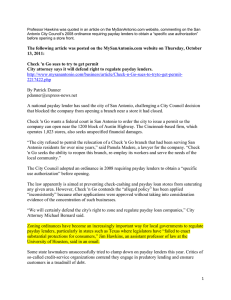

small amount lending provisions

advertisement