Unless otherwise defined, capitalized terms used herein shall have

advertisement

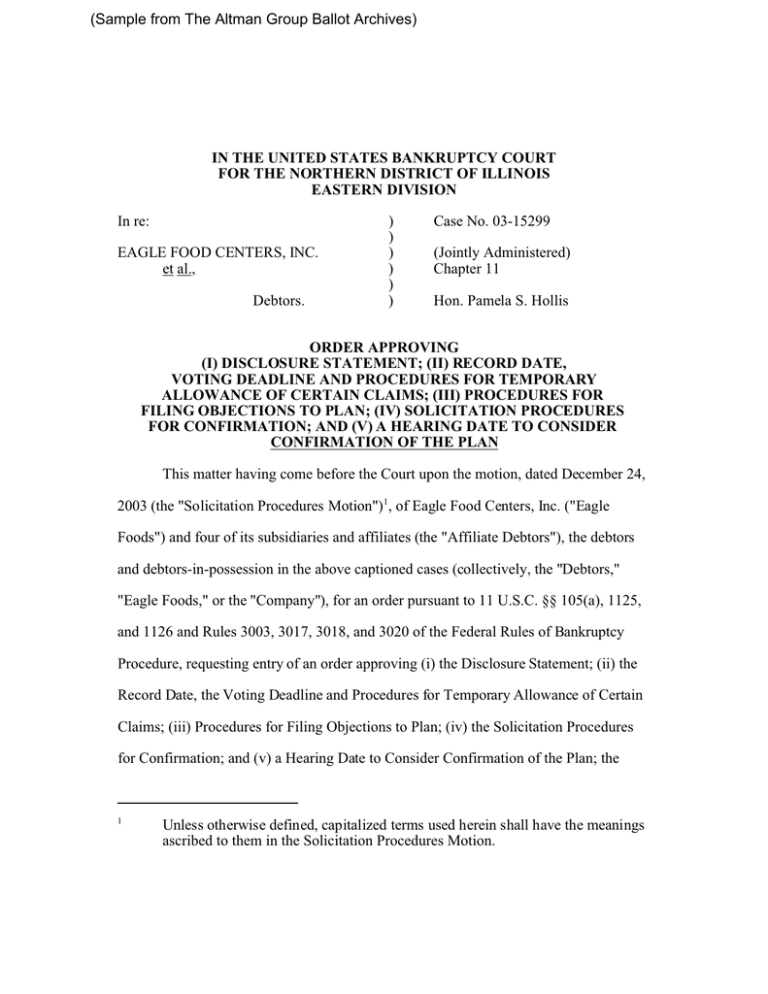

(Sample from The Altman Group Ballot Archives) IN THE UNITED STATES BANKRUPTCY COURT FOR THE NORTHERN DISTRICT OF ILLINOIS EASTERN DIVISION In re: EAGLE FOOD CENTERS, INC. et al., Debtors. ) ) ) ) ) ) Case No. 03-15299 (Jointly Administered) Chapter 11 Hon. Pamela S. Hollis ORDER APPROVING (I) DISCLOSURE STATEMENT; (II) RECORD DATE, VOTING DEADLINE AND PROCEDURES FOR TEMPORARY ALLOWANCE OF CERTAIN CLAIMS; (III) PROCEDURES FOR FILING OBJECTIONS TO PLAN; (IV) SOLICITATION PROCEDURES FOR CONFIRMATION; AND (V) A HEARING DATE TO CONSIDER CONFIRMATION OF THE PLAN This matter having come before the Court upon the motion, dated December 24, 2003 (the "Solicitation Procedures Motion")1, of Eagle Food Centers, Inc. ("Eagle Foods") and four of its subsidiaries and affiliates (the "Affiliate Debtors"), the debtors and debtors-in-possession in the above captioned cases (collectively, the "Debtors," "Eagle Foods," or the "Company"), for an order pursuant to 11 U.S.C. §§ 105(a), 1125, and 1126 and Rules 3003, 3017, 3018, and 3020 of the Federal Rules of Bankruptcy Procedure, requesting entry of an order approving (i) the Disclosure Statement; (ii) the Record Date, the Voting Deadline and Procedures for Temporary Allowance of Certain Claims; (iii) Procedures for Filing Objections to Plan; (iv) the Solicitation Procedures for Confirmation; and (v) a Hearing Date to Consider Confirmation of the Plan; the 1 Unless otherwise defined, capitalized terms used herein shall have the meanings ascribed to them in the Solicitation Procedures Motion. (Sample from The Altman Group Ballot Archives) Court having reviewed the Disclosure Statement, as amended, and the Solicitation Procedures Motion; a hearing having been held on January 29, 2004 (the "Disclosure Statement Hearing"), at which time all interested parties were offered an opportunity to be heard with respect to the Disclosure Statement and Solicitation Procedures Motion; and the Court having reviewed and considered (i) the Disclosure Statement, (ii) the Solicitation Procedures Motion, and objections thereto, if any, (iii) the arguments of counsel made, and the evidence proffered or addressed at the Disclosure Statement Hearing; it appearing that notice of the Disclosure Statement Hearing and the hearing on the Solicitation Procedures Motion was sufficient and proper under the particular circumstances, and that no other or further notice need be given; and it appearing that the relief requested is in the best interests of the Debtors, their estate and creditors and other parties in interest; and upon the record of the Disclosure Statement Hearing and these cases; and after due deliberation thereon, and good cause appearing therefor; IT IS HEREBY ORDERED AS FOLLOWS: A. Approval of Disclosure Statement 1. Pursuant to Rule 3017(b) of the Federal Rules of Bankruptcy Procedure, the Disclosure Statement is approved as containing adequate information within the meaning of Section 1125(a) of Chapter 11 of Title 11 of the United States Code, 11 U.S.C. §§ 101, et. seq. (the "Bankruptcy Code"). 2 (Sample from The Altman Group Ballot Archives) B. Establishment of Record Date, Voting Deadline, and Procedures for Temporary Allowance of Certain Claims 1. Record Date 2. Notwithstanding anything to the contrary in Fed. R. Bankr. P. 3018(a), the record date (the "Record Date") for determining (a) creditors and interest holders entitled to receive Solicitation Packages (as defined below) and (b) creditors and interest holders entitled to vote to accept or reject the Plan shall be January 29, 2004. 2. Voting Deadline 3. The last date and time (the "Voting Deadline") by which ballots for accepting or rejecting the Plan must be received by the Voting Agent (as defined below) in order to be counted shall be March 15, 2004, at 4:00 p.m. (Central Daylight Time). Ballots with original signatures, if applicable, must be returned to the Voting Agent on or prior to the Voting Deadline by (a) mail in the return envelope provided with each ballot, (b) overnight delivery, or (c) hand delivery, in order to be counted. Ballots submitted by facsimile electronic transmission only shall not be counted. 