Fee Schedule - Consumer Effective October 1, 2015

advertisement

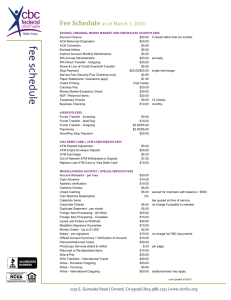

Miscellaneous Fees Account Closure Within 90 Days of Opening Account Reconciliation (1/2 Hour Minimum) Account Research (1/2 Hour Minimum) Account History Bank Initiated ACH Credits/Debits Fee Schedule - Consumer Effective October 1, 2015 Online Banking/Mobile Banking Use your PC or mobile device to check balances, view account activity, view E-Statements, transfer funds between internal or external accounts, view images of paid checks online and more. E-Statements & E-notices View and Print Check Images Mobile Banking Mobile Deposit Bill Payer On Demand Transfer Transfer funds between your Citizens Bank account and your accounts at another financial institution No Charge No Charge No Charge No Charge No Charge Outgoing - $1.00/transfer Incoming – No Charge Telephone Banking Contact Us at 262.363.6550 OR Toll Free 1.877.546.5868 24 Hour Automated Service Non-Automated Telephone Transfer No Charge * $2.00/request ATM & Debit Cards Information related to ATMs owned and operated by Citizens Bank is available at any of our branches or on our website. ATM Transaction Fee Citizens Bank ATM Non-Citizens Bank ATM Non-Customer ATM Deposit Adjustment Annual Debit Card Fee Replace Debit Card (Annual Basis) First Card Second Card Third or More Card(s) Replace Debit Card – Rush Fee Change/Reissue PIN for Debit Card PIN Mailer Transactions Conducted Outside the US No Currency Conversion Currency Conversion No Charge $2.00/item** $3.00/item $10.00/item No Charge $5.00 $15.00 $20.00 $45.00 $2.00/request $2.00/request 0.08% transaction 1.00% transaction Wire Transfers – Bank Customers ONLY Domestic Incoming Domestic Outgoing International Incoming International Outgoing $10.00/wire $25.00/wire $15.00/wire $60.00/wire $30.00/account $30.00/hour $30.00/hour $5.00/account Outgoing - $1.00/item Incoming – No charge $1.00 Balance Inquiry CD Rom (PC Format Only) Unlimited Documents $30.00/CD CD Rom (Mac/Apple Format) Up to 12 Months of Documents in PDF $35.00/CD Each Additional Year of Documents in PDF $5.00/year On-Us Check Cashing for Non-Customers $6.00/check Coin Counting Customer No Charge Non-Customer 10% of total Collections (Incoming or Outgoing) $30.00/item Deposit Bags: Locked Deposit Bags $20.00 each Banking Deposit Bags $5.00 each Deposited or Cashed Item Returned Unpaid $12.00/item Duplicate Copies of Items $5.00/item Includes statements, 1099 statements, deposit or withdrawal tickets, copies of paid checks and other bank documents Fax (Incoming or Outgoing) $2.00/page Large Outgoing Item Returned ($2500 and Over) $12.00/item Legal Processing Request $75.00/item Medallion Signature Guarantee $20.00 each Notary Customer No Charge Non-Customer $5.00/request Photocopies $0.25/page Recording / Legal / Payoff Statement Fee $15.00 Statement Duplicate Monthly Statement $10.00/month E-Statements No Charge * Printed Statement (Checking Only) $3.00/account Returned Undeliverable $5.00/item Stop Payment $30.00/item Transfer IRA to a New Custodian $40.00 Written Account Verification $5.00/request Traveler’s Checks & Gift Cards American Express – Regular Traveler’s Checks Customers Only Gift Cards No Charge $5.00/card *Waived for customers age 65 or better. **There may be additional fees imposed by other institutions or ATM owners when using Non-Citizens Bank ATMs. Overdraft/NSF – Related Charges International Transactions – Bank Customers ONLY Fees apply when overdraft is created by check, in-person withdrawal, ATM withdrawal, or other electronic means. No overdraft fees will be charged if your Account is overdrawn by $5 or less after posting all transactions at the end of a business day. Due to the high cost of collection services imposed by correspondent banks, checks drawn on banks in foreign countries (with the exception of Canada) with a value less than $100.00 in US currency cannot be accepted for redemption or collection. Overdraft Item PAID Overdraft Item RETURNED Overdraft Protection Transfer (New Account) Sweep Fee – Overdraft Sweep Fee – Balance Maintenance Canadian Checks Deposited in US Dollars $5.00/check Redemption or Collection of Foreign Checks, Travelers Checks, or Currency $20.00/order + costs Order Travelers Checks or Currency in Foreign Denominations $20.00/order + costs $30.00/item $35.00/item $30.00 annually $5.00/item $30.00 annually Official Bank Checks – Bank Customers ONLY Limitations on all Money Market and Savings Accounts Good Life Club members receive cashiers checks and personal money orders at No Charge. Federal Reserve Regulation D limits the total number of withdrawals made by check and telephone, online banking and overdraft protection, as well as preauthorized withdrawals (including card based purchases, automatic transfers and wire transfers) to six (6) per calendar month for savings and money market accounts. Cashiers Check for Amounts Over $200.00 Personal Money Orders $3.00/item $2.00/item Dormant Accounts Any checking or savings account with no customer initiated deposit or withdrawal for one year and has a balance of less than $100.00 will be charged a $6.00 “inactive” fee quarterly on January 1, April 1, July 1 and October 1. No service charge will be assessed if you maintain a balance of $100.00 or more or if you made at least one deposit or withdrawal transaction during the past year. The fee is waived on custodial accounts for minors. Health Savings Accounts Minimum balance of $100.00 required Setup Fee Transfer Fee Minimum Balance Fee $25.00 $40.00 $3.00 Safe Deposit Boxes Automated billing of fees reduces annual fee by $5.00 and an additional $5.00 for Good Life Club members annually. Box depth approximately 22”. Rent: 3x5 5x5 3 x 10 5 x 10 10 x 10 Replace Lost Key Drilling Fee Late Fee (27 days past due) $25.00/year $35.00/year $45.00/year $55.00/year $80.00/year $25.00/key $175.00 $10.00/box Excessive Withdrawal Fee (over six pre-authorized withdrawals) $10.00/calendar month See account disclosures for additional information. Account Access Online Banking View and manage your accounts and apply for mortgage loans at CitizenBank.com Mobile Banking View and manage your accounts, including mobile deposit, by downloading our free apps for Android™, iPhone® and iPad® Telephone Banking Toll Free 262.363.6550 OR 1.877.546.5868 A Personal Banker at any of our locations can answer questions regarding our fees or accounts. Call us at 262.363.6500. Visit us at CitizenBank.com to find a branch office near you. Download our free apps for Android™, iPhone® and iPad®