City National Bank Visa personal - 31302

advertisement

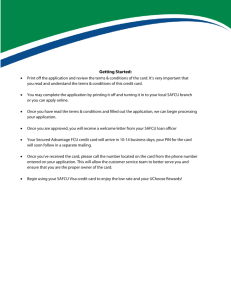

Page 1 of 2 City National Bank Visa personal credit cards for RBC clients Experience the difference You have a sophisticated financial life. With City National Bank recently joining the RBC® family of companies, you now have access to a broader and deeper range of wealth management capabilities. This includes expanding your choices regarding the credit cards you use for personal needs. City National Bank is dedicated to providing credit tools that deliver optimum flexibility, opportunity and utility to financially successful individuals and families. Designed to help you simplify your financial life, City National Bank offers the following Visa® personal credit cards1: •City National Crystal® Visa Infinite® Card •Visa Signature® Card •Visa Platinum Card Used for everyday expenses – or for travel and entertainment experiences – City National Visa® Credit Cards1 combine convenient buying power with easy online card monitoring and management. Plus, you’ll enjoy practical features and benefits every time you use your card2: •City National Rewards® 3 • Family card functionality •Card alerts •Chip technology •Apple Pay™ Being able to use your credit privileges—whenever and wherever you need them —is essential to keeping up with your busy life. With City National Bank, experience the difference and enjoy the same dedication to extraordinary client service that you receive today through RBC Wealth Management. Apply today Enjoy the benefits of being a City National Bank credit card holder. For more information, contact your RBC Wealth Management financial advisor. Exclusive offer for RBC clients As a client of RBC Wealth Management, a special offer for the Crystal® Visa Infinite® card is available through September 30, 2016. Earn 50,000 Bonus Points when you spend $5,000 or more within 90 days of opening your account.4 City National Bank Experience the differenceSM Since its founding in 1954, City National Bank has remained dedicated to building a strong and stable financial institution that places the needs and interests of its clients above everything else. •73 offices including 16 full service regional centers in Southern California, the San Francisco Bay Area, Nevada, New York City, Nashville and Atlanta. •Rated 4-Star for financial strength by Bauer Financial, the nation’s leading bank-scoring service.* •Recognized for excellence in business banking by Greenwich Associates for 11 years between 2005-2015. ** Page 2 of 2 City National Bank Visa personal credit cards for RBC clients, continued Apple and the Apple logo are trademarks of Apple Inc., registered in the U.S. and other countries. Apple Pay is a trademark of Apple Inc. Visa and Visa Infinite are registered trademarks of Visa International Service Association and used under license. * Rated “four out of five stars” (on a scale of zero to five, with five stars being strongest) by Bauer Financial (bauerfinancial.com), an independent bank-scoring service. (Current through January 2016). ** Each year Greenwich Associates evaluates more than 750 banks. Results are based on interviews of more than 25,000 executives at small and mid-sized businesses with sales of $1 million to $500 million. No Greenwich Excellence Awards in CNB’s business banking categories were made in 2006. Products and services offered through City National Bank are not insured by SIPC. City National Bank MEMBER FDIC. Banking products and services are offered or issued by City National Bank, an affiliate of RBC Wealth Management, and are subject to City National Bank’s terms and conditions. Visa Personal Credit Cards are issued and subject to credit approval by City National Bank, an affiliate of RBC Capital Markets, LLC. For more information on City National Bank Visa personal credit cards, visit www.cnb.com. 1 2 Benefits are subject to change at any time without notice. 3 For more information on the City National Rewards program, visit www.cnb.com/rewards. The Crystal Visa Infinite Credit Card is subject to credit approval. If you apply and are approved for the Crystal Visa Infinite Card account, to qualify and receive 50,000 Bonus Points, your account must be opened between May 2, 2016 and September 30, 2016, and you must make net new purchases (purchases less returns & credits) totaling $5,000 or more, which are posted to your account during the first 90 days following the date of account opening. Please allow at least 7 days for processing your application request. If additional information is needed, the processing of your application may take longer and delay the opening of your account. If your account is opened after September 30, 2016, your account will not qualify for this Bonus Point offer. The posting date for a purchase may be later than the transaction date, depending on the date merchant information is received by City National Bank. Therefore, if a purchase takes place near the end of the 90-day period, the posting date may not occur until after the expiration date of the 90-day period, in which case the purchase will not be counted toward the $5,000 or more spending requirement. Bonus Points are earned on a per account basis and not on each card issued under an account. PIN-based and ATM transactions do not earn Points. Taxes on the Bonus Points, if any, are the cardholder’s responsibility. After qualifying, please allow 4 to 6 weeks for the Bonus Points to be credited to your City National Rewards account. To be eligible for this Bonus Points offer, the Crystal Visa Infinite Card account must be open and in good standing (such as, not delinquent or otherwise in default) at the time the Bonus Points are posted to your City National Rewards account. See the City National Rewards Program Terms, Conditions and Program Rules (“Program Rules”) and FAQs on www.cnb.com/rewards for further information on earning Points. Program Rules are subject to change at any time without notice. For more details on the features and benefits of the Crystal Visa Infinite Card, visit www.cnb.com. 4 RBC Wealth Management, a division of RBC Capital Markets, LLC, Member NYSE/FINRA/SIPC. © 2016 All rights reserved. 31302 (05/16)