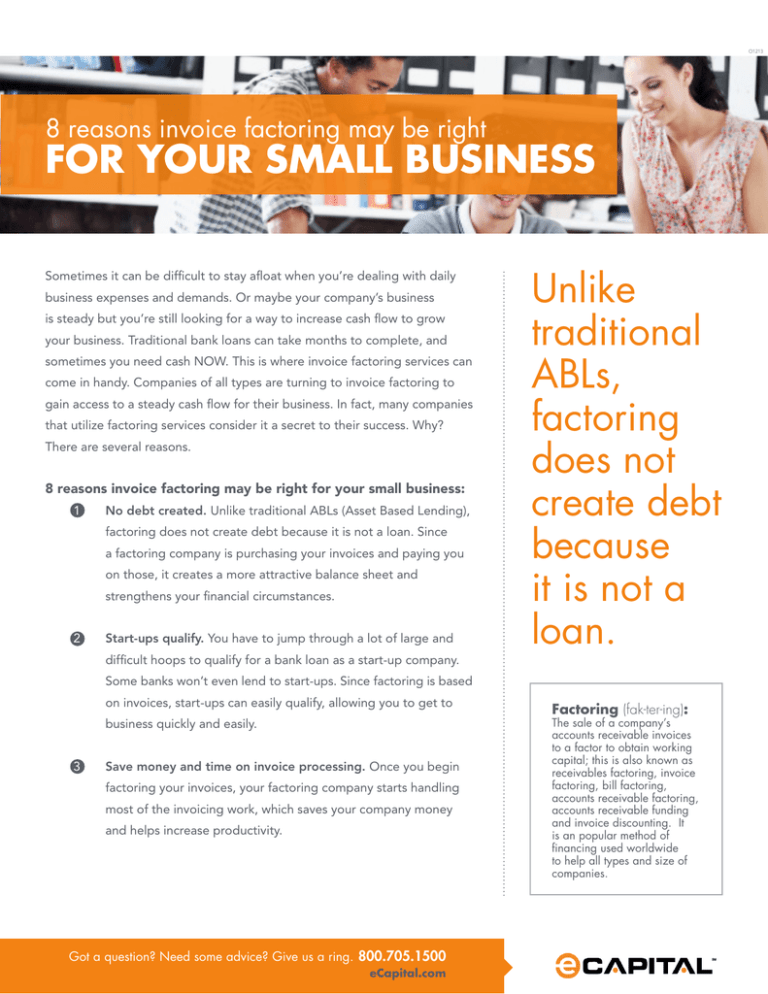

Unlike traditional ABLs, factoring does not create debt because it is

advertisement

O1213 Title 8 reasons 1 invoice factoring may be right TITLEYOUR FOR 2 SMALL BUSINESS Sometimes it can be difficult to stay afloat when you’re dealing with daily business expenses and demands. Or maybe your company’s business is steady but you’re still looking for a way to increase cash flow to grow your business. Traditional bank loans can take months to complete, and sometimes you need cash NOW. This is where invoice factoring services can come in handy. Companies of all types are turning to invoice factoring to gain access to a steady cash flow for their business. In fact, many companies that utilize factoring services consider it a secret to their success. Why? There are several reasons. 8 reasons invoice factoring may be right for your small business: 1 No debt created. Unlike traditional ABLs (Asset Based Lending), factoring does not create debt because it is not a loan. Since a factoring company is purchasing your invoices and paying you on those, it creates a more attractive balance sheet and strengthens your financial circumstances. 2 Start-ups qualify. You have to jump through a lot of large and difficult hoops to qualify for a bank loan as a start-up company. Some banks won’t even lend to start-ups. Since factoring is based on invoices, start-ups can easily qualify, allowing you to get to business quickly and easily. 3 Save money and time on invoice processing. Once you begin factoring your invoices, your factoring company starts handling most of the invoicing work, which saves your company money and helps increase productivity. Got a question? Need some advice? Give us a ring. 800.705.1500 eCapital.com Unlike traditional ABLs, factoring does not create debt because it is not a loan. Factoring (fak-ter-ing): The sale of a company’s accounts receivable invoices to a factor to obtain working capital; this is also known as receivables factoring, invoice factoring, bill factoring, accounts receivable factoring, accounts receivable funding and invoice discounting. It is an popular method of financing used worldwide to help all types and size of companies. Title 8 reasons 1 invoice factoring may be right TITLEYOUR FOR 2 SMALL BUSINESS 4 Factoring is flexible. When you factor, you control which customers you want to factor, allowing you to secure operating cash that is flexible and meets your business needs. 5 Industry knowledge and savings programs. Factoring companies generally have specific industry knowledge and understand the needs and challenges of your business. They can also provide helpful services and programs that help you save money on business expenses. 6 Quick, painless account setup. It generally takes a few days and minimal paperwork to set up a factoring account. You’re not going to have to wait weeks for an underwriting process to see your money! 7 Professional collection services. Factoring companies understand the importance of professionalism in business relationships. They treat all your debtors as if they are your biggest and best customers, ensuring your business relationship remains secure. 8 Improve your credit. With factoring, the increased working capital provides you the means to pay your bills and vendors on time, which positively affects your credit score. Need more reasons to factor? Contact one of our friendly factoring consultants at 800.705.1500 for a no-obligation chat! With factoring, the increased working capital provides you the means to pay your bills and vendors on time, which positively affects your credit score. Who is eCapital anyway? We’re pioneering the world of modern-day alternative financing with our innovative programs and desire to help businesses achieve financial freedom. Connect with us and find out more. Got a question? Need some advice? Give us a ring. 800.705.1500 eCapital.com