Term Gross Sales or Revenue Sometimes called income, refers to

advertisement

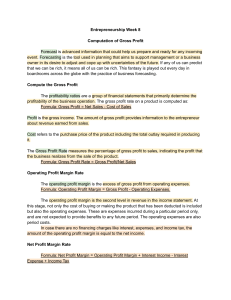

Glossary of Terms Term Definition Gross Sales or Revenue Sometimes called income, refers to the fees that a company receives for providing services or selling a product/merchandise. Net Sales or Revenue Gross sales less returns, allowances, and discounts. Costs of goods sold Costs directly attributable to the production and sale of a product. Includes direct materials, direct labor, and overheard. Gross Profit Net sales less costs of goods sold. Selling, General, and Administrative Expenses Sometimes called S,G,&A, refers to expenses that are outside of the direct production of the product or service. Depreciation Expense for the allocation of the cost of an asset (property, plant, equipment) over its useful life. Amortization Expense for the allocation of the cost of an intangible asset (software, goodwill, intellectual property) over its useful life. Operating Income Term for income left after the operating expenses are deducted from the gross profit. Interest Expense Expenses related to the servicing of a company's debt. Taxes Income taxes paid by a company. Non-Operating Expenses Expenses that are not part of the core operations of the business. Net Income Term for income left after all expenses have been deducted from gross profit. Margin Growth Margin is a measure of a company's profitability, as it compares net income to total revenue. Margin growth is experienced profitable (e.g. reduces selling costs without reducing sales). Borrowing Rate The interest rate a lender charges a borrower in exchange for credit. EBITDA Acronym for "Earnings before Interest, Taxes, Depreciation and Amortization." EBITDA is commonly used in Assets A company's resources including cash, inventory, accounts receivable, equipment, buildings, etc. Liabilities A company's obligations it must pay including accounts payable, bank debt, prepayment by customers, taxes and wages owed. Equity Retained earnings, investment by owners and stock. General Ledger A system for tracking all of a business’ transactions. General Ledger involves a system of credits and debits. Liquidity A aspect of the balance sheet. Liquidity means being able to convert something to cash in a short period of time. Working Capital A part of the balance sheet. Working capital is simply the assets and liabilities that a company works with on a daily basis. Glossary of Terms Term Historical Cost Definition Historical-cost-based information focuses on the company’s actual decisions and resulting actions to buy or sell assets and to incur or settle liabilities. Fair Market Value Fair market value is focused on current market prices. It is the amount that would be agreed upon by a willing buyer and willing seller. The amount to be received in an arm's length transaction. Generally Accepted Accounting Principles ("GAAP") This is the general standard by which complete financial statements are prepared. Operating Activities on Cash Flow Statement Transactions and events that normally enter into the determination of operating income including cash receipts from selling goods or providing services, as well as income from items such as interest and dividends. Investing Activities on Cash Flow Statement Transactions and events involving the purchase and sale of securities (excluding cash equivalents), land, buildings, equipment, and other assets not generally held for resale. Financing Activities on Cash Flow Statement The flow of cash to or from the business owners (equity financing) and creditors (debt financing).