are consistent with stock effects also. This is one of the first papers to find

evidence of the persistence of early mover advantages in this literature.

7. CONCLUSION AND POLICY CONCERNS

Most of the empirical technology adoption literature is limited by having only a cross section

of adopters and non-adopters at a single point in time. This makes them unable to test certain

theories on the adoption of new technology. This is why the literature is absent, with one exception,

any evidence that stock or order effects exist. The data used here are supplemented with adoption

dates so that the stock and order effects can be estimated. Evidence is found for the order effect and

while the stock effect can not be separately confirmed the results are consistent with the stock effect.

As in most other studies rank effects are present, most notably a firm size effect. Epidemic effect

is not supported by the results.

The model used here is due to Karshenas and Stoneman (1993). A flaw in the model is

discovered and a remedy is proposed. The revised methodology is estimated along with the original

methodology. While results are qualitatively similar the revised methodology provides significantly

better fit to the data.

The results of this research have some lessons for consumers. While bounce protection was

pioneered at smaller community bank the results of this research indicate that large banks are now

more likely to adopt bounce protection. Thus bounce protection will spread to the majority of the

31

Technology Adoption

banking public quickly. Other research (Fusaro, 2003) found that, on balance, consumers prefer

banks with bounce protection, although this study did not distinguish between formal and informal

bounce protection. The stock and order effects are both based on the idea that there is a limit to

adoption. One possible explanation for this could be that a segment of customers are harmed by

bounce protection and seek out banks that do not offer it. Thus more thorough work on the welfare

effects of bounce protection could be useful.

The rank effect variables contain little cause for concern over customer abuse. High fee

banks are no more likely to offer bounce protection. Urban banks, also, are no more likely to adopt.

These results do not raise new concerns about consumer protection but they certainly are not

definitive in dispelling the possibility that segments of the consumer population are worse off with

the spread of bounce protection.

8. REFERENCES

Abdulai, Huffman, “The diffusion of new agricultural technologies: The case of crossbred-cow

technology in Tanzania”, American Journal of Agricultural Economics, Vol 87, No 3, August 2005,

p 645-659.

Akhavein, Jalal, W. Scott Frame, Lawrence J. White, “The Diffusion of Financial Innovations: An

Examination of the Adoption of Small Business Credit Scoring by Large Banking Organizations”,

Journal of Business, Vol 78, No 2, March 2005, p 577-596.

Bartoloni, Eleonora and Maurizio Baussola, “The Determinants of Technology Adoption in Italian

Manufacturing Industries”, Review of Industrial Organization, Vol 19, No 3, Nov 2001, p 305-328.

Colombo, Massimo G., and Rocco Mosconi, “Complementary and Cumulative Learning Effects in

the Early Diffusion of Multiple Technologies”, The Journal of Industrial Economics, Vol 43, No

1, March 1995, p 13-48.

David, Paul, A Contribution to the Theory of Diffusion, Stanford Center for Research in Economic

Growth, Memorandum No 71, Stanford University, 1969.

32

Technology Adoption

David, Paul and Trond Olsen, “Technology adoption, learning spillovers, and the optimal duration

of patent-based monopolies”, International Journal of Industrial Organization, Vol 10, No 4, Dec

1992, p 517-543.

Davies, S., The Diffusion of Process Innovations, Cambridge: Cambridge University Press, 1979.

Faria, Ana, Paul Fenn and Alistair Bruce, “A Count Data Model of Technology Adoption”, Journal

of Technology Transfer, Vol 28, No 1, Jan 2003, p 63-79.

Frame, Scott W., and Lawrence J. White, “Empirical Studies of Financial Innovation: Lots of Talk,

Little Action?” Journal of Economic Literature, Vol 42, March 2004, p 116-144.

Fudenberg, Drew and Jean Tirole, “Preemption and Rent Equalization in the Adoption of New

Technology”, Review of Economic Studies, Vol 52, No 170, July 1985, p 383-401.