3. Procedures for Temporary Allowance of Certain Claims for Voting 4. Any holder of a claim or interest against which claim or interest the Debtors filed an objection to expunge or disallow such claim or interest shall not be entitled to vote on the Plan and shall not be counted in determining whether the requirements of section 1126(c) of the Bankruptcy Code have been met with respect to the Plan (except to the extent and in the manner as may be set forth in the objection) (a) unless the claim has been temporarily allowed for voting purposes pursuant to Bank3 (Sample from The Altman Group Ballot Archives) ruptcy Rule 3018(a) and in accordance with this Order or (b) except to the extent that, on or before the Voting Deadline, the objection to such claim or interest has been resolved in favor of the creditor or interest holder asserting the claim or interest. To the extent that the Debtors object to only a portion of a claim, the holder of such claim will be entitled to vote to the extent of the non-objected to portion of such claim. Recipients of an objection to expunge their claim or interest shall receive a notice of non-voting status, substantially in the form of Exhibit A attached hereto. 5. The deadline (the "Rule 3018(a) Motion Deadline") for filing motions requesting temporary allowance of a movant's claim or interest for purposes of voting pursuant to Rule 3018(a) of the Federal Rules of Bankruptcy Procedure ("Rule 3018(a) Motions") shall be March 8, 2004 at 4:00 p.m. (Central Daylight Time). Such Motions must be filed and served on the Notice Parties and in the manner set forth herein so as to be received not later than 4:00 p.m. (Central Daylight Time) on the Rule 3018(a) Motion Deadline; provided, however, that if the Debtors object to a claim or interest on or after February 24, 2004, the Rule 3018(a) Motion Deadline shall be extended as to such claim or interest such that the holder thereof shall have at least 14 days to file a Rule 3018(a) Motion. 6. Any party timely filing and serving a Rule 3018(a) Motion shall be provided a ballot and be permitted to cast a provisional vote to accept or reject the Plan. If, and to the extent that, the Debtors and such party are unable to resolve the issues raised by the Rule 3018(a) Motion prior to the Voting Deadline, then at the Confirmation Hearing, the Court shall determine whether the provisional ballot should be counted as a vote on the Plan. 4 (Sample from The Altman Group Ballot Archives) C. Confirmation Hearing and Objections 7. Pursuant to Rule 3020(b)(2) of the Federal Rules of Bankruptcy Procedure, the hearing on confirmation of the Plan (the "Confirmation Hearing") shall be March 25, 2004 at 11:00 a.m. (Central Daylight Time), to be continued, if necessary, to a later date (the "Confirmation Hearing Date"). 8. Pursuant to Rule 3020(b)(1) of the Federal Rules of Bankruptcy Procedure, objections to confirmation of the Plan ("Confirmation Objections") must be filed and served by 4:00 p.m. (Central Daylight Time) on March 12, 2004 (the "Objection Deadline"). Confirmation Objections not timely filed and served in accordance with this Order shall not be considered. 