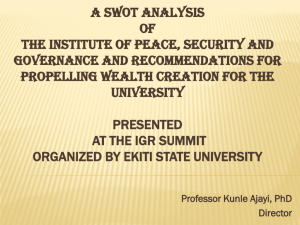

Scoping Study on Internally Generated Revenue of Nigerian States

advertisement