16 May 2016 Quite large current account deficit

advertisement

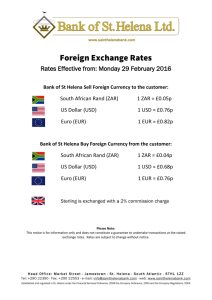

16 May 2016 RON exchange rates 4.60 Quite large current account deficit recorded during Q1 2016 4.10 USD/RON (rhs) EUR/RON 4.50 Current account deficit jumped in March and amounted to EUR 1.5bn during Q1 2016. This contrasts with a surplus of around 4.00 EUR 500mn recorded during Q1 2015. The very large current 4.40 account deficit recorded in March (around EUR 1.1bn) was mainly 3.90 the result of a large deficit in the primary income segment. However, drivers will become known only today once the central 4.30 18-Apr 26-Apr bank will release detailed statistics on balance of payments. On 3.80 13-May 5-May the other hand, the enlargement of the foreign trade deficit explains also the jump in the current account deficit in Q1 2016 Source: Daily NBR’s fixing as of 1.00 p.m (local time) from Q1 2015. Balance of foreign trade in goods and services had a deficit of EUR 423mn in Q1 2016, while it had a surplus of EUR 247mn during Q1 2015. Rapidly increasing domestic RON yield curve demand should be reflected in a visible increase of both foreign 4.0 trade deficit and current account deficit in 2016 from 2015. 3.0 2.0 Today, the Ministry of Finance plans to borrow today RON 300mn in 1.2Y T-bonds. Today's public debt auction is likely to go well, 1.0 favored by the excess liquidity on the money market which should have remained at a comfortable level. 0.0 6M 1Y 3Y 5Y Curent 10Y 1 month ago * yields to maturity (%, mid) Source: Daily NBR’s fixing as of 12.00 a.m. (local time) Raiffeisen Bank Romania: Daily rates FX quotes Interest rates for corporations TDY / TDY Bid Exc ha nge house Bid Ask EUR/RON USD/RON 4.4350 4.5550 3.9050 4.0300 4.4200 3.9000 4.5600 4.0350 EUR/USD 1.1005 1.1665 EUR/GBP 0.7686 0.8098 GBP/RON 5.6250 5.7700 5.5900 5.8000 EUR/CHF 1.0812 CHF/RON 3.9630 4.1020 3.9600 4.1050 EUR/JPY 120.52 126.53 Bid Ask 1.1494 Raiffeisen Bank’s FX quotes as of 9.00 a.m. (local time); FX quotes may change during the working day due to the market movements. For foreign exchange transactions, rates for amounts greater than EUR 20,000 or equivalent are negotiable. Treasury sales phone: RO N TDY / TDY c ross ra te s Ask US D EUR CHF G BP O/N 0.020 0.016 0.000 0.000 0.004 1W 2W 3W 0.010 0.015 0.000 0.000 0.008 0.010 0.014 0.000 0.000 0.005 0.021 0.013 0.000 0.000 0.012 1M 3M 0.020 0.015 0.000 0.000 0.012 0.050 0.006 0.000 0.000 0.010 Effective today at 9.00 a.m. (local time) Min. amount: 5,000 units in each currency +40-21-306-1991 Page | 1 Domestic financial markets FX fixing for RON Fixing 4.4974 3.9632 4.078 5.7113 3.6425 1.0202 1.4251 EUR USD CHF GBP JPY (100) PLN HUF (100) Fixing for MM rates 1D (% ) 0.04 0.59 RO BID 0.14 0.16 0.22 0.35 0.46 0.56 0.61 ON 1W 1M 3M 6M 9M 12M 13:00 local time RON money market rates 2.0% RO BO R 0.45 0.49 0.60 0.76 1.03 1.13 1.18 1.5% 1.0% 0.5% 11:00 local time 11-Mar-16 ROBOR 1M Notes: NBR fixings as of 13 May 2016 Specific money market rules apply to establish the validity of ROBOR fixings RON T-securities* Bid Ask Te nor Y ie ld Y ie ld 6M 1Y 3Y 5Y 10Y April: auctions for RON T-securities 0.58 0.75 1.92 2.75 3.66 0.32 0.50 1.70 2.53 3.45 Amount 0.0% 13-May-16 12-Apr-16 ROBOR 3M ROBOR 6M Dynamics of RON yields Y ie ld Da te Te nor Ta rge t Ac tua l 5- May 1.0 1000 960 9- May 3.8 500 520 12- May 8.8 300 328 16- May 1.2 300 19- May 6.6 300 23- May 4.8 400 26- May 2.9 3300 500 1808 Avg 