How Well Do Social Ratings Actually Measure Corporate Social

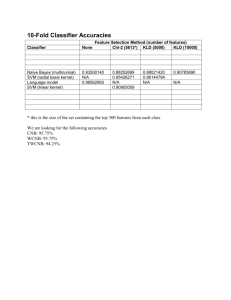

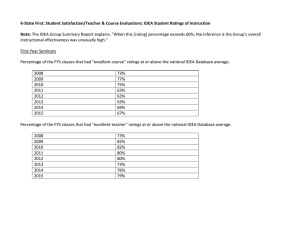

advertisement