Energy Horizons - Western States Petroleum Association

advertisement

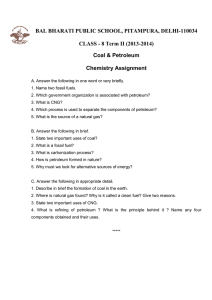

Western States Petroleum Association Energy Horizons Petroleum 401 Joe Sparano Western States Petroleum Association December 9-10, 2009 Western States Petroleum Association From wellhead to pump – a complicated business Explore Produce Natural Gas Wellhead Transport Refine/Process Natural Gas Processing Plant Natural Gas Pipeline Distribute Market Homes and Businesses Natural Gas Pipeline Truck Oil Pipeline Refinery Underground Oil Onshore Oil & Natural Gas Production Distribution Terminal Storage Tanks Cogeneration Product Pipeline Cogeneration 2 Imports Offshore Oil & Natural Gas Production Gasoline, Diesel, Jet Fuel Western States Petroleum Association Simplified refinery process 3 Source: U.S. Energy Information Administration Western States Petroleum Association Capital cost of refinery construction Current cost for refinery construction – approximately $25,000 per barrel/day of capacity Proposed 163,000 bbl/day refinery in Arizona - $4 billion Proposed 400,000 bbl/day refinery in South Dakota - $10 billion 4 Source: Arizona Clean Fuels Yuma website; Hyperion Energy Center website Western States Petroleum Association The costs in a gallon of gasoline What we pay for in a gallon of gasoline Taxes 16% Distribution & Marketing 9% Refining 6% Crude Oil 69% 5 Source: U.S. Energy Information Administration Based on U.S. average price for regular gasoline October 2009 Western States Petroleum Association Taxes are a factor in gasoline prices Gasoline taxes 70 65.8 62.8 55.9 60 51.5 47.3 Cents per gallon 50 43.4 37.4 40 30 20 10 Ar izo na O re go n Ha wa ii Ne va da to n Source: API, October 2009 Na tio na lA ve ra ge 6 W as hi ng Ca lifo rn ia 0 Western States Petroleum Association Products manufactured from a barrel of California oil Source: California Energy Commission, Fuels Office, PIIRA database, based on 2004 data. 7 Western States Petroleum Association Western US refining capacity West Coast refining system includes nearly 2.6 million B/D of capacity distributed across three regions connected by waterborne trade… 8 Source: Purvin & Gertz, West Coast Region Discussion Document, May 2006 Western States Petroleum Association Western Canada refining – Burnaby Bay refinery 9 Approx. 55,000 B/D fuels refinery near Vancouver Processes oil from northern British Columbia and Alberta delivered via a 1,200 - kilometer pipeline Crude and synthetic oils, condensate and butanes refined into 50,000 to 55,000 barrels of gasoline, diesel, jet fuel, asphalt, heating fuel, heavy fuel oil, butane and propane every day Source: Chevron Corporation website Western States Petroleum Association Refinery capacity – California issues may migrate 10 CEC forecasts no significant expansion of state refining capacity Economic upheaval and permitting barriers cited as factors in delays of 2 major expansion projects Source: California Energy Commission Transportation Energy Forecasts and Analysis for the 2009 Integrated Energy Policy Report, August 2009 Western States Petroleum Association Refinery capacity forecast – West Coast 11 Regulatory uncertainty, permitting delays and NIMBY issues have contributed strongly to minimal investment in infrastructure and refinery capacity growth Minimal West Coast refinery capacity growth anticipated between 2007 and 2020 EIA AEO forecast shows PADD 5 refinery capacity increases ~25,000 B/D in 2020 Source: ICF International; Outlook for PADD 5 Supply, Demand and Infrastructure Based on 2009 EIA Annual Energy Outlook, April 2009 Western States Petroleum Association PADD 5 motor gasoline forecast supply & demand (TBD) 2007 Supply Refinery Production Imports Net PADD Transfers Ethanol / Biodiesel 2012 1,314 Non-PADD 5 Supply Demand Consumption Exports Total Demand 2020 1,353 1,373 94 59 (94) 143 112 35 79 160 200 121 0.2 5 5 1,630 1,625 1,612 19% 15% 13% 1,626 1,621 1,609 4 4 4 1,630 1,625 1,612 Liquids from Biomass Total Supply Change 2007-2020 (108) (18) (17) 0 (18) Motor gasoline volumes include motor gasoline blending components. Imports modified slightly in 2007 to eliminate inventory build or draw 12 Source: ICF International; Outlook for PADD 5 Supply, Demand and Infrastructure Based on 2009 EIA Annual Energy Outlook, April 2009 Western States Petroleum Association Infrastructure and transportation fuel supply 13 Demand for transportation fuels has been outpacing supply; recent reductions in product consumption Crude oil imports increasing with lower California and Alaska production California petroleum infrastructure at capacity (CEC) Future energy needs will be addressed through imports California already dependent on waterborne deliveries; marine infrastructure is a critical chokepoint Port congestion, minimal additions to terminal storage and pipeline infrastructure have become increasing constraints at higher demands and as ethanol has been integrated in the supply chain (ICF) Western States Petroleum Association Marine deliveries of foreign crude increasing 2003 2007 2008 (Nov) 600 511.4 530.9 Volume Imported (TBD) 500 400 386.4 358.9 348.3 292.5 300 218.5 223.4 200 148.3 100 0 Greater Los Angeles 14 San Francisco Bay Area Puget Sound Note: volumes do not include ANS marine deliveries to West Coast. In 2007 all ANS production was shipped to the U.S. West Coast except for volumes to meet Alaska finished product demand (estimated at about 120 TBD). ICF estimates about 600 TBD ANS supply in 2007 to California and Washington ports. Source: ICF International, EIA AEO 2009 Western States Petroleum Association Increased renewable & alternative fuels (ethanol) requires major investments in new infrastructure PADD 5 Ethanol Demand/Requirements 250000 Total ethanol demand/RFS requirements Barrels per day Barrels per Day 200000 Maximum expected PADD 5 ethanol production - 2010 150000 100000 50000 0 2007 15 Source: ICF International, EIA AEO 2009 2012 2020 Western States Petroleum Association More supply/demand and infrastructure issues The narrowing “gap” between demand for products and refinery input, and product quality transitions, have put more stress on the supply/demand infrastructure Demand increases of over 500,000 B/D (23%) occurred from 1995 to 2007 with virtually no change in PADD 5 infrastructure (terminal storage, pipelines, marine) and minimal refinery capacity growth Higher prices and the recession have reduced total demand in 2008 by about 140,000 B/D clean products (5%) Renewable and alternative fuels infrastructure inadequate to meet future expectations for growth 16 Source: ICF International, EIA AEO 2009 Western States Petroleum Association California crude oil production Low Decline High Decline Historical Production Crude Oil Production (TBD) 1,200 1,000 Low Production Decline Scenario -2.20% per year 1991-2008 Average Rate of Decline 800 600 400 High Production Decline Scenario -3.03% per year 2003-2008 Average Rate of Decline 200 17 Source: ICF International; Outlook for PADD 5 Supply, Demand and Infrastructure Based on 2009 EIA Annual Energy Outlook, April 2009 *2008 data through September 2008 2030 2028 2026 2024 2022 2020 2018 2016 2014 2012 2010 2008 2006 2004 2002 2000 1998 1996 1994 1992 1990 1988 1986 0 Western States Petroleum Association Alaska crude oil production Historical Production AEO 2009 Crude Oil Production (TBD) 2,250 2,000 1,750 1,500 1,250 1,000 750 500 250 18 Source: ICF International; Outlook for PADD 5 Supply, Demand and Infrastructure Based on 2009 EIA Annual Energy Outlook, April 2009 2030 2028 2026 2024 2022 2020 2018 2016 2014 2012 2010 2008 2006 2004 2002 2000 1998 1996 1994 1992 1990 1988 1986 0 Western States Petroleum Association West Coast crude oil import supplies PADD 5 Production Refinery Crude Input 3,000 Volume (TBD) 2,500 2,000 Imports 1,500 1,000 500 19 Source: ICF International; Outlook for PADD 5 Supply, Demand and Infrastructure Based on 2009 EIA Annual Energy Outlook, April 