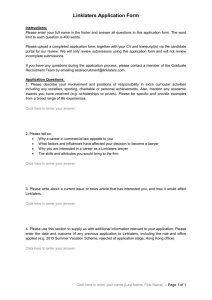

Amendments to the Prospectus and Listing Rules

advertisement

Amendments to the Prospectus and Listing Rules On 29 June 2007, the Financial Services Authority (the “FSA”) published a policy statement on amendments to the Prospectus Rules and Listing Rules. The changes take effect from 6 August 2007. This note summarises the effect of the key changes. Disclosure of directors’ dealings The FSA have clarified the uncertainty that was brought about by their previous failure to update or delete references to provisions of the Companies Act 1985 that have been repealed. A revised LR 9.8.6(1) now requires a statement setting out “all the beneficial and non-beneficial interests of each person who has been a director of the listed company during the period under review, including changes between the end of the period under review and a date not more than one month prior to the date of the [AGM notice]…. stating the date each interest commenced (and the date it came to an end or, if ongoing, a statement to that effect). Interests of each director include interests of connected persons as defined in the Companies Act 2006.” This appears to require annual reports to contain full details of all changes in directors’ interests throughout the year rather than just at the period end, as is currently required. However, the FSA have confirmed that their intention was not to go further than to replicate the provisions of the Companies Act 1985, requiring disclosure of directors’ interests in shares as at the end of the financial reporting period, which were repealed with effect from April 2007. A corresponding change has been made to DTR 3.1.4 which requires directors’ dealing notices to contain the information required under LR 9.8.6(1)R, as well as any information received under S.793 Companies Act 2006 (company inquiries about shareholdings). Model Code Removal of “employee insiders” from scope “Employee insiders” are removed from the scope of the Model Code so that it will only be “persons discharging managerial responsibilities” (“PDMRs”) who would have to comply with the Model Code. Although this technically removes the requirement for all persons on insider lists to be subject to the Model Code, in practice some companies may still feel it appropriate to have dealing codes applying to employees other than those with PDMR status. Note that this amendment does not impact on a listed company’s obligations under the Disclosure and Transparency Rules to continue to draw up insider lists. Pre-clearance to deal A revised procedure for pre-clearance for dealing in a listed company’s securities where neither the chairman nor the CEO is available is introduced. Pre-clearance may be provided by the senior independent director, a committee of the board or other officer of the company nominated for that purpose by the chairman or the CEO. This represents a change from the previous FSA proposal that the board should provide pre-clearance in this situation - this was highlighted in consultation as being too heavy-handed and costly a process. ⏐July 2007 1 Continuing obligations: ongoing control of assets A new listing rule is introduced requiring a listed company to demonstrate on an ongoing basis that it controls the majority of its assets. This will not apply to a mineral company, a scientific research based company, venture capital trust or other investment entity (new LR 9.2.2A). As regards property companies, which operate a co-investment business model with control exercised by a fund manager, advised by the property company, the FSA states that provided the company can demonstrate that it meets the underlying objectives (of being able to report properly, to ensure compliance with the related party and substantial transaction rules, and to drive the company’s agenda forward), the FSA “would normally treat this requirement as being satisfied”. Significant transactions Material changes A new rule is introduced to clarify that a material change in the terms of a transaction which occurs after shareholder approval has been given would be considered to be a new transaction subject to further shareholder approval. The rules provides “rule of thumb” guidance that an increase of 10% or more in the consideration for a transaction would constitute a material change for these purposes. Reverse takeovers New guidance is introduced to clarify when suspension of a listed company’s securities in accordance with LR 5 is necessary once a reverse takeover has been announced or leaked. The decision rests with the listed company to consider the appropriateness of suspension. Suspension will not be required if there is sufficient information in the market about the proposed transaction. However, generally, the FSA considers that the company will not be able to inform the market sufficiently about its financial position to avoid the need for suspension. The FSA expects the listed company to consult the FSA in order to reach the appropriate decision. Uncapped exit arrangements The rule that transactions with uncapped consideration are to be automatically treated as Class 1 transactions is amended. In relation to a transaction or joint venture exit arrangement where the consideration is uncapped, if the other class tests indicate it would otherwise be a Class 