Purchasing property in Switzerland

advertisement

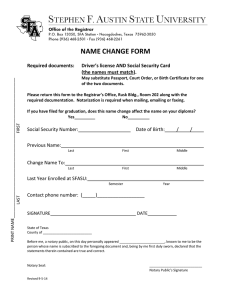

Purchasing property in Switzerland Contents Purchase of real estate in Switzerland by a non-Swiss or non-resident person. Click a heading to go straight to that section: A Introduction B Legal restrictions C Purchase costs D Guarantees E Purchase procedure F Mortgages G Terms of payment H Annual expenses I Financial considerations J Legal aspects K Death duties and succession L Residency (B permits) M Contact Us Introduction A - Introduction The Swiss government restricts the sale of second homes to foreigners and have an annual quota of just 1,500 permits. Only properties in some cantons are authorised for sale to foreigners and then only in tourist resorts. Your notary will apply for a permit for you to buy a specific property but only as part of the purchasing procedure. There are also restrictions on the size of the plot of land and the habitable area of the chalet. Usually the maximum will be around 200m2 net habitable (the chalet shown here is about the maximum size a foreigner can buy) but it is possible for foreigners to buy larger chalets if they have a Swiss B permit which entitles them to reside in Switzerland. Some Communes such as Saas Fee and Zermatt have had strict planning laws and restrict the amount of new construction. The few new properties which are built in these resorts are usually only available for Swiss buyers or Swiss residents (foreigners having a B permit). Occasionally one will be available for a foreigner but these sell fast. In a referendum in March 2012 the Swiss people voted to prohibit all new construction of second homes from 1st of January 2013 in communes which already have over 20% of second homes. New developments which have already received a building permit will continue to be built over the next two or three years but once this new stock is exhausted no more new properties will be built in any ski resort in Switzerland. This affects both Swiss buyers and foreigners. The new properties we have are the last opportunity to buy a new property in the Swiss Alps as a holiday home. These properties are authorised for sale to foreigners and the notary will apply for your foreigner purchase permit as part of the purchase procedure. These will be an excellent investment and will increase in value as no more building permits will be given in future for the construction of new properties. Where can you buy? When can you sell? Each canton has slightly different rules and these rules may even vary from commune to commune within the same canton. The most liberal canton is Vaud which includes resorts such as Villars where foreigners can buy virtually any property but they may not resell for 5 years. Less well known Cantons such as Obwalden (the resort of Engelberg) also have plenty of foreigner purchase permits and few restrictions. There are two types of restriction; legal restrictions (imposed by the Canton or local commune) and planning restrictions limiting new construction (imposed by the commune). Canton Berne (Grindelwald) In Grindelwald foreigners are permitted to buy apartments and chalets but only if they have a market value of over around 750,000 Sfrs. Canton Berne (Wengen and Lauterbrunnen) Foreigners are not permitted to buy detached chalets but they are permitted to buy apartments and there is no minimum purchase price. However, in each new apartment building 50% of the apartments must be sold to Swiss or B permit holders (foreigners with the right of residence in Switzerland). Foreigners may resell at any time. Canton Vaud (Villars) In Vaud there are few restrictions: foreigners may buy most properties but may not resell for 5 years. Foreigner permits are freely available for both re-sale and new properties. Canton Valais (Nendaz, Les Collons, Veysonnaz, La Tzoumaz) The Canton of Valais allocates the foreign permits and the notary applies for a buyer to purchase a specific property. The developer is not permitted to start construction of your chalet until you have a permit. Foreigners must wait 5 years to resell to another foreigner unless there are special circumstances such as ill health, financial problems, or buying a larger property. Canton Valais (Saas Fee) In Saas Fee planning laws restrict new construction to a total of just 1500 m2 per year (one apartment building and 2 or 3 chalets) but as a result of the referendum decision no new building permits will be authorised after January 2013. We have some new properties which have been authorised under old building permits and some resale chalets which are already owned by foreigners and these may be freely sold to another foreigner. Canton Valais (Zermatt) In Zermatt there are greater restrictions and foreigners are not permitted to buy at all. Swiss nationals and residents (B permit holders) are only permitted to buy an apartment for their own use if they are