Latest data recorded 1. Key figures

advertisement

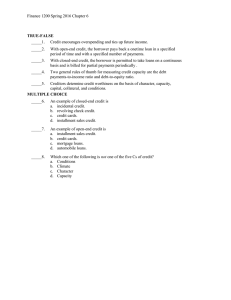

Microeconomic Information Department Latest data recorded August 2016 Central Individual Credit Register 1. Key figures TABLE 1. NUMBER OF BORROWERS (situation at end of period) With at least: - one outstanding contract - one non-regularised overdue contract 2015-08 2016-08 6,222,005 355,326 6,243,694 366,023 5.7 % 5.9 % Percentage of defaulting borrowers TABLE 2. % change +0.3 % +3.0 % NUMBER OF LOANS (situation at end of period) Outstanding contracts Consumer credit¹ Mortgage loans 2015-08 2016-08 11,266,050 8,388,952 2,877,096 11,273,250 8,332,110 2,941,140 +0.1 % -0.7 % +2.2 % 534,145 500,345 33,800 550,624 517,949 32,675 +3.1 % +3.5 % -3.3 % Non-regularised overdue contracts Consumer credit¹ Mortgage loans Percentage of overdue contracts Consumer credit¹ Mortgage loans TABLE 3. 4.7 % 6.0 % 1.2 % % change 4.9 % 6.2 % 1.1 % ARREARS / AMOUNTS DUE (situation at end of period, non-regularised contracts) 2015-08 2016-08 Total amount of overdue contracts (in thousands of euros) Average amount per overdue contract (in euro) 3,124,918 5,850 3,123,566 5,673 -0.0 % -3.0 % Consumer credit¹ (in thousands of euros) Average amount per overdue contract (in euro) 1,772,021 3,542 1,754,747 3,388 -1.0 % -4.3 % Mortgage loans (in thousands of euros) Average amount per overdue contract (in euro) 1,352,897 40,027 1,368,819 41,892 +1.2 % +4.7 % 2015-08 2016-08 TABLE 4. % change COLLECTIVE DEBT SETTLEMENTS % change Total ongoing procedures 98,207 97,276 -0.9 % New requests this year 10,784 10,750 -0.3 % ¹ includes instalment loans, instalment sales, hire-purchase and revolving credit facilities. Microeconomic Information boulevard de Berlaimont 14 tel. + 32 2 221 22 41 VAT BE 0203.201.340 National Bank of Belgium BE-1000 BRUSSELS www.nbb.be RLP Brussels 1/7 Latest data recorded August 2016 Central Individual Credit Register 2. Detailed figures 2.1 Credit trends 2.1.1 Charts CHART 1. NUMBER OF BORROWERS WITH AT LEAST ONE OUTSTANDING CONTRACT (situation at end of period - in thousands) 7,000 6,217 7,000 6,244 6,242 6,222 6,244 6,000 6,000 5,057 5,043 5,018 4,922 5,000 4,851 5,000 4,000 4,000 2,861 2,844 3,000 2,068 2,038 2,005 2,865 2,917 2,891 3,000 2,166 2,083 2,000 2,000 1,000 384 307 256 201 1,000 177 0 0 2012-08 2013-08 Installment loans Mortgage loans CHART 2. 2014-08 Installment sales 2015-08 2016-08 Revolving credit Total (right-hand scale) NUMBER OF OUTSTANDING CONTRACTS (situation at end of period - in thousands) 14,000 12,000 10,000 11,403 11,449 11,429 11,266 11,273 2,739 2,788 2,812 2,877 2,941 6,681 6,701 6,666 6,449 6,279 325 1,657 268 1,692 228 1,723 187 1,753 177 1,877 2012-08 2013-08 2014-08 2015-08 2016-08 8,000 6,000 4,000 2,000 0 CHART 3. Installment loans Installment sales Mortgage loans Total Revolving credit NUMBER OF NEW CONTRACTS (aggregate numbers for the current year) 1,300,000 1,200,000 1,100,000 1,000,000 900,000 800,000 700,000 600,000 500,000 