July.14_1520 Non Cumulative Form Hin-Eng

advertisement

g§emo{YV ànÌ "H$' (21 Aà¡b, 2014 H$mo A{Ygy{MV)

AmdoXZ g§»`m

emIm H$m

Zm_:_____________

8% ~MV (H$a`mo½`) ~m§S>, 2003 Ho$ {bE AmdoXZ

J¡a g§M`r

(Ohm§Ano{jV hmo √ H$m {MhZ bJmE§Ÿ& joÌ '*' A{Zdm`©h¢)

Ho$db H$m`m©b` à`moJ Ho$ {bE

Xbmb H$m Zm_

Ed§H$moS>

Cn-Xbmb H$m Zm_

Ed§H$moS>

~¢H$ emIm _wha

emIm H$m Zm_

Ed§H$moS>

~rEbE g§»`m

qbH$ gob H$mo A§VaU

H$s VmarI

({XZm§H$/_mh/df©)

{deof Mmby ImVm _|

O_m H$s VmarI

({XZm§H$/_mh/df©)

gaH$mar ImVm _|

O_m H$s VmarI

({XZm§H$/_mh/df©)

AmdoXZ àmá

H$s VmarI

({XZm§H$/_mh/df©)

emIm H$m nyam nVm

Ûmam gË`m{nV

AmdoXH$ (H$m|) H$m/Ho$ Zm_ [ gm\$ Ajam| _| ]

àW_§AmdoXZ: lr/lr_Vr/gwlr

A§{V_ Zm_

àW_ Zm_

_Ü` Zm_

A§{V_ Zm_

àW_ Zm_

_Ü` Zm_

A§{V_ Zm_

àW_ Zm_

_Ü` Zm_

A§{V_ Zm_

àW_ Zm_

_Ü` Zm_

{ÛVr` AmdoXH$: lr/lr_Vr/gwlr

V¥Vr` AmdoXH$: lr/lr_Vr/gwlr

A{^^mdH$: lr/lr_Vr/gwlr

A{^^mdH$ H$m Ad`ñH$ Ho$ gmW g§~§Y

[ ]

{nVm

[ ]

_mVm

[ ]

d¡Y A{^^mdH$

*OÝ_ {V{W : àW_ AmdoXH$ ({XZm§H$/_mh/df©) ................/................/...................qbJ: nwê$f/_{hbm

*OÝ_ {V{W : X²{dVr` AmdoXH$ ({XZm§H$/_mh/df©)................/................/.................qbJ: nwê$f/_{hbm

*OÝ_ {V{W : V¥Vr` AmdoXH$ ({XZm§H$/_mh/df©)................/................/...................qbJ: nwê$f/_{hbm

_mVm H$m Zm_

A§{V_ Zm_

àW_ Zm_

_Ü` Zm_

AmdoXH$ H$m nÌmMma H$m nVm :

Q>obr\$moZ (H$m`m©b`/Amdmg)

B©-_ob H$m nVm

PAGE01

pñW{V :

[ ] {Zdmgr ì`{º$

[ ] EM `y E\$

[ ] Ad`ñH$ H$s Amoa go

[ ] Y_m©W©g§ñWmZ

[ ] _w»VmaZm_m YmaH$

[ ] {díd{dÚmb`

{Zdoe H$m ã`m¡am :

[ ] Z`m ~m§S> ~hr ImVm Imob|

[ ] _oao ~m§S> ~hr ImVm g§»`m ............................................................... _| O_m H$a|

Ym[aVm H$m VarH$m :

[ ] EH$b

[ ] g§`wº$

A§eXmZ H$m VarH$m :

[ ] ZH$X

[ ] M¡H$/{S>_m§S> S´>mâQ>

[ ] H$moB©EH$ AWdm CÎma O¡{dV

M¡H$ / {S>_m§S> S´>mâQ> g§.................................. {XZm§H$ : ....... /....... /............ (~¢H$ /emIm) _| Amh[aV .....................................................................................

({XZm§H$/_mh/df©)

......................................................................................................................................................................................................................

(am{e)................................................ (ê$nE...........................................................................................................................................Ho$db)

*àW_ AmdoXH$ Ho$ ~¢H$ H$m ã`m¡am : (ã`mO/_moMZ Ho$ ^wJVmZ Ho$ {bE {ZåZ{b{IV ã`m¡am àXmZ H$a|Ÿ&)

ã`mO ^wJVmZ {dH$ën : ã`mO H$s am{e grYo _oao ImVo g§.................................................. _| O_m H$a|Ÿ&

~¢H$ ImVo H$m {ddaU : ~¢H$ H$m Zm_ ........................................................................................... emIm ...............................................................................................

ImVm g§»`m

~¢H$ Am¡a emIm H$s Zm¡A§H$s` H$moS> g§»`m, Omo ~¢H$ Ûmam Omar E_AmB©grAma

MoH$ na A§{H$V hmo

AmB©E\$Eggr H$moS>

hñVmja Ed§n¡Z g§»`m

hñVmja/A§JyR>o

H$s N>mn@

n¡Z g§»`m

Am`H$a gH©$b/

dmS>©/{Obm

~¢H$ ImVm g§»`m

Ed§emIm

E_AmB©grAma H$moS> Ed§

AmB©E\$Eggr H$moS>

àW_ AmdoXH$*

{ÛVr` AmdoXH$

V¥Vr` AmdoXH$

@A§JyR>o H$s N>mn Xmo Jdmhm| Ûmam AZwà_m{UV hmo

*g^r joÌ A{Zdm`©h¡Ÿ&

Jdmh :

àW_ Jdmh H$m Zm_..................................................................................