resident (and paying their taxes) in Zermatt. If you have a B permit you may buy in Zermatt but must rent your property out. Canton Valais (Verbier) There are very few permits available for foreigners. We occasionally have re-sale chalets which are already owned by foreigners and these may be freely sold to another foreigner. Canton Obwalden (Engelberg) There are plenty of foreigner purchase permits and few restrictions. Foreigners are permitted to re-sell immediately to a Swiss buyer and after 5 years to another foreigner. The Titlis Resort is the last possibility to buy a new property in Engelberg following the decision of the referendum to prohibit construction of new second homes so buy while you can. Legal Restrictions B - Legal Restrictions 1.Non-Swiss may only buy one property per family in Switzerland. Family is defined as husband and wife and /or under-age children. Over the age of 20, the son or daughter of an owner may purchase one property in his/her own name. 2.In some Cantons foreigners may be prohibited from re-selling their property within a certain period after they have purchased it (5 years in Valais and Vaud) and in other Cantons they may be permitted to re-sell the property immediately (Berne and Obwalden). 3.Under Swiss Law, an owner or his family may occupy their apartment for up to six months per year. If you wish to spend more time in Switzerland you would need to apply for a residence permit. 4.The owner is free to rent their property (or not) as they wish. The owner, or his friends, or family, are supposed to use the property for at least three weeks of the year so the property may not be rented on an annual basis (maximum 11 months and one week). Purchase Costs C - Purchase Costs The purchase of an apartment becomes valid once the owner is registered in the Land Registry. The purchase fees also vary from Canton to Canton between 2.5 % and 5 % of the purchase price. Canton Bern (Lauterbrunnen, Wengen and Grindelwald) - total purchase costs amount to a total of around 3% of the purchase price, (Government purchase tax (1.8%), Notary fees (0.8%), land registration fees, registration of mortgage.) In the Canton of Graubünden there are sufficient foreigner purchase permits and no waiting list. Property transfer taxes (Handänderungssteuer) are around 2% and notary fees are around 0.5% so total sales costs are in the region of 2.5% of the sales price. Canton Valais (Saas Fee, Les Collons, St Luc, etc) the taxes and notary fees together amount to a total of around 2.5% of the purchase price in total. In Villars (Canton Vaud) the total fees are 5% of the purchase price, being a one off property transfer tax of 3.3 % (similar to UK stamp duty) plus the Notary and land registration fees which total 1.7 %. In addition, the registration of a mortgage is charged on a sliding scale which varies in different cantons. In Canton Valais it is a straight 1.6% levied on the amount of the loan, in canton Vaud it is as follows: • Up • Up • Up • Up • Up to to to to to 100,000 200,000 300,000 400,000 500,000 0.6% 0.5% 0.47% 0.45% 0.44% All these purchase costs are payable by the purchaser. When you come to sell, no Notary fees are payable. Construction Guarantee & Purchase Procedure D – Construction Guarantee The federal construction guarantee is as follows: • 5 years for construction defects • 10 years for hidden defects For resale properties, there are no guarantees. E – Purchase Procedure An official Swiss notary of the district will act on behalf of both the purchaser and the vendor. Once the client has chosen an apartment or a chalet he / she will complete a civil status questionnaire and other documents stating the details of the purchaser and the property. Once the notary has received these completed and signed documents, plus the deposit and a copy of the purchaser’s passport, If the purchaser is a foreigner, the Notary will first apply to the Cantonal authorities for a permit authorising the purchaser to buy that particular property. In Valais and Vaud most of the permits are allocated in January so there may be a wait to receive one but in other cantons they may be given much more quickly (often in 6 to 8 weeks). Within 30 days of being allocated a permit the buyer must sign the notary’s deed of sale and usually they will sign a Power of Attorney, entrusting the notary’s office with the duty of ensuring that all the legal formalities are respected, particularly the registration of the deed in the Land Register and releasing the acquired property from any previous mortgage. The power of attorney must be notarised if it has not been signed in the presence of the notary dealing with your purchase. You will need to take the power of attorney to a Notary Public (not a solicitor) in your country of residence to have your signature witnessed and (in the UK) the Notary Public will send the document off to the foreign office to have it “legalised” and