2 transaction, the transaction is treated as Class 1 transaction. If the other class tests indicate that it would otherwise be a Class 3 transaction, it is treated as a Class 2 transaction. The FSA states that it will keep this area under review. Joint ventures Acquisition/disposal of joint ventures in the ordinary course of business The FSA takes the opportunity to confirm that, for some companies, the acquisition and disposal of joint venture interests might be transactions of a revenue nature in the ordinary course of business and therefore not subject to the class tests in LR 10, although this will need to be tested on a case by case basis. This is relevant to PFI companies operating through joint ventures on a regular basis. Joint ventures as related parties The references to 50:50 joint venture parties as related parties are deleted in LR 11 on the basis that such vehicles are increasingly part of normal commercial arrangements and the joint venture partner is unlikely to exert “significant influence” over the listed company involved. This is helpful ⏐July 2007 2 as it means that for joint ventures only the LR 10 significant transaction rules still need to be considered. Takeovers Cancellation of listing The requirement that a listed company need not obtain the prior approval of its shareholders in respect of the cancellation of listing in takeover situations where certain conditions have been satisfied is extended to include schemes of arrangement (as well as other situations where it is impractical for a listed company to seek the prior approval of shareholders because of a liquidation or administration). Appointment of sponsor The FSA will introduce a requirement for a listed company to appoint a sponsor when it applies for a primary listing of its equity securities which requires the publication of an equivalent document produced in lieu of a prospectus in the context of a takeover or merger. Note that this requirement will come into effect on 6 October 2007. Related Party Transactions Loans to directors The list of transactions to which related party transaction rules do not apply is extended to include loans to directors made under Sections 204 or 205 of the Companies Act 2006 (which will replace Sections 337 and 337A of the Companies Act 1985 from 1 October 2007). Substantial shareholder The definition of “substantial shareholder” is amended to exclude situations where a shareholder is only a related party of the listed company by virtue of managed funds held by the subsidiary of the shareholder. This obviates any issues that a listed company would have in dealing, for example, with a financial services institution which has fund management subsidiaries with substantial shareholdings in the company. Pro forma financial information in certain circulars A new rule is introduced into LR13 clarifying that when a Class 1, related party or significant buyback circular (i.e. a circular relating to the purchase by a company of 25% or more of its issued equity shares) includes pro forma information, the pro forma information must be prepared in accordance with the Prospectus Directive Regulation (809/2004). Annual information update PR 5.2.2R will permit wholesale issuers of debt securities to file an annual information update on a voluntary basis if they wish to do so. Once the election is made, the filing would continue on an ongoing basis for 3 years. Further information The policy statement is available at http://www.fsa.gov.uk/pubs/policy/ps07_08.pdf. For further information, please contact Lucy Fergusson (lucy.fergusson@linklaters.com) or Jo Healey (joanna.healey@linklaters.com), or your usual contact at Linklaters. ⏐July 2007 3 Linklaters 3 July 2007 This publication is intended merely to highlight issues and not to be comprehensive, nor to provide legal advice. Should you have any questions on issues reported here or on other areas of law, please contact one of your regular contacts, or contact the editors. © Linklaters LLP. All Rights reserved 2007 Please refer to www.linklaters.com/regulation for important information on our regulatory position. We currently hold your contact details, which we use to send you newsletters such as this and for other marketing and business communications. We use your contact details for our own internal purposes only. This information is available to our offices worldwide and to those of our associated firms. If any of your details are incorrect or have recently changed, or if you no longer wish to receive this newsletter or other marketing communications, please let us know by emailing us at marketing.database@linklaters.com Linklaters LLP is a limited liability partnership registered in England and Wales with registered number OC326345. The term partner in relation to Linklaters LLP is used to refer to a member of Linklaters LLP or an employee or consultant of Linklaters LLP or any of its affiliated firms or entities with equivalent standing and qualifications. A list of the names of the members of Linklaters LLP together with a list of those non-members who are designated as partners and their professional qualifications is open to inspection at its registered office, One Silk Street, London EC2Y 8HQ and such persons are either solicitors, registered foreign lawyers or European lawyers. ⏐A08021138⏐July 2007 4