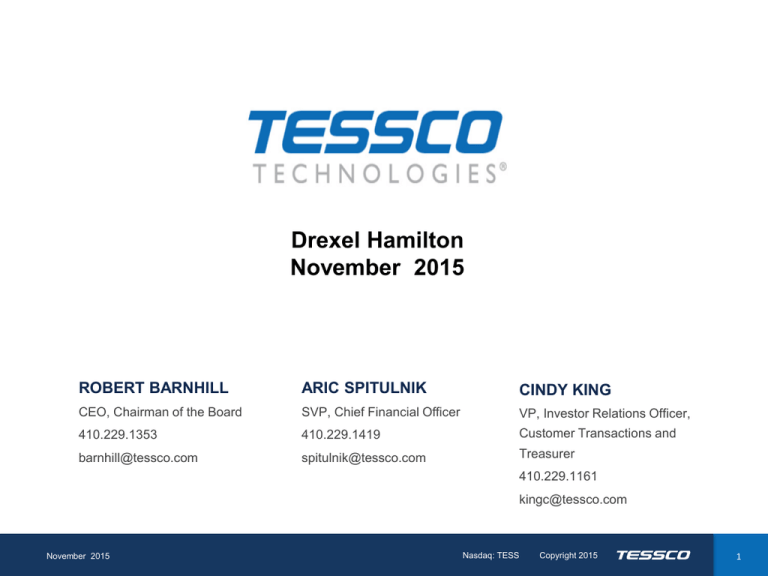

Drexel Hamilton November 2015

advertisement

Drexel Hamilton November 2015 ROBERT BARNHILL ARIC SPITULNIK CINDY KING CEO, Chairman of the Board SVP, Chief Financial Officer VP, Investor Relations Officer, 410.229.1353 410.229.1419 Customer Transactions and barnhill@tessco.com spitulnik@tessco.com Treasurer Copyright 2015. 410.229.1161 kingc@tessco.com 11/5/2015 2015 November Nasdaq: TESS Copyright 2015 11 Forward-Looking Statements Certain statements made by us during this presentation are forward-looking statements within the meaning of federal securities laws. TESSCO’s actual results may differ materially from those discussed in any forward-looking statement. Additional information concerning factors that may cause such a difference can be found in TESSCO’s public disclosure, including TESSCO’s most recent report on Form 10-K, as well as prior and subsequently filed reports. Copyright 2015. 11/5/2015 2015 November Nasdaq: TESS Copyright 2015 22 Opportunity and Vision The convergence of wireless and the Internet is revolutionizing the way we live, work and play. New systems and applications are creating challenges and opportunities at an unprecedented rate. TESSCO enables organizations to capitalize on wireless opportunities by Copyright 2015. providing end-to-end knowledge, product and supply chain solutions. 11/5/2015 2015 November Nasdaq: TESS Copyright 2015 33 Delivering to the Customer What, When and Where Needed Four strategically positioned locations for national reach: Timonium, MD Hunt Valley, MD Reno, NV San Antonio, TX (Product Development) Copyright 2015. 11/5/2015 2015 November Nasdaq: TESS Copyright 2015 44 TESSCO Facts Founded 1982 800 Team Members* $525M $0.70 EPS (LTM) 3.7% Dividend Yield* $185M Market Cap* Revenue (LTM) $16M Adj. EBITDA (LTM) Copyright 2015. Note: LTM represents the twelve months ended 9/30/2015. * As of 11/3/2015. 11/5/2015 2015 November Nasdaq: TESS Copyright 2015 55 TESSCO Facts Serving 20K+ customers per quarter • Public network organizations • Private system operators • Government system operators • Commercial resellers • Retailers Growing proprietary products under Ventev® brand 14 Supplying 51K+ products from 390+ vendors • • • • Base station infrastructure Network equipment Installation, test & maintenance Mobile device accessories Copyright 2015. 11/5/2015 2015 November Nasdaq: TESS Copyright 2015 66 Building End-to-End Solutions with Products from Top Tier Manufacturers to Serve a Broad and Diverse Customer Base Products Offered* Base Station Infrastructure Network Equipment Installation, Test & Maintenance Mobile Devices Accessories Customers Served* Systems Supported • Machine to Machine 39% • Internet of Things • Wireless Backhaul 16% 7% 38% • Base Station • Wi-Fi Networks • Site Survey Test & Maintenance • Enhanced Cellular Coverage & Capacity • In Vehicle & Mobile Communications • Mobile Device Performance Public Network Organizations 18% Private System Operators 17% Government 6% Commercial Resellers 24% Retailers 35% Copyright 2015. * Based on last twelve months ended 9/30/15 11/5/2015 2015 November Nasdaq: TESS Copyright 2015 77 Systems We Support Enhanced Cellular Coverage & Capacity Mobile Device 11/5/2015 2015 November Wi-Fi Network Internet of Things Wireless Backhaul Machine to Machine Wireless Base Station In-Vehicle & Mobile Communications Site Survey, Test & Maintenance Copyright 2015. Nasdaq: TESS Copyright 2015 88 Offering Products from Industry-Leading Manufacturers Base Station Infrastructure Revenue*: $207M Gross profit margin*: 28% Copyright 2015. *last the twelve months ended 9/30/2015. 