Loss Cost Quote Reports

advertisement

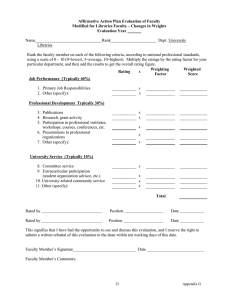

13169 SPI Loss Costs Report v04__ 6/5/14 12:08 PM Page 1 ProMetrix There’s more to your risk than meets the eye Loss Cost Quote Reports Because all commercial risks are NOT created equal When you insure commercial properties, you need accurate rating and underwriting information that will lead you to profitable results. There’s only one logical place for you to turn to get that information — Verisk Commercial Property. Our core expertise is surveying and evaluating commercial properties. We incorporate the latest industry loss experience to develop loss costs tailored to the conditions we find. And we know what to look for when examining a building’s construction, hazards, public and private fire protection, occupancy, and other exposures. We consider those and hundreds of other variables to develop prospective specific loss costs for nearly 3.5 million commercial properties in the ProMetrix® commercial property database. Specifically rated risks have certain characteristics: • higher values than class-rated buildings • unique construction types, ranging from combustible to fire resistive • special hazards, such as flammable liquids, spray painting, or chemicals • complicated protection features, such as automatic sprinklers or automatic detection systems The degree of hazard variability for commercial businesses can be very high, and you need an equitable way to price your policies for larger buildings. If you use a class loss cost for those higher-valued properties without field-verifying the key rating variables, you risk pricing the policy incorrectly. The value of loss costs for commercial properties ISO uses its Specific Commercial Property Evaluation Schedule (SCOPES) to assure the consistent analysis of hazards for every property we survey and to develop specific loss costs. In the states where we provide commercial property rating services, we’ve filed our insurance rating program and received approval from state insurance regulators. And most insurers have adopted that program. SCOPES provides many unique features: • a nationally recognized method of evaluating potential losses through the interaction of key variables, such as construction, hazards, private and public protection, and occupancy • a sophisticated analysis of the causes of and contributors to potential property losses • use of nationally recognized safety standards — such as those of the National Fire Protection Association (NFPA) — and product listings of recognized testing organizations such as UL • the latest industry loss experience With ISO’s specific loss costs, you can see where SCOPES deficiency points apply and then encourage the businessowner to reduce them through hazard mitigation measures. Moreover, you can improve your bottom line by offering pricing incentives for policyholders to install and maintain protection features, such as automatic fire detection systems, automatic fire suppression systems, portable fire extinguishers, standpipe systems, and watchman services. 13169 SPI Loss Costs Report v04__ 6/5/14 12:08 PM Page 2 Make more profitable underwriting decisions When you use ISO’s loss costs, the premiums you charge will accurately reflect the wide variations in hazards and conditions among commercial properties. Your rating process will also reflect the contributing loss factors for individual buildings, not just overall loss experience of classes of businesses. Specific loss costs can help promote underwriting and rating equity in your business — buildings with higher loss potential have higher ISO loss costs. How Verisk’s field representatives can help Our staff of specially trained field representatives gives you the information you need to: • concentrate on administering your underwriting criteria, since you can rely on Verisk’s experienced staff to verify onsite information • reduce your time and expense for underwriting and rating with site-verified information about millions of buildings and occupants throughout the country • establish rating charges for deficiencies and credits for protection features Internet delivery of loss costs through ProMetrix When you’re ready to calculate the premium for a business or commercial building, you can obtain a Loss Cost Quote Report through the ProMetrix system. You can retrieve loss cost quotes for commercial properties located throughout the country. Our advanced address search options and comprehensive ProMetrix database can reduce your costs and save you valuable time. And you get easy-to-read reports that you can print or download (as XML data sets). You can search for a match from approximately 3.5 million buildings