{ÛVr` Jdmh H$m Zm_...............................................................................

nVm..........................................................................................................

nVm.........................................................................................................

................................................................................................................

...............................................................................................................

hñVmja...................................................................................................

hñVmja..................................................................................................

PAGE02P02

EZB©grEg/EZB©E\$Q>r AmXoe nÌ

(~¢H$ ImVo H$s _moMZ am{e/ã`mO O_m H$aZo hoVw Omo ~m§S> ~hr ImVm YmaH$ ~¢H$ Ûmam Zht O_m H$s OmVr)

1) àW_ AmdoXH$ H$m Zm_

àW_ AmdoXH$ : lr/lr_Vr/gwlr

A§{V_ Zm_

àW_ Zm_

_Ü` Zm_

2. ~¢H$ Ho$ ImVo H$m {ddaU : ~¢H$ H$m Zm_................................................................. ................................... emIm ….................................................................................

~¢H$ Ûmam Omar E_AmB©grAma M¡H$ na ~¢H$ d emIm H$s Zm¡A§H$ H$s H$moS> g§»`m

AmB©E\$Eggr H$moS>

(H¥$n`m H$moS> g§. Ho$ gË`mnZ Ho$ {bE ~¢H$ Ûmam AmnH$mo Omar {H$E JE M¡H$ H$s EH$ N>m`mà{V AWdm H¢${gb M¡H$ g§b¾ H$a|)Ÿ&

3. ImVo H$m àH$ma

[ ] ~MV ImVm

[ ] Mmby ImVm

ImVm g§»`m

boOa g§»`m

boOa n¥ð> g§»`m

_¢ EVÛmam ............................................................................................................ (~¢H$ H$m Zm_), EZB©grEg / EZB©E\$Q>r Ho$ _mÜ`_ go AnZo ã`mO

/ _moMZ am{e H$mo O_m H$amZo Ho$ {bE àm{YH¥$V H$aVm / H$aVr hÿ± & _¢, EVÛmam, KmofUm H$aVm hÿ± {H$ Cn`©wH¥V {X`m J`m {ddaU ghr Am¡a nyU©h¡& `{X AnyU©AWdm JbV gyMZm Ho$

H$maU boZ-XoZ _| {db§~ hmoVm h¡, _¢BgHo$ {bE à`moJH$Vm©g§ñWmZ H$mo Xmofr Zht R>hamD§$Jm & _¢, EVÛmam ñH$s_ Ho$ VhV à{V^mJr Ho$ Vm¡a na _wPgo Ano{jV CÎmaXm{`Ëdmo§H$m

{Zd©hZ H$aZo H$mo gh_V hÿ±Ÿ &

ñWmZ ............................................................................ {XZm§H$ : ....... /....... /............ (AmdoXH$ Ho$ hñVmja) .........................................................

~¢H$ à_mUrH$aU (Ano{jV Zht, `{X M¡H$ H$s N>m`mà{V Xr JB©h¡&)

......................................................................................................................................................................................................................

à_m{UV {H$`m OmVm h¡{H$ D$na {X`m J`m {ddaU h_mao [aH$mS>©Ho$ AZwgma ghr h¡Ÿ&

({XZm§H$, ~¢H$ H$s _wha d à{YH¥$V A{YH$mar Ho$ hñVmja)

PAGE03

J¡a {d^m{OV {hÝXy n[adma KmofUm ànÌ

(A{Zdm`©, `{X AmdoXH$ J¡a {d^m{OV {hÝXy n[adma _| H$Vm©h¡)

_¢, ........................................................................................ àW_ AmdoXH$ Ho$ g_j {XE JE nVo H$m {Zdmgr, gË`{Zð>mnyU©`h KmofUm H$aVm / H$aVr hÿ± {H$ _¢J¡a

{d^m{OV {hÝXy n[adma _| H$Vm©hÿ± Am¡a Bg h¡{g`V go _wPo J¡a {d^m{OV {hÝXy n[adma Ho$ Zm_ go 8% ~MV (H$a`mo½`) ~«m§S> 2003 H$mo ~oMZo, n¥ð>m§{H$V, hñVm§V[aV AWdm AÝ`

Hw$N> H$aZo H$s nyU©e{º$ h¢Ÿ&

(J¡a {d^m{OV {hÝXy n[adma) Ho$ {bE Am¡a CZH$s Amoa go Z_yZm hñVmja ..............................................................................................................................

(J¡a {d^m{OV {hÝXy n[adma H$s _wha g{hV H$Vm©H$m Zm_)

ñWmZ: ............................................................................................................

{XZm§H$: ....... /....... /............

Zm_m§H$Z gw{dYm (d¡H${ënH$)

_¢..................................................................................................... {Zdmgr .................................................................................................

................................................................................... Omo {H$ ~m§S> ~hr g§»`m ...................................................... .............................. H$m YmaH$ hÿ±.

{ZåZ{b{IV ì`{º$`m| H$mo Zm_m{§H$V H$aVm h,±ÿ {OZH$m _aor _Ë¥`w H$o níMmV ~mS§> na A[YH$ma hmJom/{ZåZ{b{IV {d{Z{Xï©> ~mS§> na X`o ^JwVmZ am{e àmá H$aZo H$m A{YH$ma hmJom :

Zm_m§H$Z ì`{º$`m| H$m {ddaU

H«$.

g§.

