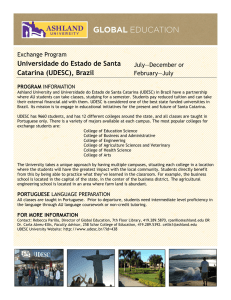

Centrais Elétricas de Santa Catarina S.A.

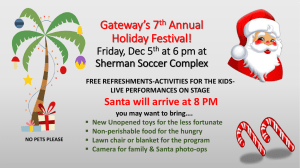

advertisement