and 6 million businesses occupying those buildings. You get the accurate loss cost information you need to underwrite and price your commercial policies. A Verisk Loss Cost Quote Report covers all the specifics Here’s a sample Loss Cost Quote Report for a specifically rated risk in a sprinklered building with one occupant. The construction class is masonry noncombustible, and the Public Protection Classification (PPCTM) is 4. ProMetrix RCP (Rating Plan/ Construction/Protection) code RCB (Rating Plan/ Construction/BCEGS®) code Experience Level Adjustment (ELA) Protective Safeguard Clause Commercial Statistical Plan (CSP) territory code Basic Group II (BG II) symbol CSP class codes Basic Group I (BG I) loss costs Enhanced Wind Basic Group II (BG II) loss costs Wind Factor Indicated Basic Group II (BG II) loss costs BCEGS Factor Wind Factor Applied 13169 SPI Loss Costs Report v04__ 6/5/14 12:08 PM Page 3 Terms and definitions Experience Level Adjustment (ELA) The ELA is based on our annual actuarial reviews of premium and loss data. This critical information reflects increasing or decreasing industry loss experience for each of the major statistical classifications in each state — giving you the competitive pricing edge you need to stay profitable. When you retrieve a Loss Cost Quote Report, you’ll get the current loss costs first. But if your company hasn’t adopted the most recent ELA, you can choose the appropriate prior one from a dropdown menu. You’ll find up to seven prior levels, and the system adjusts the loss cost to reflect the ELA you select. Also, for each ELA, the Loss Cost Quote Report provides our filing designation used with state insurance regulators and the circular number that announced the implementation date. Limit of insurance (LOI) LOI curves provide varying loss costs (per $100 of insured value) as the limit of insurance changes. LOI rating reflects the need to vary the rate depending on the actual limit selected. Basic Group I (BG I) loss costs BG I perils include fire, lightning, explosion, vandalism, and sprinkler leakage. The report displays loss costs for the building and its occupants. Basic Group II (BG II) loss costs BG II perils include windstorm or hail, smoke, aircraft or vehicle, riot or civil commotion, sinkhole collapse, and volcanic action. The report displays the ISO loss costs for the building and its occupants, in addition to the BG II Rating Group symbol. Protective Safeguard Clause (specific rated only) The Protective Safeguard Clause highlights which (if any) protective features have received credit in the BG I loss cost and which you should include in the Protective Safeguard Endorsement. Protective features include: • automatic sprinkler system • automatic fire alarm • security service • subscription fire department service contract Type of risk code Basic Group I Nonsprinklered Schedule (Specifically) Rated 1 – with Basic Group II Class-Rated G – with Basic Group II Specific Wind Rating G Commercial Statistical Plan (CSP) codes The CSP codes help you properly record the required statistical codes, including: • CSP territory code • BG II CSP code • RCP (Rating Plan/Construction/ Protection) code R – The first digit identifies how the building is rated: • specifically rated, nonsprinklered • class-rated • class-rated, substandard conditions • specifically rated, sprinklered C – The second digit is the building’s CSP construction class: • frame • joisted masonry • noncombustible • masonry noncombustible • modified fire resistive • fire resistive P – The third and fourth digits show the building’s PPC code: 1 to 10. • CSP class codes for the building and each of the occupants Basic Group I Class-Rated with Substandard Condition Charge(s) applicable 3 – with Basic Group II Class-Rated 3 J – with Basic Group II Specific Wind Rating J BG II RCB (Rating Plan/BG II Construction Class/BCEGS® classification) R – The first digit identifies how the building is rated Providing reliable loss cost data for class-rated risks Many insurers use class (manual) rates when insuring smaller commercial properties (25,000 square feet or less) without sprinklers and without manufacturing occupants. However, it’s not always easy to get reliable information on those properties, since many have complicated mixtures of construction and occupancy types. That makes policy rating complicated. The ProMetrix database gives you immediate access to underwriting and rating information on many of those properties. You can order a class-rated Loss Cost Quote Report for any of the buildings in our database eligible for class rating according to the rules in the ISO Commercial Lines Manual. You’ll get Basic Group I Class-Rated with no