9. Confirmation Objections, if any, must (a) be in writing, (b) comply with the Bankruptcy Rules Procedure and the Local Rules, (c) set forth the name of the objector and the nature and amount of any claim or interest asserted by the objector against or in the Debtors, their estates or their property, (d) state with particularity the legal and factual bases for the objection, (e) be filed with the Court together with proof of service, (f) and served by personal service, overnight delivery, or first class mail, so as to be received no later than the Objection Deadline, by the following (collectively the "Notice Parties"): 5 (Sample from The Altman Group Ballot Archives) Counsel for the Debtors: Skadden, Arps, Slate, Meagher & Flom LLP 333 West Wacker Drive, Suite 2100 Chicago, Illinois 60606 Attn: John Wm. Butler, Jr., Esq. George N. Panagakis, Esq. Ron E. Meisler, Esq. United States Trustee The Office of the United States Trustee 227 West Monroe, Suite 3350 Chicago, Illinois 60606 Attn: M. Gretchen Silver, Esq. Counsel for the Creditors' Committee Foley & Lardner 321 North Clark Street, Suite 2100 Chicago, Illinois 60610 Attn: William J. McKenna, Esq. Jonathan E. Aberman, Esq. D. Solicitation Procedures 1. Duties of Voting Agent 10. In connection with the solicitation of votes with respect to the Plan, Logan & Company, Inc. ("Logan") shall act as the Voting Agent. The Voting Agent is authorized and directed to assist the Debtors in: (i) mailing Solicitation Packages (as defined below), (ii) receiving, tabulating, and reporting on ballots cast for or against the Plan by holders of claims against the Debtors, (iii) responding to inquiries from creditors and stakeholders relating to the Plan, the Disclosure Statement, the ballots and matters related thereto, including, without limitation, the procedures and requirements for voting to accept or reject the Plan and for objecting to the Plan, (iv) soliciting votes on the Plan, (v) if necessary, contacting creditors regarding the Plan, and 6 (Sample from The Altman Group Ballot Archives) (vi) mailing Confirmation Notices to holders of Old Equity and other non-voting parties entitled to notice. 2. Ballots 11. The ballots in substantially the forms attached hereto as Exhibits Exhibits B-1 through B-4 attached hereto, are approved and shall be used in connection with the solicitation of votes on the Plan by holders (and record holders) of impaired claims against the Debtors in Classes 3 and 4. The form of ballots attached hereto as Exhibits B-1 through B-4 each contain sufficient disclosure regarding third party releases. 12. Pursuant to the Plan, Classes 1 and 2 are unimpaired and, therefore, are conclusively presumed to accept the Plan. The Debtors shall not solicit votes with respect to such classes of claims and such classes of claims shall not be entitled to receive ballots. In lieu of a ballot and in accordance with Rule 3017(d), the Debtors shall mail to the Unimpaired Creditors a notice, substantially in the form of Exhibit C attached hereto, which provides (i) notice of the filing of the Plan, (ii) notice of the specific Plan provisions with respect to the unimpaired creditors, (iii) instructions regarding the various ways to obtain and/or view additional copies of the Disclosure Statement and Plan and other documents, (iv) information regarding the Confirmation Hearing, and (v) detailed directions for filing objections to confirmation of the Plan. The Debtors are authorized to distribute Solicitation Packages, absent ballots, to holders of Class 1 and Class 2 claims. 7 (Sample from The Altman Group Ballot Archives) 13. Class 5 does not retain or receive any property under the Plan and is deemed to reject the Plan. The Debtors shall not send ballots to holders of Class 5 Claims and Interests. 3. Content and General Transmittal of Solicitation Package 14. Pursuant to Rule 3017(d) of the Federal Rules of Bankruptcy Procedure, on or before February 12, 2004 (the "Solicitation Mailing Date"), the Debtors shall transmit or cause to be transmitted, to the persons listed below, by United States mail, first class postage prepaid, or by hand or by overnight courier, a solicitation packet (the "Solicitation Package") containing a copy or conformed printed version of: (a) the Notice of (1) Approval of Disclosure Statement, (2) Hearing on Confirmation of Plan; (3) Deadline and Procedures for Filing Objections to Confirmation of Plan; (4) Deadline and Procedures for Temporary Allowance of Certain Claims for Voting Purposes; (5) Treatment