2008-2009 - Financial Planning Standards Council

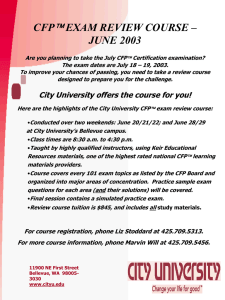

advertisement

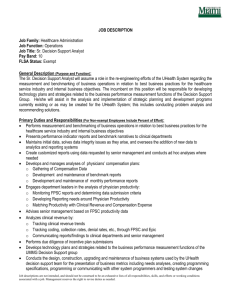

Financial Planners Standards Council 902-375 University Avenue Toronto, ON 2J5 Telephone: 416 593 8587 Toll Free: 1 800 305 9886 Email: inform@fpsc.ca Website: www.fpsc.ca CFP®, CERTIFIED FINANCIAL PLANNER® and are certification marks owned outside the U.S. by Financial Planning Standards Board Ltd. (FPSB). Financial Planners Standards Council is the marks licensing authority for the CFP marks in Canada through agreement with FPSB. ©2008, Copyright Financial Planners Standards Council. All rights reserved. 2008-2009 annual report Table of Contents Our Purpose, Mission and Values . ............................................................................ 2 Message to our Stakeholders..................................................................................... 3 President’s Message Chair’s Message RAISING AWARENESS............................................................................................ 6 FOSTERING A PROFESSIONAL ENVIRONMENT.................................................. 9 The Path to CFP® Certification.................................................................................... 10 LEADING THE PROFESSION.................................................................................. 13 Profile of the Profession.............................................................................................. 16 2009 Financial Statements ........................................................................................ 19 Member Organizations............................................................................................... 20 FPSC Board of Directors............................................................................................ 21 FPSC ANNUAL REPORT 2008-2009 | TABLE OF CONTENTS Our Purpose To ensure the financial planning needs of Canadians are well served. Our Mission We develop, promote and enforce professional standards in financial planning and we raise awareness of the importance of financial planning. Our Values Financial Planners Standards Council embraces professionalism, demonstrates leadership and offers an unparalleled commitment to excellence, quality and continuous improvement in every task we undertake and each relationship we forge and preserve. We believe diversity is a vital ingredient in any productive environment. Our dedication to an equitable workplace will always ensure that all are valued and all are treated with dignity. We value our integrity and our passion; it is the basis for our reputation and our source of strength. We expect to be held accountable, always striving to be clear and open in all of our communications. Above all, and in every transaction and engagement we are ethical, respectful and fair. 2 Message to our Stakeholders President’s Message Like most Canadians, FPSC will remember 2008 -09 as a year of challenge. The economic downturn in the fall of 2008 created uncertainty for all. Many looked at the erosion of their retirement savings and expressed concern on their future financial wellbeing. However, with challenge always comes opportunity and this past year was no exception. FPSC saw this year in particular as one in which the benefits of financial planning became especially salient. In the last year, we clarified our purpose of ensuring the financial planning needs of Canadians are well served. This clear statement of purpose reached deep into FPSC’s core. Everything we do as an organization now directly reflects this purpose, giving us greater strength to stay on course and to do what’s needed. The economic crisis also brought into focus the lack of existing research on the real benefits of financial planning and of CFP® certification. FPSC began addressing this gap with a groundbreaking study on the value of financial planning – initiated this fiscal year and expected to be published in the winter of 2010. We placed a high value on education this year: for candidates, by unveiling a new Capstone Course as part of the new certification path; for CFP professionals, by introducing new CE requirements that now align with the Competency Profile; and for consumers, by promoting the importance of financial planning to all. Finally, as we continue to develop voice as the authority on the financial planning profession, cooperation with governments, regulators, allied organizations and industry takes on renewed importance, and we’re up for the challenge. The commitment of FPSC staff, the Board, Committees and all volunteers continues to impress. It is both heartening and encouraging to know we have such a dedicated team of individuals committed to our purpose. I look forward to the next year, as we continue on our course towards ensuring the financial planning needs of Canadians are well served. On a final note, you’ll see a different look for FPSC throughout this year’s Annual Report. It’s a