TIAA-CREF ONLINE VDC ADMINISTRATOR SERVICES

TA PIF

F11507 (7/13)

TIAA-CREF ONLINE

VDC ADMINISTRATOR SERVICES

ADMINISTRATOR SERVICES

This application allows you to authorize administrators at your institution to become users of TIAA-CREF’s Administrator

Services, which provides access to the secure Plan Administrator website and the Administrator Telephone Center (ATC).

These resources will provide the information and tools you need to efficiently administer your retirement plans.

You can use this application to add or delete users from your institution’s authorized users list, and upgrade or remove a user’s access to online functionality.

To complete this application, the following definitions will be helpful. There are two Authorization levels:

PRIMARY AUTHORIZER

A Primary Authorizer is the administrator who has the authority to add, edit and delete other Plan Administrators at the institution. This authorization level may have access to one or more Administrator Services Functions.

PLAN ADMINISTRATOR

A Plan Administrator is an administrator that has been authorized to use TIAA-CREF’s Online Administrator services.

A Plan Administrator cannot add, edit or delete the access rights of another administrator. This authorization level may have access to one or more Administrator Services Functions.

NEITHER THE PRIMARY AUTHORIZER NOR ANY PLAN ADMINISTRATOR IS AUTHORIZED TO GRANT ACCESS TO ANY INDIVIDUAL

OUTSIDE OF YOUR INSTITUTION THROUGH THE USE OF THIS FORM. ANY ACCESS TO AGENTS, REPRESENTATIVES OR

SUBCONTRACTORS OF YOUR INSTITUTION MUST BE ADDRESSED SEPARATELY FROM THIS FORM.

Once completed, please print, sign and fax, mail or email to TIAA-CREF. Refer to page 6 for our fax number, mailing address and email address.

Please note that missing signatures, incomplete or inaccurate information on this form will delay the adding/removal of access for the Plan Administrator, which can impact/delay their ability to access your institution’s data available on our secure Plan Administrator website.

EDELIVERY TERMS AND CONDITIONS

By requesting we deliver any documents to you electronically, you agree to the following terms and conditions, and acknowledge you can electronically access, view, print and save these documents.

Your request to receive documents electronically requires you to have Internet access and a valid email account. We will email you a notification when a document is available for viewing and you can thereafter log in to your secure TIAA-CREF account to access it.

In the case of public documents like Prospectuses, Supplements, Annual Reports and Semi-Annual Reports, we will include a direct link to the document for your convenience.

Accessing public documents will not require you to log in to the secure site. Once you access the document, we provide the option for you to save it to your personal computer or print it. We may provide certain documents in portable document format, often referred to as a PDF. This format requires you to use free Adobe Reader software, which you can download at www.adobe.com

.

Your preference selections remain effective until changed by you, or as the result of service necessity (e.g., incorrect or nonworking email address), or upon notice from TIAA-CREF. Should you have any questions, wish to change your eDelivery preferences, or request a paper version of any document, please contact your Managing Consultant. If your plan is serviced by the Administrator

Telephone Center, you can speak with a representative at 888 984-0010 Monday through Friday, 8 a.m. to 6 p.m. (ET).

When accessing the Internet, you may incur online subscription charges through your Internet service provider. TIAA-CREF, however, charges no fee for electronic delivery.

TA PIF

F11507 (7/13)

Last Name

Institution Name

Title

Street Address

City

Phone Number

Email Address

TIAA-CREF ONLINE

VDC ADMINISTRATOR SERVICES

Page 1 of 4

SECTION 1: GENERAL INFORMATION

Please indicate whether you are applying as a Primary Authorizer or a Plan Administrator at your institution. If you are a

Primary Authorizer and are replacing a current user, complete the application for the replacement user and provide the name of the user(s) to be deleted in Section 5.

Provide the general information requested in Section 1 for the administrator who is being authorized to use TIAA-CREF’s

Administrator Services. Email addresses will remain confidential and will not be shared with any external entities.

Check One

I am applying as a Primary Authorizer of my institution. Sign Section 6 and obtain the signature of the current Primary

Authorizer. If you are the only Primary Authorizer at your institution, check here:

I am applying as a Plan Administrator of my institution. Sign Section 6 and obtain the signature of the Primary Authorizer.

