Tax services

Managing global tax risks

EY’s Global Tax Risk Tool provides businesses with visibility of

how tax risks are managed around the world

Ninety-four per cent of

the largest companies

think that global disclosure and transparency requirements will continue

to grow in the next two

years.1

Background

The management of tax risk in the face of ever increasing complexity, globalisation, internal

pressure on resources, more frequent tax authority audits and increased threat of penalties, is one of

the biggest challenges facing tax departments today. Multinationals are recognising the need for

greater visibility over tax risks globally. This is not just the risk that process and control failures lead

to tax being underpaid in jurisdictions, but also the risk that tax is overpaid because there are not

appropriate processes, controls and knowledge to identify all available reliefs and planning

opportunities. Increasingly, senior management require a process that describes key risks and how

they are being managed and monitored, together with details of any significant issues, remedial

actions, and who is accountable.

Sixty-eight per cent of the

largest companies reported Global Tax Risk Tool

that they feel tax audits have To address these issues we have developed a Global Tax Risk Tool ( GTRT) which uses a detailed risk

become more aggressive in and control diagnostic assessment to collate and report objective findings. This application helps

‘kick start’ the process of evaluating an organisation’s global compliance and risk management activitthe last two years .1

1. 2014 EY Tax risk and

controversy survey

ies across all major tax types, including corporate income taxes, payroll taxes and indirect taxes.

Without the investment of significant resources, it is designed to deliver;

►► A data collection platform to facilitate rapid collection, collation and analysis of data

►► An indicative assessment of inherent risk factors across the group

►► The identification and preliminary assessment of the key risks in each jurisdiction

► A standardised reporting dashboard in an easily updateable format for ease of classification

►► A prioritised plan of enhancement action

►► A blueprint for an ongoing tax risk management framework

►

Tax services

What we are seeing

Internal pressures

Issues

External pressures

►►Rapidly expanding global footprint

►►Increased risk environment

►►Increased tax complexity

►►Greater internal focus on risk

management and corporate governance

►►Inadequate visibility, control and

risk management

►►Focus on headcount/cost reduction

►►Fire fighting

►►Increased regulation (i.e., FIN48, SAO,

IRS uncertain tax positions reporting

requirements, etc.)

►►Focus on delivering more value with

less resource

►►Inability to match resource to risk

►►Information systems are not geared to

tax needs

►►Increased reputational risk

►►Tax authorities’ increasingly

rigorous approach:

►►Increased penalty exposure

►►More frequent audits

►►More intense audits

►►Financial loss from increased exposure to

risks materialising

►►Targets to reduce ETR

►►Frequent risk assessment

►►Inability to deliver consistent standards of

tax risk management

►►Focus on systems and governance

►►Inability to monitor performance

against standards

►►Greater sharing of information

and collaboration between tax

authorities

►►Increased penalty threat

►►Tax reliefs not claimed

Whilst organisations typically have ambitions to develop a global

tax risk framework to address these issues, such an exercise can

seem an enormous task, and difficulties can be experienced

for some of the following reasons:

►► Resource constraints

►► A lack of knowledge about current risks and processes within

the group

►► The group lacks a standard terminology to apply a common

tax risk ‘language’.

►► The group has difficulty in converting information gathered

into a prioritised remedial management action plan.

►► There is no template for future tax risk framework design and

ongoing risk management activities.

►► There is no means to obtain the required information quickly

and efficiently

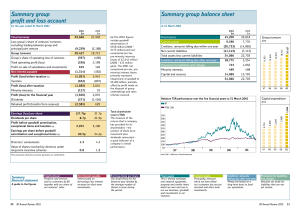

Figure 1: an extract from a report illustrating the percentage of controls present across the organisation

Risk category

UK

US

France

Germany

Russia

Japan

Australia

India

China

Brazil

97

93

57

64

43

79

71

21

32

45

Data posting

91

98

57

57

29

86

71

29

45

52

Data collation

100

95

52

75

25

100

25

52

41

38

98

100

38

38

63

63

50

38

10

15

Tax compliance

VAT return accuracy (process)

Data set up

Data review

Specific risk areas (technical)

Transfer pricing

Transaction identification

Transaction pricing

Documentation

65

50

51

59

19

73

67

20

20

20

100

85

57

75

33

85

70

46

46

46

80

60

38

54

25

55

56

30

30

30

100

85

57

75

33

85

70

46

46

46

80

60

38

54

25

55

56

30

30

30

Payroll

90

80

60

80

20

80

40

60

82

72

Employee expenses

86

92

50

100

10

100

100

50

60

65

Employee benefits

78

80

60

80

60

60

80

20

35

50

Share schemes

95

100

57

71

43

86

57

57

20

35

Expatriates/short term visitors

80

60

38

54

25

55

56

30

30

30

Employee leaving/joining payments

96

100

90

95

90

90

100

75

80

85

Status of worker

65

72

62

72

55

68

68

52

50

45

Policy implementation

Change monitoring

Employment Tax

2

| Managing global tax risks

Tax services

Global Tax Risk Tool: how does it work?

Global Tax Risk Tool: the key advantages

The GTRT uses our client portal as a platform to issue tax risk

and control diagnostic assessments to the relevant responsible

contacts within the organisation. The GTRT is very flexible,

allowing the business to choose individual territories, entities and

specific risk areas to ensure a bespoke approach which addresses

any known concerns. It can also be customised to meet the very

specific requirements an organisation may have.

