Implementation of Value Added Tax in Tally.ERP 9

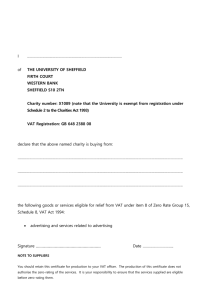

advertisement