SEC FINRA National Senior Investor Initiative Report

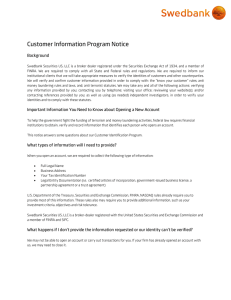

advertisement