2014 ASME Annual Report - American Society of Mechanical

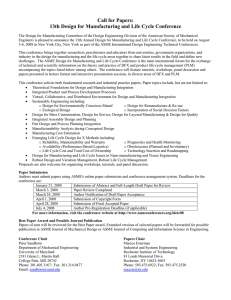

advertisement