Omar H$aZo

H$s VmarI

am{e(`)

nwZ: ^wJVmZ

H$s VmarI

Zm_m§{H$V ì`{º$ H$m nyam Zm_ VWm

{dñVm[aV Cn-Zm_ VWm nVm

OÝ_ {V{W

YmaH$ go g§~§Y

~¢H$ boIm

H$m {ddaU

`{X Zm_ {ZX}{eV ì`{º$ Ad`ñH$ h¡, Vmo H¥$n`m {ZåZ{b{IV bmBZ ^a| :

My§{H$ ............................................................. Cn`w©º$ Zm_{ZX}{eV ì`{º$ Bg VmarI H$mo Ad`ñH$ h¡, AV: _¢.......................................... lr/lr_Vr/Hw$_mar

............................................................ ....... H$mo _oar _¥Ë`w hmoZo na Cn`w©º$ Zm_m§{H$V ì`{º$ ............................................. (Zm_m§{H$V ì`{º$ H$mo Ad`ñH$ h¡) Ho$

Ad`ñH$ ~Zo ahZo na Cn`w©º$ ~m§S> ..................... na Xo` YZam{e àmá H$aZo Ho$ {bE {Z`wº$ H$aVm hÿ±Ÿ&

Zm_m§H$Z _| n[adV©Z H$aZm: `h Zm_m§H$Z _oao Ûmam {H$E JE {XZm§H$ : ....... /....... /............ Ho$ Zm_m§H$Z Ho$ à{VñWmnZ Ho$ g§~§Y _| h¡, Omo {H$ AmnH$s dhr _|

............................................................................................. XO©h¡VWm Omo Bg Zm_m§H$Z Ho$ XO©Zm_m§H$Z Ho$ XO©{H$E OmZo Ho$ níMmV aÔ hmo OmEJm &

ñWmZ ...................................

{XZm§H$ : ....... /....... /............

àW_ AmdoXH$ Ho$ hñVmja/A§JyR>m {ZemZ

@ A§JyR>o Ho$ {ZemZ H$mo Xmo Jdmhm| Ûmam AZwà_m{UV {H$`m OmE

Jdmh :

àW_ Jdmh H$m Zm_......................................................................

{ÛVr` Jdmh H$m Zm_.....................................................................

nVm.........................................................................................

nVm.........................................................................................

..............................................................................................

..............................................................................................

hñVmja...................................................................................

hñVmja...................................................................................

PAGE04

8% ~MV (H$a`mo½`) ~m§S> 2003 _| {ZdoXH$m|

Ho$ {bE OmZH$mar

^maV gaH$ma Zo {XZm§H$ 21 _mM©, 2013 H$s AnZr A{YgyMZm g§»`m E\$ 4 (10) S>ãë`y EÊS> E_ / 2013 Ho$ Ûmam 8% (H$a`mo½`) ~m§S>, 2003 H$mo ewê$ {H$`m h¡Ÿ&