sneak preview of the new brand identity FPSC will officially unveil next year. We hope you like it. Cary List CA, CFP President and CEO Financial Planners Standards Council FPSC ANNUAL REPORT 2008-2009 | 3 Chair’s Message FPSC is maturing. We recognize the meaningful commitment and responsibility we have to Canadians in working to achieve a financial planning solution in Canada, and for providing them with competent and ethical financial planners. Other organizations are showing increased recognition of FPSC; regulators are taking greater notice of our role. It is undeniable to say that FPSC is growing in profile, visibility and acceptance, and I am immensely proud of the role the Board has played in assisting this progression. As Board Members and FPSC staff worked together at the October Board meeting to develop a revamped mission and values statement, it was a revelation to me the extent to which we are united in our perception of FPSC’s purpose: to ensure the financial planning needs of Canadians are well served. Our governance structure was rejuvenated this fiscal year to ensure the representation of a variety of perspectives, including that of the first- ever Public Member, Ellen Roseman, Toronto Star finance columnist. The new structure encourages greater involvement from the CFP® professional community. We felt it was incumbent to have CFP professionals participate directly in the election of a portion of FPSC leadership, similar to other professional organizations. I am appreciative of the exemplary group of people that sit on the FPSC Board, as well as the FPSC staff who bring our vision to life. I look forward to seeing FPSC further fulfill its potential in the years ahead. Cheryl Bauer Hyde CFP Bauer Hyde Financial Services 4 Thank you to our dedicated volunteers. FPSC is proud of the passion and dedication of its many CFP® professional volunteers across Canada. As a Toronto-based organization, FPSC relies on volunteers coast-to-coast to create a presence in their local communities. The success of many of our public relations and media activities depends upon them and the knowledge they enthusiastically impart to Canadians. Volunteers also provide subject matter expertise in financial planning for examination development activities like item development and test writing. Raising Awareness In the 2008-2009 fiscal year, FPSC continued to build upon existing relationships and projects to accomplish our goal of obtaining recognition of financial planning as a distinct profession. Concern regarding succession planning for financial planners brought a renewed focus on attracting new candidates to the profession, while the economic crisis of fall 2008 provided a platform for FPSC to speak to Canadians – through a variety of media – about the value and importance of financial planning. “Now, more than ever…” The economic downturn in fall 2008 had many Canadians Landmark financial planning study underway thinking about their personal financial situation, and FPSC In 2008, FPSC laid the groundwork for a landmark harnessed that opportunity to create a conversation “Value of Financial Planning” study that will begin in the about the value of financial planning. 2009-2010 fiscal year. This significant five-year study, In September 2008, Canadians experienced the value proposition of financial planning and of CFP® professionals in particular during the GLOBAL TV HELPLINE segment. More than 400 Canadians called in with questions and concerns about their current financial situation during the immensely popular segment. which will follow a group of Canadians and track their financial situation, will quantify the tangible benefits of financial planning as well as the value related to achieving one’s life goals (the emotional benefits of financial planning). This ground-breaking study is the first of its kind in Canada, and given the lack of existing research on “CFP®” in the media FPSC continues to be highly-regarded amongst trade and consumer media for sourcing financial planning experts. Throughout the 2008 - 2009 fiscal year, numerous community print, industry papers and local radio programs interviewed CFP professional volunteers as experts in various financial planning issues, like mortgages, divorce, post graduates, youth, severances, etc. We also issued 12 news releases on a variety of timely finance topics to consumer and industry press. the real value of financial planning, we look forward to sharing the preliminary results in late 2009. NOCA Conference At the NOCA 2008 Educational Conference in November, FPSC staff presented a seminar entitled “How to Really Use Your Competency Profile to Drive Your Certification Requirements” to approximately 50 conference attendees. Led by FPSC, this presentation also featured speakers from Advocis, CGA-Canada, and the CFA Institute. 