11/5/2015 2015 November Nasdaq: TESS Copyright 2015 99 Offering Products from Industry-Leading Manufacturers Network Systems Revenue*: $82M Gross profit margin*: 18% Copyright 2015. *last twelve months ended 9/30/2015. 11/5/2015 2015 November Nasdaq: TESS Copyright 2015 10 10 Offering Products from Industry-Leading Manufacturers Installation & Maintenance Revenue*: $38M Gross profit margin*: 23% Copyright 2015. *last twelve months ended 9/30/2015. 11/5/2015 2015 November Nasdaq: TESS Copyright 2015 11 11 Offering Products from Industry-Leading Manufacturers Mobile Devices & Accessories Revenue*: $198M Gross profit margin*: 23% Copyright 2015. *last twelve months ended 9/30/2015. 11/5/2015 2015 November Nasdaq: TESS Copyright 2015 12 12 Fulfilling Unmet Needs – TESSCO’s Design & Manufacturing Unit • Margins higher than core product offering • Launching aggressive product roadmap • 14% of overall revenues Wireless Infrastructure (48%) Mobile Accessories (52%) Comprehensive ecosystem of products to deploy, protect, power and improve the performance of Wi-Fi, DAS and LTE networks. Accessories and components to support wireless mobile and portable device performance. • • • • • • • • • Antennas Cable Site Hardware Grounding Equipment Enclosures Mounts Chargers Protection Power Hubs Copyright 2015. Note: Percentages represent contribution to total Ventev® revenue last 12 months ended 9/30/15. 11/5/2015 2015 November Nasdaq: TESS Copyright 2015 13 13 Serving a Broad & Diverse Customer Base Retailers Gov 6% Commercial Resellers • Value Added Resellers & Integrators Public System Operators • • • • Program Managers Tower Owners Carriers Contractors Public Network Operators 18% Commercial Resellers 24% Private System Operators • • • • • • • Mining Technicians & Service Centers Oil & Gas Manufacturers Transportation Enterprise Utilities Private System Operators 17% Government • Federal Government • State & Local • GVARS 11/5/2015 2015 November Retailers 35% Copyright 2015. Nasdaq: TESS Copyright 2015 14 14 Making The Difference in our Customers’ Success High B2C experience on a B2B website Designed solutions Technical Complexity Supply-Chain Services Knowledge and Tech support Complete order configuration Typical Distributors Low Narrow 11/5/2015 2015 November Proprietary Products Training Copyright 2015. Broad Offering Nasdaq: TESS Copyright 2015 15 15 Where we are today FY2015 results were disappointing, primarily as a result of the dramatic pull-back in purchasing from our wireless carrier customers, but also due to … • Tentativeness from our private system operator customers • Higher talent and technology investments we are making to execute upon our key growth initiatives initiatives These results did not reflect the progress we made to reduce carrier concentration, renew growth and improve profitability Q1 and Q2 FY 16 exceeded high end of our guidance • Sequential growth in all markets in both quarters • Reaffirmed annual guidance at $1.05 to $1.25 • Continued $0.20 quarterly dividend • While carriers have grown sequentially, outlook still soft for FY16 11/5/2015 2015 November Copyright 2015. Nasdaq: TESS Copyright 2015 16 16 What’s happening with the wireless carriers Wireless carrier spending continues to be soft in the US as