I am a Primary Authorizer of my institution and am deleting access to TIAA-CREF’s Plan Administrator Services for a

Primary Authorizer and/or a Plan Administrator. Please complete the application for the replacement user (if applicable) and indicate the user to be deleted in Section 5.

New York State Voluntary Defined Contribution Program 406081

Prefix First Name Middle Initial

Department

State

Extension

Fax Number

Zip Code

SECTION 2: PLAN ACCESS

Please list agencies for which you would like access:

Agency Name Address

TIAA-CREF ONLINE

VDC ADMINISTRATOR SERVICES

Page 2 of 4

Agency Website

New York State Voluntary

Defined Contribution Location

Code OR Agency Payroll Code

TA PIF

F11507 (7/13)

SECTION 3: ADMINISTRATOR SERVICES FUNCTIONS

Plan Administration Ability to Enroll employees/Approve & Decline Retirement Plan Elections (RPE) Access to employee account information, (dates & vesting status) including account balance, contributions & asset allocation

General Access Limited to general inquires and requests (nonconfidential data) & ordering print materials

Contributions This includes activities related to contributions made to the plan

NOTE: If your agency’s payroll is administered by a state or local payroll administrator, a TIAA-CREF profile will be created.

If your agency’s contribution file is remitted to TIAA-CREF directly by a Third-Party Provider, for example, ADP,

Ceridian, Paychecks, please submit a form for those representatives checking only the functions that apply.

Person requesting access for Plan Administration will answer questions or authorize the following:

Contribution Remittance files and wires

Distribution requests from participants

Loan requests from participants

Plan compliance corrections

Receive Prospectus Correspondence

TA PIF

F11507 (7/13)

TIAA-CREF ONLINE

VDC ADMINISTRATOR SERVICES

Page 3 of 4

SECTION 4: SECURITY QUESTION AND ANSWER REQUIRED

Please choose a security question and answer. TIAA-CREF will use this question to authenticate caller.

What is your mother’s maiden name?

What is your favorite sports team?

What is the city/town where you were born?

What is the name of your pet?

What is the name of street you grew up on?

Answer

SECTION 5: COMPLETE ONLY TO DELETE AN EXISTING USER

Name Title

Name Title

SECTION 6: SIGNATURES — REQUIRED

Person Requesting Access (person listed in Section 1) This signature is always required (for person requesting)

Name (Print) Telephone

Signature Today’s Date

(mm/dd/yyyy)

/ /

Primary Authorizer

New Primary Authorizer

Name (Print)

Signature

Additional Primary Authorizer

Telephone

Today’s Date

(mm/dd/yyyy)

/ /

Email Address

TA PIF

F11507 (7/13)

TIAA-CREF ONLINE

VDC ADMINISTRATOR SERVICES

Page 4 of 4

SECTION 6: SIGNATURES — REQUIRED (CONTINUED)

I have read, and will comply with, the security guidelines set forth in this application. I approve the Plan Administrator to have access to the Administrator Services indicated herein.

Current Primary Authorizer Name — REQUIRED (Print)

Phone Number Extension

Email Address

Signature Today’s Date (mm/dd/yyyy)

/ /

For Internal Use

OPS – PLNFRMERS

TA PIF

F11507 (7/13)

TIAA-CREF ONLINE

VDC ADMINISTRATOR SERVICES

RETURN COMPLETED APPLICATION(S) USING ONE OF THESE METHODS

Fax to

800 842-5916

Mail to

TIAA-CREF

P.O. Box 1259

Charlotte, NC 28201-1259

Email paservices@tiaa-cref.org

Be sure to send all pages together. TIAA-CREF will notify you once this Application has been processed.

Any information missing on this application will delay processing. If you have any questions about how to fill out this form, please call the Administrator Telephone Center at 888 984-0010 .

NOTE : You may download additional copies of this application from the TIAA-CREF Plan Administrator website at www.tiaa-cref.org/administrators .

SECURITY GUIDELINES

The Administrator Services developed by TIAA-CREF allow authorized users of an institution to access certain information relating to such institution’s participants’ TIAA-CREF accounts and accumulations for the purpose of plan administration or counseling your employees.

THE INFORMATION OBTAINED THROUGH THESE SERVICES IS EXTREMELY SENSITIVE AND HIGHLY CONFIDENTIAL, AND

AUTHORIZED USERS OF THESE SERVICES AGREE TO MAINTAIN THE SECURITY OF THE SERVICES AND THE CONFIDENTIALITY

OF THE INFORMATION.