Bg `moOZm Ho$ _w»` nhby {ZåZmZwgmar h¢:-

_X

8% ~MV (H$a`mo½`) ~m§S>, 2003

{Q>ßnUr

1) {ZdoeH$ H$s loUr

EH$b ì`{º$,

{hÝXy A{d^m{OV n[adma,

{díd{dÚmb`,

Y_m©W©g§ñWm

BZ ~m§S>m| _| {Zdoe Ho$ {bE A{Zdmgr

^maVr` nmÌ Zhr h¢Ÿ&

2) {Zdoe H$s gr_m

A{YH$V_ 1000/- ê$nE VWm

1000/- ê$nE Ho$ JwUm§H$

{Z{Y àmá H$aZo Ho$ VmarI/M¡H$/S´>mâQ> Ho$ ImVo _|

AmZo H$s VmarI

H$moB©A{YH$V_ gr_m Zht

3) ~m§S> Omar H$aZo H$s VmarI

4) ~m§S> Ho$ ànÌ

~m§S> dhr ImVm

5) {dH$ën

J¡a g§M`r/g§M`r

{dH$ën _| n[adV©Z H$s AZw_{V Zht h¡Ÿ&

6) ã`mO

J¡a g§M`r {dH$ën Ho$ _m_bo _| ã`mO N>_mhr

AmYma na Xo` hmoJm Ÿ& g§M`r {dH$ën Ho$ _m_bo

_| ã`mO n[an¹$Vm Ho$ g_` Xo` hmoJmŸ&

N>_mhr ã`mO 1 \$adar/1 AJñV H$mo Xo` h¡Ÿ&

7) n[an¹$Vm Ho$ ~mX ã`mO

n[an¹$Vm Ho$ ~mX ã`mO Xo` Zht h¡Ÿ&

8) ~¢H$ boIm

{ZdoeH$ Ho$ {bE `h A{Zdm`©h¡{H$ dh ~¢H$ ImVo

H$m ã`m¡am Xo Vm{H$ ã`mO/n[an¹$Vm am{e H$m

^wJVmZ H$aZm AmgmZ hmo gHo$Ÿ&

9) H$a bm^

~m§S> go hmoZo dmbr Am` H$a `mo½` h¡Ÿ&

gån{Îm H$a H$s Ny>Q> h¡Ÿ&

ã`mO ^wJVmZ na H$a H$mo òmoV go

H$mQ> {b`m OmEJmŸ&

10) Zm_m§H$Z gw{dYm

nyU©YmaH$ AWdm g^r g§`wº$ YmaH$, EH$ AWdm A{YH$

ì`{º$`m| H$mo Zm_m§{H$V H$a gH$Vo h¢Ÿ&

A{Zdmgr ^maVr` ^r Zm{_V {H$E Om gH$Vo h¢Ÿ&

VWm{n, ã`mO/n[an¹$Vm am{e H$m g§àofU Cg g_`

àofU Ho {bE àM{bV {dXoer {d{Z_` {Z`_m| Ho VhV

hmoJmŸ&

11) n[an¹$Vm Ad{Y

6 df©Ho$ níMmVŸ&

12) g_`nyd©_moMZ

29 OwbmB©2013 H$s gaH$mar A{YgyMZm Am¡a 16 AJñV,

2013 H$s A{YgyMZm Ho$ n[adVu g§emoYZ Ho$ AZwgma `h

gw{dYm nmÌ {ZXoeH$m| H$mo CnbãY h¡Ÿ&

13) A§VaUr`Vm

~m§S> H$m {ÛVr`H$ ~mOma _| ì`mnma Zht hmoJmŸ&

VWm{n, ~m§S>m| na F$U {b`m Om gHo$JmŸ&

14) BZ ~MV ~m§S>m| H$s à{V^y{V

na ~¢H$m| go F$U

BZ ~m§S>m| Ho$ YmaH$, ~m§S> à{V^y{V Ho$ ~Xbo F$U

hoVw AZwgy{MV ~¢H$m|, Ho$ nj _| enW,

{Jadr AWdm {b`Z aI gH|$JoŸ&

15) AmdoXZ nÌ

^maVr` ñQ>oQ> ~¢H$ VWm gå~Õ ~¢H$m| H$s emImE§,

18 amï´>r` H¥$V ~¢H$, {ZOr joÌ Ho$ 3 ~¢H$

Am¡a ñQ>m°H$ hmopëS>J̈ H$manmoaoeZ Am°\$ B§{S>`m {b.

PAGE05

{ZdoeH$/AmdoXH$ Ho$ H$V©ì`

H$) H¥$n`m AmdoXZ nyU©ê$n go ^a|Ÿ&

I) AYyao ^ao JE AmdoXZ go ~m§S>m| Ho$ Omar hmoZo _| {dbå~ hmoJm ({ZdoXH$ H$mo ZwH$gmZ hmoJm)Ÿ&

J)

`{X YmaH$ Ûmam AmdoXZ _w»VmaZm_m Ho$ O[aE àñVwV {H$`m OmVm h¡_yb _w»VmaZm_m H$s AZwà_m{UV à{V Ho$ gmW gË`mnZ Ho$ {bE àñVwV H$a|Ÿ&

K)

`{X AmdoXZ Ad`ñH$$H$s Amoa go h¡Vmo ñH$yb AWdm ZJa {Z`_ àm{YH$mar H$m OåZ H$m _yb à_mU-nÌ AZwà_m{UVà{V Ho$ gmW gË`mnZ Ho$ {bE àñVwV H$a|Ÿ&

S>)

H¥$n`m `h ZmoQ> H$a| {H$ Zm_m§H$Z H$s gw{dYm ghm`Vm/~MV ~m§S> Ho$ EH$_mÌ YmaH$ AWdm g^r g§`wº$ YmaH$m| ({ZXoeH$m|§) H$mo h¡Ÿ&

M)

`{X Zm_{ZX}{eV ì`{º$ Ad`ñH$ h¢Vmo H¥$n`m CgH$s OÝ_{V{W {bI| VWm BgHo$ {bE A{^^mdH$ ^r {Z`wº$ {H$`m Om gH$Vm h¡Ÿ&

N>)

`{X {Zdoe Adí`H$ H$s Am¡a go h¡Vmo Zm_m§{H$V gw{dYm CnbãY Zht hmoJrŸ&

O) H¥$n`m g§M`r/J¡a g§M`r ~m§S>m| Ho$ {ZJ©_ Ho$ {bE n¥WH$ AmdoXZ nÌ ({^Þ-{^Þ a§Jm|) _| ^a|Ÿ& {dH$ën _| n[adV©Z H$s AZw_{V Zht h¡Ÿ&

P) H¥$n`m nVo _| n[adV©Z go `WmerK«AdJV H$amE§Ÿ&

A) n[an¹$Vm {V{W Ho$ níMmV, n[an¹$Vm ~mX H$m ã`mO Xo` Zht hmoJm Ÿ& AV: Xo` VmarI na ^r YZam{e dmnmg b|Ÿ&

Q>)

H¥$n`m AnZr OÝ_{V{W/C_«Xem©E§Ÿ&

R>)

BboŠ Q´>m{ZH$ VarHo$ go AnZm ^wJVmZ àmá H$aZo Ho$ {bE AnZm ~¢H$ ImVm CnbãY H$amdmE§Ÿ&

S>)

H$a bmJy hmoZo g§~§Yr H$moB©^r OmZH$mar ~¢H$/emIm H$mo Xr OmEŸ&

{ZdoeH$ Ho$ A{YH$ma

H$) ~m§S> à_mUnÌ {Z{Y àmá hmoZo/M¡H$/S´>mâQ> Ho$ ImVo _| O_m hmoZo H$s VmarI H$mo Omar {H$`m OmEJmŸ&