of Certain Unliquidated, Contingent or Disputed Claims for Notice, Voting and Distribution Purposes, (6) Record Date; and (7) Voting Deadline for Receipt of Ballots, in substantially the form of the notice annexed as Exhibit E hereto (the "Confirmation Hearing Notice"); (b) the Disclosure Statement; (c) the Plan (which shall be furnished in the Solicitation Package as Appendix A to the Disclosure Statement); (d) the Solicitation Procedures Order (without exhibits attached); (e) solicitation letters, if any, from the Creditors' Committee; and (f) to the extent applicable, a ballot and/or notice appropriate for the specific creditor, in substantially the forms attached hereto (as may be modified for particular classes and with instructions attached thereto). 8 (Sample from The Altman Group Ballot Archives) 15. The Debtors shall file all exhibits and schedules to the Plan and/or appendices to the Disclosure Statement with the Court on or before March 8, 2004 (the "Exhibit Filing Date"). 16. The following creditors and other persons shall receive the Solicitation Package (with exclusions as noted herein): (i) the United States Trustee; (ii) all non-voting unimpaired creditors; (iii) creditors holding claims designated as impaired and entitled to vote on the Plan (A) who have filed timely proofs of claim (or untimely proofs of claim which have been allowed as timely by the Court under applicable law on or before the Record Date) that have not been disallowed by an order of the Court entered on or before the Record Date or (B) whose claims are scheduled in the Debtors' schedules of assets and liabilities dated June 6, 2003, or any amendment thereof (the "Schedules") (other than those scheduled as (x) unliquidated, contingent or disputed or (y) zero or unknown in amount and no proof of claim was timely filed). So as to avoid duplication and reduce expenses, the Debtors propose that creditors who have filed duplicate claims in any given class should be required to receive only one Solicitation Package and allowed one ballot for voting their claims with respect to that class. 17. To supplement notice of the Confirmation Hearing, the Debtors shall send a Confirmation Hearing Notice to parties to executory contracts and unexpired leases, which parties are not currently "creditors" as defined in section 101(10) of the Bankruptcy Code. In addition, the Debtors shall publish the Confirmation Hearing Notice not less than twenty-five (25) days before the Confirmation Hearing in the Quad City Times, The Chicago Tribune and The Wall Street Journal (National Edition). 9 (Sample from The Altman Group Ballot Archives) 4. Transmittal to Certain Claim and Interestholders a. Contingent, Unliquidated, And Disputed Claims 18. Pursuant to Rule 3003(c)(2) of the Federal Rules of Bankruptcy Procedure, with respect to all persons or entities who are listed on the Debtors' Schedules as having a claim or a portion of a claim which is disputed, unliquidated or contingent or which is scheduled as zero or unknown in amount and such person or entity did not timely file a proof claim, the Debtors shall not distribute any documents or notices. 19. Unless otherwise provided herein, with respect to all persons or entities, who timely filed a proof of claim reflecting a claim or portion of a claim that is unliquidated or contingent, the Debtors shall distribute a Solicitation Package which contains, a ballot and the Confirmation Hearing Notice, which shall inform the recipient that his, her or its claim has been allowed temporarily for voting purposes only and not for purposes of allowance or distribution, at $1.00. b. Class 5 Creditors and Equity Holders Deemed to Reject the Plan 20. Holders of Class 5 claims and interests shall receive no distribu- tions under the Plan and are deemed to reject the Plan pursuant to Section 1126(g) of the Bankruptcy Code. The Debtors therefore are authorized and directed to mail to such holders notices, in lieu of the Solicitation Package, substantially in the form of Exhibit D attached hereto. 