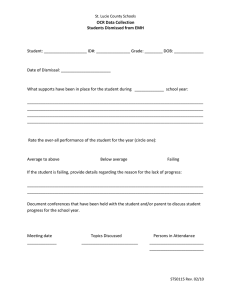

Guidelines on failing or likely to fail

advertisement