6 Connecting with Canadians Attracting new candidates To reach wider audiences with the financial planning story, FPSC staff (often accompanied by CFP professional volunteers) attended 15 career recruitment events in the 2008-2009 fiscal year. Career events and designation days continue to be crucial as FPSC moves to address both the potential lack of talent that is causing concern in the financial services industry and to communicate the 2010 certification program changes. FPSC participated in six tradeshows in this fiscal year. Thousands of people stopped by the FPSC booth at a variety of venues across Canada to learn more about financial planning and to talk to a CFP professional. Information sessions, facilitated by FPSC and hosted by CFP professional volunteers, continued to be popular: eight seminars in three provinces occurred this fiscal. These sessions objectively informed hundreds of Canadians about the value of financial planning and encouraged an interactive engagement on financial planning issues. FPSC staff recognized for expertise FPSC staff continue their involvement in external projects that will further FPSC’s consumer-interest mandate. Cary List, President and CEO, is in his third year on the Board of the National Association for Competency Assurance (NOCA), and remains active in the advancement of financial planning internationally as FPSC’s delegate to the international FPSB Council. Dr. John Wickett, Senior VP, Standards and Certification, has joined IIROC’s Education and Equivalency Committee. Lovett-Reid wins 2009 DJJ Award The 2009 winner of the Donald J. Johnston Award for Excellence in Financial Planning (DJJ award) was Patricia Lovett-Reid, Senior Vice President of TD Waterhouse. Patricia’s career in the financial services industry spans more than 20 years, and Presentations about CFP certification were in unprecedented high demand this fiscal year. FPSC facilitated 17 sessions with the assistance of professors and teachers from colleges and universities across Canada. The Student Associate Program continues to increase in value for its members. In the 2008-2009 fiscal year, FPSC held three interactive webinars for Student Associates, and new sample exam questions were added regularly. The number of members has remained steady, with approximately 530 as of March 2009. Unique candidate groups FPSC attended two conferences targeting internationally educated professionals seeking information on the banking and finance industry in Canada, and provided information via networking sessions and panel discussions. FPSC engaged professionals holding an Approved Prior Credential (APC) to encourage them to earn CFP certification as a value-add for their clients. FPSC staff presented at an Accounting Conference and Wealth Management tour; CFP professional volunteers also spoke to two local chapter groups for accountants in Alberta. Another campaign encouraged APC bodies to notify their members about the 2010 Certification changes. she is a respected public educator and sought-out media personality. Patricia directed the $10,000 DJJ charitable donation to Youth in Motion. FPSC ANNUAL REPORT 2008-2009 |7 FPSC Officially Announces Changes to CFP Certification Program ® “Candidates for CFP certification will have an opportunity to demonstrate their competence in serving the financial planning needs of Canadians through a progressive certification process that provides them with a pathway to success; employers will be assured of a credential that continues to earn its reputation as the highest standard in financial planning; and the public will continue to be assured that a CFP professional holds the credential that represents the appropriate competence and ethical standards in financial planning to serve their needs.” Cary List, President and CEO, FPSC Excerpt from June 24, 2008 press release Fostering a Professional Environment FPSC strives to ensure CFP® professionals gain access to adequate professional resources and services. In this fiscal year, we continued to build on relationships with industry players for the purpose of increased support of CFP certification and FPSC’s financial planning standards. Evolution of continuing education requirements To better align continuing education (CE) activities with the CFP Professional Competency Profile, new requirements were announced in 2009. In effect as of January 1, 2009 in regard to strengthening the relationship between IQPF and FPSC, and will work toward a more formalized relationship in 2009-2010 fiscal year, to ensure common standards across all provinces. be related to the CFP Professional Competency Profile FPSC website: a hub for the public and professionals through the elements of competency, the professional In addition to acquiring our new web domain, www.fpsc.ca, skills or the technical knowledge required. CE activities FPSC’s online presence continued to improve in the are now classified as “verifiable” or “non-verifiable”. 