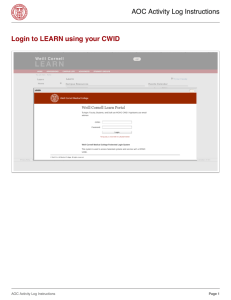

Company Timeline

AOC celebrates 20 years in business.

AOC announces introduction of Transact Global, a new issuer processing platform dedicated to virtual

card payments.

2016

Over 16,000 organizations use the EnCompass platform to pay their suppliers.

AOC receives the Top Workplaces honor from The Washington Post for the third time.

President and CEO Allen O. Cage Jr. is named a SmartCEO Future 50 Award winner for the second time.

AOC launches AR-Exchange supplier portal in partnership with 3Delta Systems.

The EnCompass platform makes over 100 million electronic transactions.

Over 185,000 merchants are enabled to receive electronic payments via the EnCompass platform.

2015

Central Bank becomes the eighth financial institution partner to white-label EnCompass for reselling to

corporate clients.

AOC receives the Top Workplaces honor from The Washington Post for the second time.

President and CEO Allen O. Cage Jr. is named a SmartCEO Future 50 Award winner for the first time.

Regions Bank becomes the seventh financial institution partner to white-label EnCompass for reselling to

corporate clients.

Over 10,000 organizations use the EnCompass platform to pay their suppliers.

2014

AOC is named to the INC 5000 list of the Fastest Growing Companies in the U.S. for the sixth time.

AOC receives the Top Workplaces honor from The Washington Post for the first time.

AOC opens a corporate office in Portland, Maine.

KeyBank becomes the sixth financial institution partner to white-label EnCompass for reselling to

corporate clients.

Over 115,000 merchants are enabled to receive electronic payments via the EnCompass platform.

AOC launches EnCompass Mobile.

2013

AOC receives the Global Award for Excellence in Innovation from Commercial Payments International.

FEDAC Processing exceeds the $1 billion threshold for transactions processed and vendors funded.

AOC is named to the INC 5000 list of the Fastest Growing Companies in the U.S. for the fifth time.

AOC opens a corporate office in Louisville, Kentucky.

AOC launches EnCompass enhancements to support international B2B payments, allowing for multi2012

currency, multi-language and respective localization.

The EnCompass platform makes over 60 million electronic transactions.

AOC is named to the INC 5000 list of the Fastest Growing Companies in the U.S. for the fourth time.

AOC launches PreFunds technology within the EnCompass platform.

2011

Over 50,000 merchants are enabled to receive electronic payments via the EnCompass platform.

AOC opens a corporate office in Columbus, Georgia.

Alaska USA Federal Credit Union becomes the fifth financial institution partner to white-label EnCompass

2010

for reselling to corporate clients.

The EnCompass platform makes over 15 million electronic transactions.

PNC becomes the fourth financial institution partner to white-label EnCompass for reselling to corporate

clients.

2009

AOC affiliate, FEDAC Processing, achieves annual processing volume that places it in the Top 100 acquirer

volume in the nation.

AOC is named to the INC 5000 list of the Fastest Growing Companies in the U.S. for the third time.

Synovus Bank becomes the third financial institution partner to white-label EnCompass for reselling to

corporate clients.

2008

Over 10,000 merchants are enabled to receive electronic payments via EnCompass.

AOC is named to the INC 5000 list of the Fastest Growing Companies in the U.S. for the second time.

Commerce Bank becomes the second financial institution partner to white-label EnCompass for reselling

to corporate clients.

2007

AOC introduces accounts payable automation offering via EnCompass platform.

AOC is named to the INC 5000 list of the Fastest Growing Companies in the U.S. for the first time.

AOC launches EnCompass commercial payments platform.

AOC develops virtual card/single-use ghost account (SUGA) offering via EnCompass platform.

2005

AOC introduces commercial card and P-card programs via EnCompass platform.

WEX becomes the first financial institution partner to white-label EnCompass for reselling to corporate

clients.

AOC President and CEO Allen O. Cage Jr. co-founds the YouthQuest Foundation, a 501(c)(3) nonprofit

organization dedicated to serving and providing scholarships to America's at-risk youth.

AOC begins development of EnCompass commercial payments platform.

2004

AOC headquarters expands to the current location at 14151 Newbrook Drive in Chantilly, Virginia.

2001

AOC develops Global Web Reporting (precursor to EnCompass platform).

AOC establishes the Federal Financial Management division of the company to provide accounting, audit

and consulting services for government agencies.

AOC's Federal Financial Management division is awarded its first contract with the U.S. Department of

2000

State.

AOC introduces commercial card and e-payables solution for the Department of Veterans Affairs.

AOC secures contract with the Department of Veterans Affairs to perform Level-3 supplier enablement.

1999

Allen O. Cage Jr. co-founds 3Delta Systems Inc., an AOC companion company focused on delivering

supplier products and services, such as payment acceptance and tokenization.

1997

AOC opens an operations and contact center in Morgantown, West Virginia.

Allen O. Cage Jr. founds and becomes President & CEO of AOC Solutions Inc., a payments technology

provider, and FEDAC Processing, an AOC affiliate dedicated to merchant processing.

1996

AOC opens company headquarters in a basement office in Fairfax, Virginia.

Visa becomes the first client of AOC.

www.aocsolutions.com | info@aocsolutions.com | 703.234.6300

© 2016 AOC Solutions Inc. | All rights reserved | 07/2016