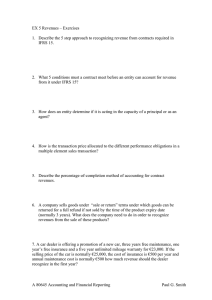

Financial reporting in the oil and gas industry

advertisement