2008-2009 fiscal year. The job site continues to grow as and to be reported in the 2009 period, all activities must a resource – presently, we have posted opportunities from Annual licence certificate for CFP professionals 107 employers. FPSC developed new certificates for CFP professionals place for a major revamp of the website in the 2009-2010 which accompany the FPSC annual licence. Newly licensed fiscal year. To make the site more intuitive and user-friendly, plans are in professionals receive the certificate as well as a new ‘seal’ every year to continue to demonstrate to their clients that they are keeping up their licensing requirements. IQPF & FPSC Working with key stakeholders FPSC staff and representatives of Member Organizations continued to engage in discussions on matters of mutual interest during the 2008-2009 fiscal year. FPSC FPSC continued to meet with Institut québécois de continued to work closely with CIFPs, discussing items like planification financère (IQPF) to advance our mutual the proposed IIROC financial planning rule. In his keynote interests, and FPSC also attended a networking session address at the annual CIFPs conference in spring 2008, hosted by Authorite des Marches Financiers (AMF). Cary List spoke to the results of recent FPSC surveys which We are pleased with the progress that has been made illuminate the challenges faced in increasing the perceived value and understanding of financial planning. FPSC ANNUAL REPORT 2008-2009 | 9 The Path to CFP Certification ® Core Curriculum 10 Financial Planning Examination Level 1 Effective as of July 1, 2010. Officially register with FPSC Complete a minimum of 1 year work experience Capstone Course Financial Planning Examination Level 2 Complete remainder of 3 year work experience FPSC ANNUAL REPORT 2008-2009 | 11 Demand for financial planners is high. As millions of Baby Boomers retire and fewer people enter the workforce, there will be a shortage of talent in finance jobs – yet demand for these services continues to grow. In 2006, Canadian Business magazine deemed careers in financial planning as a major growth area through to 2012. A Statistics Canada study from 2008 reported that the demand for financial professionals across all sectors in Canada is beyond the number of qualified individuals. In the U.S., a report by Fast Company magazine listed “Personal Financial Advisor” as one of the Top 25 Jobs for 2005-2009, with growth projected at 35 per cent through to 2012. Leading the Profession This fiscal year, we continued to set and enforce relevant and rigorous standards for financial planning professionals in Canada. Major revisions to the CFP® certification program added a new dimension to our role as the leading standardssetting body for financial planning in Canada. 2010 Certification Program changes announced The proposed changes to CFP certification were initially released in an Exposure Draft in June 2008. The Exposure Draft invited comments from industry stakeholder groups, and the responses received were very supportive of the stakeholders (member organizations, regulators, industry professionals) and developed a brochure which outlines the new certification program. We also facilitated speaking opportunities at colleges, universities and finance clubs to communicate these details most effectively. direction proposed by FPSC. Capstone Course development FPSC officially announced the changes to the CFP The introduction of the Capstone Course, which requires Certification Program in December 2008. In effect as of July 1, 2010, candidates pursuing CFP certification will take an additional “Capstone Course” in addition to the current education requirement. Another significant change to the program saw the standardized national exam split into two distinct components: Financial Planning Examination Level 1 (FPE1) and Financial Planning Examination Level 2 (FPE2). The work experience requirement has been candidates to develop and present a comprehensive financial plan, kept staff (and FPSC’s Academic Advisory Committee) busy developing Course requirements and resources, as well as the Application for Approval of Capstone Course (released December 2008) for potential providers. To earn approval, a Capstone Course must meet specific learning objectives developed by FPSC, and utilize an FPSC-developed case study in the completion increased, from two years to three. of comprehensive financial plans. During this fiscal year, FPSC’s Certification Scheme To gain insight on usability and pedagogical value, the Committee approved the blueprints for FPE1 and FPE2, leading the way for sample item development for experimental testing in 2009. As part of the new program, all candidates are now required to maintain Continuous Registration with FPSC cases were piloted in three live classroom environments: Fanshawe College, George Brown College, and Ryerson University. FPSC plans to discuss the results of the pilot at the 2009 FPSC Educator Conference. while they are working towards CFP certification. They will Core Curriculum applications be expected to abide by the CFP Code of Ethics and will As of March 31, 2009, 22 applications for renewal of have access to all Student Associate