Find out how much truck costs per mile

advertisement

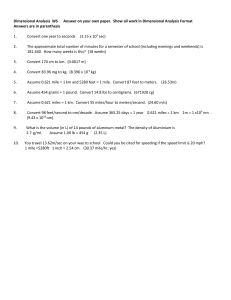

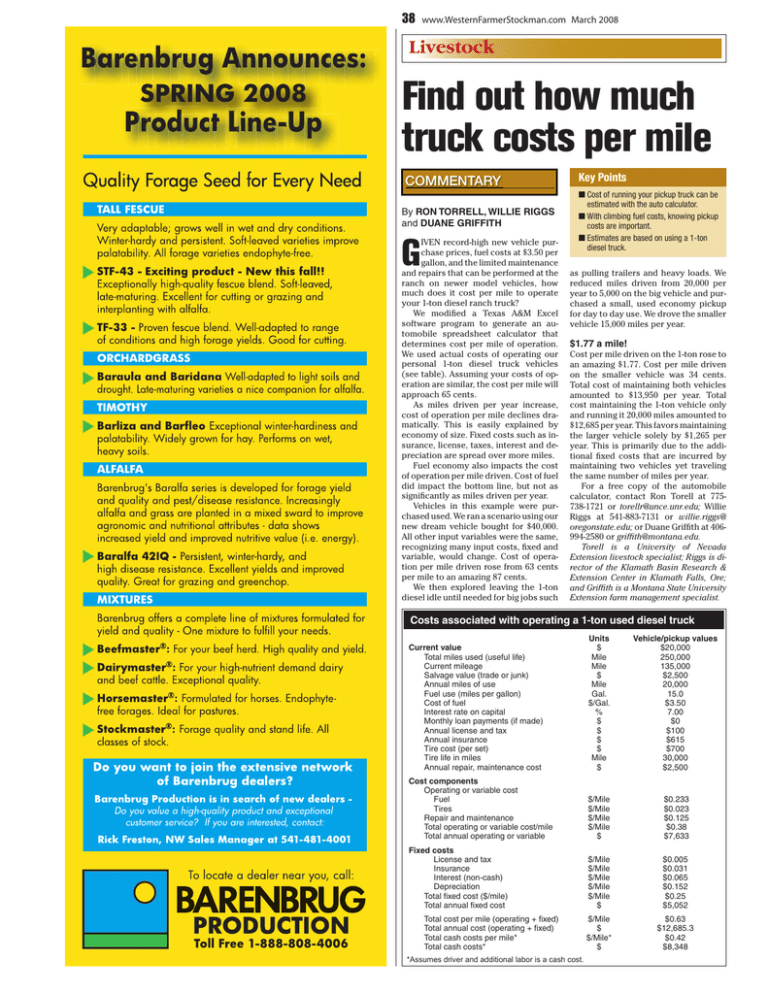

38 www.WesternFarmerStockman.com March 2008 Livestock Find out how much truck costs per mile COMMENTARY By RON TORRELL, WILLIE RIGGS and DUANE GRIFFITH IVEN record-high new vehicle purchase prices, fuel costs at $3.50 per gallon, and the limited maintenance and repairs that can be performed at the ranch on newer model vehicles, how much does it cost per mile to operate your 1-ton diesel ranch truck? We modified a Texas A&M Excel software program to generate an automobile spreadsheet calculator that determines cost per mile of operation. We used actual costs of operating our personal 1-ton diesel truck vehicles (see table). Assuming your costs of operation are similar, the cost per mile will approach 65 cents. As miles driven per year increase, cost of operation per mile declines dramatically. This is easily explained by economy of size. Fixed costs such as insurance, license, taxes, interest and depreciation are spread over more miles. Fuel economy also impacts the cost of operation per mile driven. Cost of fuel did impact the bottom line, but not as significantly as miles driven per year. Vehicles in this example were purchased used. We ran a scenario using our new dream vehicle bought for $40,000. All other input variables were the same, recognizing many input costs, fixed and variable, would change. Cost of operation per mile driven rose from 63 cents per mile to an amazing 87 cents. We then explored leaving the 1-ton diesel idle until needed for big jobs such G Key Points ■ Cost of running your pickup truck can be estimated with the auto calculator. ■ With climbing fuel costs, knowing pickup costs are important. ■ Estimates are based on using a 1-ton diesel truck. as pulling trailers and heavy loads. We reduced miles driven from 20,000 per year to 5,000 on the big vehicle and purchased a small, used economy pickup for day to day use. We drove the smaller vehicle 15,000 miles per year. $1.77 a mile! Cost per mile driven on the 1-ton rose to an amazing $1.77. Cost per mile driven on the smaller vehicle was 34 cents. Total cost of maintaining both vehicles amounted to $13,950 per year. Total cost maintaining the 1-ton vehicle only and running it 20,000 miles amounted to $12,685 per year. This favors maintaining the larger vehicle solely by $1,265 per year. This is primarily due to the additional fixed costs that are incurred by maintaining two vehicles yet traveling the same number of miles per year. For a free copy of the automobile calculator, contact Ron Torell at 775738-1721 or torellr@unce.unr.edu; Willie Riggs at 541-883-7131 or willie.riggs@ oregonstate.edu; or Duane Griffith at 406994-2580 or griffith@montana.edu. Torell is a University of Nevada Extension livestock specialist; Riggs is director of the Klamath Basin Research & Extension Center in Klamath Falls, Ore; and Griffith is a Montana State University Extension farm management specialist. Costs associated with operating a 1-ton used diesel truck Current value Total miles used (useful life) Current mileage Salvage value (trade or junk) Annual miles of use Fuel use (miles per gallon) Cost of fuel Interest rate on capital Monthly loan payments (if made) Annual license and tax Annual insurance Tire cost (per set) Tire life in miles Annual repair, maintenance cost Units $ Mile Mile $ Mile Gal. $/Gal. % $ $ $ $ Mile $ Vehicle/pickup values $20,000 250,000 135,000 $2,500 20,000 15.0 $3.50 7.00 $0 $100 $615 $700 30,000 $2,500 Cost components Operating or variable cost Fuel Tires Repair and maintenance Total operating or variable cost/mile Total annual operating or variable $/Mile $/Mile $/Mile $/Mile $ $0.233 $0.023 $0.125 $0.38 $7,633 Fixed costs License and tax Insurance Interest (non-cash) Depreciation Total fixed cost ($/mile) Total annual fixed cost $/Mile $/Mile $/Mile $/Mile $/Mile $ $0.005 $0.031 $0.065 $0.152 $0.25 $5,052 $/Mile $ $/Mile* $ $0.63 $12,685.3 $0.42 $8,348 Total cost per mile (operating + fixed) Total annual cost (operating + fixed) Total cash costs per mile* Total cash costs* *Assumes driver and additional labor is a cash cost.