Alternative Investments and Complex Products

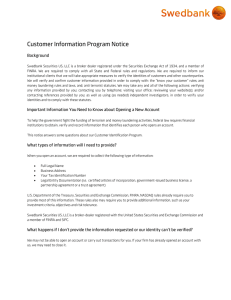

advertisement