Program features. Core Curriculum programs were received and approved. Communicating these changes clearly to all relevant parties and stakeholders was a priority this past year. In addition FPSC was pleased to receive four new applications from one university and three colleges. to a press release, FPSC sent e-communications to all FPSC ANNUAL REPORT 2008-2009 | 13 New VP emphasizes enforcement and greater regulation for financial planning Enhanced governance structure In October 2008, FPSC created the position of Vice- in 2008-2009. The review focused primarily on the role President, Policy & Enforcement and General Counsel of Member Organizations and the constitution of the and hired Stephen Rotstein, LL.B. In addition to oversight Board of Directors. of the Ethics & Enforcement area, the VP advocates on After a process that included extensive research as well as the value of financial planning and professional certification with regulators, government officials and other external stakeholders, ensuring FPSC’s voice is heard on financial planning-related matters and standards. This fiscal year, Stephen met with Government officials and regulators including Saskatchewan Financial Services Commission, British Columbia Securities’ Commission, Ontario Ministry of Finance, and Investment Industry Regulatory Organization of Canada (IIROC). Application for ISO 17024 certification ISO 17024 is an international standard for certifying bodies developed by the International Standards Organization and awarded nationally by the Standards Council of Canada. The standard is based on the well-known ISO 9001 standard for quality management, but also includes standards related specifically to running a certification organization and programs. In the 2008-2009 fiscal year, an extensive external review of internal procedures was conducted to ensure that FPSC’s policies and procedures are in line with ISO requirements. As a result FPSC developed a Quality Policy and set in motion a new Quality Management System. FPSC expects to formally receive ISO 17024 accreditation in September 2009. To align FPSC’s governance structure with its new strategic plan, FPSC underwent a full governance review consultations with the FPSC Board of Directors and Member Organizations, the Board finalized proposed changes to FPSC’s governance structure and bylaws. All changes were unanimously approved on June 12, 2008 at FPSC’s Annual Meeting of Members in St. John’s, Newfoundland. FPSC welcomed the addition of a Public Member seat as part of the new Board structure. The Public Member, who cannot be a CFP professional nor be directly involved in the financial services industry, provides a unique consumeroriented perspective on financial planning issues. Ellen Roseman, a personal finance and consumer affairs columnist with the Toronto Star, was appointed in June 2008. Three seats were also created for CFP professionals, who are to be elected directly by the CFP professional community. The election for the first CFP professional seat will take place in April 2009. New strategic vision In October 2008, the Board and Senior Management team refined FPSC’s strategic plan. This revamped plan demonstrates a fine-tuning of focus and mission, a formal embrace of our role and responsibility to the Canadian consumer, and reinforces FPSC’s commitment to the ongoing professionalization of financial planning. In addition, FPSC developed a set of corporate values that details our dedication to organizational excellence and continuous improvement. 14 Standards enforcement update Having a standards enforcement FPSC welcomed over 60 delegates, including international representatives, process that is clear and accessible to the 2008 FPSC Educator Conference on May 22-23 in Toronto. to Canadians is important to FPSC. To this end, we developed and launched an online complaints tool. This tool offers the public another avenue to the existing complaints process, which was previously accessible only by phone or Attendees got a first look at the 2010 certification program changes, and a panel discussion with key employers from the financial services industry generated lively discussion. Feedback indicates that the conference was a great success. The 2009 conference, with an added half-day workshop, is planned for May 26-28, 2009. regular mail. In the 2008-2009 fiscal year, 640 CFP professionals were randomly selected for audit of their Continuing Education activities. Of these, 64 were found to be deficient, and 13 CFP professionals could no longer comply with CE requirements and chose to cancel their licence. Three files were forwarded to the Director of Ethics for review. FPSC in the media In this fiscal year, FPSC was increasingly called upon as a source for credible information and a voice for financial planning standards. Throughout the year, we were in the media spotlight commenting on issues such as financial planning regulation, financial literacy initiatives, ethics for financial planners and more. 2008 