Fusaro, Marc Anthony, “Consumers’ Checking Account Behavior: Are ‘Bounced Check Loans’

Really Loans? Theory, Evidence and Policy”, mimeo, 2006.

Fusaro, Marc Anthony, “Consumers’ Bank Choice and Overdraft Volume: A Structural Empirical

Study of Bounce Protection Programs”, mimeo, 2003.

Genesove, David, “The Adoption of Offset Presses in the Daily Newspaper Industry in the United

States”, NBER Working Paper W7076, April 1999.

Geroski, P.A., “Models of Technology Diffusion”, Research Policy, Vol 29, No 4-5, April 2000, p

603-625.

Gouray, Adrian, and Eric Pentecost, “The Determinants of Technology Diffusion: Evidence from

the UK Financial Sector”, Manchester School, Vol 70, No 2, March 2002, p 185-203.

Greene, William H., Econometric Analysis, 4th Edition, Prentice Hall, Upper Saddle River, NJ, 2000,

p 933-934.

Gotz, Georg, “Monopolistic Competition and the Diffusion of New Technology”, RAND Journal

of Economics, Vol 30, No 4, Winter 1999, p 679-693.

Hannan, Timothy and John McDowell, “The Determinants of Technology Adoption: The Case of

the Banking Firm”, RAND Journal of Economics, Vol 15, No 3, Autumn 1984, p 328-335.

Hannan, Timothy and John McDowell, “Rival Precedence and the Dynamics of Technology

Adoption: The Case of the Banking Firm”, Economica, Vol 54, No 214, May 1987, p 155-171.

Hoppe Heidrun, “The Timing of New Technology Adoption: Theoretical Models and Empirical

Evidence”, Manchester School, Vol 70, No 1, January 2002, p 56-76.

33

Technology Adoption

Hoppe Heidrun, “Second-mover Advantages in the Strategic Adoption of New Technology Under

Uncertainty” International Journal of Industrial Organization, Vol 18, No 2, Feb 2000, p 315-338.

Ireland, N. and Paul Stoneman, “Order effects, Perfect Foresight and Interterporal Price

Discrimination.” Recherches Economiques de Louvain, Vol 51, No. 1, 1985, p 7-20.

Ireland, N. and Paul Stoneman, “Technological Diffusion, Expectation and Welfare” Oxford

Economic Papers, Vol 38, No. 2, July 1986, p 283-192.

Karshenas, Massoud and Paul Stoneman, “Rank, Stock Order and Epidemic Effects in the Diffusion

of new process technologies: An Empirical Model”, RAND Journal of Economics, Vol 24, No 4,

Winter 1993, p 503-528.

Krugman, Paul, Peddling Prosperity, New York, Norton, 1994.

Mansfield, Edwin, Industrial Research and Technological Innovation: An economic Analysis, New

York: Norton, 1968.

Mansfield, Edwin, “The Diffusion of Industrial Robots in Japan and the United States”, Research

Policy, Vol 18, No 4, August 1989, p 183-192.

Molyneux, Philip and Nidal Shamroukh, “Diffusion of Financial Innovations: the Case of Junk

Bonds and Note Issuance Facilities”, Journal of Money, Credit and Banking, Vol 28, No 3, 1996,

p. 502-522.

Mulligan, James G., and Emmanuel Llinares, “Market Segmentation and the Diffusion of QualityEnhancing Innovations: The Case of Downhill Skiing”, Review of Economic and Statistics, Vol 85,

No 3, August 2003, p 493-501.

Reinganum, Jennifer, “Market Structure and the Diffusion of New Technology”, Bell Journal of

Economics, Vol 12, No 2, Autumn 1981, p 618-624.

Riordan, Michael, “Regulation and Preemptive Technology Adoption”, RAND Journal of

Economics, Vol 23, No 4, Autumn 1992, p 334-349.