Substandard Condition Charge(s) 2 – With Basic Group II Class-Rated 2 H – with Basic Group II Specific Wind Rating H Basic Group I Sprinklered Schedule Rated 4 – with Basic Group II Class Rated 4 K – with Basic Group II Specific Wind Rating K C – The second and third digits are the building’s BG II construction: Fifty possible wind construction codes and definitions B – The fourth and fifth digits show the Building Code Effectiveness Grading Schedule (BCEGS®) classification for the community: 01 to 10 and 95 to 99. BG II Enhanced loss cost (specific rated only) Buildings in wind-prone areas are eligible for BG II specific rating if they exceed a size threshold depending on the level of wind hazard for that geographic location. We produce specific loss costs by modifying the underlying BG II loss costs and using credits and debits related to the building features, such as roof and wall envelope, framework, building code, location, and surrounding environment. Wind factor indicated (specific rated only) This is a Verisk-calculated composite debit/credit factor. We provide the factor, which is an uncapped value, for information purposes only. Wind factor applied (specific rated only) We calculate the BG II specific loss cost using this factor. The wind factor applied is the composite debit/credit factor calculated by Verisk and currently capped at the latest filed cap values for the state. BCEGS factor (specific rated only) We review a community’s building code enforcement agency and assign a BCEGS classification for insurance underwriting information and rating purposes. We calculate the BCEGS factor using the BCEGS grade assigned to the building relative to the community grade and year built. We don’t use the BCEGS factor in any calculations; therefore, the BG II specific loss cost doesn’t reflect it. We provide the BCEGS factor for information purposes and optional application. Class Insight ratio (class-rated only) For buildings eligible for class rating, the class-determined loss cost is the average of all properties that fall within a range. The Class Insight ratio — using a range of .50 to 2.0 — is a more precise evaluation of the class-rated risk. This analytic tool provides important insight into where the property falls within this range in comparison to the class average. similar information and the same screen functionality used for specifically rated risks. And you can trust that experienced Verisk staff members have evaluated the eligibility requirements and verified important rating variables, such as construction, public protection, square footage, occupancy, and BG II classifications. 13169 SPI Loss Costs Report v04__ 6/5/14 12:08 PM Page 4 Class Insight Class Insight is a new capability that enhances the class-rated loss cost. When you use a class-determined loss cost, it’s the average of all the properties that fall within a range. The new Class Insight ratio is a more precise individual risk evaluation that provides important insight into where the risk falls in that range. That allows you to underwrite the property as competitively as possible to avoid adverse selection and maximize profitability. Estimated Loss Costs and loss cost surveys You’re likely to find the information you’re looking for in the database. But if you don’t find a specific building or if the occupants have changed, you can order a loss cost survey on the property. We can produce loss costs quickly and easily — usually within 30 calendar days. In the meantime, you can call us for an estimate of the loss cost or calculate one yourself using our exclusive Estimated Loss Cost feature. ProMetrix RCP (Rating Plan/ Construction/Protection) code RCB (Rating Plan/ Construction/BCEGS) Code Wind Factor Indicated Experience Level Adjustment (ELA) Enhanced Wind Basic Group II (BG II) loss costs Basic Group I (BG I) loss costs 545 Washington Boulevard • Jersey City, NJ 07310-1686 • www.verisk.com/cp © Insurance Services Office, Inc., 2014. ISO, the ISO logo, BCEGS, and ProMetrix are registered trademarks and Verisk, Verisk Insurance Solutions, the Verisk Insurance Solutions logo, and PPC are trademarks of Insurance Services Office, Inc. AIR Worldwide and the AIR Worldwide logo are registered trademarks of AIR Worldwide Corporation. Xactware is a registered trademark of Xactware Solutions, Inc. All other product or corporate names are trademarks or registered trademarks of their respective companies. RSS031 (6/14) z13169 For more information about Verisk’s Loss Cost Quote Reports Call Verisk Customer Support at 1-855-859-8775 or send e-mail to info@verisk.com. Or contact your Verisk representative. For information on all Verisk products, visit us at www.verisk.com.