network builds and associated spending continues to be delayed for a variety of reasons • It has impacted our business and many of our manufacturing partners and customers We believe carriers are preserving capital as they look to acquire additional spectrum, integrate major acquisitions, evaluate the FCC’s net neutrality policy, international network expansion and consider new competition from other carriers and companies like Google and Apple We believe carriers continue to expand and enhance their networks to meet consumers’ insatiable appetite for data Expect spending to pick up slightly during this fiscal year, but more so in our fiscal ’17 As spending and building does resume, we are well positioned to capture share within all segments of the carrier eco-system Copyright 2015. 11/5/2015 2015 November Nasdaq: TESS Copyright 2015 17 17 Transforming the Way We do Business to Realize Our Opportunities and Vision Value Engineering Simplifying the way we do business Relationship Solution Selling End-to-End Solutions Transitioning from reactive to proactive endto-end solution selling Develop new products and solutions Making the Trusted Difference in our Customers’ Success Supply Chain & Operational Excellence Seamless, reliable delivery and availability of configured, kitted end-to-end solutions 11/5/2015 2015 November Scientific Data, Digital, Internet Marketing Delivering an extraordinary experience while generating Copyright 2015.opportunities for TESSCO Nasdaq: TESS Copyright 2015 18 18 D E TA I L E D F I N A N C I A L R E S U LT S Solid Core Revenue Growth 8.2% CAGR $539M $450M $560M $550M FY14 FY15 $482M $371M Transitioned Major 3PL 11/5/2015 2015 November FY10 FY11 FY12 FY13 $151M $155M $251M $214M NA Copyright 2015. Nasdaq: TESS Copyright 2015 NA 20 20 Consistent Profitability Core Gross Margin* Operating Margin* 4.7% 3.7% 26.0% 24.6% 25.3% 24.5% 24.7% Adjusted EBITDA* FY10 FY11 FY10 FY11 2.6% FY12 FY13 $2.03 $2.15 FY14 FY15 EPS* $34.7 $22.7 2.6% 23.8% FY10 FY11 FY12 FY13 FY14 FY15 $21.3 2.9% 3.9% FY12 $36.7 FY13 $33.4 FY14 $20.7 $1.19 $1.27 FY15 FY10 FY11 $1.94 $1.04 FY12 FY13 FY14 FY15 *Includes impact of Major 3PL that ended at the end of FY13 11/5/2015 2015 September Nasdaq: TESS Copyright 2015 21 21 Delivering Shareholder Value Annual Dividends 32% CAGR $0.80 $0.72* $0.74 $0.55 $0.40 $0.20 FY2010 FY2011 FY2012 FY2013 FY2014 FY2015 Copyright 2015. * Does not include one-time Special Dividend of $0.75 per share 11/5/2015 2015 November Nasdaq: TESS Copyright 2015 22 22 Strong Balance Sheet • 9/27/2015 ($ in millions) 3/29/2015 Total assets $6.0 $66.2 $75.1 $20.5 $11.7 $13.3 $192.8 $7.5 $59.6 $72.4 $21.1 $11.7 $17.3 $189.6 Accounts payable Note payable Accrued expenses & other liabilities Total liabilities $56.4 $2.1 $19.7 $78.2 $51.8 $2.2 $22.5 $76.5 $114.6 Total liabilities Copyright & equity 2015. $192.8 $113.1 $189.6 Assets $6.0 million in cash; no operational debt outstanding • $35 million credit facility • Generated $11.1 million in cash from operations in FY15 • Minimal CAPEX • $0.20 per share quarterly dividend Cash and equivalents Accounts receivable Inventory Property & equipment Goodwill Other Liabilities Equity Equity 11/5/2015 2015 November Nasdaq: TESS Copyright 2015 23 23 Positioned for Growth Making the trusted difference in our customers’ success and increasing shareholder value • Exploding new markets and systems • Relationship selling and online commerce • Digital and Internet marketing