beyond borders - Semiconductor Industry Association

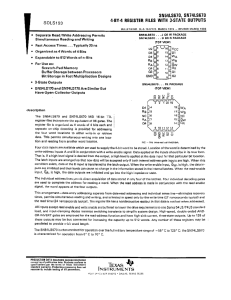

advertisement