then you will send it back to the notary. All stage payments after signing the deed of sale are made to the notary. The notary will also liaise with the bank for the registration of the required mortgage. As part of the purchase procedure the notary will request permission from the local canton and from the central government in Bern for the sale to be approved. In the Canton of Valais the notary may only sign the official deed of sale when a foreigner purchase permit has been pre-allocated to the purchaser to buy that particular property. Usually a sale to a foreigner will only be refused if the purchaser already owns another property in Switzerland. A contract can be made conditional upon the authorisation being granted and the process of obtaining the purchase permit is undertaken by the notary. In some cantons such as Bern (Wengen) it may take only a few weeks. In Switzerland both the purchaser and vendor are required to attend at the notary’s office to sign the deed of sale in his presence but usually both parties will sign a power of attorney which will authorise one of the secretaries working in the notary’s office to sign the sales deed on their behalf. The notary will therefore send you a copy of the deed of sale in French or German with a professional English translation of this and a power of attorney (also in English) which authorises his secretary to sign this for you. The Commission Fonciere (Land Register) when authorising a foreigner to purchase will also impose certain conditions. These conditions are not onerous there is usually the obligation for the owner or his family or friends to use the property for 3 weeks of the year. There is also a prohibition against renting the property for more than 11 months per year. The property can only be purchased in the name of an individual or individuals. It is not possible for a foreigner to be able to acquire a property in the name of a company. F – Mortgages Swiss banks will lend up to 70% of the purchase price and we can introduce you to a bank which has all their documentation in English. The loan is usually granted in the form of a current account overdraft secured on the property repayable over 25 years. As interest is payable every quarter on the capital balance outstanding over that period, the repayments will be higher in the earlier years but will reduce as the capital is repaid. Swiss interest rates are the cheapest in Europe currently around 1.5% variable rate or fixed at 2% for the first ten years. It is possible to defer changing pounds sterling or euros in to Sfrs for 3 years as the bank will invest your 30% equity in a £ or € investment account. The banks do not charge a set up fee or require any life insurance. The costs for registering the mortgage varies from one canton to another but will be a maximum of 1.6% of the amount borrowed. G – Terms Of Payment If purchasing off plan you will be required by the developer to make stage payments as the construction proceeds. Each developer has a different payment structure but typically it would be a deposit of around 30,000 sfrs to reserve a property, 10% when the notary’s deed of sale is signed and then payments when the foundations and roof are started. Final payment when the keys are handed over. If you are taking bank finance then you pay the first 30% and then the bank pays the remaining stage payments. H – Annual Expenses H – Annual Running costs The annual running costs for a property are not expensive in Switzerland. The service charges for an apartment building are divided up proportionately between the owners, according to the size of their apartment. These expenses include, the caretaker, maintenance of the building and grounds, communal water, electricity and heating. In addition are structural insurance and various taxes, gardening and maintenance of roads (inc. snow clearing), administration fees and an allocation to the building’s renovation fund. These are payable quarterly, half yearly, or yearly and typically they are around 0.5% to 0.75% of the value of the property per year so 5,000 sfrs for a 3 bedroom apartment. Chalets are cheap to maintain particularly if new as very little maintenance is required. Annual Property taxes Foreigners owning a property in Switzerland pay taxes to three bodies - the Federal Government, the Canton, and the Commune. The total of all these annual taxes varies from Canton to Canton. Owners have a choice of completing a tax declaration disclosing their worldwide assets or being assessed simply on the basis of the property in Switzerland and the income it produces. Most owners elect to be assessed. The annual taxes are based on the “tax value” of a property, which is about 60% of the market value. The annual property taxes are, in effect, a tax on the notional rental income, which could be derived from the property and often you will pay almost the same annual tax if you decide