I) {Z{dXm Ho$ AmdoXZ H$s VmarI go 5 {XZ Ho$ ^rVa Ym[aVm à_mUnÌ Omar {H$E OmE§JoŸ&

J)

~m§S> H$a ã`mO ZH$X _| A§eXmZ H$s VmarI AWdm M¡H$ Ho$ ZH$XrH$aU H$s VmarI go àmoÕÿV hmoVm h¡Ÿ& ã`mO AmdoXZ \$m_©_| CgHo$ Ûmam _wh¡`m H$amE JE YmaH$ Ho$ ImVo _| grYo

O_m {H$`m OmEJmŸ&

K)

1 \$adar/1 AJñV H$mo ã`mO ~¢H$ ImVo _| O_m {H$`m OmEJmŸ&

S>.) {ZdoeH$ H$mo ã`mO Ho$ ^wJVmZ H$s agrX Xo` {V{W go EH$ _mh A{J«_ _| Omar H$s OmEJrŸ&

M)

~m§S> H$s Xo` VmarI Ho$ EH$ _mh nyd©n[an¹$Vm gyMZm {^Odm Xr OmEJrŸ&

N>)

ã`mO Am¡a _ybYZ Ho$ {Z:ewëH$ {S>_m§S> S´>mâQ> AWdm g_Vwë` M¡H$ na ^wJVmZ H$s gw{dYm CnbãY h¡Ÿ&

O) A§Va ~¢H$ emIm AWdm A§Va ~¢H$ emIm _| ~m§S> Ho$ A§VaU H$s gw{dYm C~bãY h¡Ÿ&

P) ~MV ~m§S>m|§Ho$ g§~§Y _| {Zdoe, _moMZ, EZB©grEg/EZB©E\$Q>r A{YXoe Am{X Ho$ {bE AmdoXZ nÌ do~gmB©Q www.hdfcbank.com (~¢H$ Am¡a EgEMgrAmB©Eb

do~gmBQ>) na CnbãY h¡Ÿ&

Ì)

EH$_mÌ YmaH$ AWdm g^r g§`wº$ YmaH$, ~m§S> Ho$ A{YH$ma Ho$ g§~§Y _| EH$ AWdm A{YH$ ì`{º$`m| H$mo Zm_{ZX}{eV H$a gH$Vm h¡Ÿ& A{Zdmgr ^maVr`m| H$mo ^r Zm_{ZX}{eV

{H$`m Om gH$Vm h¡Ÿ&

Q>)

Zm_m§H$Z Omar {H$E OmZo dmbo H$m`m©b` _| XO©{H$`m OmEJm VWm YmaH$ H$mo n§OrH$aU H$m à_mU-nÌ Omar {H$`m OmEJmŸ&

R>)

Z`m Zm_m§H$Z XO©H$adm H$a Zm_m§H$Z _| n[adV©Z {H$`m Om gH$Vm h¡Ÿ&

S>)

Omar H aZo dmbo H$m`m©b` H mo AZwamoY H aHo _m¡OyXm Zm_m§H Z H mo aÔ H adm`m Om gH Vm h¡Ÿ&

T>)

{Zdoe H$s VmarI go 6 df©nyao hmoZo na _moMZ hmo gHo$Jm &

U)

{XZm§H$ 29 OwbmB©, 2013 H$s A{YgyMZm Am¡a 16 AJñV, 2013 H$s n[adVu A{YgyMZm Ho$ O[aE gaH$ma Ûmam Omar eVm] Ho$ AZwgma, n[an¹$Vm g_` nyd©_moMZ H$s

gw{dYm ewê$ H$s JB©h¡Ÿ&

PAGE06

V)

YZam{e dmng boZo Ho$ AZwamoY H$s VmarI go nm§M H$m`©{Xdg Ho$ ^rVa {ZdoeH$ ^wJVmZ àmá H$aZo Ho$ {bE nmÌ hmo OmEJmŸ&

W)

ã`mO/YZam{e dmng boZo _| {db§~ go ~MZo Ho$ {bE AmdoXH$, AY©dm{f©H$ ã`mO/n[an¹$Vm na YZam{e Ho$ B©grEg/EZB©E\$Q>r/AmaQ>rOrEg AWdm ~¢H$ ImVo _|

grYo H«o${S>Q> H$aZo H$m {dH$ën Xo gHo$Jm Ÿ&

X)

{ZdoeH$, {db§~ ^wJVmZ Ho$ {bE ^maVr` [aOd©~¢H$ Ûmam n[anÌm| Ho$ _mÜ`_ go g_`-g_` na Omar Xam| na à{Vny{V©H$m hH$Xma h¡Ÿ&

`{X ~¢H$ Cn`wº$ AZwnmbZ Zht H$aVm h¡Vmo Amn Cgr ~¢H$ Ho$ H$mC§Q>a na CnbãY ànÌ _| ^maVr` [aOd©~¢H$ Ho$ ZOXrH$s H$m`m©b` H$mo {ZåZmZwgma {b{IV _| {eH$m`V

H$a gH$Vo h¡:

joÌr` {ZXoeH$,

^maVr` [aOd©~¢H$,

J«mhH$ godm {d^mJ/~¢qH$J bmoH$nmb

(ñWmZ)

--------------------------------------------------------------------------

Amn AnZr {eH$m`V {ZåZ{b{IV H$mo g§~§{YV H$a gH$Vo h¡:

