Modeling variables of different frequencies

advertisement

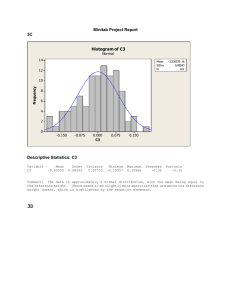

International Journal of Forecasting 16 (2000) 117–119 www.elsevier.com / locate / ijforecast Modeling variables of different frequencies Tilak Abeysinghe* Department of Economics, National University of Singapore, 10 Kent Ridge Crescent, Singapore 119260, Singapore Abstract The transformation introduced in Abeysinghe (1998: International Journal of Forecasting 14, 505-513) to model dynamic regressions with variables of different frequencies creates an autocorrelation problem when applied to flow variables. This exercise shows that the magnitude of the autocorrelation is rather small and offers a solution to the problem. 2000 Elsevier Science B.V. All rights reserved. Keywords: Flow variables; Autocorrelation; IV estimator 1. Introduction 2. Flow dependent variable The transformation proposed by Abeysinghe (1998) to regress a low-frequency variable on high-frequency variables works exactly for stock dependent variables. This transformation leads to an autocorrelation problem in flow variables. The model fitted to flow variables by Abeysinghe passes through the autocorrelation tests because the autocorrelation present in the residuals is too small to be detected by standard tests. In this note we present a more natural transformation that can be used for flow dependent variables and address the issue of autocorrelation and examine the problems associated with estimation. The basic model considered in Abeysinghe (1998) is y t 5 a0 1 b0 x t 1 l y t 2t 1 u t , t 5 t, 2t, 3t, . . . ,T, where t is a fraction of the time interval at which y is observed. If y is quarterly and x is monthly then t 51 / 3. u t is assumed to be a white noise process with zero mean and constant variance. When y t in (1) is a flow variable, the recorded values of y are the period aggregates. By aggregating (1) over the range of r 5 0, 1, . . . , 1 /t 2 1 we get 12t Yt 5 a0 ]] 1 b0 Xt 1 lYt 2t 1 Ut , 2t 2 t 5 t, 2t, . . . , T *Tel.: 11-65-874-6116; fax: 11-65-775-2646. E-mail address: tilakabey@nus.edu.sg (T. Abeysinghe) (1) (2) where the upper case letters indicate the (moving) aggregates: 0169-2070 / 00 / $ – see front matter 2000 Elsevier Science B.V. All rights reserved. PII: S0169-2070( 99 )00028-X T. Abeysinghe / International Journal of Forecasting 16 (2000) 117 – 119 118 Oy , X 5 Ox , Y 5 Oy and U 5 Ou . Yt 5 Ol , i t2rt t2rt t j di 5 j50 t2t and t2(r11 )t l j 11 , j5i 21 / t S D 1 1 1 if i 5 ], ] 1 1, . . . , 2 ] 2 1 . t t t Note that Yt , Xt , and Ut constitute non-overlapping sums at integer lags whereas Yt2t involves the sums of overlapping periods. Model (2) cannot be estimated because at integer lags Yt2t is not observed. The transformation Abeysinghe (1998) introduced to convert the fractional lag (t 2 t ) to integer lag (t 2 1) involves lagging (2) by rt and multiplying by l r and summing over the range of r. This will yield From (4) we can see that the first 1 /t terms of u (i 5 0, 1, . . . , 1 /t 2 1) belong to the current period t (t 5 1, 2, . . . , T ) and the rest of the (1 /t 2 1) terms belongs to the period (t 2 1). It can easily be verified that Vt is an MA(1) process. To compute the first order autocorrelation coefficient r, let d 95[d0 , d1 , . . . , d2(1 / t 2 1 ) ], d 91 5 [d0 , d1 , . . . , d1 / t 2 2 ], and d 92 5 [d1 / t , d1 / t 11 , . . . , d2(1 / t 21) ] be column vectors. Then it can easily be verified that 2 9 E(Vt ) 5 0, Var(Vt ) 5 s 2ud 9d, E(VV t t21 ) 5 s u d 1 d2 Yt 5 a 1 b0 Zt 1 l 1 / t Yt 21 1Vt , t 5 1, 2, . . . ,T, (3) with E(VV t t21 ) r 5 ]]]. Var(Vt ) where OlX 1 / t 21 Zt 5 O 1 / t 22 di 5 t2rt t 1 if i 5 0, 1, 2, . . . ,] 2 1, t r OlU 1 / t 21 t 2rt , r50 Vt 5 r t 2rt In the case of aggregating