The GTRT is designed to provide the following key benefits;

The risk areas addressed by the GTRT cover three broad areas;

1. Strategic — the risks associated with the business and tax

strategy and their implementation.

2. Tax compliance — the risks related to the end-to-end process

for the relevant tax filings.

3. Operations and management — the risks around how tax

interacts with other parts of the business and how the tax

function is managed.

►► It provides a rapid insight of how effectively tax risks are

managed around the world

►► It facilitates a standardised approach with a common tax

risk language

►► It leverages a wealth of knowledge and experience throughout

EY to benchmark current state risk management practices

and controls

►► It helps promote a tax risk aware culture by highlighting the

areas where tax risk could arise across the group

►► It involves a relatively low investment to provide key insights

►► It is very flexible — the business can choose which territories to

review, which taxes to cover, and which risks to focus on

We collate the responses and analyse the results in a report. The

report provides a ‘traffic light’ summary across all territories and,

for the risk areas addressed, assesses the overall risk level. It also

produces an exception report of controls not present.

The GTRT assists businesses to quickly evaluate the status of

the tax risk framework of the organisation around the world and

assists in identifying where any actions should be focused to

improve controls.

Figure 2: a high level summary of controls across the organisation

Entity:

Turnover:

Profit:

Controls present:

G Ltd

$66,000,000

$30,000,000

40.80%

UK

Germany

Russia

Entity:

Turnover:

Profit:

Controls present:

C Ltd

$10,000,000

$3,000,000

35.00%

Entity:

Turnover:

Profit:

Controls present:

F Ltd

$141,000,000

$57,000,000

37.44%

China

Entity:

Turnover:

Profit:

Controls present:

US

Entity:

Turnover:

Profit:

Controls present:

D Ltd

$75,000,000

$50,000,000

49.32%

Japan

J Ltd

$110,000,000

$75,000,000

76.95%

Entity:

Turnover:

Profit:

Controls present:

E Ltd

$5,000,000

$1,000,000

75.60%

Australia

France

Brazil

Entity:

Turnover:

Profit:

Controls present:

I Ltd

$3,000,000

$500,000

55.70%

Entity:

Turnover:

Profit:

Controls present:

H Ltd

$17,000,000

$10,000,000

47.84%

India

Entity:

Turnover:

Profit:

Controls present:

B Ltd

$52,000,000

$40,000,000

29.00%

Entity:

Turnover:

Profit:

Controls present:

A Ltd

$100,000,000

$25,000,000

53.99%

Managing global tax risks |

3

Global Tax Risk Tool: a typical project

The findings of the GTRT can be delivered within weeks, providing

rapid insight into how risks are being managed across the

organisation. A typical project will involve the following activities.

Step 1

Step 2

Step 3

We meet with the

business to agree

the territories to

be included, select

the categories

from the GTRT

database to be

incorporated in the

assessments, and

identify the relevant

persons within

the organisation

to respond.

We provide online

access and support

to the relevant

individuals in

each jurisdiction

to complete

the assessment.

We report the

findings, setting

out a ‘traffic light’

report of controls

present across

the organisation,

an exceptions list

detailing missing

controls, and

providing suggested

remedial actions

where required.

EY | Assurance | Tax | Transactions | Advisory

About EY

EY is a global leader in assurance, tax, transaction and advisory

services. The insights and quality services we deliver help build trust

and confidence in the capital markets and in economies the world

over. We develop outstanding leaders who team to deliver on our

promises to all of our stakeholders. In so doing, we play a critical role

in building a better working world for our people, for our clients and

for our communities.

EY refers to the global organization, and may refer to one or more, of

the member firms of Ernst & Young Global Limited, each of which is

a separate legal entity. Ernst & Young Global Limited, a UK company

limited by guarantee, does not provide services to clients. For more

information about our organization, please visit ey.com.

Ernst & Young LLP

The UK firm Ernst & Young LLP is a limited liability partnership registered in England and

Wales with registered number OC300001 and is a member firm of Ernst & Young Global

Limited.

Ernst & Young LLP, 1 More London Place, London, SE1 2AF.

Why EY?

© 2013 Ernst & Young LLP. Published in the UK.

All Rights Reserved.

The GTRT is provided by the Tax Controversy and Risk

Management practice within EY, a global team focused

on the management of tax risks around the world

with designated specialists in all major jurisdictions.

The combination of our data collection technology and

our tax risk methodology with local specialist knowledge

enables us to deliver real insight for our global clients

into how they are managing tax risk around the world.

ED None

1374767.indd (UK) 09/13. Artwork by Creative Services Group Design.

In line with EY’s commitment to minimise its impact on the environment,

this document has been printed on paper with a high recycled content.

Information in this publication is intended to provide only a general outline of the subjects

covered. It should neither be regarded as comprehensive nor sufficient for making decisions,

nor should it be used in place of professional advice. Ernst & Young LLP accepts no

responsibility for any loss arising from any action taken or not taken by anyone using this

material.

ey.com/uk

Further information

Please contact one of the following UK-based specialists for

further information who would be happy to illustrate to you

the benefits of the GTRT.

Andrew Hinsley

+ 44 20 7951 1932

ahinsley@uk.ey.com

Charles Brayne

+ 44 20 7951 6337

cbrayne@uk.ey.com

Paul Dennis

+ 44 121 535 2611

pdennis@uk.ey.com

Rakhim Mirzayev

+ 44 20 7951 6213

rmirzayev@uk.ey.com