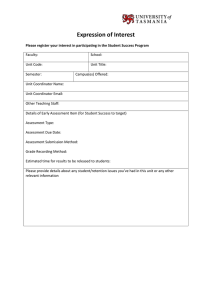

Project management guide

advertisement