to rent your apartment or if you prefer to keep it exclusively for your own use. You may also be liable to pay tax in your country of domicile. If you do not rent your property then your tax is calculated on a notional rental income which is based on the taxable value of the property (about 60% of the market value). The total annual property taxes will be around 4,500 Sfrs per year for a property valued at 1m sfrs (0.0045% of market value). Or if you do rent then you will be taxed on the actual rental income. You may deduct some expenses and interest on your mortgage. As a rule of thumb you will pay income tax at around 20% on the gross income or approximately 5,000 Sfrs on a property valued at 1m sfrs so also around (0.0045% of market value). I – Financial Considerations 1. Taxes on real estate profit (capital gains tax) In the case of resale, the property is subject to an appreciation tax. The purchase price is not indexed to the cost of living in Switzerland so the taxable profit is the difference between the sale price and the total purchase price (including fees and special renovations or improvements to the property). Deductions can be made for any commission due to the real estate agents and other costs. The rate of the capital gains tax decreases with each year of ownership, starting at 30% (if you sell within a year) and decreasing to 9% after 10 years and 1% after 25 years. 2. Return on capital The principal source of profit for foreign investors has been the Swiss Franc, which has been, and continues to be one of the strongest of the world’s currencies. Swiss real estate has appreciated on a very steady basis. Prices fell in the early 90’s, but not nearly as dramatically as they did in the UK. The market has been rising again since the mid/late 90’s. As a generalisation, prices of detached chalet do tend to go up more than apartments and if you can buy a chalet where a tour operator is prepared to offer a guaranteed rent for the season then this can make a very good hassle-free investment. 3. Administration services Local agents can handle the administration and management of your property including checking, cleaning and maintaining the property, stocking refrigerators with necessary basics before arrival, restaurant and ticket bookings, payment of bills, insurance for household contents, baby-sitting and even car delivery to the airport. 4. Rental Rental can easily be arranged through a local agent, or a larger agency such as Interhome (which has 500 agencies throughout Europe) or through a tour operator in the UK, Germany, or Holland. Renting the property out when you are not using it, can provide sufficient income to cover the annual running costs. Generally, tour operators will only give a guaranteed rental income if you are buying in a resort which is relatively high and snow sure and has a long season. They prefer to rent chalets which are part of a larger development (rather than a one off property) and also favour developments which have additional facilities. Should you decide to let your property, then any rental income would be liable for taxation in Switzerland and you may be liable to pay tax on such income in the country in which you are resident. Most countries have a dual taxation agreement with Switzerland so you get a credit for any tax paid in Switzerland. You do not get taxed twice. J – Legal Aspect Apartments are organised as ‘Propriete Par Etage’ (PPE) - in effect each apartment is ‘freehold’ and the owner of that apartment has a share of the whole building and its integral and communal parts and an exclusive right to use their own apartment. All the apartment owners are bound together in a kind of residents association (known as a “co-propriety”), which sets out the rules of the house (e.g. the laundry room to be used only between certain hours). The owners have complete control over the building, but at the annual meeting they will appoint an Administrator who will deal with the day to day running of the property. The annual meeting will also set the budget for the forthcoming year, vote on suggestions made by the administrator and apartment owners, and review any problems. A complete set of rules for co-ownership may be provided on request. Similar arrangements are made for a community of several chalets which will share costs and will be run on similar lines. K – Death Duties And Succession All properties in Switzerland are freehold and the purchaser has the right to transfer the property to his or her heirs by way of succession. Unless the purchaser becomes a Swiss resident then English law will apply, so the property will devolve in accordance with your English Will. We would advise that you have a separate Will drawn up which deals specifically with the Swiss property. A copy of your Will should be lodged with the Swiss notary. Inheritance tax is payable in Switzerland but is much lower than in the UK and