400,000 300,000 200,000 100,000 0 1,159,647 957,969 209,094 1,103,702 1,004,375 205,311 867,813 468,190 348,104 174,464 350,421 384,695 73,022 278,905 254,688 61,888 62,476 48,537 325,432 352,481 351,968 388,232 2012-08 2013-08 2014-08 2015-08 Installment loans Mortgage loans Installment sales Total 248,884 54,508 452,206 2016-08 Revolving credit 2/7 Latest data recorded August 2016 Central Individual Credit Register 2.1.2 Tables TABLE 5. NUMBER OF BORROWERS WITH AT LEAST ONE OUTSTANDING CONTRACT (situation at end of period) Total¹ Consumer credit¹ of which: Instalment loans Instalment sales Revolving credit Mortgage loans TABLE 6. Change over one month* Change over one year** 2015-08 2016-07 2016-08 6,222,005 5,528,771 6,247,556 5,525,817 6,243,694 5,519,164 -0.1 % -0.1 % +0.3 % -0.2 % 2,083,281 200,556 4,922,065 2,891,226 2,168,541 179,335 4,858,776 2,915,742 2,166,428 176,994 4,850,812 2,916,585 -0.1 % -1.3 % -0.2 % +0.0 % +4.0 % -11.7 % -1.4 % +0.9 % NUMBER OF OUTSTANDING CONTRACTS (situation at end of period) Total Consumer credit of which: Instalment loans Instalment sales Revolving credit Mortgage loans TABLE 7. Change over one month* Change over one year** 2015-08 2016-07 2016-08 11,266,050 8,388,952 11,281,780 8,343,885 11,273,250 8,332,110 -0.1 % -0.1 % +0.1 % -0.7 % 1,753,023 187,149 6,448,780 2,877,096 1,875,251 177,606 6,291,028 2,937,895 1,876,769 176,659 6,278,682 2,941,140 +0.1 % -0.5 % -0.2 % +0.1 % +7.1 % -5.6 % -2.6 % +2.2 % 2015-08 2016-08 867,813 693,349 1,159,647 691,457 1,103,702 755,598 -4.8 % +9.3 % 351,968 62,476 278,905 174,464 388,232 48,537 254,688 468,190 452,206 54,508 248,884 348,104 +16.5 % +12.3 % -2.3 % -25.6 % NUMBER OF NEW CONTRACTS (aggregate numbers for the current year) 2014-08 Total Consumer credit of which: Instalment loans Instalment sales Revolving credit Mortgage loans % change * Percentage change compared with the previous month. ** Percentage change compared with the corresponding month of the previous year. ¹ The total number of borrowers is not equal to the sum of the number of borrowers per type of credit. A borrower who has contracted several different types of loan is counted in each of the categories but only once in the total number. 3/7 Latest data recorded August 2016 Central Individual Credit Register 2.2 Trends in credit defaults 2.2.1 Charts CHART 4. NUMBER OF BORROWERS WITH AT LEAST ONE OUTSTANDING OVERDUE CONTRACT (situation at end of period - non-regularised - in thousands) 300 323 250 200 174 192 177 173 222 206 177 400 366 240 355 345 335 350 300 174 171 250 200 150 150 100 41 50 41 42 40 44 38 45 37 43 35 100 50 0 0 2012-08 CHART 5. 