Suggested Solutions: Autumn - Accounting Technicians Ireland

advertisement

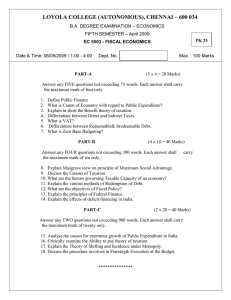

Adv. Taxation NI 2nd Year Paper August 2015 Advanced Taxation (Northern Ireland) 2nd Year Examination August 2015 Solutions & Marking Scheme & Examiner’s Comments Page 1 of 23 Adv. Taxation NI A2015 Adv. Taxation NI 2nd Year Paper August 2015 NOTES TO USERS ABOUT THESE SOLUTIONS The solutions in this document are published by Accounting Technicians Ireland. They are intended to provide guidance to students and their teachers regarding possible answers to questions in our examinations. Although they are published by us, we do not necessarily endorse these solutions or agree with the views expressed by their authors. There are often many possible approaches to the solution of questions in professional examinations. It should not be assumed that the approach adopted in these solutions is the ideal or the one preferred by us. Alternative answers will be marked on their own merits. This publication is intended to serve as an educational aid. For this reason, the published solutions will often be significantly longer than would be expected of a candidate in an examination. This will be particularly the case where discursive answers are involved. This publication is copyright 2015 and may not be reproduced without permission of Accounting Technicians Ireland. © Accounting Technicians Ireland, 2015. Page 2 of 23 Adv. Taxation NI A2015 Adv. Taxation NI 2nd Year Paper August 2015 Accounting Technicians Ireland 2nd Year Examination: Autumn 2015 Paper: ADVANCED TAXATION (Northern Ireland) Thursday 13 August 2015 2.30 p.m. to 5.30 p.m. INSTRUCTIONS TO CANDIDATES PLEASE READ CAREFULLY For candidates answering in accordance with the law and practice of Northern Ireland. Candidates should answer the paper in accordance with the appropriate provisions up to and including the Finance Act, 2014. The provisions of the Finance Act, 2015 should be ignored. Allowances and rates of taxation, to be used by candidates, are set out in a separate booklet supplied with the examination paper. Answer ALL THREE QUESTIONS in Section A, and ANY TWO of the FOUR questions in Section B. If more than TWO questions are answered in Section B, then only the first two questions, in the order filed, will be corrected. Candidates should allocate their time carefully. All workings should be shown. All figures should be labelled as appropriate e.g. £s, units, etc. Answers should be illustrated with examples, where appropriate. Question 1 begins on Page 2 overleaf. The following insert is included with this paper. Tax Reference Material (NI) Page 3 of 23 Adv. Taxation NI A2015 Adv. Taxation NI 2nd Year Paper August 2015 SECTION A Answer QUESTION 1 and QUESTION 2 and QUESTION 3 (Compulsory) in this Section QUESTION 1 (Compulsory) John It is August 2015 and John, a new client and higher rate taxpayer, has come into the office for some information as he is worried about his ability to meet his future tax liabilities. He has also told you that he did not include on the relevant income tax return £6,000 of income that he received in 2013/14. He does not know if he is too late to notify HMRC about the omission and what the consequences of telling HMRC or keeping quiet about it could be. The payments to date this year have been as follows:PAID 31-01-2015 £ 2013/14 Balancing Payment 2014/15 1st POA 18,250 14,625 32,875 PAID 31-07-2015 £ 2014/15 2nd POA 14,625 You have completed the draft tax computation for him for 2014/15 and calculate the total Income Tax payable for the tax year will be £30,800. In addition the Capital Gains Tax for 2014/15 is estimated to be £12,575. REQUIRED i. Explain the amounts that will be payable on 31-01-2016 and 31-07-2016 and how they are calculated. 