Use of these services signifies your agreement to comply with these security guidelines, and TIAA-CREF reserves the right to revoke access to these services for anyone who violates these guidelines.

From time to time, authorized representatives of TIAA-CREF may monitor the use of these services by authorized users; authorized users should not expect their use of the services to remain private and agree that TIAA-CREF may monitor and/or disclose their activity.

TIAA-CREF will revoke access for any authorized user who engages in improper conduct with regard to these services or the information obtained through the services. Examples of improper conduct include:

■

■

Deliberately bypassing or probing security measures

Disclosing or failing to protect any information contained in the website or disclosed by the ATC

■

■

■

■

■

■

Failure to maintain the confidentiality of the security question and answer or the user ID and password

Sharing the security question and answer, the user ID or password with any other individual

Sharing or distributing proprietary or copyrighted software

Using these services in connection with any unauthorized, illegal, fraudulent or unethical activities, or activities that may be embarrassing or detrimental to TIAA-CREF

Introducing or attempting to introduce viruses into TIAA-CREF’s systems

Transmitting encrypted materials in violation of applicable laws, including but not limited to privacy and export laws

TIAA-CREF will not be held liable for the misuse of these services. In the event you or any authorized user terminates employment with your institution, TIAA-CREF requests that you notify us immediately and we will revoke these services.

New York Voluntary Defined Contribution Program

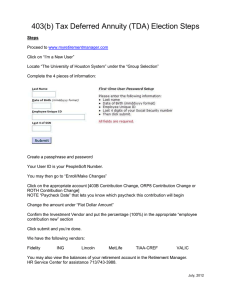

Quick Guide for oSc Supported AGencieS

Initial set-up

1. Identify your internal team that will work with the VDC Program — usually someone from Benefits and Payroll.

2. Human Resources should request access to the Administrator Web Center. Complete and return the TIAA-CREF Secure Access Administrator Services form. This form must be completed by each person requiring access to the plan administrator site and it must be signed by the individual who will act as the primary authorizer. The access request form is located at www.vdc.ny.gov

. Go to Employer Resources and then VDC

Implementation Materials. Click Administrator Web Center Access Request. You may also visit www.tiaa-cref.org/nysadministrator ; select Administrator Web Center tab and select the access form PDF. Follow the instructions for submitting the request.

3. Complete and return the access form to TIAA-CREF. You can contact the Administrator

Telephone Center (ATC) at 888 984-0010 , Monday to Friday, 8 a.m. to 6 p.m. ET, if you have any questions or to begin the onboarding process.

4. When you have your first new enrollee in the VDC Program, OSC will instruct you on how to add/code new employee(s) in PayServ. Please review OSC Payroll Bulletin

No. 1256 for additional information. The OSC has established a mailbox to which you can direct questions: payrolldeduction @ osc.state.ny.us

.

New employee is hired

1. You must first determine if the new employee is eligible to join the VDC program. Refer to www.vdc.ny.gov

for VDC eligibility definitions. If yes, you must provide the employee information in order for them to make an informed decision between the defined benefit plan and the VDC. Provide each eligible employee with the VDC Enrollment Guide

(online or hard copy) along with all other new hire materials. Employee has 30 days from date of hire to elect a retirement plan.

2. If the employee chooses the VDC Program, he/she will make the election using the online enrollment system called Retirement @ Work. Instructions on how to access the enrollment system are noted in the VDC Enrollment Guide. The employee may also visit www.vdc.ny.gov

and locate the Enroll Online link.

3. Enrollment is 3-step process.

a. Complete Retirement @ Work Online enrollment — employee will respond to three questions to determine eligibility and vesting. NOTE: If employee states they own an employer-funded annuity contract with any of the approved investment providers

(ING, MetLife, VALIC or TIAA-CREF), he/she must present a statement to the agency

VDC Program Administrator to prove ownership and receive vesting credit. b. Select investment provider(s) to receive employee and employer VDC contributions.

c. Open an account with each investment provider selected to receive contributions.

If you have questions, call the

Administrator Telephone Center at 888 984-0010.

