Breaking Away from the Pack

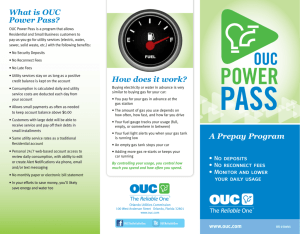

advertisement