0.70 2.26 3.58 5.0 Ma x 0.74 2.28 3.60 4.0 3.0 2.0 1.0 20-Nov-15 18-Feb-16 6M 1Y 5Y 10Y *NBR's fixing as of 13 May 2016 (12.00 local time) 0.0 13-May-16 3Y Eurobonds issued by Romania (in EUR) Ma turity IS IN XS0371163600 XS0852474336 XS0972758741 XS1060842975 XS1129788524 XS1312891549 Da te Jun 2018 Nov 2019 Sep 2020 Apr 2024 Oct 2024 Oct 2025 XS1313004928 Oct 2035 Y e a rs Cupon 2.1 6.50 3.5 4.88 4.3 4.63 7.9 3.63 8.5 2.88 9.5 2.75 19.5 3.88 Mid yie ld 0.14 0.39 0.72 2.12 2.22 2.39 Mid pric e 113.25 115.47 116.64 110.90 105.00 103.00 3.57 104.25 Foreign market rates 1.0% 0.8% 0.6% 0.4% 0.2% 0.0% -0.2% -0.4% 20-Nov-15 Date as of 13 May 2016 17:24 (local time) Source: Bloomberg 16-Feb-16 -0.6% 12-May-16 Euribor 1M Euribor 6M Libor Usd 1M Libor Usd 6M International financial market FX ma rke t ra te s* 1D (%) EUR/USD 1.1312 - 0.40 O/N - 0.342 0.38500 GBP/USD 1.4363 - 0.42 1W - 0.363 0.40490 USD/CHF 0.9763 0.42 1M - 0.349 0.43445 USD/JPY 108.70 0.06 3M - 0.258 0.62610 6M - 0.144 0.90665 9M - 0.079 n.a 12M - 0.012 1.22690 Date as of 16 May 2016 08:33 (local time) Euribor Libor US D Foreign exchange rates 1.18 125 1.14 120 1.10 115 1.06 110 Libor Usd fixing on 12 May 2016 Euribor fixing on 12 May 2016 IRS 2Y - 0.16 0.88 EUR IRS rates on 12 May 2016 , 16.00 USD IRS rates on 12 May 2016 , 16.00 IRS 5Y IRS 10Y 0.01 0.56 1.20 1.62 1.02 24-Nov-15 22-Feb-16 105 16-May-16 USD/JPY (rhs.) EUR/USD Note: Specific money market rules apply to establish the validity of LIBOR USD and EURIBOR fixings Source: Bloomberg, Thomson Reuters Datastream Page | 2 Bucharest Stock Exchange (BSE): daily trading summary Issue r Close 1D (% ) FP SIF1 SIF2 SIF3 SIF4 SIF5 FONDUL PROPRIETATEA SIF BANAT CRISANA SIF MOLDOVA SIF TRANSILVANIA SIF MUNTENIA SIF OLTENIA 0.72 1.41 0.67 0.24 0.54 1.40 - 0.1 0.0 - 0.2 - 1.7 0.0 - 0.1 TLV BRD BANCA TRANSILVANIA BRD - GSG 2.76 9.81 0.9 0.3 BVB TEL EL SNP SNN SNG TGN Issue r Close BURSA DE VALORI BUC. TRANSELECTRICA ELECTRICA OMV PETROM NUCLEARELECTRICA ROMGAZ TRANSGAZ 25.00 29.20 12.10 0.23 4.98 22.95 271.00 BS E turnove r (EUR mn) 1D (% ) 1.2 - 0.5 0.3 0.2 3.1 - 0.9 0.0 8.43 Date as of 13 May 2016 19:00 (local time) Main BSE indexes Inde x BET BET- TR BET Plus BET- FI V a lue 6462.97 7387.74 958.14 1D 0.2 0.2 0.2 1M - 4.0 - 3.7 - 4.0 3M 5.3 5.7 5.0 6M - 11.3 - 11.0 - 10.8 1Y - 14.0 - 10.0 - 13.3 Y TD - 7.7 - 7.4 - 7.4 7500 32000 7000 30000 25569.12 - 0.3 - 8.3 - 4.3 - 17.1 - 18.2 - 15.5 6500 28000 5002.80 7389.26 936.1 0.2 0.2 0.2 - 4.6 - 4.2 - 4.6 4.7 5.1 4.3 - 12.0 - 11.7 - 11.5 - 14.9 - 10.9 - 14.2 - 7.2 - 6.8 - 6.8 6000 26000 12327.59 - 0.3 - 8.8 - 4.9 - 17.8 - 19.0 - 15.0 BET EUR BET- TR EUR BET Plus EUR BET- FI EUR 5500 26-Feb-16 Note: All changes are in % 5-Apr-16 BET 24000 13-May-16 BET-FI (RHS) Date as of 13 May 2016 19:00 (local time) Mutual Funds managed by Raiffeisen Asset Management P e rforma nc e (% ) Y e a r on ye a r Y e a r to da te (yoy) (ytd) Inc e ption month Asse ts unde r ma na ge me nt (RO N mn)* Ne t Asse t V a lue pe r unit (NAV ) Raiffeisen Benefit Jun 2006 72.29 147.5503 - 5.6 - 3.4 Raiffeisen Romania Actiuni Aug 2007 16.51 38.6578 - 10.9 - 10.5 Raiffeisen Confort Sep 2007 326.75 160.9169 - 0.7 - 0.9 Raiffeisen RonPlus Sep 2008 2,687.09 176.7616 2.9 1.0 Raiffeisen RonFlexi Jun 2011 747.22 125.0817 2.3 0.8 Raiffeisen EuroPlus (in EUR) Oct 2009 479.06 127.4677 1.6 0.7 Raiffeisen DolarPlus (in USD) Oct 2010 104.51 1195.2354 2.2 1.1 Raiffeisen Confort Euro (in EUR) Oct 2013 53.55 