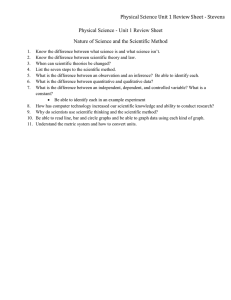

See Faculty Bios - Stevens Institute of Technology

advertisement

SPEAKERS KHALDOUN KHASHANAH I O N U T F LO R E S C U PhD, Professor and Financial Engineering Director, Stevens Institute of Technology PhD, Research Professor, Director of The Hanlon Financial Systems Lab, Stevens Institute of Technology Dr. Khashanah joined Stevens in 1994 and initiated the FE Dr. Florescu’s Ph.D. is in Statistics from Purdue University and program in the Department of Mathematical Sciences in 2002. his research is concentrated in Stochastic Processes and their He holds a 1994 PhD in Applied Mathematics from the University applications. He has authored three books, served as the main of Delaware, Newark, Delaware, in the field of partial differential editor for volumes of articles in High Frequency Finance, and has equations and mathematical modeling of mixed media. He holds authored over 35 journal and conference publications. Professor a Masters of Science in Applied Mathematics in complex Florescu expertise lies in developing stochastic models and variables from the University of Cincinnati. Dr. Khashanah received two undergraduate degrees in Electrical Engineering and Mathematics from the University of Petroleum and Minerals in 1987. using them for real-life applications. As detailed in many in publications, these applications pertain to computer vision, cryptography, environmental studies, geophysics and transformative learning. Dr. Khashanah’s research started with nonlinear Biot Theory of acoustics in porous One such application is the Stevens High Frequency Trading (SHIFT) Simulation elastic media and boundary transmission problems in mixed media with interest in System which started development in January 2014. It is the first model of its kind to inverse problems. More recently, his research has been dedicated to information- test the behavior of modern high frequency financial markets using live, real-time theoretic financial risk flow networks, high frequency finance, systemic risk, data market data. Other applications include the ABCShift a patented computer vision visualization, the science of complexity and standards, financial complex adaptive algorithm that allows tracking of objects in videos when the background is changing, systems, and systems taxonomy. Among other funded projects, he is the PI of ROI the cloud robotics application, liquidity studies in finance and his main area of project ACTUS for algorithmic contract type unified standards funded by the Alfred expertise stochastic volatility modeling. P Sloan Foundation. Dr. Khashanah is a member of the Committee to Establish the National Institute of Finance, New York Society of Security Analysts, International Association of Quantitative Finance, and The International Council on Systems Engineering. He is also cofounder and President of Computum© Technologies, Inc. DISRUPTIVE TECHNOLOGIES: FUTURE OF PENSION ASSETS & FUNDING SPEAKERS R U PA K C H AT T E R J E E PhD, Industry Professor and Financial Engineering Deputy Director, Stevens Institute of Technology Dr. Rupak Chatterjee has over fifteen years’ experience as a quantitative analyst working for various top-tier Wall Street firms. His last role before returning to academia was as Director of the Multi-Asset Hybrid Derivatives Quantitative Research group at Citi in New York. He was also the Global Basel III coordinator for all modeling efforts needed to satisfy the new regulatory risk requirements imposed on banks. Previously, he was a quantitative analyst at Barclays Capital, a vice president at Credit Suisse, and a senior vice president at HSBC. His educational background is in theoretical physics where he studied at Stony Brook University and the University of Chicago. Professor Chatterjee’s current research focuses on quantum computing, machine learning, and computational finance. He helped to launch the Center for Distributed Quantum Computing at Stevens and was the inaugural program manager for the Accenture-Stevens Financial Services Analytics graduate program. His recent book, Practical Methods of Financial Engineering and Risk Management, Stevens Series on Quantitative Finance, Springer, was published in August 2014 to great reviews. DISRUPTIVE TECHNOLOGIES: FUTURE OF PENSION ASSETS & FUNDING