_w»` _hmà~§YH$ à^mar,

gaH$mar Am¡a ~¢H$ boIm {d^mJ, Ho$ÝÐr` H$m`m©b`,

~mB©-----, _w§~B©, g|Q´>b aobdo ñQ>oeZ Ho$ gm_Zo

_w§~B©- 400008, _hmamï´>

{S>ñŠ bo_a : _¢Zo {ZdoeH$ H$s OmZH$mar H$m ã`m¡am VWm A{YH$ma Am¡a H$V©ì` n‹T> Am¡a g_P {bE h¢Ÿ& EO¢Q>/~¢H$ Zo Bg `moOZm Ho$ nhbwAm| go _wPo AdJV H$am {X`m h¡Ÿ&

AmdoXH$ Ho$ hñVmja

--------------------------------------------------------------------

`hm§go \$mS>| --------------------------------------------------------------------------------

PAGE07

--------------------------------------------------------------------

`hm§go \$mS>| --------------------------------------------------------------------------------

AmdoXZ ànÌ H$s nmdVr

AmdoXZ g§»`m

~¢H$ emIm ……………………………………………................

{XZm§H$: ....... /....... /............

lr/lr_Vr/gwlr ....................................................................................................................................................... go 8% ~MV (H$a`mo½`) ~m§S>,

2003 H$s IarX Ho$ {bE 6 df©H$s Ad{Y Ho$ {bE .................................................................................................. ............ê$nE ZH$X/S´>mâQ>/no Am°S>©a/

M¡H$ g§»`m......................................... {XZm§H$ :....... /....... /............ (~¢H$ Am¡a emIm) go àmá hþEŸ& BZ na ................................................................

ê$nE .............................................................................. (ê$nE .....................................................................................Ho$db) H$s Zm__mÌ H$s_V

na g§M`r/J¡a g§M`r AmYma na ã`mO Xo` h¡Ÿ&

{XZm§H$, ~¢H$ H$s _wha d ~¢H$ Ho$ à{lH¥$V A{YH$mar

Ho$ hñVmja

PAGE08

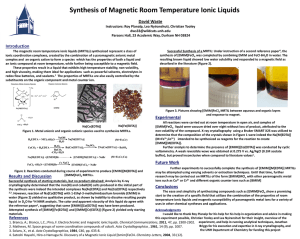

Revised Form A (Notified on April 21, 2014.)

Name of the

Application Number

branch:_________________

APPLICATION FORM FOR 8% SAVINGS (TAXABLE) BONDS, 2003

Non Cumulative

(Put √ wherever required. Fields with '*' are mandatory)

For Office use only

Broker's name

& Code

Sub Broker's

name & Code

Bank branch

stamp

Branch name

& Code

BLA Number

Date of transfer

to Link Cell

(DD/MM/YYYY)

Date of Credit to

Special Current A/C

(DD/MM/YYYY)

Date of Credit

To Govt. A/C

(DD/MM/YYYY)

Date of receipt of

Application

(DD/MM/YYYY)

Full Address of

the Branch

Verified By

Applicant(s) name(s) [in block letters]

1stApplicant: Mr/Mrs/Ms

Last Name

First Name

Middle Name

Last Name

First Name

Middle Name

Last Name

First Name

Middle Name

Last Name

First Name

Middle Name

2ndApplicant: Mr/Mrs/Ms

3rdApplicant: Mr/Mrs/Ms

Guardian : Mr/Mrs/Ms

Guardian's relationship with minor

[ ] Father

[ ] Mother

[ ] Legal Guardian

st

*Date of Birth: 1 Applicant (DD/MM/YYYY) ............./............./............. Gender: M/F

*Date of Birth: 2ndApplicant (DD/MM/YYYY) ............./............./............. Gender: M/F

*Date of Birth: 3rdApplicant (DD/MM/YYYY) ............./............./............. Gender: M/F

Mother's maiden name

Last Name

First Name

Middle Name

Communication address of the applicant:

Telephones (office/residence)

Email Address

PAGE09

Status:

[ ] Resident Individual

[ ] On behalf of minor

[ ] Power of Attorney holder

Investment details:

[ ] HUF

[ ] Charitable Institution

[ ] University

[ ] Open a new Bond Ledger Account

[ ] Credit to my Bond Ledger Account No………………….................

Mode of Holding:

[ ] Single

[ ] Joint

Mode of investment:

[ ] Cash

[ ] Cheque/DD

[ ] Anyone or Survivor

Cheque/DD No……………………… dated: ....... /....... /............ drawn on (Bank/branch) ……………………............................

(DD/MM/YYYY)

………………………………………………………………………..…………………………………….……………………………......

for (Amount) `…………………………………(Rupees………….………………….………………………………………….…only)

*Bank details of First Applicant: (Please provide the following details for Interest / Redemption payment)

Interest Payment Options: Directly credit interest amount to my bank account No.

Particulars of the Bank account: Bank name…………………………......

Branch………………………………………………….

Account Number

Nine digit Code number of the Bank & Branch appearing on

the MICR Cheque issued by the bank

IFSC Code

Signature and PAN Number

Signature/Thumb

Impression@

PAN Number

I.T. Circle/Ward/

District

Bank A/c No.

and Branch

MICR CODE &

IFSC CODE

1st Applicant*

2nd Applicant

3rdApplicant

@Thumb impression to be attested by two witnesses on the back side

*All fields Mandatory.

Witnesses:

Name of 1st Witness………………………………...........

Name of 2nd Witness……………………………… ..........