10 marks ii. Explain briefly the implications of not making these payments when due. iii. Explain the deadlines to John and the main implications of either notifying HMRC now or of failing to notify HMRC of the undeclared income of £6,000. 6 marks 4 marks Total 20 Marks Page 4 of 23 Adv. Taxation NI A2015 Adv. Taxation NI 2nd Year Paper August 2015 QUESTION 2 (Compulsory) Spratt Limited Spratt Limited a UK registered company with no associates commenced trading on the 1 st December 2013 and has produced a set of financial accounts for a 16 months period ended 31-03-2015. The draft financial accounts before publication for the 16 months to 31-03-2015 are as follows: £ Sales Less cost of sales Gross Profit ADD: Other Income Discount Received Rental Income (note 1) Interest Received from Investments Profit on Sale of Assets (note 2) Bad Debts Recovered Dividends Received from UK Co (note 3) £ 3,221,300 (1,706,500) 1,514,800 7,800 72,000 117,006 128,702 31,004 58,500 315,012 1,829,812 Less Expenses Salaries and Wages Rent, Rates and Insurance Depreciation General Administrative Expenses (note 4) Interest Payable Bad Debt written off Selling Expenses (note 5) 751,350 110,120 111,000 176,193 91,306 136,400 161,500 (1,537,869) 291,943 NET PROFIT Page 5 of 23 Adv. Taxation NI A2015 Adv. Taxation NI 2nd Year Paper August 2015 NOTES 1. Rental Income accrues at £4,500pm. 2. Profit on Sale of Assets relate to the profit made on a number of disposals during the period of accounting. These have resulted in Chargeable Gains of Disposals as follows: Disposal made 12-06-2014 Disposal made 15-02-2015 £52,400 £41,000 3. Dividends received from UK Companies is the net income received from UK Companies on 30-06-2014. 4. General administrative expenses include the following: Loan to Employee written off Increase in Specific Bad Debt Provision Increase in General Bad Debt Provision Gift Aid Payment (paid 30-09-2014) 5. Selling expenses include the following: Entertaining Customers Gifts of diaries to customers (@ £6 each with Company logo) £1,200 £10,920 £30,036 £30,000 £11,930 £6,000 6. Capital Allowances have been calculated and agreed as follows: 01-12-2013 to 30-11-2014 4 m/e 31-03-2015 £81,000 £24,500 REQUIRED Calculate the Corporation Tax Liability for all Chargeable Accounting Periods. Total 20 Marks Page 6 of 23 Adv. Taxation NI A2015 Adv. Taxation NI 2nd Year Paper August 2015 QUESTION 3 (Compulsory) Maeve Maeve runs her own business and prepares accounts to 30 th September each year. In the year to 30th September 2014, Maeve has found that the business has expanded rapidly and as a consequence she has invested heavily in assets for the business as follows: Date 07-11-2013 14-01-2014 15-02-2014 12-08-2014 Plant & Machinery £ 75,500 62,400 153,750 20,250 Motor Vehicles £ 18,500 27,230 9,275 15,300 (CO2 emissions 90g/km) (CO2 emissions 175 g/km) (CO2 emissions 140 g/km) (CO2 emissions 122g/km + 30% private use) During the year Plant and Machinery was disposed of for £14,625 that had cost £22,525 in the previous year. Written down values brought forward on 1st October 2013 were as follows: Main pool £46,724 Special rate pool £18,293 REQUIRED Calculate the capital allowances that Maeve is entitled to claim. Total 20 Marks Page 7 of 23 Adv. Taxation NI A2015 Adv. Taxation NI 2nd Year Paper August 2015 SECTION B Answer ANY TWO of the FOUR questions in Section B QUESTION 4 a) In 2014/15 Nuala has the following income and expenses:Gross Taxable Income Personal Pension per month Gift Aid Donation (one off) £125,000 £1,250 £5,900 REQUIRED i) Calculate the personal allowance claimable by Nuala in 2014/15. 3 marks ii) b) Calculate Nuala’s Income Tax Liability for 2014/15. 