Human Resources approves VDC plan election

1. Administrator will receive an email when there are elections awaiting approval. This occurs at the end of each day.

2. Access the TIAA-CREF Plan Administrator website to review and approve your employees’

VDC Plan election.

3. As a best practice, visit the Plan Administrator website regularly. Agency personnel responsible for validating an employee’s retirement plan elections will receive an email notification when VDC Plan requests are submitted by employees. Refer to the VDC

Agency Information Guide for guidance on how to interpret retirement election questions.

4. If an employee meets the vesting exception, you will need to refer to Payroll Bulletin 957 to complete Form AC1767 for the OSC. The OSC will override vesting status. The

Retirement @ Work form of any employee that will receive prior service credit from another state-run retirement system (like ERS, TRS, NYCERS, NYCTRS, BERS) will also need to be submitted to the OSC.

5. Update Payserv as instructed by the OSC. Please review OSC Payroll Bulletin No. 1256 for additional information. Employees that are not vested will have employee and employer contributions held in escrow. Escrow amounts will be held and recordkept by the OSC for non-vested employees.

Three-day common remitter cycle

OSC will ask each agency to review their remittance file before it is sent to TIAA-CREF for processing.

DAY 1 OSC will create an extract file from Payserv prior to “Pay/Check Date” and will send file before your Pay/Check Date to TIAA-CREF. TIAA-CREF will determine if file is in Good Order before dispersing records to investment providers. Please review

OSC Payroll Bulletin No. 1256 for additional information.

DAY 2 TIAA-CREF will send a Request for Funding Notification to OSC.

DAY 3 TIAA-CREF will disperse funds received before 1 p.m. (ET) to respective investment providers.

TIAA-CREF property not to be distributed externally without approval – CONFIDENTIAL

© 2013 The State University of New York, SUNY Plaza, 353 Broadway, Albany, NY 12246

236520_341308 (08/13)

Enrollment steps for the new hire

1

7 9

1 2

5

3 4

7

6

NYS Administrator steps in the process

1

7 9

• Retirement program election

• Investment provider

• Election(s) + Investment

• Provider Enrollments

• Email advises of employee retirement program election

6

1 5 6

8

NEW YORK STATE VOLUNTARY

DEFINED CONTRIBUTION PROGRAM

DEFINED BENEFIT VS.

DEFINED CONTRIBUTION:

A COMPARISON

Feature

Vesting

Portability

Control

Expected

Retirement

Income

Defined Benefit

10 years.

If the employee leaves before reaching the 10-year vesting period, employee contributions are refunded — employer contributions will be forfeited.

Funds are managed for the employee to help meet current and future liabilities.

Income is determined by a formula and depends on length of service, earnings, tier and age. The employee will receive a fixed monthly payment with annual cost-of-living adjustments.

VDC Program: Defined Contribution

Shorter. 366 days.

Portable. Employer contributions plus applicable earnings are the employee’s to keep after 366 days. Employee contributions are always assets of the employee.

Employees have the flexibility to manage the investment of their contributions and the employer’s contributions based on the investment options available in the program.

Employee’s income is determined by the account balance — the employee has the opportunity for higher or lower retirement income based on investment decisions and the performance of the underlying investment options which include securities. The retirement income benefit will depend on several factors including salary, duration of contributions, investment earnings and age at retirement.

Income is not guaranteed.

For Institutional Investor Use Only. Not for Use With or Distribution to the Public.

Investment, insurance and annuity products are not FDIC insured, are not bank guaranteed, are not bank deposits, are not insured by any federal government agency, are not a condition to any banking service or activity and may lose value.

Investment products may be subject to market and other risk factors. See the applicable product literature, or visit www.tiaa-cref.org for details.You should consider the investment objectives, risks, charges and expenses carefully before investing. Please call 877 518-9161 or log on to www.tiaa-cref.org for current product and fund prospectuses that contain this and other information. Please read the prospectuses carefully before investing.

TIAA-CREF Individual & Institutional Services, LLC and Teachers Personal Investors Services, Inc., members FINRA, distribute securities products. Annuity contracts and certificates are issued by Teachers Insurance and Annuity Association (TIAA) and College Retirement Equities Fund (CREF), New York, NY.