to deliver the knowledge and opportunities • Strong balance sheet • Scalable operating leverage to grow profitability • Strong dividend yield 11/5/2015 2015 November Copyright 2015. Nasdaq: TESS Copyright 2015 24 24 CASE STUDIES ® Case Study: Ventev Infrastructure Client Southern Company – premier energy company Challenge Provide SCADA (industrial control system) radio enclosure with capability to remotely monitor & test backup batteries & send reports by Ethernet TESSCO Solution “ Now, I ask others in the industry if they are remotely testing their backup batteries. And when they say they are not, I tell them to call TESSCO.” -Bob Cheney, Southern Company Ventev® Outdoor Wireless Enclosure & custom-engineered Battery Test Remote Monitor TESSCO Advantage Pre-engineered, turnkey solution for faster, less expensive deployment Copyright 2015. 11/5/2015 2015 November Nasdaq: TESS Copyright 2015 26 26 Case Study: Cellular Coverage & Capacity Enhancement Client American Tower Corporation – global provider of wireless communications infrastructure Challenge Managing and keeping up with the high velocity inventory requirements and logistics of their major DAS program rollout “ Our DAS supply chain relies on TESSCO almost entirely… the TESSCO group is the engine behind all of it.” -Sean Christopher, American Tower Sourcing Manager TESSCO Solution TESSCO acts as an extension of ATC: dealing with product manufacturers to manage the lead times, tracking, and delivery of materials, and ensuring that deployments stay on schedule TESSCO Advantage Thoroughly executed program management allows for rapid deployment in an ever changing, demanding DAS marketplace Copyright 2015. • 11/5/2015 2015 November Nasdaq: TESS Copyright 2015 27 27 27 Case Study: Retail Support Client Mybullfrog.com – Verizon Premium Wireless Retailer Challenge Increase sales of power accessories through training and education of employees and customers “ We had huge success working with TESSCO and Ventev® on the promotional program… it really was a collaborative team effort.” -Jason Hancock, mybullfrog Marketing Communications Manager TESSCO Solution TESSCO and Ventev® developed a thoroughly integrated marketing strategy including training, product demos, promotions, videos, and social media TESSCO Advantage Custom training solutions translated directly to a substantial increase in accessory attach rates and sales 11/5/2015 2015 November Copyright 2015. Nasdaq: TESS Copyright 2015 28 28 APPENDIX TESSCO Technologies Incorporated Reconciliation of Net Income to Earnings Before Interest, Taxes and Depreciation and Amortization (EBITDA) (Unaudited) September 27, 2015 Net income $ Fiscal Quarters Ended June 28, September 2015 28, 2014 $ 3,513,600 Six Months Ended September September 28, 27, 2015 2014 2,748,300 $ 1,695,300 $ 4,443,600 $ 7,185,000 1,850,900 1,117,900 2,303,600 2,968,800 4,676,200 47,100 46,300 49,400 93,400 77,800 1,207,200 1,131,300 1,185,100 2,338,500 2,352,900 5,853,500 $ 3,990,800 9,844,300 $ 14,291,900 268,000 131,700 228,000 399,700 677,600 $ 4,122,500 $ 7,279,700 $ 10,244,000 $ 14,969,500 Add: Provision for income taxes Interest, net Depreciation and amortization EBITDA Add: Stock based compensation $ Adjusted EBITDA $ 6,121,500 EBITDA per diluted share Adjusted EBITDA per diluted share $ 0.71 $ 0.48 $ 0.84Copyright $ 2015. 1.19 $ 1.70 $ 0.74 $ 0.50 $ 0.86 $ 1.78 11/5/2015 2015 November $ 7,051,700 Nasdaq: TESS $ $ 1.24 Copyright 2015 30 30