28.2012 - 3.3 - 0.4 * EUR mn for Raiffeisen EuroPlus and Confort Euro, and USD mn for Raiffeisen DolarPlus NAV as of: 11 May 2016 For further details please visit www.raiffeisenfonduri.ro 46 166 44 161 42 156 40 151 38 11-Nov 12-Jan 14-Mar 11-May 146 11-Nov 12-Jan 14-Mar 11-May 178 127 175 125 172 123 169 NAV Romania Actiuni NAV Benefit NAV Confort 11Nov 121 1411Mar May Raiffeisen RON Plus (rhs.) 12-Jan Raiffeisen RON Flexi 129 1220 127 1200 125 1180 123 1160 121 11Nov 12-Jan 14Mar 1140 11May Raiffeisen Dolar Plus (rhs.) Raiffeisen Euro Plus Page | 3 Research team for macroeconomics and financial markets Ionut Dumitru – Chief Economist, Nicolae Covrig – Financial Analyst, Silvia Maria Rosca –- Financial Analyst, +40 - 730 - 222 - 953 +40 - 799 - 718 - 476 +40 - 799 - 718 - 083 Disclaimer Financial Analysis - Raiffeisen BANK Romania Publisher: Raiffeisen Bank S.A. Romanian legal person authorised to carry out banking activities, managed in a two tire system, with legal premises in Sky Tower building located at 246 C Calea Floreasca, 1st district, Bucharest, postal code 014476, registered at Trade Register under no. J40/44/1991, Sole Registration no. 361820, VAT registration number RO361820, listed in the Banking Register under no. RB-PJR-40-009/1999, in its capacity as an Intermediary, registered with the Romanian Financial Supervisory Authority under no. PJR01INCR/400009 (abbreviated as “RBRO”) Supervisory authority: The National Bank of Romania (NBR) and the Financial Supervisory Authority (FSA) This document is for information purposes, is delivered without any charge, and may not be reproduced or distributed to other persons. This document is governed by Romanian legislation in force and constitutes neither a solicitation of an offer nor a prospectus in the sense of the Capital Market Law no. 297/2004 or any other comparable foreign law. An investment decision in respect of a security, financial product or investment must be made on the basis of an approved, published prospectus or the complete documentation for the security, financial product or investment in question, and not on the basis of this document. This document does not constitute a personal recommendation to buy or sell financial instruments, or consultancy in the sense of the Capital Market Law no. 297/2004, or counselling of any kind. Neither this document nor any of its components shall form the basis for any kind of contract or commitment whatsoever. This document is not a substitute for the necessary advice on the purchase or sale of a security, investment or other financial product. In respect of the sale or purchase of securities, investments or financial products, your banking advisor can provide individualised advice which is suitable for investments and financial products. This analysis is fundamentally based on generally available information and not on confidential information which the party preparing the analysis has obtained exclusively on the basis of his/her client relationship with a person. Unless otherwise expressly stated in this publication, RBRO deems all of the information to be reliable, but does not make any assurances regarding its accuracy and completeness. Past performance is no guarantee for the future performance of the financial instruments. No assurance can be given regarding the favourable return of the financial instruments portfolio or of an issuer described in this report. It is possible that, due to