Address………………………………..............................

Address………………………………..............................

......................................................................................

......................................................................................

Signature……………………………………....................

Signature……………………………………....................

PAGE10P02

NECS/NEFT Mandate Form

(For credit of Redemption amount/interest to bank account not held with bank having the Bond Ledger Account)

1. Name of the First Applicant

1stApplicant: Mr/Mrs/Ms

Last Name

First Name

Middle Name

2. Particulars of the Bank account: Bank name…………………………............... Branch …………………………......................

Nine digit Code number of the Bank & Branch appearing on

the MICR Cheque issued by the bank

IFSC Code

(Please attach a photocopy of the Cheque leaf or a cancelled cheque issued to you by the bank for verification of the

Code number)

3. Account Type

[ ] S. B. Account

[ ] Current Account

Account Number

Ledger Number

Ledger Folio No.

I hereby authorize ………………………………………………………….……………................(name of the bank) to credit my

interest/redemption amounts through NECS/NEFT. I hereby declare that the particulars given above are correct and complete.

If the transaction is delayed at all for reasons of incomplete or incorrect information, I would not hold the user institution

responsible. I hereby agree to discharge the responsibility expected of me as a participant under the scheme.

Place………………………...................Date:....... /....... /............ (Signature of the Applicant)…………………..............................

Bank Certification (Not required if photocopy of the cheque is submitted)

…………………………………………………………………………………………………………………………..……………………

Certified that the particulars furnished above are correct as per our records.

(Date, Bank Stamp & Signature of Authorised Official)

PAGE11

H.U.F. declaration form

(Mandatory if applicant is Karta of HUF)

I,……………………………………………………………, residing at the address given against First Applicant, do solemnly affirm

that I am the Karta of the Hindu Undivided Family and as such have full powers to sell, endorse, transfer or otherwise deal in the

8% Savings (Taxable) Bonds, 2003 standing in the name of the HUF.

Specimen signature for and on behalf of the HUF (name of the HUF)……..…………………………………………………...............

(Signature of the Karta with seal of HUF)

Place :…………………………………………….....................................

Date : ....... /....... /............

Nomination facility (optional)

I, …………………………………………………………………… residing at……………………………………...............................

………………………………………………………, and holder of Bond Ledger Account No……………………..………................

………………………………................................... nominate the following person/s who shall on my death have the right to the

bond / receive payment of the amount for the time being due on the bond(s) specified below :

Particulars of Nominee/s

Sr.

No.

Date of

issue

Amount (`)

Date of

repayment

Full name with expanded

initials and address of

nominee

Date of

birth

Relationship

to holder

Particulars

of bank

account

If nominee is minor, please fill in the line below:

As………………………………………………………....... the sole nominee above is a minor on this date, I appoint Mr/Mrs/

Ms………………………………………………………….. to receive the amount for the time being due on the above bond(s) in

the event of my death during the minority of the said nominee…………………………………………………(name of the nominee

who is a minor).

Change of nomination: This nomination is in substitution of the nomination dated: ....... /....... /............ made by me and

registered on your books at…………………………………………………………………………. which shall stand cancelled on

registration of this nomination.

Place………………….....

Date : ....... /....... /............

Signature / Thumb impression of the 1st Applicant

@Thumb impression to be attested by two witnesses.

Witnesses:

Name of 1st Witness………………………………...........

Name of 2nd Witness……………………………… ..........

Address………………………………..............................

Address………………………………..............................

......................................................................................

......................................................................................

Signature……………………………………....................

Signature……………………………………....................

PAGE12

INFORMATION FOR INVESTORS IN 8% SAVINGS (TAXABLE)

BONDS, 2003

Government of India had introduced 8% Savings (Taxable) Bonds, 2003 vide their notification No. F.4 (10)-W&M/2003 dated

March 21, 2003. The main features of the Scheme are as under:-

Item

8% Savings (Taxable) Bonds, 2003

Remarks

1) Category of Investor

Individual

Non resident Indians are not eligible to

invest in these bonds

HUF

University

Charitable Institution

No maximum limit

2) Limit of investment

Minimum ` 1000/- and in multiples of

` 1000/-

3) Date of Issue of bonds

Date of receipt of subscription in cash or date

of realization of cheque / draft

4) Forms of Bonds

Bond Ledger Account

5) Option

Non-cumulative / Cumulative

Change of option is not permitted.

6) Interest

In case of non -cumulative option, interest is

payable on half yearly basis. In case of

Cumulative option, interest is payable at the

time of maturity

Half-yearly interest is payable on

1st February /1st August

7) Post Maturity Interest

Post Maturity Interest is not payable

8) Bank account

It is mandatory for the investors to provide

bank account details to facilitate payment of

interest /maturity value

9) Tax benefits

Income from the bonds is taxable.

Wealth tax is exempted.

Tax will be deducted at source while

interest is paid

10) Nomination Facility

The sole Holder or all the joint holders may

nominate one or more persons as nominee.

Non-Resident Indians can also be

nominated. However, remittance of the

interest/maturity proceeds will be subject

to the foreign Exchange regulations

prevailing at the time of remittance

11) Maturity period

After 6 years

12) Premature redemption

Facility is available to the eligible investors as

per the Govt. Notification dated July 29, 2013

and subsequent amendment vide Notification

dated August 16, 2013.

13) Transferability

The bonds are not tradable in the secondary

market. However, the Bonds shall be eligible

as collateral for loans.