© 2013 Teachers Insurance and Annuity Association-College Retirement Equities Fund (TIAA-CREF), 730 Third Avenue, New York, NY 10017

C11977 236520_351603

NEW YORK STATE

VOLUNTARY DEFINED

CONTRIBUTION PROGRAM

ELIGIBILITY INFORMATION

Eligibility

Definition

Determination

Temporary employee hired before 7/1/2013

Question Answer

What are the basic criteria for eligibility?

Who determines eligibility?

Defined Benefit (DB) Plan participant moves to a

NYS agency

Is an employee from a local municipality who transfers to a State Agency eligible to join the

Voluntary Defined Contribution

(VDC) Program?

Will temporary employees hired before 7/1/13 who chose not to participate in the DB Plan be qualified to participate in the VDC

Program on or after 7/1/13?

An employee hired 7/1/13 or later who will earn at an annual rate of at least $75,000 and is unrepresented

(not associated with a union), and whose immediately preceding employment was not with another New

York State department, division, etc.

The agency determines eligibility (including vesting) based on the rules of the plan and the Retirement

Plan History provided by the employee.

Yes, as long as the immediate prior employment was not with a State Agency – the employee is able to join (assuming they meet requirements).

However, if an employee goes from one State Agency to another State Agency, they are not eligible for the

VDC Program. If they move from a non-state, local municipality to another, they are not eligible.

No. Legislation says hired ON or AFTER July 1, 2013.

Moving from a part-time to a full-time position does not change the original hire date.

Eligibility

Unrepresented to represented

Existing employee prior to

7/1/2013

Is a current Tier 6 employee whose salary is greater than $75,000, able to participate in the VDC Program on

July 1, 2013?

Qualifying employment change

Salary decreases

Retired rehired

Salary change increase

Question Answer

What about employees who move from unrepresented to a represented position?

If an employee has a qualifying change (e.g., moving from an ineligible position to an unrepresented one earning at the annual rate of at least $75,000), will the employee have a one-time opportunity to change?

If an employee was part of the VDC

Program, (because his/her salary rate was greater than $75,000), but later has a salary decrease to below

$75,000, can he/she still be in the

VDC Program?

Is a retiree from NYC Pension

System who is rehired eligible to join the VDC Program?

If an employee starts employment under $75,000 but then gets an increase in salary over $75,000, would they then be eligible?

Yes. If an unrepresented employee is in the VDC

Program, and then moves to a represented position, he or she would be allowed to remain in the VDC

Program. Once in the program, the employee can’t be forced out. An employee cannot change plans during employment.

No. To be eligible, the employee must have a qualifying change (e.g., moving from one ineligible position to an eligible position), and the employee has a one-time opportunity to change. Only employees hired on or after 7/1/2013 who have a subsequent status change would be eligible to switch to the VDC Program.

It depends. The legislation is intended for employees newly hired on or after July 1, 2013. So, an existing employee, hired prior to July 1, 2013, is not eligible — unless there is a qualifying change or the individual leaves employment and returns. Otherwise employees have to maintain their current plan membership. They do not have the option to switch.

Yes. Once you’ve established membership in the VDC

Program, you retain membership in the VDC Program.

If an employee is actively receiving a public pension benefit, he/she is not eligible for the VDC Program unless he/she elects to suspend that previous public benefit and otherwise meet eligibility requirements, and had not previously been offered the VDC as a retirement plan option (i.e., through NYS employment prior to retirement while concurrently employed by NYPD).

No. An employee must have been hired by the NYS

VDC–eligible Agency on or after July 1, 2013. An employee is not eligible to join the VDC Program because a salary increase is not considered a qualifying event.

For Institutional Investor Use Only. Not for Use With or Distribution to the Public.

TIAA-CREF Individual & Institutional Services, LLC and Teachers Personal Investors Services, Inc., members FINRA, distribute securities products. Annuity contracts and certificates are issued by Teachers Insurance and Annuity Association (TIAA) and College Retirement Equities Fund (CREF), New York, NY.

© 2013 Teachers Insurance and Annuity Association-College Retirement Equities Fund (TIAA-CREF), 730 Third Avenue, New York, NY 10017

C11978 236520_351703

INTRODUCING

THE NEW YORK STATE

VOLUNTARY DEFINED

CONTRIBUTION PROGRAM

IS YOUR HR TEAM ON BOARD?