various factors, the projections are not met. Nor RBRO, nor any of its directors, officers or employees are responsible for any loss or damage that may result from the use of this document, of its content or in some other way. Any transaction with financial instruments involves risks among which are included but not limited to: the fluctuation of the prices in the relevant market; the unpredictability of dividends, profitability and profits; the fluctuation of the exchange rates, of the interest rates and of the yields. Please be informed that it is possible that the Bank, its affiliates or its employees may hold on their own account products / financial instruments referred to in this material, carry on sale, purchase or any other transaction with these products / financial instruments, be a market maker for these products / financial instruments, provide investment banking services, lending or other services in connection with the issuers mentioned herein this material or have intermediated public offerings related to these issuers. The information in this publication is current, up to the dates mentioned in the document. It may be outdated by future developments, without the present publication being changed. The analysts employed by RBRO are not compensated for specific investment banking transactions. Compensation of the author or authors of this report is based (amongst other things) on the overall profitability of RBRO, which includes, inter alia, earnings from investment banking and other transactions of RBRO. In general, RBRO forbids its analysts and persons reporting to the analysts from acquiring securities or other financial instruments of any enterprise which is covered by the analysts, unless such acquisition is authorised in advance by RBRO’s Compliance Department. RBRO has put in place the following organisational and administrative agreements, including information barriers, to impede or prevent conflicts of interest in relation to recommendations: RBRO has designated fundamentally binding confidentiality zones. Confidentiality zones are typically units within credit institutions, which are isolated from other units by organisational measures governing the exchange of information, because compliance-relevant information is continuously or temporarily handled in these zones. Compliance-relevant information may fundamentally not leave a confidentiality zone and is to be treated as strictly confidential in internal business operations, including interaction with other units. This does not apply to the transfer of information necessary for usual business operations. Such transfer of information is limited, however, to what is absolutely necessary (need-to-know principle). The exchange of compliance-relevant information between two confidentiality zones may only occur with the involvement of the Compliance Officer. If any term of this Disclaimer is found to be illegal, invalid or unenforceable under any applicable law, such term shall, insofar as it is severable from the remaining terms, be deemed omitted from this Disclaimer; it shall in no way affect the legality, validity or enforceability of the remaining terms. This material is exclusively addressed to the recipients of the e-mail. It may not be reproduced, retransmitted or published, in whole or in part, for any purpose without the written consent of RBRO. By receiving this document, the recipient agrees to the terms specified above. Page | 4