10 (Sample from The Altman Group Ballot Archives) c. Prepetition Note Holders 21. With respect to the holders of claims arising from the Debtors' Prepetition Notes, the Debtors shall transmit the Solicitation Package (as defined below) to holders of the Prepetition Notes by mailing the Solicitation Package, on or before the Solicitation Mailing Date (as defined herein), to (i) each holder of record of Prepetition Notes as of the Record Date (the "Record Owners"), and (ii) to each bank, brokerage firm, or the agent therefor (collectively, the "Intermediary Record Owners") identified by the Debtors or the Voting Agent as an entity through which beneficial owners (the "Beneficial Owners") hold Prepetition Notes. 22. To facilitate the mailing described above, U.S. Bank Trust National Association (as Indenture Trustee for the Prepetition Notes), within five business days after the Record Date, shall provide the Voting Agent with an electronic file containing the names, addresses and holdings of the respective Record Owners of the Debtors' Prepetition Notes as of the Record Date or, if unable to provide an electronic file, two sets of pressure-sensitive labels and a list containing the same information. The Intermediary Record Owners are ordered to distribute Solicitation Packages to the respective Beneficial Owners within five days of receipt of the Solicitation Packages. Intermediary Record Owners are authorized and directed to follow one of two options to obtain the votes of Beneficial Owners. First, Intermediary Record Owners may forward the Solicitation Package to the Beneficial Owners of the Prepetition Notes for voting, which Package shall include a Beneficial Owner Ballot substantially in the form of Exhibit B-2 attached hereto for Beneficial Owners of the Prepetition Notes and a return envelope provided by, and addressed to, the Intermediary 11 (Sample from The Altman Group Ballot Archives) Record Owner. Under this option, the Intermediary Record Owners must summarize the individual votes of their Beneficial Owners from the Beneficial Owner Ballots on a Master Ballot in substantially the form attached hereto as Exhibit B-3. The Intermediary Record Owners shall then return the Master Ballot to the Voting Agent. 23. Alternatively the Intermediary Record Owner may prevalidate a Beneficial Owner Ballot (a "Prevalidated Ballot") by signing that ballot and by indicating on that ballot the Intermediary Record Owner for the Prepetition Notes, the principal amount of Prepetition Notes, as applicable, owned by such Beneficial Owner, and the appropriate account numbers through which the Beneficial Owner's holdings are derived. The Intermediary Record Owner shall then forward the Solicitation Package, including the Prevalidated Ballot and a return envelope addressed to the Voting Agent, for voting by the Beneficial Owner. 24. Intermediary Record Owners shall pursue the first option, described above, entailing use of Beneficial Owner Ballot and Master Ballot unless such Owners are incapable of doing so, in which case they shall employ the option entailing use of Prevalidated Ballots. 25. The Debtors are authorized to reimburse Intermediary Record Owners for their reasonable, actual, and necessary out-of-pocket expenses incurred in performing the tasks described above upon written request by such entities (subject to the Court's retaining jurisdiction to resolve any disputes over any request for reimbursement). 26. The Debtors shall serve a copy of the Solicitation Procedures Order on the Indenture Trustees for the Prepetition Notes and each Intermediary Record 12 (Sample from The Altman Group Ballot Archives) Owner identified by the Debtors and the Voting Agent as an entity through which Beneficial Owners hold Prepetition Notes. 