14) Loans from banks

against the security of

these Savings bonds

The holders of the said bonds shall be entitled

to create pledge, hypothecation or lien in favour

of scheduled bank for loans against the security

of the bonds.

15) Application forms

Available at designated branches of SBI and

Associate banks,18 Nationalised banks,

3 Private Sector banks and Stock Holding

Corporation of India Ltd.

PAGE13

DUTIES OF INVESTOR/ APPLICANTS

A) Please fill up the application in all respects

B) Incomplete applications are liable to result in delay of issue of the bonds (at the cost of the applicant)

C) In case the application is submitted by a Power of Attorney (POA) holder, please submit original POA for verification,

along with an attested copy

D) In case the application is on behalf of a minor, please submit the original birth certificate from the School or Municipal

Authorities for verification, together with an attested copy

E) Please note that nomination facility is available to a Sole Holder or all the joint holders (investors) of a Relief/Savings bond.

F)

In case nominee is a minor, please indicate the date of birth of the minor and a guardian can be appointed

G) Nomination facility is not available in case the investment is on behalf of minor

H) Please fill separate application form (different colours) for issue of CUMULATIVE / NON-CUMULATIVE bonds. Change of

option is not permitted.

I)

Please notify the change of address immediately

J)

POST MATURITY INTEREST IS NOT PAYABLE AFTER DATE OF MATURITY. HENCE PLEASE OBTAIN

REDEMPTION PROCEEDS ON THE DUE DATE

K) Indicate your date of birth / age.

L)

Provide your bank account details for receiving payment through Electronic mode

M) Any information regarding tax applicability may be provided to the bank/branch

RIGHTS OF THE INVESTOR

a)

The Bond will be issued on the same day if subscription is received in cash and on realization of the cheque if subscription is

received through cheque.

b)

The Certificate of Holding will be issued within 5 days from the date of tender of application.

c)

The interest on the bond accrues from the date of subscription in cash or date of realization of cheque. The interest will be

credited to the bank account of the holder directly provided by him/her in the application form.

d)

The interest on the date of 1st February / 1st August will be credited to the bank account.

e)

An advice of payment of interest will be issued to the investor one month in advance from the due date.

f)

Maturity intimation advice will be issued one month before the due date of the bond.

g)

Facility for payment of interest and principal by 'demand draft free of cost or at par cheques' for up country customers is

available.

h)

The facility of intra-bank branch and inter bank branch transfer of the bonds is available.

I)

Application forms for investments, redemption, NECS/NEFT Mandate, etc, in respect of Savings Bonds are available on the

website at www.hdfcbank.com (Banks and SHCIL website).

j)

A sole holder or all the joint holders may nominate one or more nominees to the rights of the bonds. Non-resident Indians

can also be nominated

k)

The nomination will be registered at the office of Issue and a Certificate of Registration will be issued to the holder.

l)

The nomination can be varied by registering a fresh nomination.

m) The existing nomination can be cancelled by a request to the Office of Issue.

n)

The redemption is due on expiry of six years from the date of investment.

o)

Premature redemption facility has been introduced as per the conditions issued by the Govt. vide its Notification dated

July 29, 2013 and subsequent amendment vide Notification dated August 16, 2013.

PAGE14

p)

The investor is entitled to receive repayment amount within five clear working days from the date of tender of acquaintance.

q)

To avoid delay in receipt of interest / redemption proceeds applicants may indicate his choice, for availing of half yearly

interest / redemption proceeds through ECS/NEFT/RTGS or direct credit to the bank account.

r)

Investors are entitled for compensation for delayed payments at the rate decided by RBI vide their circulars issued from time

to time.

In case the bank does not comply with the above, you may lodge a complaint in writing in the form provided at the counter and

address the same to the nearest office of Reserve Bank of India as under :

THE REGIONAL DIRECTOR,

RESERVE BANK OF INDIA,

CUSTOMER SERVICE DEPARTMENT/

BANKING OMBUDSMAN

(LOCATION)

-------------------------------------------------------------------------YOU MAY ALSO ADDRESS YOUR COMPLAINT TO:

THE CHIEF GENERAL MANAGER IN-CHARGE

DEPARTMENT OF GOVERNMENT AND BANK ACCOUNTS

CENTRAL OFFICE

BYCULLA, OPP. BOMBAY CENTRAL RAILWAY STATION

MUMBAI- 400 008, MAHARASHTRA

Disclaimer: -I have read and understood the details of information for the investors as well as rights and duties of investors.

The agent/bank has explained the features of the scheme to me.

Signature of the applicant

-------------------------------------------------------------------- TEAR AWAY HERE ------------------------------------------------------------------

PAGE15

-------------------------------------------------------------------- TEAR AWAY HERE ------------------------------------------------------------------

Acknowledgement of Application Form

Application Number

Bank branch……………………………………………........

Date : ....... /....... /............

Received from Mr/Mrs/Ms………………………………………………………………………………..……...Cash/Draft/PayOrder/

Cheque No.………………… dated : ....... /....... /............ drawn on (Bank and branch)……………….......................................

for `……………….................(Rupees……………………………………………………………........ only) for the purchase of 8%

Savings (Taxable) Bonds, 2003 for a period of 6 years, interest payable on cumulative [ ] /payable on Non-cumulative [ ]

basis of the nominal value of `…………………......... (Rupees………………………………………………………...............only).

Date, Bank Stamp & Signature of the authorized

official of the Bank.

PAGE16