monthly data to quarterly data t 5 1 / 3 and , r50 r 5 l(1 1 l)2 /(3l 4 1 4l 3 1 5l 2 1 4l 1 3). and O 1 2 t 1 / t 21 r a 5 ]] a l. 2t 2 0 r50 To see the autocorrelation in Vt we have to express Vt in terms of lower case u t . Expanding over r and after collecting common terms, Vt can be expressed as 1 2( ]21 ) t Vt 5 O du i t 2it i50 where For 0 , l , 1, the range most likely for many economic time series, 0 , r , 4 / 19. The (non-linear) least squares bias caused by the MA(1) errors can easily be assessed in the following simple model that sets a0 5 b0 5 0 and t 5 1 / 3. The resulting model is 3 Yt 5 l Yt21 1Vt , t 5 1, 2, . . . , T, 0 , l , 1, Vt 5 et 1 uet21 (4) where et is zero-mean white noise process. Note that r 5 u /(1 1 u 2 ) and by imposing the invertibility condition we get u 5 (1 2 (1 2 4r 2 )1 / 2 ) / T. Abeysinghe / International Journal of Forecasting 16 (2000) 117 – 119 2r. By minimizing o V 2t and solving for l we get 3 1/3 p lim lˆ 5 [ l 1 Cov(Yt 21 ,Vt ) /Var(Yt )] 3 6 3 2 1/3 5[ l 1 u (1 2 l ) /(2ul 1 u 1 1)] ± l. A plot of the asymptotic autocorrelation bias ( p limlˆ 2 l) against l, 0 , l , 1, shows that the bias increases first with l and reaches a maximum of 0.23 when l ¯ 0.14 and then declines steadily towards zero as l increases. For larger values of l, the autocorrelation bias becomes negligibly small. Although the bias is small, especially for large values of l, it has to be dealt with explicitly as it leads to inconsistent LS estimators. In small samples, however, it would be difficult to detect the presence of autocorrelation because of its small magnitude. Fortunately, the MA(1) parameter u is a function of l, though highly non-linear. What we need is a ‘‘good’’ estimate of l which can then be used to estimate u, which in turn will be useful in obtaining improved short-term forecasts. A simple solution is to use an instrumental variable (IV) estimator using Yt22 as an instrument. We carried out a limited Monte-Carlo experiment to compare the performance of the LS and IV estimators in small samples. This experiment shows that the small-sample bias of both LS and IV estimators is negligibly small. For l close to unity the LS bias tends to be smaller than the IV bias. The IV estimator tends to perform better when the LS bias is large. To save space we do not report all the results here. Overall, it seems advisable to examine both the LS and IV estimates and compare the results before making a choice. 119 3. Conclusion Model (3) can easily be generalised as in Abeysinghe (1998). Although it looks different from the one that was estimated in Abeysinghe (1998), the autocorrelation problem is exactly the same in both cases. The difference lies in the way the high-frequency variable is handled. A re-estimation of the Singapore model given in Abeysinghe (1998) shows that formulation (3) leads to a more parsimonious model, yet with a similar underlying distributed lag structure. Acknowledgements I would like to thank two anonymous referees for their valuable comments and working through my derivations and pointing out some mistakes. My thanks are also due to Jan G. De Gooijer, Editor-in-Chief, for further comments on the revised version. The full paper can be obtained from the author or be downloaded in PDF format from http: / / courses.nus.edu.sg / course / ecstabey / IJF4.PDF. References Abeysinghe, T. (1998). Forecasting Singapore’s quarterly GDP with monthly external trade. International Journal of Forecasting 14, 505–513. Biography: Tilak ABEYSINGHE is an Associate Professor in econometrics in the Department of Economics of the National University of Singapore. He is the Director of the Econometric Studies Unit, the forecasting and policy research arm of the Department of Economics.