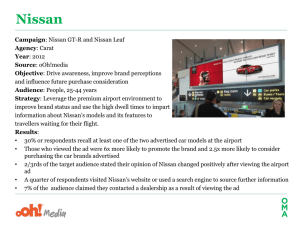

industry, Lessons from Nissan`s experience

advertisement