FPSC Educator Conference This year’s conference marked another step forward in strengthening our relationship with the educator community. FPSC ANNUAL REPORT 2008-2009 | 15 Profile of the Profession Knowing about CFP® professionals ultimately helps us understand their needs better – and therefore, helps them best serve the Canadian public. The following information is culled from the license renewal forms that CFP professionals complete each year. By submitting information such as age, methods of compensation and demographics, FPSC gets a better idea of who these planners are, what they do and where they do it. FPSC also uses these statistics to identify trends within the CFP professional population. For example, the increasing percentage of CFP professionals who are over the age of 50 is an issue that FPSC is preparing to address in the coming years. Additionally, this information is of value to candidates interested in becoming CFP professionals, and is useful for members of the media who call FPSC for credible, relevant information on Canada’s largest body of professional financial planners. 16 FPSC ANNUAL REPORT 2008-2009 | 17 Auditors’ Report on Summarized Financial Statements To the Stakeholders of Financial Planners Standards Council The accompanying summarized balance sheet and statement of operations and changes in unrestricted net assets and cash flows are derived from the complete financial statements of Financial Planners Standards Council as at March 31, 2009 and for the year then ended on which we expressed an opinion without reservation in our report dated April 21, 2009. The fair summarization of the complete financial statements is the responsibility of the Council’s management. Our responsibility, in accordance with the applicable Assurance Guideline of The Canadian Institute of Chartered Accountants [“Guideline”], is to report on the summarized financial statements. In our opinion, the accompanying financial statements fairly summarize, in all material respects, the related complete financial statements in accordance with the criteria described in the Guideline referred to above. These summarized financial statements do not contain all the disclosures required by Canadian generally accepted accounting principles. Readers are cautioned that these statements may not be appropriate for their purposes. For more information on the Council’s financial position, results of operations and cash flows, reference should be made to the related complete financial statements. Chartered Accountants Licensed Public Accountants Thornhill, Canada, April 21, 2009. 18 Member Organizations FPSC was formed on the initiative of organizations whose members deal with the personal finances of individuals. It continues to be supported through the participation of: CMA Canada Canadian Institute of Chartered Accountants (CICA) 10,000 students in Canada. Canadian Institute of Chartered Accountants (CICA) represents a membership of over 66,000 professional accountants and 8,500 students in Canada and Bermuda. Management Accountants around the world and www.cma-canada.org Credit Union Institute of Canada (CUIC) Credit Union Institute of Canada (CUIC) is the national educational arm of Credit Union Central of Canada, www.cica.ca the association representing the Canadian credit union Canadian Institute of Financial Planners (CIFPs) caisse populaires with assets of $114 Billion. The CIFPs is an association of Canadian CFP professionals. www.cifps.ca Certified General Accountants Association of Canada (CGA) Certified General Accountants Association of Canada is a national self-regulating association of 60,000 CGAs and students. www.cga-canada.org 20 CMA Canada represents more than 40,000 Certified system – a system of more than 430 credit unions/ www.cusource.ca The Financial Advisors Association of Canada (Advocis) The Financial Advisors Association of Canada (Advocis) is a professional organization representing professional insurance and financial advisors. www.advocis.ca FPSC Board of Directors 2008-2009 Fiscal Chair Past Chair Cheryl Bauer Hyde, CFP Peter Volpe, CFP Bauer Hyde Financial Services Senior Vice President Integra Capital Financial Corp. Vice-Chair Debbie Ammeter, LL.B., CFP President VP, Advanced Financial Planning Support Cary List, CA, CFP Investors Group Financial Planners Standards Council Members: John Charette, CFP Randall Reynolds, MBA, CLU, Ch. FC, CFP Senior Business Advisor President CIBC Imperial Service FAB Financial Advisors Brokerage Group Inc Paul A. Issacson, CLF, CFP Sally Rycroft, CGA, CFP Senior Vice President, Sales and Distribution President Credential Financial Rycroft & Associates, Inc. James Kraft, CA, CLU, TEP, CFP Lisa Pflieger, CGA, TEP, CFP Marketing Vice President, Independent Advisors Department Leader, Tax, Estate and Manulife Financial Financial Planning Edward Jones Alan Munro, FCA, CFP Senior Financial Advisor Ellen Roseman Assante Capital Management Toronto Star Columnist FPSC ANNUAL REPORT 2008-2009 | 21