2016 The Household, Income and Labour Dynamics in Australia

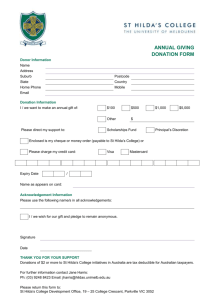

advertisement