3 marks Delta Ltd a close company with a year end of 31 st October pays Corporation Tax at the small company’s rate 20%. On 30th April 2013 Delta Ltd made a loan of £45,000 to Donna a higher rate taxpayer and shareholder of the company at the official rate of interest 3.25%. On the 31 st March 2015 Delta Ltd wrote off the loan. REQUIRED Outline the tax consequences if any of this transaction. i) On Delta Ltd at the time the loan is made. 2 marks ii) On Donna at the time when the loan is written off. 2 marks c) Paul is employed as a special consultant with a security firm Axle Ltd and has a salary of £32,000pa. He makes a contribution of 5% of his salary to the Approved Company Pension scheme and Axle Ltd make a further 8% contribution as employer. During the year Paul is required to stay in accommodation provided by Axle Ltd. This accommodation has an annual value of £3,600 but has been agreed with HMRC that it could be considered “job related” accommodation for tax purposes. Furniture with a market value of £2,200 has been provided in the house and other bills paid by Axle Ltd on Paul’s behalf have amounted to £3,400. As a bonus this year Paul was given vouchers to spend on a holiday with a local travel agent. The retail value of the vouchers was £1,500 but they cost Axle Ltd £1,250. Paul is required to use his own car for occasional business use for which the company agreed to reimburse him at a rate of 55p per mile. During the 2014/15 year he travelled 7,500 business miles. Paul has also made payments in the year of £175 (on approved professional subscription) and a further £30pm to Oxfam under the Payroll Giving Scheme, organized by Axle Ltd. This amount is deducted each month from his salary. REQUIRED Calculate the assessable amount of employment income for Paul in the 2014/15 year. 10 marks Total 20 Marks Page 8 of 23 Adv. Taxation NI A2015 Adv. Taxation NI August 2015 2nd Year Paper QUESTION 5 Alice Alice has decided that she would dispose of a number of significant assets that she has held for some time. Details of the cost, disposal value and other relevant information is as follows: Asset Disposal of piece of land Antique Painting Antique Necklace Aston Martin DB9 Disposal Proceeds £ £30,000 Cost £ Other Information £50,000 Value of remaining land £120,000 £20,000 £5,000 Additional restoration cost in 1995 amounted to £6,000 £Nil Gift £5,000 The necklace was gifted to her sister June on the occasion of her 60th birthday. At the time of the gift it had been valued at £8,000 £18,000 £6,000 Alice has also spent £10,000 having the car professionally restored. On 31-12-2014 Alice also disposed of her house for £470,000. The house had been bought for £80,000 on 01-01-1988. Her use of the house was as follows: 01-01-1988 to 31-12-1997 01-01-1998 to 31-12-1999 01-01-2000 to 31-12-2008 01-01-2009 to 31-12-2014 Occupied by Alice as her principle private residence (PPR). Rented out as Alice was on a 2year trip to Australia Occupied by Alice as her PPR Rented out as Alice had moved elsewhere REQUIRED Calculate the total Capital Gains Tax payable by Alice in the 2014/2015 year assuming that her other taxable income in the year amounted to £30,000. Total 20 Marks Page 9 of 23 Adv. Taxation NI A2015 Adv. Taxation NI August 2015 2nd Year Paper QUESTION 6 Downton Boilers Ltd Downton Boilers Limited operates a UK based business for the maintenance, installation and repairs of domestic boilers. A significant amount of the parts that the company buy are bought from a VAT registered German supplier. The company accounts for VAT on the normal invoice basis. The following relates to transactions undertaken in the quarter ended 31 st December 2014. All figures are exclusive of VAT unless otherwise stated. SALES/SERVICE £ 28,953 1,745 1,945 268 Sales/service invoiced in the UK (note 1) Sales/services to non-registered EU customers Cash sales Credit notes issued PURCHASES/EXPENSES Purchases of materials/equipment in UK Purchases of materials imported from EU VAT- registered suppliers Purchases of motor van (note 2) Wages and salaries Rent (note 3) Telephone Insurance Bad debts (note 4) Other standard rated expenses (note 5) 7,917 4,125 14,000 8,450 2,500 642 1,800 2,496 4,720 NOTES 1. Sales/services carried out in the UK are all standard rated. The company offers discount of 5% for prompt payment and it is estimated that this is taken up by 80% of its customers. 