In March of 2012, Governor Andrew Cuomo signed into law a new defined contribution retirement plan option. The program is called the New York State Voluntary Defined

Contribution (VDC) Program. Beginning July 1, 2013, the new option should be made available to all unrepresented employees of New York State public employers hired on or after that date, and who earn $75,000 or more on an annual basis.

State University of New York: Having offered a defined contribution retirement option since the 1960s, the State

University of New York (SUNY) Optional Retirement Plan (ORP) was selected to administer the new VDC Program for other New York public employees.

TIAA-CREF: The plan service provider and recordkeeper has worked with SUNY for almost 50 years to provide retirement plans and services to SUNY employees. Headquartered in New York, TIAA-CREF is a Fortune 100 financial services company with $523 billion in combined assets under management and 3.9 million participants as of 6/30/13. And they’re dedicated to serving the needs of people in the academic, medical, cultural, governmental and research fields.

Retirement benefits from the New York State VDC Program will depend on the value upon distribution of individually owned annuity contracts purchased on behalf of electing employees through employer and required employee contributions from one or more of the currently authorized investment providers, including TIAA-CREF,

ING, MetLife and VALIC.

All New York State public agencies are responsible for communicating the program to new eligible employees and performing the administration duties of the program.

For program details, visit www.vdc.ny.gov

or watch an online presentation at www.brainshark.com/tiaa-cref_direct/NYSVDC .

Get started today: Call the dedicated New York State Voluntary Defined Contribution

Program Administrator Telephone Center.

If you have any questions, please call 888 984-0010 , Monday–Friday, 8 a.m. – 6 p.m. (ET).

CLIENT: TIAA-CREF

JOB #: 2629

COMPONENT: SUNY NYS MAYOR’S CONFERENCE FACT SHEET

SIZE:

(FLAT/FOLDED)

8.5 X 11

PR:

CW:

AD:

PD:

AE:

CS:

COMPARISON CHART

Feature

Shorter vesting

VDC Program

366 days. After 366 days, employees get to keep both the employer and employee contributions.

Portability

Ability to manage retirement account

Employee retirement planning advice and education

Expected income

The VDC is the employees’ personal retirement account, and is supported by employer and employee contributions plus any applicable earnings. The VDC can follow employees if they change jobs (employer contributions after vesting).

Employees manage their own account. They select available choices from the authorized investment providers and maintain an appropriate asset allocation to suit their individual retirement goals, risk tolerance and preferences.

Professional guidance and support is available through all authorized investment providers to assist plan participants with retirement planning, investment allocation decision making, asset accumulation and fund distribution options.

Employees’ income is determined by the account balance at distribution — employees have the opportunity for higher or lower retirement income based on their investment decisions and the performance of the underlying investment options chosen, which include securities. The retirement income benefit will depend on several factors, including salary, duration of contributions, investment earnings and age at retirement.

Income is not guaranteed.

Defined Benefit Plan

10 years of service credit.

If employees leave State service prior to 10-year vesting, employees’ own contributions are retained by the employees but all employer contributions are returned to the State.

Funds are managed for employees to help meet current and future plan liabilities.

Plan managed by the State.

Income is determined by a formula and depends on length of service, earnings, tier and age. Employees will receive a fixed monthly payment with annual cost-of-living adjustments. Investment risk is assumed by the State.

NY State Public Agencies must communicate this program to all eligible employees. Eligible employees should make an informed decision between the Defined Benefit Plan and the Voluntary Defined Contribution Program within 30 days of their date of hire.

You should consider the investment objectives, risks, charges and expenses before investing. Please call 877 518-9161 or go to tiaa-cref.org/nystate for fund and product prospectuses that contain this and other information. Read the prospectuses carefully before investing.

Investment products may be subject to market and other risk factors. See the applicable product literature, or visit www.tiaa-cref.org/nystate TIAA-CREF

Individual & Institutional Services, LLC and Teachers Personal Investors Services, Inc., members FINRA, distribute securities products. Annuity contracts and certificates are issued by Teachers Insurance and Annuity Association (TIAA) and College Retirement Equities Fund (CREF), New York, NY.

C12373 236520_360403

CLIENT: TIAA-CREF

JOB #: 2629

COMPONENT: SUNY NYS MAYOR’S CONFERENCE FACT SHEET

SIZE:

(FLAT/FOLDED)

8.5 X 11

PR:

CW:

AD:

PD:

AE:

CS: