Beneficiary Designation - Cornell University

advertisement

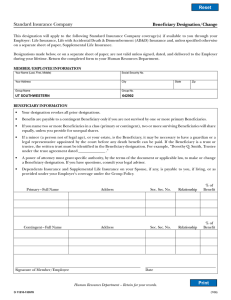

Beneficiary Designation Form Cornell University - Active Employees Basic Life Insurance Cigna Customer Service Center administered by McCamish Systems, LLC PO Box 14577 Des Moines, IA 50306 1.800.231.1193 Facsimile 1.877.435.7181 Collect 515.243.1776 from Alaska or Outside the U.S.A. CLEAR FORM Employee Name: Current Address: City: Social Security Number: State: Home Phone: Zip: Work Phone: Please review the back of this form for Guidelines for Designation of Beneficiaries BASIC LIFE INSURANCE, Cigna Life Insurance Company of New York PRIMARY BENEFICIARY DATE OF BIRTH (FLY-051460) RELATIONSHIP TO EMPLOYEE SOCIAL SECURITY NUMBER PERCENTAGE Total Must = 100% % % CONTINGENT BENEFICIARY DATE OF BIRTH RELATIONSHIP TO EMPLOYEE SOCIAL SECURITY NUMBER PERCENTAGE Total Must = 100% % % If you need additional space for your beneficiaries - sign, date and attach a separate sheet of paper using the above format. Primary and Contingent Beneficiaries - Unless you designate a percentage, proceeds are paid to primary surviving beneficiaries in equal shares. Proceeds are paid to contingent beneficiaries only when there are no surviving primary beneficiaries. If you designate contingent beneficiaries and do not designate percentages, proceeds are paid to the surviving contingent beneficiaries in equal shares. Unless otherwise provided, the share of a beneficiary who dies before the insured will be divided proportionately among the surviving beneficiaries in the respective category (primary or contingent). Community Property Laws - If you are married, reside in a community property state (Arizona, California, Idaho, Louisiana, Nevada, New Mexico, Texas, Washington or Wisconsin), and name someone other than your spouse as beneficiary, it is possible that payment of benefits will be delayed or disputed unless your spouse also signs the beneficiary designation. Spouse Signature: Owner Signature: 831620 01/2013 Date: Date: GUIDELINES FOR DESIGNATION OF BENEFICIARIES General - Please be sure to include the beneficiary’s full name, social security number and relationship to you. Providing this information can help expedite the claim process by making it easier to locate and verify beneficiaries. Minors - While you may designate minors as beneficiaries, please note that claim payments may be delayed due to special issues raised by these designations. In the event of a claim and the beneficiary is a minor child, the insurance proceeds will not be released to the minor child. The insurance proceeds may be paid to a duly appointed guardian of the child’s estate. You may want to obtain the assistance of an attorney in drafting your beneficiary designation. Trust as Beneficiary - You may designate a trust as beneficiary, using the following form: "To [name of trustee], trustee of the [name of trust], under a trust agreement dated [date of trust]." If you wish to designate a testamentary trust as beneficiary (i.e. one created by will), you should recognize the possibility that your will which was intended to create this trust may not be admitted to probate (because it is lost, contested, or superseded by a later will). Claim payment delays can result if the beneficiary designation doesn’t provide for this situation. Domestic Partner - If you wish to designate your domestic partner as your beneficiary, you must complete a beneficiary form. Otherwise, your death benefit will automatically be paid to the first beneficiary listed as follows who is living at the time of your death: (1) your spouse; (2) your child(ren); (3) your parents; (4) your siblings; or (5) your estate. Life Status Changes - We recommend that you review your beneficiary designation when significant life status events occur, such as marriage, divorce, or birth of a child. See an Attorney! The above guidelines are general, and are not intended to be relied on as legal advice. Unless your designation is a simple one, we recommend that you obtain the assistance of an attorney in drafting your beneficiary designation. A qualified attorney can help assure that your beneficiary designation correctly reflects your intentions, is clear and unambiguous, and meets legal requirements. PRINT 831620 01/2013 (BACK)