2. A new company van was purchased in October 2014 at a cost of £14,000 (net of a trade-in allowance on the old van of £8,000). Both these amounts are VAT inclusive. 3. The ‘option to tax’ has been exercised by the landlord. 4. Bad debts written off as irrecoverable debts this quarter are in respect of two UK customers for invoices (inc VAT) of £1,080 (due for payment March 2014) and £1,416 (due for payment September 2014). 5. Other standard rated expenses include fuel costs of £500 for petrol for a company car driven by one of the directors. The car has CO2 emissions of 205 g/km. It is estimated that the director uses the vehicle 80% for business use. 6. No account has been taken for a boiler that has been taken from stock and given at no charge to a customer who was a friend of one of the directors. The company normally sells the products for £840 (exc VAT). The company has a normal mark up on such products of 40%. REQUIRED Calculate the VAT Payable or Repayable by the company for the Q/E 31 December 2014 Total 20 Marks Page 10 of 23 Adv. Taxation NI A2015 Adv. Taxation NI 2nd Year Paper August 2015 QUESTION 7 Quik-Text Ltd has been trading for many years and preparing accounts to 31 st March each year. It has changed its accounting date to 31st December now and results for the last Periods of Account have been as follows: Trade Profit/(loss) Rental Income Interest Income Chargeable Gain/(loss) Charitable Donation Y/E 31-03-12 £ 35,625 2,250 3,450 0 12,000 Y/E 31-03-13 £ 62,550 3,450 4,750 (2,000) 18,000 9 M/E 31-12-13 £ 43,500 2,250 4,500 4,500 13,500 12 M/E 31-12-14 £ (166,500) 6,000 18,000 REQUIRED i. Compute the taxable profits for each of the relevant accounting periods on the assumption that the company makes all available loss claims against the earliest possible profits. 14 marks ii. Show any unrelieved charges there may be in years affected. 4 marks iii. State (but do not re-calculate) what difference it would make if the trade loss incurred in the 12 m/e 31-12-14 was the last 12 months of trading. 2 marks Total 20 Marks Page 11 of 23 Adv. Taxation NI A2015 Adv. Taxation NI 2nd Year Paper August 2015 2nd Year Examination: August 2015 Adv. Taxation (Northern Ireland) Suggested Solutions and Examiner’s Comments Students please note: These are suggested solutions only; alternative answers may also be deemed to be correct and will be marked on their own merits. Statistical Analysis – By Question Question No. Average Mark (%) Nos. Attempting 1 39 2 44 3 65 4 32 5 54 6 42 7 52 48 48 48 35 16 26 19 Statistical Analysis - Overall 59% Pass Rate 47% Average Mark Range of Marks Nos. of Students 0-39 9 40-49 15 50-59 18 60-69 4 70 and over 1 Total No. Sitting Exam 47 10 Total Absent 2 Total Approved Absent 59 Total No. Applied for Exam General Comments: This sitting of examination saw a significant drop in the percentage passing (48% ) compared to August 2014 (58%). This was to a large degree as a consequence of the poor marks achieved in compulsory questions 1 and 2 with an average marks of 39% and 44% respectively. Candidates must ensure that when 60% of these papers are compulsory questions they do not present themselves for examination with significant gaps in their knowledge base. Page 12 of 23 Adv. Taxation NI A2015 Adv. Taxation NI 2nd Year Paper August 2015 Examiner’s Comments on Question One As