PDF, 3,25 Mb

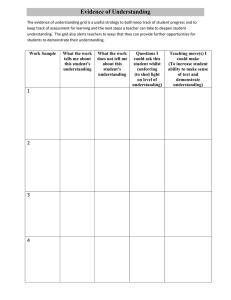

advertisement