5. When No Notice or Transmittal Necessary 27. Solicitation Packages shall not be sent to creditors whose claims are based solely on amounts scheduled by the Debtors but whose claims already have been paid in the full scheduled amount; provided, however, if, and to the extent that, any such creditor would be entitled to receive a Solicitation Package for any reason other than by virtue of the fact that its claim had been scheduled by the Debtors, such creditor will be sent a Solicitation Package in accordance with the procedures set forth above. In addition, no Solicitation Package shall be sent to any creditor who filed a proof of claim if the amount asserted in such proof of claim has already been paid. 28. The Debtors shall retain the discretion not to give notice or service of any kind upon any person to whom the Debtors mailed a Disclosure Statement Hearing Notice and received any of such notices returned by the United States Postal Service marked "undeliverable as addressed," "moved - left no forwarding address" or "forwarding order expired," or similar reason, unless the Debtors have been informed in writing by such person or entity of that person's or entity's new address. 6. Procedures for Vote Tabulation 29. Any ballot timely received that contains sufficient information to permit the identification of the claimant and is cast as an acceptance or rejection of the Plan will be counted and will be deemed to be cast as an acceptance or rejection, as the case may be, of the Plan. The foregoing general procedures shall be subject to the following exceptions: 13 (Sample from The Altman Group Ballot Archives) (a) If a Claim is deemed Allowed in accordance with the Plan, such Claim is Allowed for voting purposes in the deemed Allowed amount set forth in the Plan; (b) If a Claim for which a proof of claim has been timely filed is marked as contingent, unliquidated, or disputed, the Debtors propose that such Claim be temporarily Allowed for voting purposes only, and not for purposes of allowance or distribution, at $1.00; (c) If a Claim has been estimated or otherwise Allowed for voting purposes by order of the Court, such Claim is temporarily Allowed in the amount so estimated or Allowed by the Court for voting purposes only, and not for purposes of allowance or distribution; (d) If a Claim is listed in the Schedules as contingent, unliquidated, or disputed and a proof of claim was not (i) filed by the Bar Date or (ii) deemed timely filed by an order of the Bankruptcy Code prior to the Voting Deadline, the Debtors propose that such Claim be disallowed for voting purposes and for purposes of allowance and distribution pursuant to Bankruptcy Rule 3003(c); and (e) If the Debtors have served and Filed an objection to a Claim at least fourteen (14) days before the Confirmation Hearing, such Claim shall be temporarily disallowed to the extent and in the manner as may be set forth in the objection for voting purposes only and not for the purposes of the allowance or distribution, unless otherwise ordered by the Court. The following ballots not be counted or considered for any purpose in determining whether the Plan has been accepted or rejected: (f) Any ballot received after the Voting Deadline unless the Debtors shall have granted an extension in writing of the Voting Deadline with respect to such ballot; (g) Any ballot that is illegible or contains insufficient information to permit the identification of the claimant; 14 (Sample from The Altman Group Ballot Archives) 30. (h) Any ballot cast by a person or entity that does not hold a claim in a class that is entitled to vote to accept or reject the Plan; (i) Any ballot cast for a claim scheduled as unliquidated, contingent, or disputed and for which (a) no proof of claim was timely filed and (b) no Rule 3018(a) Motion has been filed by the Rule 3018(a) Motion Deadline; (j) Any ballot cast in a manner that neither indicates an acceptance nor rejection of the Plan or that indicates both an acceptance and rejection of the Plan; (k) Any ballot submitted by facsimile or electronic transmission; or (l) Any unsigned ballot. Notwithstanding Rule 3018(a) of the