mentioned this question was very badly answered by a number of candidates. It is most important that candidates are able to calculate an Outstanding IT liability and payments on Account. Payments due on 31/1 each year take account of the IT liability Less any POA that have been made Plus any CGT due plus POA in respect of the following year. POA will be calculated as 50% of last year’s IT liability and must include any Class 4 NIC but exclude CGT. Calculation of penalties and interest on late payments should use the figures in the question given Question 1 John i) Payment Due: Income Tax Liability 2014/15 30,800 Total Marks Allocated 2 Less Payments on Account -29,250 2 Add C.G.T. due 2014/15 12,575 31/01/2016 £ 1,550 2 14,125 Add 1st Payment on A/C 2014/15 (50% x 2014/15) 15,400 2 29,525 31/07/2016 2nd Payment on A/C 2015/16 15,400 2 10 Note: There will be no Payment on A/C relating to Capital Gains Tax. ii) If payments are late Interest will be due at a rate of 3.25% p.a. Penalties for late payments are as follows: 30 days – 60 months 5% of tax (eg (5% x 29,525 = £1,47625) >6 months a further 5% penalty will arise >12 months a further 5% penalty will arise 4 iii) The income should have been recorded on the 2013/14 tax return due on 31-01-2015. Changes can be made to a tax return up to 1 year after the deadline without having to make a formal written application to HMRC. Page 13 of 23 2 Adv. Taxation NI A2015 Adv. Taxation NI 2nd Year Paper August 2015 John therefore can declare this income before 31-01-2016. As a higher rate taxpayer he will owe £2,400 additional Income Tax on this (40% x £6,000). 2 There could be a penalty of up to 30% of the extra tax if the 1 omission is considered careless, or 70% if the omission was deliberate. If John choose not to notify HMRC about the omission and it is subsequently discovered the penalty could be up to 100% of the additional tax. 1 6 Examiner’s Comments on Question Two The calculation of a CT liability on a long Accounting period must be a basic knowledge point that candidates should familiarise themselves with. In particular note; 1. Do the Adjusted profits computation first for the full 18m period and 2. Apportion Profits as required 12/18 and 6/18 3. All other deuctions and Income apportion as it arises Question 2 Spratt Limited WORKINGS Adjusted Profits computation 1 Total Marks Allocated £ Net Profit per accounts 291,943 1½ Less income assessable elsewhere Rental Income 72,000 1 Interest Received 117,006 1 Profit on Sale 128,702 1 Dividends received 58,500 1 376,208 84,265 Add: Disallowable Expenses General Admin Depreciation 111,000 1 Increase in General Bad Debt 30,036 1 Page 14 of 23 Adv. Taxation NI A2015 Adv. Taxation NI 2nd Year Paper August 2015 Gift Aid Payment 30,000 2 Selling expenses Entertaining Customers 11,930 1 182,96 6 Adjusted Profits before CA 98,701 9½ 01-12-2013 to 30-112014 £ 74,026 4 m/e 31-032015 £ 24,675 1 -81,000 -24,500 0.5 Chargeable Accounting Periods: Adjusted Profits (12/16, 4/16) Less Capital Allowances Trade Profits -6,974 175 1 Chargeable Gains 52,400 41,000 1 Interest Income 87,754 29,252 0.5 Rental Income 54,000 18,000 0.5 187,180 88,427 Less Charges on Income -30,000 - PCTCT 157,180 88,427 65,000 - Profits 222,180 88,427 Lower Limit 300,000 100,000 Upper Limit 1,500,000 500,000 £31,436.00 £17,685.40 Add FII ( 58,500 /0.90) 2 2 SCR Applies CT Payable @20% 1 20 Examiner’s Comments on Question Three I am delighted to report that by in large this question was well answered by all candidates and that the topic and rules relating to Capital Allowance were well known and applied correctly. Candidates should note marks will be awarded for correct categorization of asset types, identifying those eligible for AIA and the appropriate identification of assets attracting WDA @ 18% or 8%. Page 15 of 23 Adv. Taxation NI A2015 Adv. Taxation NI 2nd Year Paper August 2015 Question 3 Maeve 9. Maeve Capital Allowances Claim WDV BIF Additions Qualifying for FYA FYA AIA £ £ General PoolSpecial Rate Single Asset Private Use (30%)Capital Allowance Pool Pool Claim £ £ £ £ £ 46,724 18,293 18,500 18,500 Additions not Qualifying for AIA (CO2 175 g/km) (CO2 140 g/km) CO2 122 g/km 27,230 9,275 15,300 Additions qualifying for AIA 07.11.2013 11.01.2014 05.02.2014 8.2014??? 