most European countries. Inheritance tax is a cantonal tax and varies from one canton to another. In most cantons there is no tax between spouses and in Canton Valais (Verbier) there is zero inheritance tax if the property is willed to direct line descendants. In Canton Vaud (Villars) the tax is progressive - starting at 1.8% for property valued at up to 500,000 Sfrs, rising to 4.3 % on property valued at over 500,000 Sfrs. If the fiscal value of the property is over 1m Sfrs, the tax is levied at a rate of 5.068%. If the property is registered in the name of more than one person, then tax would be payable only on the share of the property owned by the deceased. However, as is always the case (in whatever country you may own property) where there is a dual taxation treaty, you would be liable to pay tax in the country in which you reside and be given credit for any tax paid to the foreign (Swiss) government. It is highly recommended that you consult a notary regarding the Swiss law and to take in to account your rights in your country of origin L – Residency The high standard of living, low crime figures, good health care, strong economy, low taxes and a position at the crossroads of Europe, have always attracted residents from other countries to retire or work in Switzerland. If an EU passport holder buys a holiday home in Switzerland they will be permitted to spend up to 6 months a year in Switzerland without requiring any special permission. To spend more than 6 months in Switzerland or to become resident there for tax purposes they must apply for a B permit. On 1st of June 2002, the bilateral agreement between Switzerland and EU countries came into force and this has made it much easier for EU passport holders to work and/ or reside in Switzerland. There are two types of permit - a B permit which gives you the right to reside in Switzerland (but not to work) or a permit which gives both the right to work and residency. To work in Switzerland you will need a contract of employment from a Swiss company or you could establish your own company or be self-employed. Usually you will need to show that you are creating employment for Swiss nationals or you have an annual income of over 50,000 Sfrs. It is easier to obtain a B permit (residence) on the basis that you are not gainfully employed and if you are over the age of 55 but it is still possible to obtain a B permit if you are younger! You must satisfy the following requirements: People who are not gainfully employed must have sufficient financial means for them not to become dependent on social security and a burden on the host country. They must have a private Swiss health insurance cover which covers all risks, including accidents (it costs around 120 sfrs per month). You must also pay tax in Switzerland. EC residence permits are valid for five years and will automatically be renewed by the competent authorities if the above-mentioned requirements are still satisfied. In exceptional cases, the authorities may limit individual permits to two years if the holders’ financial means do not appear to be secured. If you obtain a B permit this would entitle you to buy a property which would otherwise not be available to purchase by a foreigner and you may sign the deeds as soon as you receive the permit. NON EU Passport holders will have their applications reviewed case by case but generally the requirements, if retiring, are to have reached retirement age (60 years old), not to work in Switzerland, to prove one has sufficient financial means to live in Switzerland without working and to have personal ties in Switzerland such as family or a house. A useful book if you are considering retiring or working in Switzerland is ‘Living and working in Switzerland’ by David Hampshire (available from Amazon). Contact us for advice or to arrange a visit Contact Company Profile Simon Malster – Investors in Property Tel: +44 (0)20 8905 5511 simon@investorsinproperty.com Investors in Property specialise in the sale of ski chalets and apartments in Switzerland, Austria, France & Italy. We have over 20 years experience and an unrivalled knowledge of well established and up and coming ski resorts. We will provide expert advice and professional guidance through every step of your purchase. If you have any questions or need general advice please do not hesitate to contact us. 7 February 2013 Disclaimer Whilst we make every attempt to ensure the accuracy and reliability of the information contained in all brochures and the company website, the company, its employees and agents will not be responsible for any loss, however arising, from the use of, or reliance on this information. The sales deed prepared by the local Notary will contain all the terms of the sale and no warranty or representation made by an other person which is not specifically included in that deed of sale is legally enforceable. © Investors in Property 2013