Federal Rules of Bank- ruptcy Procedure, whenever two or more ballots are cast voting the same claim prior to the Voting Deadline, the last ballot received prior to the Voting Deadline will be deemed to reflect the voter's intent and thus to supersede any prior ballots, provided however that where an ambiguity exists as to which ballot was the latest mailed, the voting agent reserves the right to contact the creditor and calculate the vote according to such voter's stated intent. This procedure shall be without prejudice to the Debtors' right to object to the validity of the second ballot on any basis permitted by law, and, if the objection is sustained, to count the first ballot for all purposes. 31. Claim splitting is not permitted. Creditors who vote must vote all of their claims within a particular class to either accept or reject the Plan. 32. Intermediary Record Owners electing to use the Master Ballot voting process shall retain for inspection by the Court the Beneficial Owner Ballots cast by Beneficial Owners for one year following the Voting Deadline. Intermediary Record 15 (Sample from The Altman Group Ballot Archives) Owners electing to send Prevalidated Ballots to Beneficial Owners for direct return to the Voting Agent shall retain for inspection by the Court a list of those Beneficial Owners to whom such Prevalidated Ballots were sent for one year following the Voting Deadline. 33. To avoid double counting, (i) votes cast by Beneficial Owners holding Prepetition Notes through Intermediary Record Owners and transmitted by means of either a Master Ballot or a Prevalidated Ballot shall be applied against the positions held by such Intermediary Record Owners with respect to such Security and (ii) votes submitted by an Intermediary Record Owner on a Master Ballot or a Prevalidated Ballot shall not be counted to the extent they are in excess of the position maintained by the respective Intermediary Record Owner in the Prepetition Notes on the Record Date. 34. The following assumptions shall apply to Prevalidated Ballots: (i) each Prevalidated Ballot shall be for a single account, and (ii) each vote shall be a separate vote and not duplicative of any other vote cast by other customers of such Intermediary Record Owner (unless specific evidence exists that indicates that one vote is for the identical account number and amount of another vote). 35. To the extent that conflicting votes or overvotes are submitted on a timely received Master Ballot or Prevalidated Ballot, the Voting Agent shall attempt to resolve the conflict or overvote prior to the Voting Deadline in order to ensure that as many Prepetition Notes claims as possible are accurately tabulated. 36. To the extent that overvotes on a timely received Master Ballot or Prevalidated Ballot are not reconcilable prior to the preparation of the vote certification, 16 (Sample from The Altman Group Ballot Archives) the Voting Agent shall count votes in respect of such Master Ballot or Prevalidated Ballot in the same proportion as the votes to accept and reject the Plan submitted on the Master Ballot or Prevalidated Ballot that contained the overvote, but only to the extent of the applicable Intermediary Record Owner's position on the Record Date in the Prepetition Notes. 37. Intermediary Record Owners are authorized to complete multiple Master Ballots, and the votes reflected by such multiple Master Ballots shall be counted except to the extent that they are duplicative of other Master Ballots. If two or more Master Ballots are inconsistent, in whole or in part, the latest Master Ballot received prior to the Voting Deadline will, to the extent of such inconsistency, supersede and revoke any prior Master Ballot, subject to the Debtors' right to object to the validity of the second Master Ballot on any basis permitted by law, including under Rule 3018(a), and, if such objection is sustained, the first Master Ballot will then be counted. 17 (Sample from The Altman Group Ballot Archives)