75,500 62,400 153,750 20,250 311,900 -270,250 AIA (WI) 270,250 41,650 88,374 (14,625) 73,749 Disposal WDA @ 18% WDA @ 8% (13275) WDV CIF 60,474 54,798 15,300 (2,754) 826 (4,384) 50,414 15,203 4,834 12,546 Total Capital Allowance Claim 308,337 Workings 1. Maximum AIA 01-10-2013 - 05-04-2014 6/12 X 250,000 = 125, 000 06-04-2014 - 30-09-2014 6/12 X 500,000 = 250, 000 Maximum AIA Total £375,000 The maximum eligible expenditure in 1-10-20135-4-2014 is £250,000. Expenditure incurred 07/01/2013 75,500 14/01/2014 62,400 15/02/2014 153,750 291,650 Eligible Expenditure 250,000 12/08/2014 20,250 270,250 Total 20 marks Page 16 of 23 Adv. Taxation NI A2015 Adv. Taxation NI August 2015 2nd Year Paper Examiner’s Comments on Question Four A lot of candidates chose to do this question in Section B but sadly simply did not know the relevant rules relating specifically to Personal Allowances and Adjusted Net Income calculation in part 1 and the rules relating to Close companies part 2. The calculation of BIK for Paul however was generally well answered Question 4 1) Nuala i) Personal Allowance Claimable Adjusted Net Income Total Marks Allocated £ Gross Taxable 125,000 ½ -18,750 1 -7,375 1 Less Personal Pension (Gross) 1,250 x 12 /0.80 Less Gift Aid (Gross) 5,900 /0.80 Adjusted Net Income (ANI) 98,875 As ANI < £100,000 Nuala will be entitled to claim full ½ Personal Allowance of £10,000. ii) Income Tax Computation 2014/15 £ Gross Taxable 125,000 ½ Less PA (as above) -10,000 ½ 115,000 Basic Rate Band 31,865 Add Gross Personal Pension 18,750 1 Gross Gift Aid 7,375 1 Extended Basic Rate 57,990 Income Tax due Page 17 of 23 £ Adv. Taxation NI A2015 Adv. Taxation NI 2) August 2015 2nd Year Paper 57,990 x 20% 11,598 57,010 x 40% 22,804 115,000 I T Liability 2014/15 34,402 Delta Limited Delta Ltd must make a payment of £11,250 (ie. £45,000 x25%) to HMRC. This will be payable at the same time as the Corporation Tax for the Accounting Period in which the loan was made. ie. AP ending period 31st October 2013 so it is payable by 1st August 2014. 2 When the loan is written off Donna will be deemed to have received dividend income of £50,000 (45,000 /0.90) and as a higher rate tax payer she will be subject to additional tax of £11,250 (ie. 50,000 x 22½%). 2 Paul Assessable Employment Income 2014/15 £ GROSS SALARY 32,000 Less 5% Pension contribution -1,600 1 Payroll Giving Oxfam -360 1 Net taxable for PAYE 30,040 ADD benefits Accommodation* Bills only as job related Limited to 10% 3,040 2 750 1 Holiday Vouchers – cost to Employer 1,250 1 Less allowable deduction - Professional Subs -175 1 Excess Mileage (7,500 x 55-45p) 34,905 Note:Axle’s contribution to the Pension scheme (8%) is not included as a benefit. 1 *Accommodation Benefit Bills paid on behalf Furniture (20% x 2,000) Page 18 of 23 3,400 1 440 1 3,840 10 Adv. Taxation NI A2015 Adv. Taxation NI 2nd Year Paper August 2015 Examiner’s Comments on Question Five This question was well answered by most candidates who chose to do so. At this level it is pleasing to note that students know and apply the rules for CGT on individuals well. Question 5 Alice a) Alice Capital Gains Tax Chargeable Disposals 2014/15 £ i) LAND: PART DISPOSAL Proceeds Less Apportioned cost Chargeable £ Total Marks Allocated 30,000 50,000 x 30,000 /30,000 + 120,000 Gain ii) ANTIQUE PAINTING Proceeds Less cost Restoration iii) GIFT TO SISTER Deemed Proceeds (MV) Less costs Gain Limited to 5/3 x (8,000-6,000) = 3,333 (10,000) 20,000 20,000 2 20,000 (5,000) (6,000) 9,000 9,000 2 8,000 (5,000) 3,000 3,000 3 iv) ASTON MARTIN DB9 Exempt Asset - b) Disposal of Principal Private Residence will be subject to partial charge ie. Absence in Australia will be considered to be a period of deemed occupation under the absence for any reason rule since it is for less than 3 years and is both preceded and succeeded by periods of actual occupation. 