2009 2029 2027 2025 2023 2021 2019 2017 2015 2013 2011 2009 2007 0 Western States Petroleum Association Where the West Coast gets its foreign oil West Coast Foreign Imports 2008 Saudi Arabia 21% Other 24% Korea 2% Colombia 4% Iraq 15% Angola 4% Brazil 5% 20 Source: Energy Information Administration Canada 12% Ecuador 13% Western States Petroleum Association Canada’s energy reserves 21 Source: Government of Alberta, Oil & Gas Journal Western States Petroleum Association Importance of Canadian petroleum supply 22 Source: Government of Alberta, Canada Western States Petroleum Association West Coast petroleum product distribution 23 Source: Purvin & Gertz, West Coast Region Discussion Document, May 2006 Western States Petroleum Association Crude oil, product imports into West Coast 500,000 450,000 Thousand Barrels 400,000 350,000 300,000 Crude oil 250,000 200,000 150,000 100,000 50,000 Source: Energy Information Administration 20 05 20 07 20 01 20 03 19 93 19 95 19 89 19 91 19 85 19 87 19 81 19 83 24 19 97 19 99 Refined Products 0 Western States Petroleum Association West Coast demand forecast 1,800 Thousand Barrels Per Day 1,600 1,400 1,200 2007 1,000 2012 800 2020 600 400 200 0 Gasoline 25 Distillate Jet Fuel Source: ICF International; Outlook for PADD 5 Supply, Demand and Infrastructure Based on 2009 EIA Annual Energy Outlook, April 2009 Western States Petroleum Association CEC transportation fuels forecast 2007 - 2030 60.0% 51.2% 50.0% 40.0% 30.0% 22.5% 20.0% 10.0% 7.0% Gasoline 0.0% 1 2 Diesel Jet 3Fuel Crude 4 Oil -10.0% -20.0% -30.0% -40.0% 26 -33.6% Source: California Energy Commission Transportation Energy Forecasts and Analysis for the 2009 Integrated Energy Policy Report, August 2009; Low-demand forecast Western States Petroleum Association Caltrans forecasts 2008 - 2030 – a contradiction? 70% Percent Change 60% 60% 55% 50% 43% 40% 30% 20% 10% 3% 0% 27 Gasoline & diesel consumption (billions of gallons) Vehicle miles traveled (billions of miles) Number of registered Fuel economy (miles vechiles (millions) per gallon) Western States Petroleum Association The West Coast is an energy island 28 Source: California Energy Commission Western States Petroleum Association Petroleum product distribution Increasing number of international refineries produce finished products meeting California’s strict fuel specifications 29 Source: Purvin & Gertz, West Coast Region Discussion Document, May 2006 Western States Petroleum Association West Coast crude oil, gasoline, diesel prices 600 $6.00 500 $5.00 400 $4.00 Crude Oil Gasoline 300 $3.00 Diesel $2.00 200 100 $1.00 7/7/2009 1/7/2009 7/7/2008 1/7/2008 7/7/2007 1/7/2007 7/7/2006 1/7/2006 7/7/2005 1/7/2005 7/7/2004 1/7/2004 7/7/2003 Source: Energy Information Administration 1/7/2003 7/7/2002 1/7/2002 7/7/2001 1/7/2001 7/7/2000 30 1/7/2000 0 Western States Petroleum Association Selected West Coast gasoline prices $5.00 $4.50 $4.00 $3.50 West Coast (PADD5) California $3.00 $2.50 Los Angeles $2.00 San Francisco $1.50 Seattle $1.00 $0.50 Oct-09 Jul-09 Apr-09 Jan-09 Oct-08 Jul-08 Apr-08 Jan-08 Oct-07 Jul-07 Apr-07 Jan-07 Oct-06 Jul-06 Apr-06 Jan-06 Oct-05 Jul-05 Apr-05 Jan-05 Oct-04 Jul-04 Apr-04 Jan-04 $0.00 31 Source: Energy Information Administration; All Grades All Formulations Retail Gasoline Prices (Cents per Gallon) Western States Petroleum Association West Coast gasoline Oct-2009 prices - October 2009 $3.15 $3.10 $3.05 $3.00 $2.95 $2.90 $2.85 $2.80 $2.75 $2.70 $2.65 West Coast (PADD5) California Los Angeles San Francisco 32 Source: Energy Information Administration; Monthly Average; All Grades All Formulations Retail Gasoline Prices Seattle Western States Petroleum Association Major factors that impact product prices Global and regional crude oil costs Regional and local supply/demand issues Inventories Refinery/infrastructure capacity, operations and outages Other marketplace factors/issues Taxes 33 Source: Energy Information Administration Western States Petroleum Association 34