2013-08 2014-08 Installment loans Installment sales Mortgage loans Total (right-hand scale) 2015-08 2016-08 Revolving credit NUMBER OF OVERDUE CONTRACTS (situation at end of period - non-regularised - in thousands) 515 534 551 494 33 33 31 34 30 236 256 275 297 317 300 200 46 46 45 44 43 100 161 161 161 160 158 2012-08 2013-08 2014-08 2015-08 2016-08 600 472 500 400 0 CHART 6. Installment loans Installment sales Mortgage loans Total Revolving credit TOTALS OF ARREARS / AMOUNTS DUE (situation at end of period - in million euro) 3,500 3,000 3,055 3,125 3,124 1,127 1,267 1,353 1,369 441 61 466 58 480 55 485 49 501 44 1,208 1,237 1,253 1,238 1,209 2013-08 2014-08 2015-08 2,888 2,642 2,500 2,000 1,500 1,000 500 932 0 2012-08 Installment loans Installment sales Mortgage loans Total 2016-08 Revolving credit 4/7 Latest data recorded August 2016 Central Individual Credit Register 2.2.1 Charts (continued) CHART 7. ARREARS / AVERAGE AMOUNTS DUE (situation at end of period - in euro) 60,000 5,848 5,595 50,000 5,937 7,000 5,850 5,673 6,000 5,000 40,000 30,000 40,027 41,892 36,176 38,411 1,872 1,328 7,514 1,824 1,260 7,676 1,742 1,204 7,799 1,635 1,119 7,755 1,580 1,027 7,667 2012-08 2013-08 2014-08 2015-08 2016-08 31,457 3,000 20,000 10,000 0 CHART 8. 4,000 Installment loans Installment sales Mortgage loans Total (right-hand scale) 2,000 1,000 0 Revolving credit NUMBER OF NEW OVERDUE CONTRACTS (aggregate numbers for the current year) 120,000 100,000 101,254 104,897 101,727 103,536 104,317 8,831 9,214 8,668 8,047 8,306 62,026 64,003 63,957 68,306 67,983 8,510 8,081 6,463 6,628 5,867 21,887 23,599 22,639 20,555 22,161 2015-08 2016-08 Revolving credit 80,000 60,000 40,000 20,000 0 2012-08 2013-08 Installment loans Mortgage loans 2014-08 Installment sales Total 5/7 Latest data recorded August 2016 Central Individual Credit Register 2.2.3 Tables TABLE 8. NUMBER OF BORROWERS WITH AT LEAST ONE OUTSTANDING OVERDUE CONTRACT (situation at end of period - non-regularised) Total¹ Consumer credit¹ of which: Instalment loans Instalment sales Revolving credit Mortgage loans TABLE 9. 2015-08 355,326 333,381 2016-07 365,474 344,584 2016-08 366,023 345,339 174,470 36,730 222,430 44,592 171,193 34,917 239,432 43,460 171,015 34,876 240,361 43,182 2015-08 534,145 500,345 2016-07 549,866 516,960 2016-08 550,624 517,949 159,597 44,201 296,547 33,800 157,853 42,830 316,277 32,906 157,749 42,859 317,341 32,675 Change over Change over one month* one year** +0.2 % +3.0 % +0.2 % +3.6 % -0.1 % -0.1 % +0.4 % -0.6 % -2.0 % -5.0 % +8.1 % -3.2 % NUMBER OF OVERDUE CONTRACTS (situation at end of period - non-regularised) Total Consumer credit of which: Instalment loans Instalment sales Revolving credit Mortgage loans TABLE 10. Change over Change over one month* one year** +0.1 % +3.1 % +0.2 % +3.5 % -0.1 % +0.1 % +0.3 % -0.7 % -1.2 % -3.0 % +7.0 % -3.3 % ARREARS / AMOUNTS DUE (situation at end of period - in thousands of euro) Total Consumer credit of which: Instalment loans Instalment sales Revolving credit Mortgage loans TABLE 11. Change over Change over one month* one year** -0.4 % -0.0 % -0.4 % -1.0 % 2015-08 3,124,918 1,772,021 2016-07 3,135,467 1,761,243 2016-08 3,123,566 1,754,747 1,237,616 49,474 484,931 1,352,897 1,210,548 44,467 506,229 1,374,224 1,209,405 44,034 501,308 1,368,819 -0.1 % -1.0 % -1.0 % -0.4 % % change +0.8 % +0.5 % -2.3 % -11.0 % +3.4 % +1.2 % NUMBER OF NEW OVERDUE CONTRACTS (aggregate numbers for the current year) 2014-08 101,727 93,059 2015-08 103,536 95,489 2016-08 104,317 96,011 Instalment loans 22,639 20,555 22,161 +7.8 % Instalment sales Revolving credit Mortgage loans 6,463 63,957 6,628 68,306 5,867 67,983 -11.5 % -0.5 % 8,668 8,047 8,306 +3.2 % Total Consumer credit of which: * Percentage change compared with the previous month. ** Percentage change compared with the corresponding month of the previous year. ¹ The total number of borrowers is not equal to the sum of the number of borrowers per type of credit. A borrower who has contracted several different types of loan is counted in each of the categories but only once in the total number. 6/7 Latest data recorded August 2016 Central Individual Credit Register 2.3 Regional breakdown TABLE 12. NUMBER OF BORROWERS WITH AT LEAST ONE OUTSTANDING CONTRACT (situation at end of period) Total in Flanders in Wallonia in the Brussels-Capital Region abroad Consumer credit in Flanders in Wallonia in the Brussels-Capital Region abroad Mortgage loans in Flanders in Wallonia in the Brussels-Capital Region abroad TABLE 13. 2015-08 6,222,005 3,565,030 2,029,874 527,234 99,867 5,528,771 3,070,707 1,885,950 482,197 89,917 2,891,226 1,800,278 895,268 174,931 20,749 2016-07 6,247,556 3,580,452 2,031,207 529,886 106,011 5,525,817 3,065,458 1,880,511 483,446 96,402 2,915,742 1,819,435 900,542 175,498 20,267 2016-08 6,243,694 3,578,339 2,029,424 527,044 108,887 5,519,164 3,061,227 1,878,038 480,727 99,172 2,916,585 1,820,686 900,677 174,440 20,782 Change over Change over one month* one year** -0.1 % +0.3 % -0.1 % +0.4 % -0.1 % -0.0 % -0.5 % -0.0 % +2.7 % +9.0 % -0.1 % -0.2 % -0.1 % -0.3 % -0.1 % -0.4 % -0.6 % -0.3 % +2.9 % +10.3 % +0.0 % +0.9 % +0.1 % +1.1 % +0.0 % +0.6 % -0.6 % -0.3 % +2.5 % +0.2 % NUMBER OF BORROWERS WITH AT LEAST ONE OUTSTANDING OVERDUE CONTRACT (situation at end of period - non-regularised) Total in Flanders in Wallonia in the Brussels-Capital Region abroad Consumer credit in Flanders in Wallonia in the Brussels-Capital Region abroad Mortgage loans in Flanders in Wallonia in the Brussels-Capital Region abroad 2015-08 355,326 133,049 152,590 49,152 20,535 333,381 123,493 142,944 47,151 19,793 44,592 18,258 21,152 3,750 1,432 2016-07 365,474 137,404 154,446 50,792 22,832 344,584 128,370 145,286 48,858 22,070 43,460 17,626 20,598 3,714 1,522 2016-08 366,023 137,569 154,384 50,828 23,242 345,339 128,605 145,364 48,896 22,474 43,182 17,502 20,410 3,715 1,555 Change over Change over one month* one year** +0.2 % +3.0 % +0.1 % +3.4 % -0.0 % +1.2 % +0.1 % +3.4 % +1.8 % +13.2 % +0.2 % +3.6 % +0.2 % +4.1 % +0.1 % +1.7 % +0.1 % +3.7 % +1.8 % +13.5 % -0.6 % -3.2 % -0.7 % -4.1 % -0.9 % -3.5 % +0.0 % -0.9 % +2.2 % +8.6 % * Percentage change compared with the previous month. ** Percentage change compared with the corresponding month of the previous year. For further information, contact the Central Individual Credit Register. 7/7