2 2 18m of the final 6 years of absence will count as deemed occupation as it was occupied as a Principle Private Residence. The remaining 4½ years of absence in this last period will be chargeable. 1 £ Proceeds 470,000 Less cost -80,000 Page 19 of 23 Adv. Taxation NI A2015 Adv. Taxation NI 2nd Year Paper August 2015 Gain Chargeable 390,000 x 4.5 /27 = GAINS SUMMARY i) Land £ 20,000 ii) Antique Painting 9,000 iii) Gift 3,000 iv) Aston Martin 390,000 1 65,000 2 - v) PPR 65,000 Total Gains 97,000 Less Annual Exemption -11,000 Taxable 86,000 Other Taxable Income 30,000 1 Capital Gains Tax 1,865 x 18% = 335.7 2 84,135 x 28% = 23,557.80 2 86,000 23,893.50 20 Page 20 of 23 Adv. Taxation NI A2015 Adv. Taxation NI 2nd Year Paper August 2015 Examiner’s Comments on Question Six There were a couple of issues in this question that candidates should review carefully. In particular note 1. the rules on the VAT charge where discount is offered to customers 2. treatment of the VAT on sale of assets 3. treatment of the VAT on asset purchases where a trade in has been offered VAT Return Q/E 31st December 2014 OUTPUT TAX Sales/Services in the UK (28,953 x 95% x 20%) £ Total Marks Allocated 5,501.07 2 349 2 Sales/Services to non-registered EU Customers (1,745 x 20%) Cash Sales (1,945 x 20%) 389 1 Credit Notes Issued (268 x 20%) -53.6 2 EU Acquisitions (4,125 x 20%) 825 1 80.83 2 120 2 Deemed supplies Fuel Scale charge (485 x1/6) Gift to customer (840/1.40 x 20%) 7,211.30 INPUT TAX Purchase of materials/equipment in UK (7,917 x 20%) 1,583.40 1 Purchase of motor van (22,000 x 20%) 4,400.00 2 Rent (2,500 x 20%) 500 2 Bad Debts (1,080 x 20%) 216 2 Other Standard Rates expenses 944 1 7,642.40 432.1 20 Page 21 of 23 Adv. Taxation NI A2015 Adv. Taxation NI 2nd Year Paper August 2015 Examiner’s Comments on Question Seven Candidates answering this question did so well. The only point of note is that even those who answered the treatment of losses well they often failed to answer part ii to the question ie “Show any unrelieved charges there may be in years affected” which was worth 4 marks! Question 7 Quik-Text Limited 31-03-2012 35,625 2,250 3,450 0 41,325 41,325 41,325 (12,000) 29,325 31-03-2013 62,550 3,450 4,750 70,750 70,750 (17,687) 53,063 (18,000) 35,063 31-12-2013 43,500 2,250 4,500 2,500 52,750 52,750 (52,750) 0 0 0 Marks TOTAL MARKS 4 4 4 2 14 ii) Unrelieved Charges 0 0 13,500 18,000 Marks TOTAL MARKS 1 1 1 1 4 Trade Profit Rental Income Interest Income Chargeable Gains Total Profits Less c/y Loss Relief Less c/b Losses Less Charitable Donation PCTCT Loss Memo Loss y/e 31-12-2014 c/y Loss Relief 31-12-2014 0 6,000 6,000 (6,000) 0 0 0 0 £ 166,500 -6,000 160,600 -52,750 107,750 -17,687 90,063 c/b 9 m/e 31-12-2013 Loss avail c/b Loss c/b 3m (70,750 x 3/12) Page 22 of 23 Adv. Taxation NI A2015 Adv. Taxation NI August 2015 2nd Year Paper ii) A loss incurred in the final 12 months of trading can be carried back and relieved against total profits of the 36 months preceding the loss making period on a LIFO basis. The carry back operates in the same way as the normal c/b loss relief ie. set off against total profits of the 36 months. Where it includes c/b to a short accounting period apportionment will be required. 2 TOTAL MARKS 20 Page 23 of 23 Adv. Taxation NI A2015